Herewith you receive our monthly report in which we share current insights. Each month we discuss different topics, ranging from trends and opportunities in the financial markets to in-depth analyses of relevant developments or strategic themes. Our goal is to provide you with valuable information in line with the constantly changing investment environment so that you are better informed about the dynamics of today’s financial world.

Turtle Creek: A Complementary Manager In Our Model Portfolio

Last week Andrew Brenton, CEO and co-founder of Turtle Creek, held a monthly performance update on the Turtle Creek funds. Along with his two co-founders, Brenton founded Turtle Creek in 1998. Over the longer term, he and his team manage to achieve impressive average annual returns that have long beaten the benchmark.

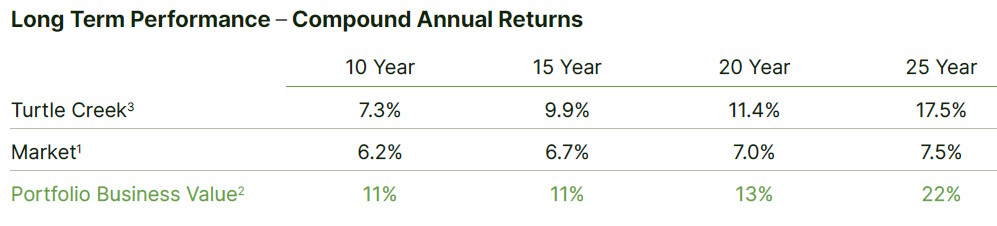

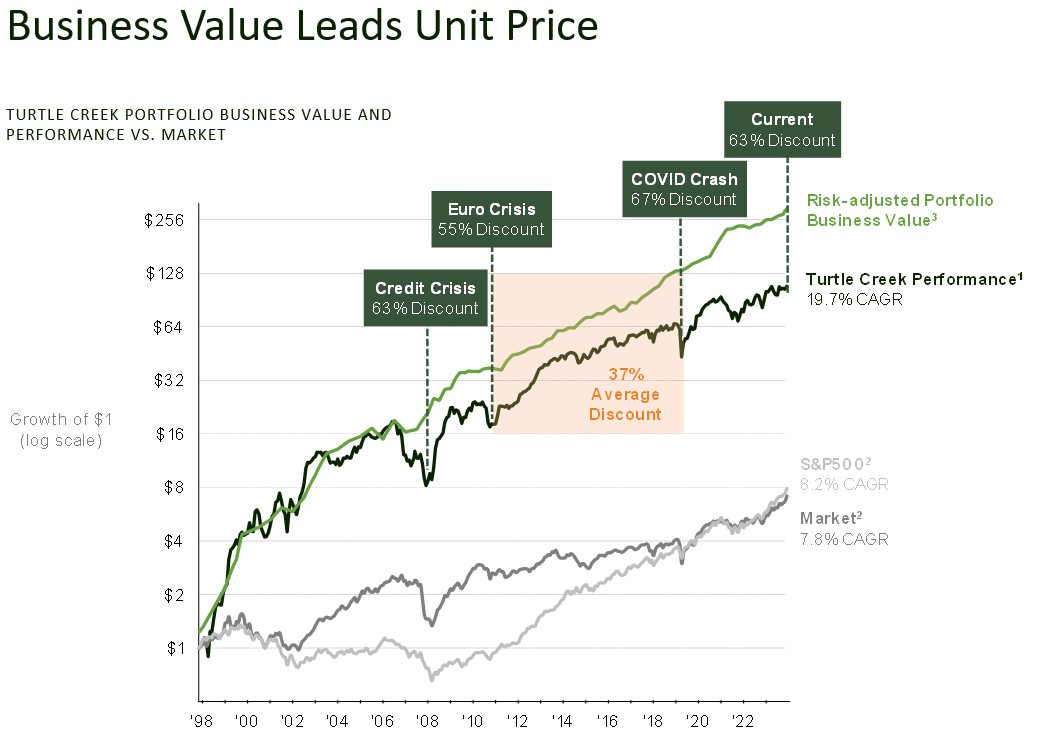

In the figure above, you can see that the Turtle Creek Equity Fund (institutional founder share class in USD) manages to beat the stock market in the long run. Also interesting is the green line called “Portfolio Business Value.” This is the intrinsic value calculated by Turtle Creek. Over the longer term, the stock price follows the intrinsic value of the fund.

This impressive track record, combined with a conservative investment strategy, makes the Turtle Creek fund a valuable addition to our model portfolios. Turtle Creek currently manages approximately USD 5.5 billion, with the founders having placed a large portion of their assets in the funds. Thus, they have considerable “skin in the game” to keep Turtle Creek’s funds performing optimally. Tresor Capital clients have exclusive access to the institutional founder share class, the fund class on the most attractive terms in which the founders themselves have also invested their capital.

Strategy and Philosophy

Brenton and his co-founders have a background in private equity (PE), which is the basis of their investment philosophy. They are now applying the principles and practices from private equity to the publicly traded market. Turtle Creek distinguishes itself as a value investor by calculating an intrinsic value for each share in their fund based on net present value (NPV). The size of each position is determined by how much the market price differs from this intrinsic value.

A distinguishing feature is their strategy of selectively buying in when share prices fall, as long as a company’s fundamentals remain solid. This disciplined process allows Turtle Creek to profit from market declines while effectively managing risk. Conversely, shares are sold when prices rise rapidly. It is important to note that this approach differs from index investing, which instead involves buying shares with rising prices.

Results and Current Challenges

Although Turtle Creek’s historical performance has been impressive, the fund lags behind the broader equity markets in 2024. One possible explanation is Brenton’s aversion to expensive stocks in specific sectors, such as technology, which have performed strongly in recent years. Turtle Creek views valuations in the capital markets as far too high and therefore does not invest in, in their view, overvalued technology companies.

Despite the underperformance in 2024, we continue to highlight the complementary nature of Turtle Creek. Their active approach continuously optimizes the portfolio to achieve a better risk-return ratio. In the long run, companies with solid fundamentals are expected to perform stronger.

During a recent presentation to Tresor Capital, the three best performing and the three least performing positions over the past 12 months were discussed. These examples provide insight into both the diversity and risks of the fund.

Top Performers

Kinsale Capital: A specialized reinsurer operating in 50 countries, with a focus on niche markets such as commercial property and shipping. The company is showing strong growth in premium income and has a conservative investment policy for its insurance book. Turtle Creek expects earnings growth of 20% per year over the next five years. However, the current price-to-earnings (P/E) ratio of 30 is high compared to the other stocks in the Turtle Creek fund.

Bread Financial: This company operates in credit cards and lending, capitalizing on the growing demand for consumer loans. The stock is showing recovery after a sharp correction in 2022.

Gildan Activewear: A producer of sports and leisurewear in the lower price segment, many of whose products are sold even without a logo. Gildan has been reporting positive surprises in earnings trends and sales growth for several quarters in a row.

Stragglers

Jeld-Wen: A manufacturer of materials for doors and windows, heavily dependent on the performance of the housing sector. With interest rate hikes in 2022-2024 in both Canada and the US, activity in the construction sector is lagging, negatively affecting the company’s performance.

Celanese: A chemical company that supplies plastics to the automotive industry. Despite stable production, the share price trend remains flat. This is partly caused by dependence on the German auto industry, which is currently under pressure.

Premium Brands: A producer of high-quality food products. Although its fundamentals are solid, its share price performance shows little momentum. Premium Brands owns, among others, SK Group, which supplies sandwiches to Starbucks, and has recently expanded its business into the seafood sector.

These underperforming positions show that Turtle Creek continues to invest patiently in undervalued companies as long as there is confidence in a long-term recovery. They emphasize that they work closely with management and that laggards are not value traps (companies that remain persistently cheaply valued and therefore do not create value).

New additions to the funds include:

- ATS Automation: A technology holding company specializing in automation projects, machine building and production lines in factories, and also active in distribution centers.

- Ingersoll Rand: A leading provider of compression equipment and gas technology.

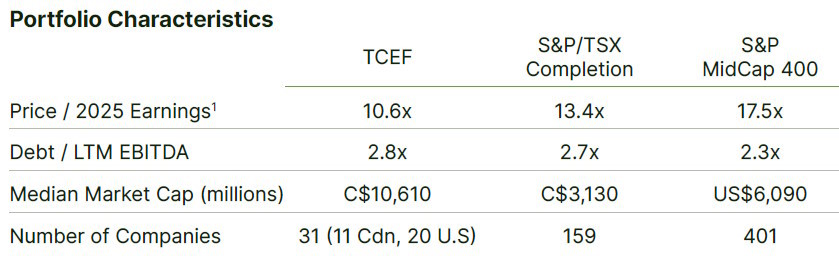

Looking at the fund, it is notable that Turtle Creek focuses mainly on companies with a market capitalization between USD 2 and 20 billion. About 65% of the portfolio is invested in U.S. companies, while the rest is invested in Canadian companies. Brenton emphasizes that the funds are not sensitive to import tariffs that may be imposed on Canadian companies by President Trump.

The fund has a broad sector spread, with a focus on niche markets and companies with a clear competitive edge. There is no strict top-down allocation process for countries (U.S. vs. Canada) or sectors. Country and sector weights are the result of the relative valuation of individual companies.

Historical Undervaluation: An Opportunity to Invest

During our 2024 Relationship Day, Brenton highlighted a remarkable fact: the fund’s current price is at a historically large distance from its calculated intrinsic value. Based on their calculations, the current undervaluation is 62% (see image below). In a market where virtually all asset classes are in a euphoric mood, this market inefficiency presents a unique opportunity, according to Brenton.

While the Nasdaq trades at a price-to-earnings (P/E) ratio of 50 and Bitcoin breaks through the USD 100,000 mark, the Turtle Creek funds, with a P/E of 10, offer an attractive opportunity for (new) investors. Even compared to small- and mid-cap indices such as the Russell 2000, which trades at a P/E of 20, the Turtle Creek funds are attractively priced.

Brenton illustrated that undervaluation has often provided perfect entry points in the past. Similar undervaluations occurred only during major crises, such as:

- The credit crunch in 2009;

- The euro crisis in 2011;

- The corona pandemic in 2020.

In all the cases mentioned, the value of the fund increased by an average of 25% per year in subsequent years. Brenton emphasized that such opportunities are rare and that Turtle Creek is currently at a similar point.

Conclusion

Turtle Creek stands out for its unique approach, disciplined strategy and impressive historical results. Although market performance lagged in 2024, the fund’s current valuation presents an attractive opportunity for new investors. Brenton emphasizes that the combination of strong fundamentals and significant undervaluation represents a rare and valuable opportunity.

Podcast

For more information on the Turtle Creek Equity Fund, please refer to a recent podcast with Andrew Brenton. Additionally, during the 2024 Tresor Capital relationship day, Brenton gave a presentation, a report of which you can read here.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Michel Salden, MBA

Investment Manager