Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Why Family Investment Holdings Belong In Every Portfolio

As an investment boutique, we seek to distinguish ourselves by offering unique investment opportunities for our clients. In the illiquid piece, for example, we regularly offer various private equity propositions. In the liquid piece, we seek to offer distinctive investment funds, such as the Turtle Creek Equity Fund. Currently, we distinguish ourselves with the family investment holding strategy.

Family Holding Companies

Family holding companies are publicly traded investment companies owned by wealthy families, who over the years have amassed their wealth through a distinctive trading spirit and sophisticated entrepreneurial instinct. These companies have often stood the test of time and are used by these families to invest and manage family capital in a sustainable manner.

Because the family has invested a large portion of its own capital in the holding company that is at stake (skin in the game), family interests are aligned with those of outside shareholders. Holding companies typically invest in a combination of listed and private companies, real estate and private equity funds. So by buying the shares of a holding company, you are already investing in a diversified portfolio.

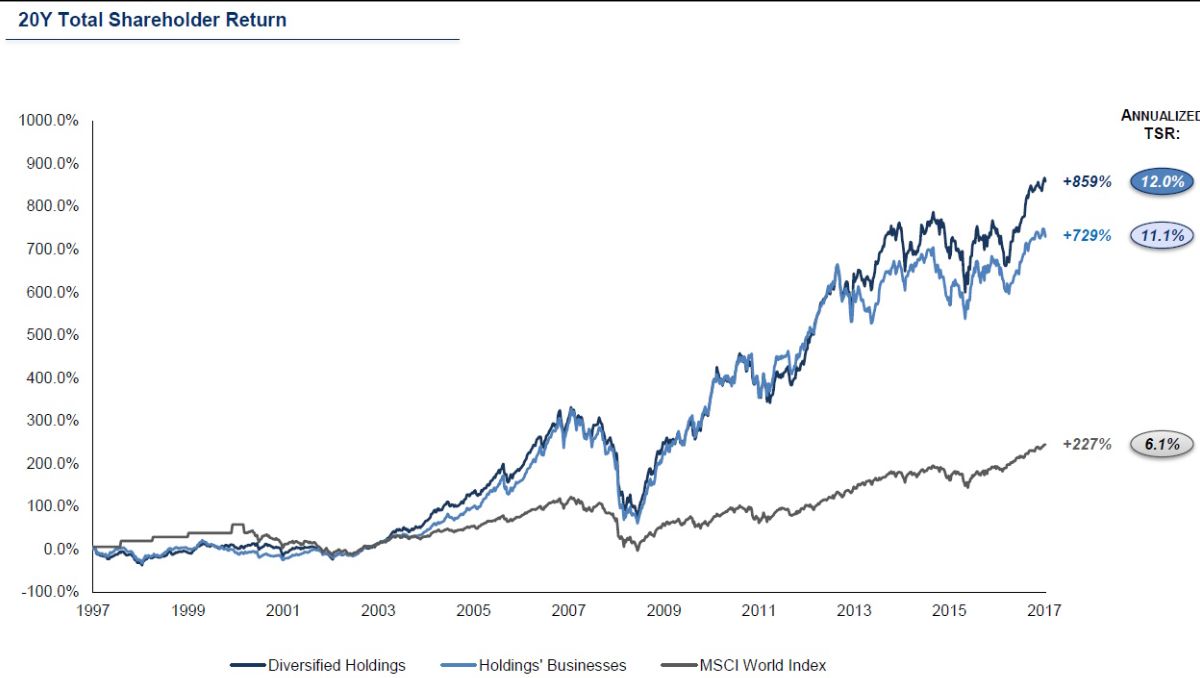

Research has shown that family businesses outperform companies without a family or reference shareholder because of several key characteristics. For example, the CS Research Institute found that family businesses produce better returns, as shown in the figure above.

Key explanations for these better returns include that family businesses have a long-term focus, have lower debt levels and typically invest more in research and development. This results in faster sales growth and higher profitability.

Without question, the most important characteristic of family holding companies is their long-term focus. One thinks in generations, rather than quarterly profits. Family stewardship has the preservation and sustainable growth of the family capital as its primary goal. To achieve this, they manage their portfolio in an active, fundamental way. They value entrepreneurship highly, and usually have a knack for good investments.

An interesting factoid is that a 2017 study by family holding company Exor showed that in the long run, family holding companies even manage to beat the publicly traded companies in their portfolio in terms of returns. A common criticism of holding companies is that by buying a basket of stocks you can achieve holding company diversification yourself, or that by buying their publicly traded subsidiaries you can replicate the portfolio.

In practice, family (holding) companies do add value. On the one hand, this has to do with the active management of their portfolio. For example, Investor AB sold key components of its real estate portfolio at timely moments, fixed EUR 2.1 billion in debt at 1.5% interest with a 14-year maturity, and bought shares of Atlas Copco and Ericsson on firm stock price corrections, which has produced particularly handsome returns.

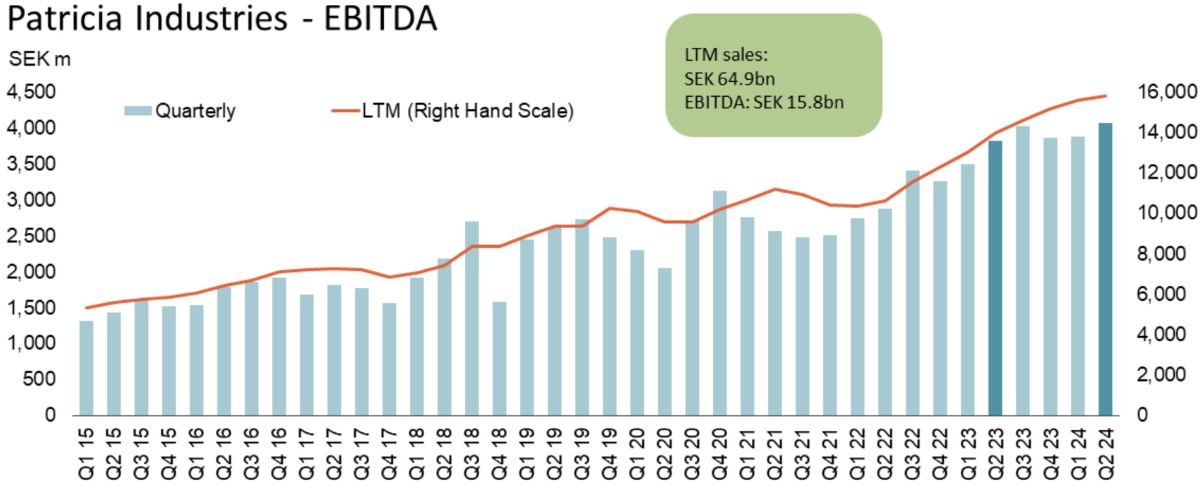

Added value also lies in access to unique assets. For example, Sofina has exclusive access to the best venture capital managers in the world such as Sequoia, due to the enduring relationship built over decades. With Patricia Industries, Investor AB has a portfolio of unlisted companies on which particularly pleasing returns are achieved, with strong growth in operating profitability (see figure below).

Degroof Petercam study

Recently, holding analysts Joren van Aken and Kris Kippers of Degroof Petercam published an interesting study with the same title as this monthly report. They note that professional investors often shun family holding companies because they are said to be too diversified, too illiquid and because these investors themselves think they can beat the returns of family holding companies.

Degroof Petercam noted just the opposite appears to be true. Investment holding companies offer clear diversification advantages compared to the broader equity market, outperform the stock market and also manage to achieve a better risk-adjusted return than the stock market. Here, risk is measured by volatility (price fluctuations).

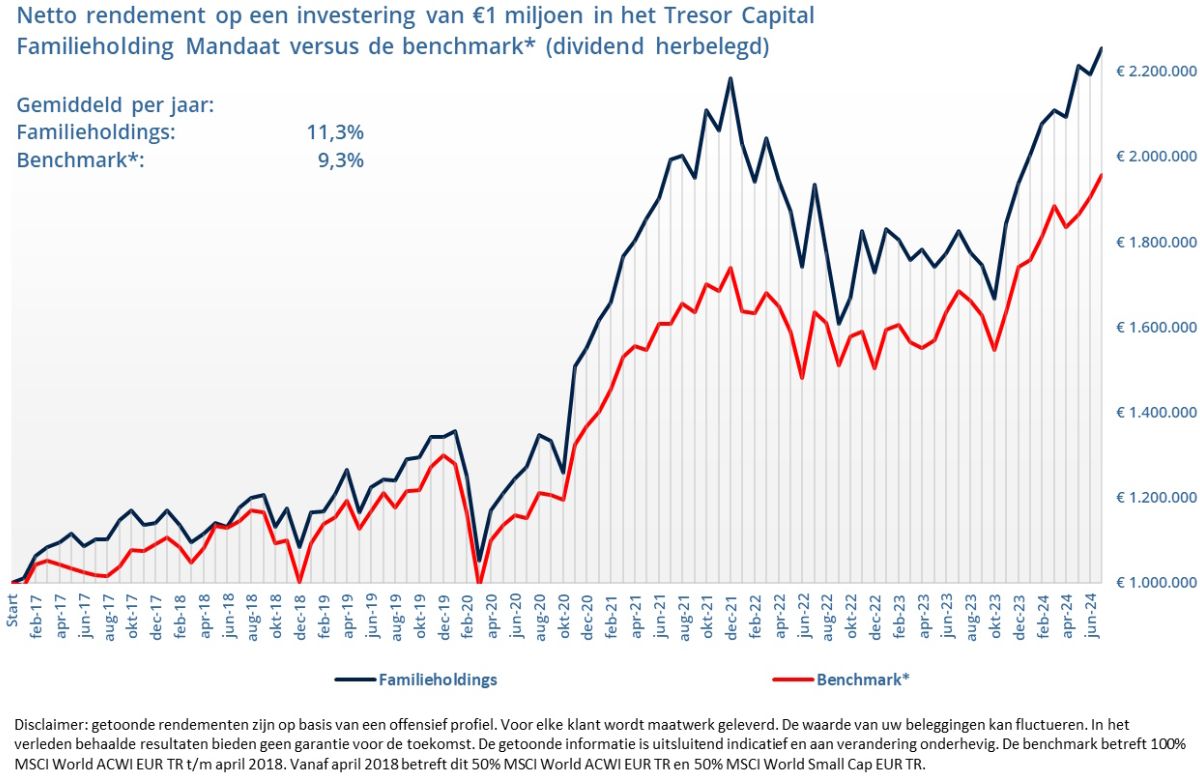

We also clearly see volatility in our holding strategy (see figure above), but we do not consider volatility a risk. As far as we are concerned, the permanent loss of capital is the actual risk. Price fluctuations are just part of it, and that is also why there is a so-called risk premium for investing in stocks: compensation for the higher risk. If one does not wish to run a risk, it is best to park one’s money in a savings account.

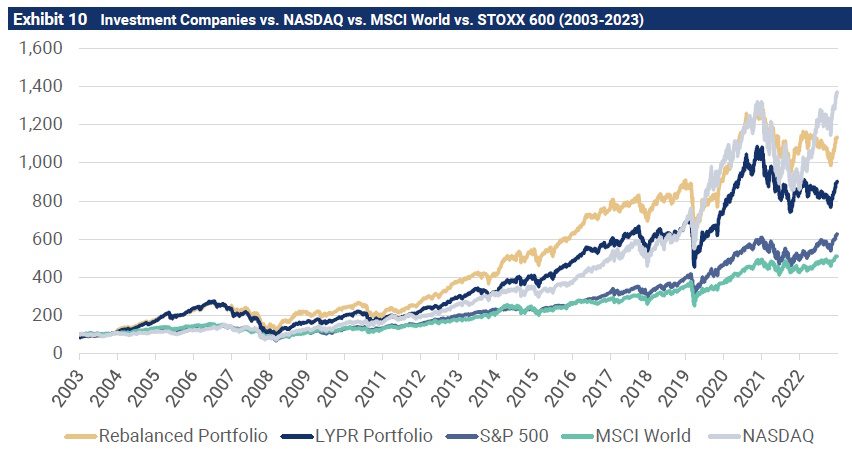

Degroof is testing two strategies, which somewhat overcome the issue of timing the stock market. With one portfolio of holdings, everything is invested at once and one simply stays away from it (“Let Your Profits Run,” LYPR). In another portfolio of holdings, each holding is given the same weighting and is rebalanced each year, thus bringing all the holdings back to the same weight after each year.

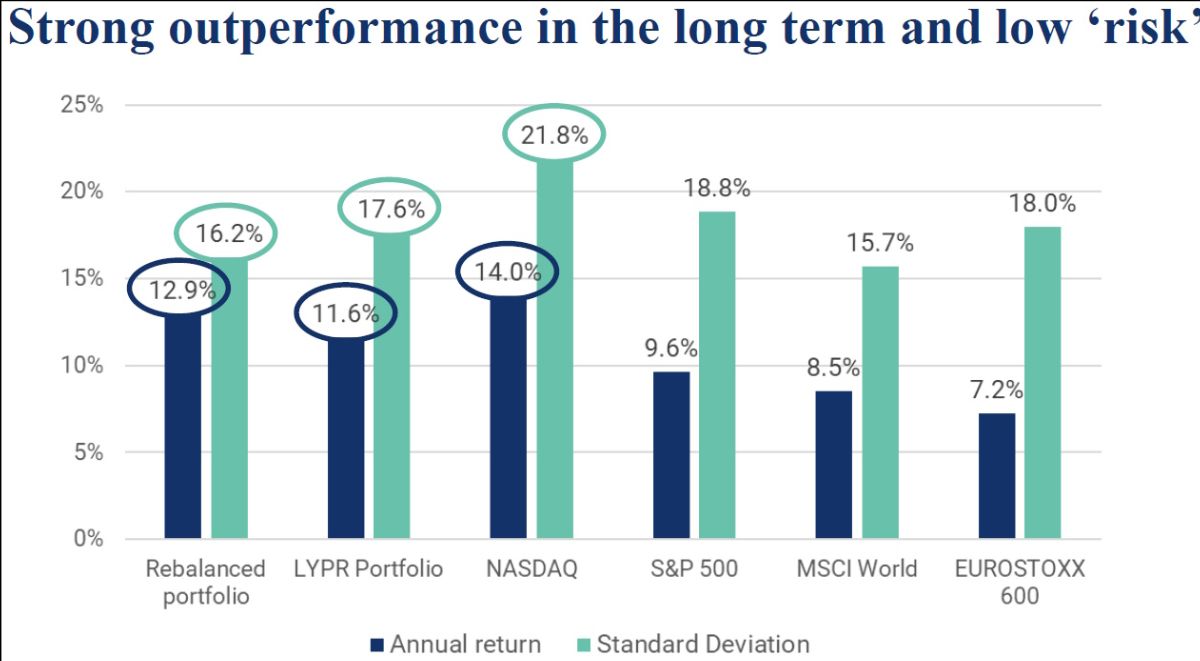

The figure above clearly shows that both holding strategies outperform the MSCI World world stock index and the U.S. S&P 500 index. Only the Nasdaq index outperforms, recently driven primarily by the technology boom due to the breakthrough of generative artificial intelligence.

The rebalanced holding strategy posted an average annual return of 12.9%; the “Let Your Profits Run” holding strategy achieved an average annual return of 11.6%. That compares to 14% for the Nasdaq, 9.6% for the S&P 500, 8.5% for the MSCI World stock index and 7.2% for the EuroStoxx 600 European stock index.

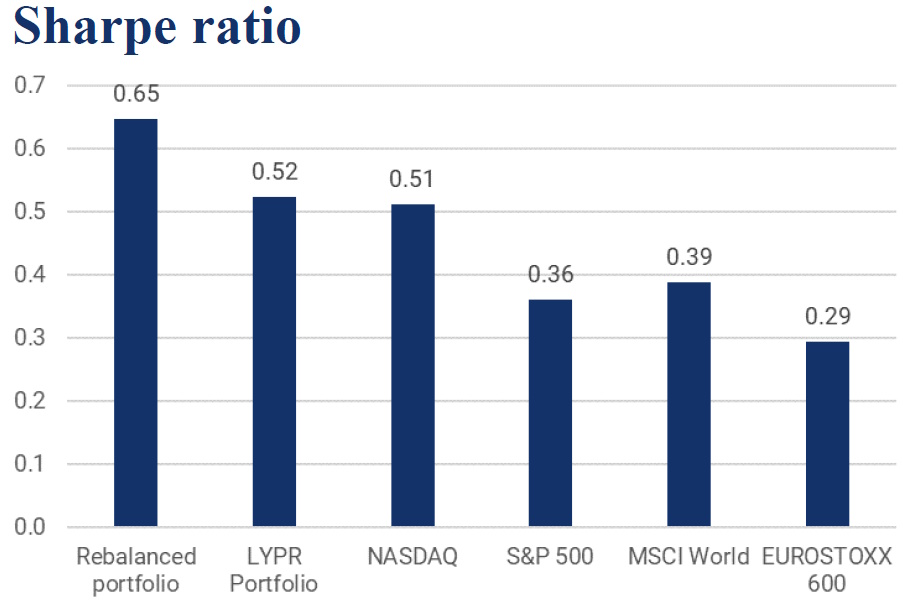

Degroof Petercam puts the returns we listed in the previous paragraph in the figure above into perspective of price fluctuations through volatility. While the Nasdaq outperformed the two holding strategies, this was also accompanied by much more violent price swings. Degroof shows through various ratios that holding companies, adjusted for risk, outperform all stock market indices, including the Nasdaq.

The best known in this regard is the Sharpe Ratio, which is calculated by subtracting the risk-free interest rate from a portfolio’s return and dividing that result by the standard deviation (i.e., price fluctuations). The figure below shows that both holding strategies have superior Sharpe Ratios compared to all stock market indices, i.e. better risk-adjusted returns.

Important note

One important note we wish to reiterate here. The fact that a strategy outperforms the stock market over a longer period of time does not guarantee that it will always outperform the stock market.

As you can see in the return graph of the Tresor Capital Family Holding Strategy (further up in this monthly report), there was quite a decline in the fourth quarter of 2018, in the first quarter of 2020 and in 2022. In 2022 and 2023, the benchmark outperformed the family holding strategy, starting in the third quarter in 2023, we see that trend clearly reversing again. Throughout the entire, longer period, however, family holding companies clearly outperform the benchmark.

Degroof Petercam cites why there is sometimes additional underperformance relative to the broader stock market. When the stock market falls sharply, the intrinsic value of family holding companies drops due to the fall in the share price of their holdings. On top of that, the undervaluation of family holding companies also increases.

On the recovery side, family holdings actually benefit from this two-stage rocket, both intrinsic values can then rise and undervaluations fall again. We cited exactly this effect in our December 2022 monthly report. By the way, we still see above-average undervaluations in holdings, so expect the recovery to continue.

This world-famous cartoon from The Economist captures well the extreme sentiment investors sometimes exhibit

Conclusion

All of the above actually comes together in the investment horizon. Our main task as managers of our clients’ capital, is to ensure that the portfolio allocation fits the client’s risk appetite. Equity risk should generally only be taken if the investment horizon is long enough, and one does not need the capital in the short term (principal risk).

Price fluctuations are part and parcel of the stock market. In various periods, our family holding strategy has also fallen. The trick is to stay put, or even to benefit from the fall by buying additional shares. On our website you can read the various monthly reports from 2022, in which we tried to keep our eye on the long term and prevent clients from selling before a recovery could take place.

Meanwhile, the Tresor holding strategy has set new records, but that does not mean that the 2022 stock price decline was a pleasant experience. The holder (part) ultimately wins, even in the stock market, provided the underlying fundamentals of the portfolio companies remain strong. There has never been any doubt about that with us.

We look forward to the future with confidence. We are regularly asked what the stock market will do. The famous answer that businessman and banker J.P. Morgan once gave was, “the stock market will fluctuate.”

As long as the companies in our portfolio continue to make the right decisions rationally, with a long-term focus, we are confident that the prerequisites are in place for continued good performance in the future. That is built into the corporate culture, as we wrote about Danaher in the previous monthly report. And so we repeat the statement: we think family holding companies belong in every investment portfolio.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl