Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Danaher, Built to withstand the test of time

Every once in a while a special piece of information about one of our companies appears. For example, we recently listened to an extremely rare interview with Mitchell Rales, who along with his brother Steven Rales founded the investment holding company Danaher in 1984.

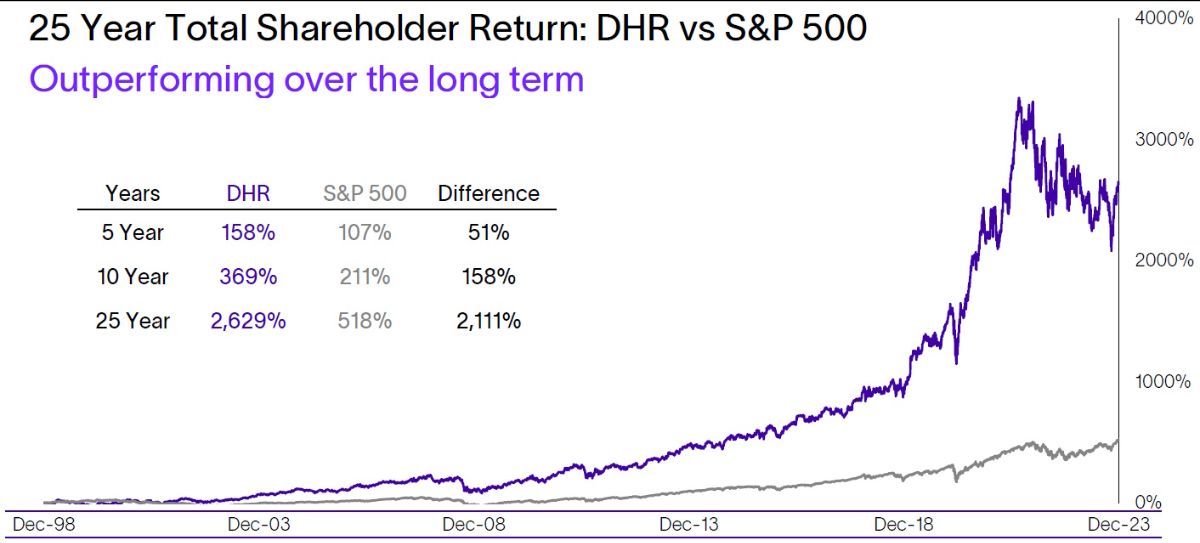

Since its inception, the company has returned 1,800x the deposit. That translates into a staggering 180,000% return over 40 years, or a compound return of more than 21% per year.

In other words, when founder Mitch Rales speaks, we listen intently. Especially when he makes his first appearance on a podcast, as he recently did at The Art Of Investing. It’s beyond the scope of this article to name all the nuggets of wisdom, but we’re happy to share some highlights with you in this monthly report.

Brief Introduction

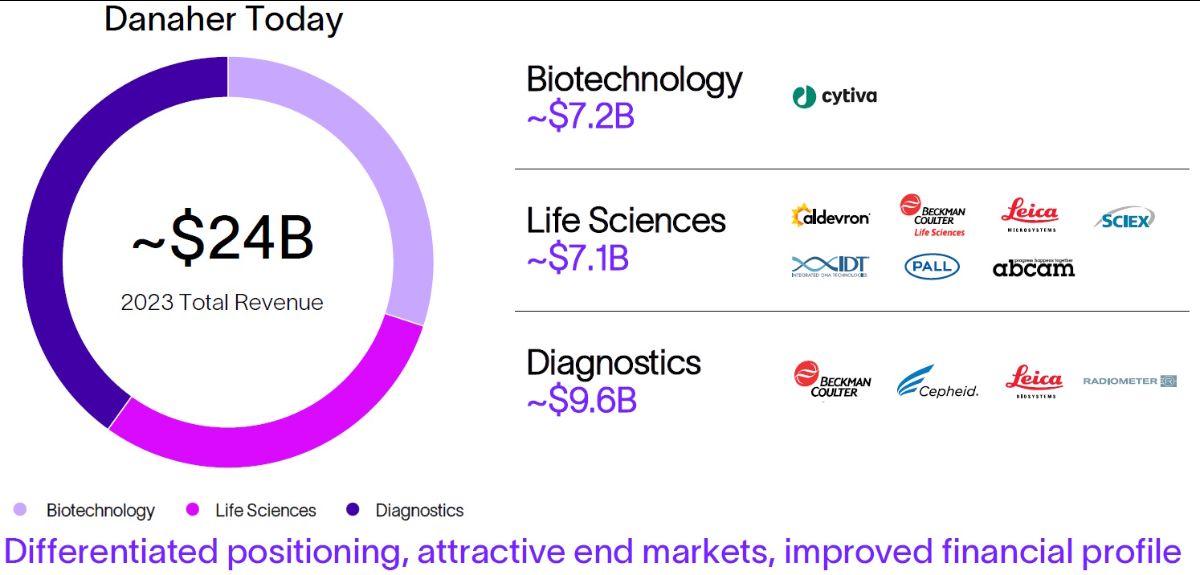

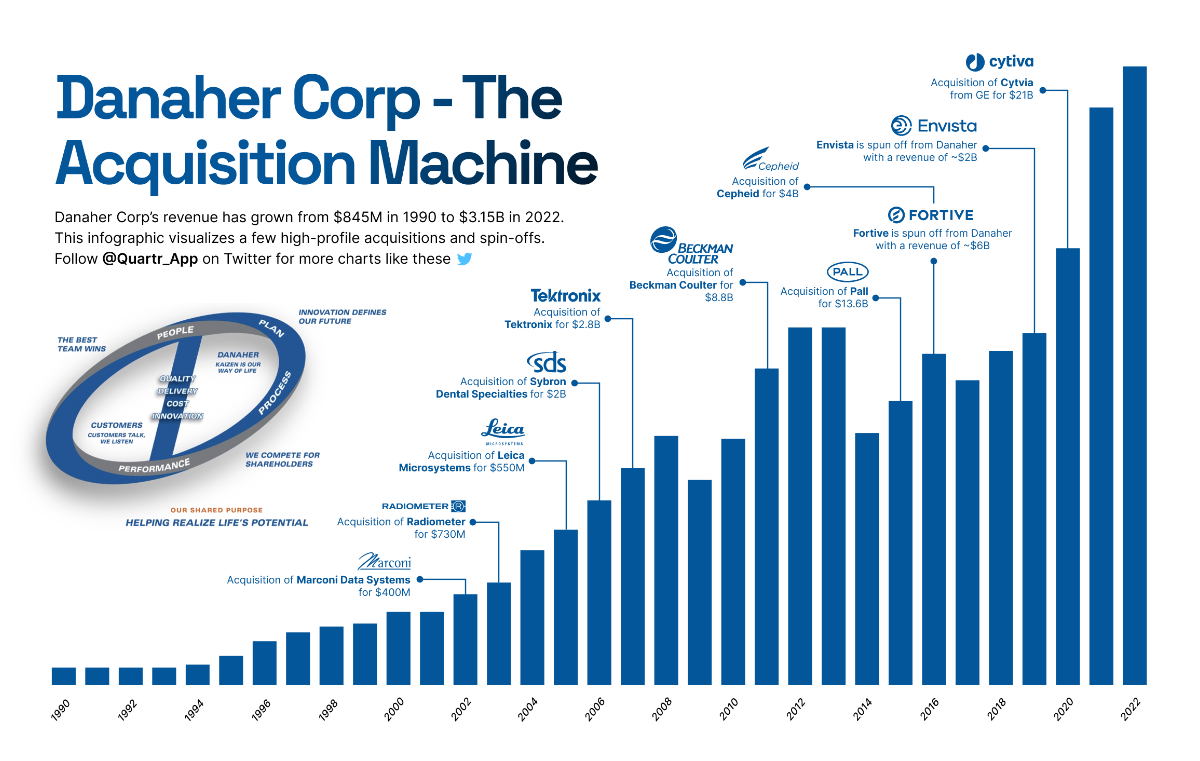

Danaher is an acquisition machine, a company that has successfully weathered multiple transformations. Today, the company is made up of three divisions: biotechnology, life sciences and diagnostics.

The biotechnology division comprises subsidiary Cytiva (the former biopharma division of General Electric) and makes instruments, consumables and software for the development, production and delivery of treatment methods to bring vaccines, biologics and new cell or gene therapies to market.

Companies in the life sciences division create the tools and technologies that enable breakthrough innovations that advance human health. These include microscopes, analytical instruments for (bio-)pharma, medical filtration, etc.

The companies in the diagnostics division provide analytical instruments for diagnosis, electronic measuring instruments (blood, molecules, etc.), as well as related software and services in hospitals, laboratories and at physicians’ offices.

However, after a great development, both in terms of fundamentals and share price, in the period after corona, there was a bit of a downturn because the clients had too much stock, and had to reduce it again. This hit the stock price quite hard, which made it possible for us to take a first position for the Tresor Capital relationships last year at attractive levels, having followed the company for years.

Moat (competitive advantage)

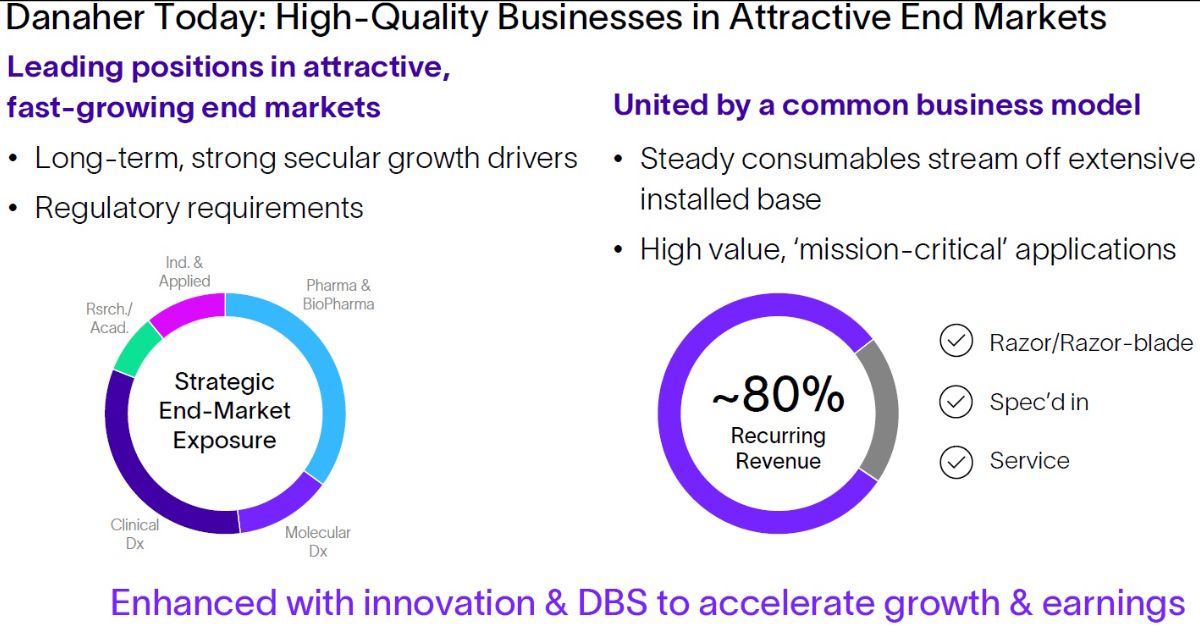

At first glance, Danaher’s rock-solid market position in the healthcare sector is the competitive advantage many point to. This is also known as a “sticky business,” because customers remain tied to the company, so to speak, and cannot easily switch to a competitor. This provides pricing power and a strong foundation to reinvest in further growth.

It can be a great basis for the interest-on-interest (compounding) effect, as can be seen in Danaher’s price chart. That’s why we at Tresor Capital are such fans of such business models.

Danaher compares their “sticky” business model to that for razor blades. Warren Buffett, after investing USD 600 million in razor blade company Gilette in 1989, said, “It is pleasant to go to bed every night knowing that there are 2.5 billion men who need to shave in the morning.”

In Danaher’s case, once customers have purchased the “razor” and enter the ecosystem by purchasing advanced equipment or instruments, they will be a continuous source of recurring revenue through the purchase of one-time consumables (think contrast medium or chromatography resin, for example) and services for the devices.

The customer is stuck, so to speak, because the equipment and instruments are included in drug patents. During the term of the patent (typically 10 to 20 years), the drug may then only be produced on Danaher machines, otherwise a new patent application must be filed. As a result, exchange costs for customers are extremely high. Today, this form of recurring revenue represents 80% of Danaher’s portfolio.

Rales says the following about that recurring revenue:

- “We just love that, it gives you the opportunity and ability to think about a lot of other things while that cash flow comes in steadily. The same goes for software, Software-as-a-Service companies or specific niche software (Vertical Market Software).”

Regarding the latter, there is an interesting link to Constellation Software. Constellation top executive Mark Leonard has identified Danaher as one of the exceptionally performing holdings that serve as a model for Constellation. Conversely, Rales is also a fan of Constellation:

- “Constellation is one of the greatest success examples of compounding and the interest-on-interest effect of all time. Mark Leonard of Constellation has built a phenomenal business.”

Rales, with some investments outside Danaher, such as Arcadia and the publicly traded Chapters Group, is trying to build a Constellation 2.0 that, in addition to growth through acquisitions, is also trying to achieve higher organic growth. However, many have already tried that in vain. Perhaps Rales would be wise to take a look at Topicus.com of the Netherlands, Constellation’s subsidiary, also listed in Canada, which can rebut twice as high organic growth as its parent company.

Long-term focus

As the figure below nicely shows, for stock price performance in the shorter term (2-5 years), the industry in which one operates matters. With the healthcare sector, Danaher is well positioned in this regard. In the medium term (5-10 years) the return on invested capital is important, and in the long term (>10 years) the people and corporate culture.

What is striking when listening to the podcast is that there really is a long-term mindset in all respects. For example, Rales states:

- “It all starts with creating an objective, a set of core values, a vision statement of what you stand for. A big and ambitious goal that you really strive for over a 20- to 30-year period. Do you want a company that’s a six or a seven? No way. You want companies that are a 10+, that are pivotal in the industry they are in. So not good, but great.You just can’t be great quickly. ‘Great’ takes time and compounding. So the 30-year journey to get to that point is what we’re really looking for, and that’s the big and ambitious goal we’re pursuing. We want to create something that doesn’t exist anywhere else in the world.”

There is a cross-generational time horizon, something that appeals so much to us as Tresor Capital in such family investment holding companies. For example, Rales states that at Danaher “they don’t think in terms of quarters or years, they think in terms of decades and in many cases even to the concept of an unlimited time horizon.”

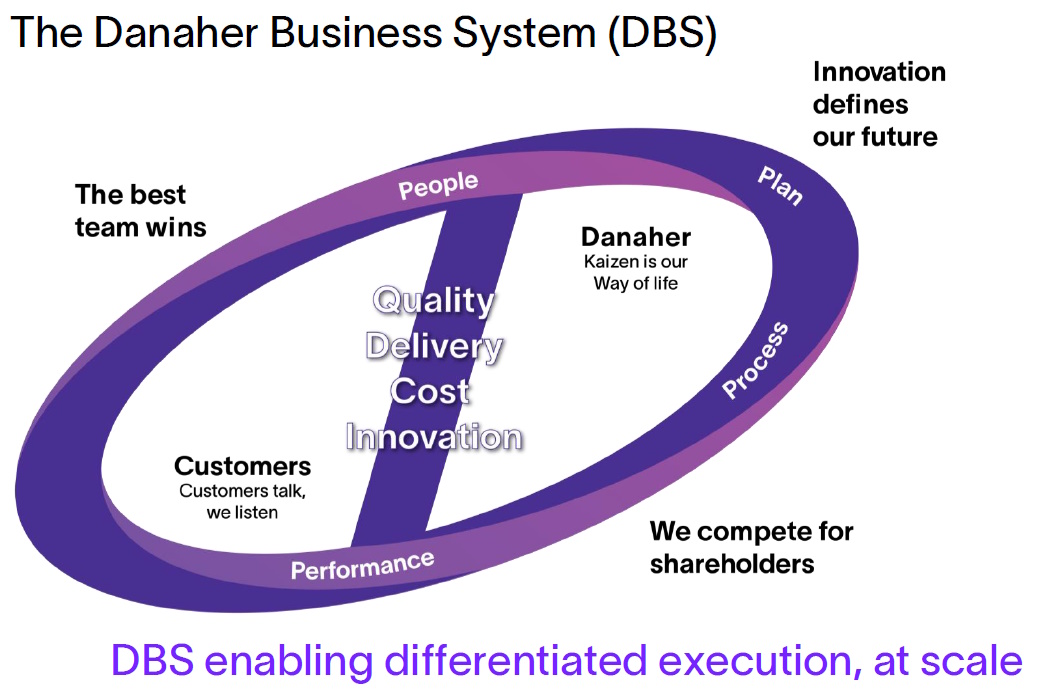

The entire corporate culture is set up on the premise that every little long-term improvement results in big steps forward, decentrally driven with each employee taking responsibility. In fact, Rales emphasizes that “the deeply rooted culture of continuous improvement that we have in the company” is the most underrated crucial aspect of the family holding company’s historic business success.

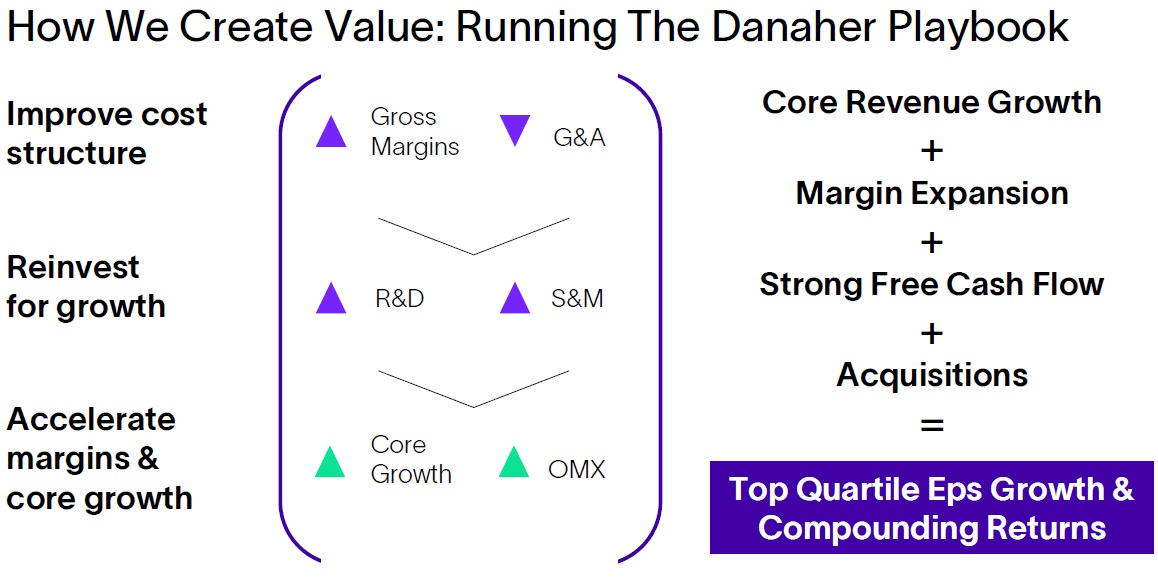

So our conclusion is that it is not the strong market position in the healthcare sector that is the moat , the so-called Danaher Business System (DBS) and corporate culture are Danaher’s true competitive advantage.

Indeed, it is not that Danaher has always been in the healthcare business. The company went through a deliberate transformation to get to this point after the investment holding company acquired a healthcare company in 2003. Rales:

- “We learned the quality of secular trends in healthcare. And this is where the thinking in secular trends started to develop for us: what are the better businesses to own, less cyclical, things that you don’t have to take apart if you’re in a recession because your revenues have dropped by 10%, which happens to this day for the most part in the industrial world.We could put the Danaher Business System to work to further optimize it. And gee, when you’re in a recession, you still grow organically! We learned something from that. That led us to the acquisition of Beckman Coulter in 2009/2010, and so the birth of our interest in the healthcare sector really began to form.”

Danaher had grown for decades by focusing on (acquiring) companies in the manufacturing industry, but after the above insights, the focus shifted more and more to the healthcare sector. At one point, they decided to radically simplify the organization, doing something few management teams would dare to do. Rales:

- “In 2014, we were aware as a board of directors that we had become too complex in terms of organizational structure. How do you create 50 strategic plans, 50 operational reviews and go deep into these businesses and really understand them when you have global competition? We decided to change tack by simplifying the company again and getting more clarity and focus.We did that by divesting all of our original industrial activities through a spin-off and listing them separately on the stock exchange. In doing so, we threw out at once about 25% of the turnover, but also 60% of the complexity of the number of subsidiaries we had.”

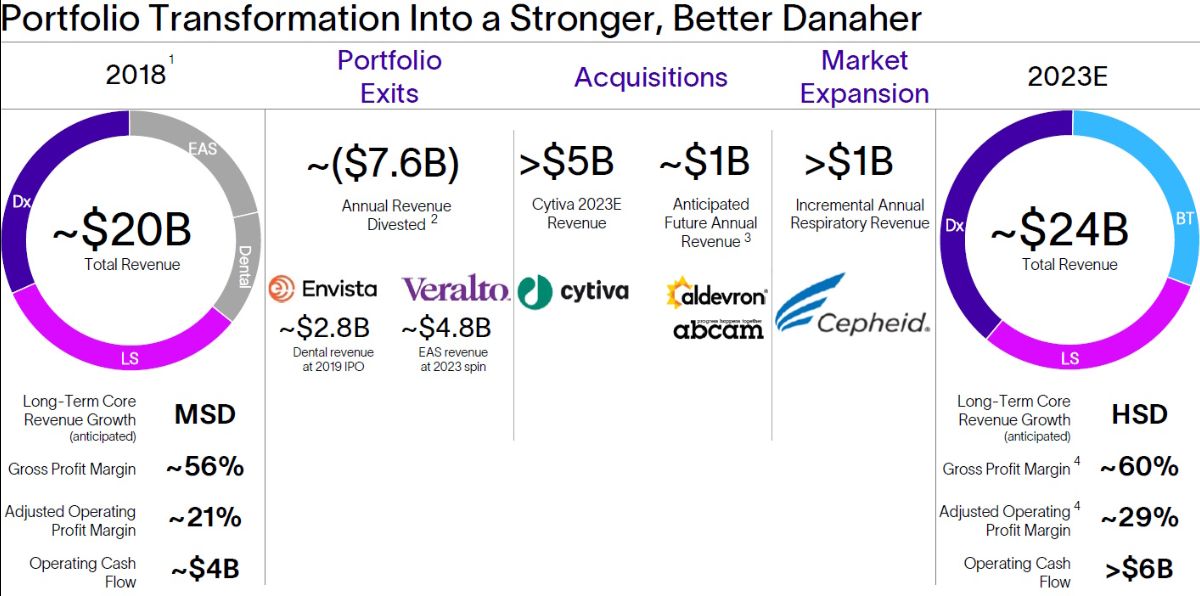

The figure above shows that after divesting the industrial division (Fortive) in 2015, Danaher also divested the dental division (Envista) in 2019 and the environmental and applied solutions division (Veralto) in 2023, while major acquisitions were made to become an even higher-value player in the healthcare sector. Structurally higher growth, higher profit margins and higher cash flow were the result.

Danaher Business System

Back to the Danaher Business System (DBS). In the early 1980s, the Rales brothers laid the foundation for today’s Danaher by acquiring several industrial companies. However, they had little knowledge of manufacturing business management, so they decided to visit industrial companies worldwide to learn about it, from America to Scandinavia to Asia. Rales:

- “We saw something amazing in Japan. It took General Motors 6 weeks to change a 2-ton mold, but Toyota changed that same mold in 6 hours. Then we said, ‘There’s something going on here that we need to understand.’What we discovered was that Toyota was adopting the principles of a famous quality guru named Edward Deming. He had 10 or 11 different quality principles he prescribed, but American companies like GM, Ford and Chrysler didn’t want to know about them at the time. In 1959, Toyota embraced Deming’s teachings.”

Rales continued:

- “When we learned what the Toyota production system meant, it was clear that they were the best of the best, and we were able to adopt those principles and integrate them into the company. So what we like to say is that we were just importing Edward Deming’s principles back to America, after he exported them to Toyota.Over time, we learned how broadly applicable all these lessons were, not just to manufacturing, but to the company as a whole, whether it’s accounts receivable management, whether it’s your call centers and so on, you can continually improve all these things. Thus, the principle of Kaizen was integrated into what we today call the Danaher Business System. This laid the groundwork in the 1980s for decades of compounding, something that has done us no favors over the past 40 years.”

The power of compound interest

We like to quote a telling anecdote from Rales about compound interest, also known as the interest-on-interest effect or compounding in English:

- “The strength of compounding at Danaher over the past 40 years, tax-free, by the way, is what I call the eighth wonder of the world. It’s something phenomenal . And you don’t really start until you get to the 10-year mark. So we look at a lot of what’s happening today in the world of short-termism; whether it’s the daily mark-to-markets that hedge funds have to go through, or the cadence of 3 to 5 years that private equity and venture capital engage in.It’s really hard to build something lasting that’s great when you take those kinds of time horizons. It just takes time, whether it’s business practices or financial returns, it just takes time. If you want to go to the promised land, which is 100x the stake on your investment, you need 20 to 30 years to do it.So all I think about when I’m assessing an investment is: do we have the youth who are talented enough and have the learning ability and the desire to become ‘great’? And if they have, can they give us that 20- to 30-year time horizon that we need? And will they be able, at the right time, to make the turnaround that needs to be made in every business over time?That’s the way I think about things before we actually start at all. If they are just a 3 to 5 year person, it can be a very good return in 3 to 5 years, but then I don’t want anything to do with it. At the end of the day, you put too much time and effort into it, only to have to start all over again and go through that journey for another 3 to 5 years for a good return. The real goody basket starts after year 10 when you start going from 10x your investment to migrating to the probability of an outcome of 100x your investment.”

Concentration versus diversification

The consequence of having such a big winner as Danaher is that it automatically takes up a very large portion of your wealth if you hold on to the shares and don’t sell them in the interim. That happened to almost all the major shareholders in successful investment holding companies: Buffett at Berkshire Hathaway, Arnault at LVMH, Leonard at Constellation Software, and also the Rales brothers at Danaher. All are currently still major shareholders at their companies. It is therefore no coincidence that these names sound familiar to our clients.

According to general stock market wisdom, it is prudent to build a wide spread, but the aforementioned entrepreneurs/investors still have the vast majority of their assets in their businesses. Mitch Rales has a strong opinion about it:

- “With Danaher, everyone told me I was too focused and that I needed to diversify. Thank God I didn’t listen to any of the schmucks who encouraged that. For example, it was the investment advisers, people who don’t know any different, who look at this with a traditional lens, and it was just wrong. I mean, what better way to stay focused than to invest in yourself and what your beliefs are over the long term.So we didn’t diversify. And that, of course, served us very, very well. During my lifetime, Danaher will always be a very concentrated position, because I don’t know where else to put that size of dollars. What am I going to do? Sell it, pay taxes and put it into index funds? I mean, what’s the fun in that? My wealth will be a lot less then anyway. My wife and I would rather give it to our charitable foundation and let them start the diversification journey over the long term.”

Conclusion

The fact that the Rales brothers still have a substantial ownership interest in Danaher makes us as fellow shareholders feel comfortable. With this skin in the game, they are still as hungry for success as when they started in the 1980s. This is evident in the podcast, which tells many more impressive and telling anecdotes than we have only briefly touched on with the excerpts in this article.

The impressive transition to a higher-value company, a strong balance sheet and still more than enough growth potential, both organically through innovations and by making acquisitions, plus further optimization through the application of the Danaher Business System, give us confidence that the end of Danaher’s growth path is far from in sight.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl