Team Tresor Capital, from left to right: Ton Schimmel, Michel Salden, Michael Gielkens, Rob Rutten, Erik Klinkers, Jelle Vermeulen, Maurice Essers and Jan Groothaar

Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Report From Successful Relationship Day 2024

On October 2, we organized our 2024 Relationship Day at the special five-star venue La Butte aux Bois in Lanaken. We were able to welcome a total of about 90 relations of Tresor Capital in the morning and evening sessions.

After the reception with a small snack, the formal program began. On behalf of Tresor Capital, Michael Gielkens provided a brief introduction. The growth of our company was also reviewed. More and more relations are finding their way to Tresor Capital. This also means that we are expanding as a company. We have taken a larger office space (at the same address) and strengthened the team with Michel Salden and Jelle Vermeulen.

After Tresor Capital’s teammates were briefly introduced, a brief explanation of our investment vision and approach was given. As an investment boutique, we distinguish ourselves by making unique investments accessible to our clients.

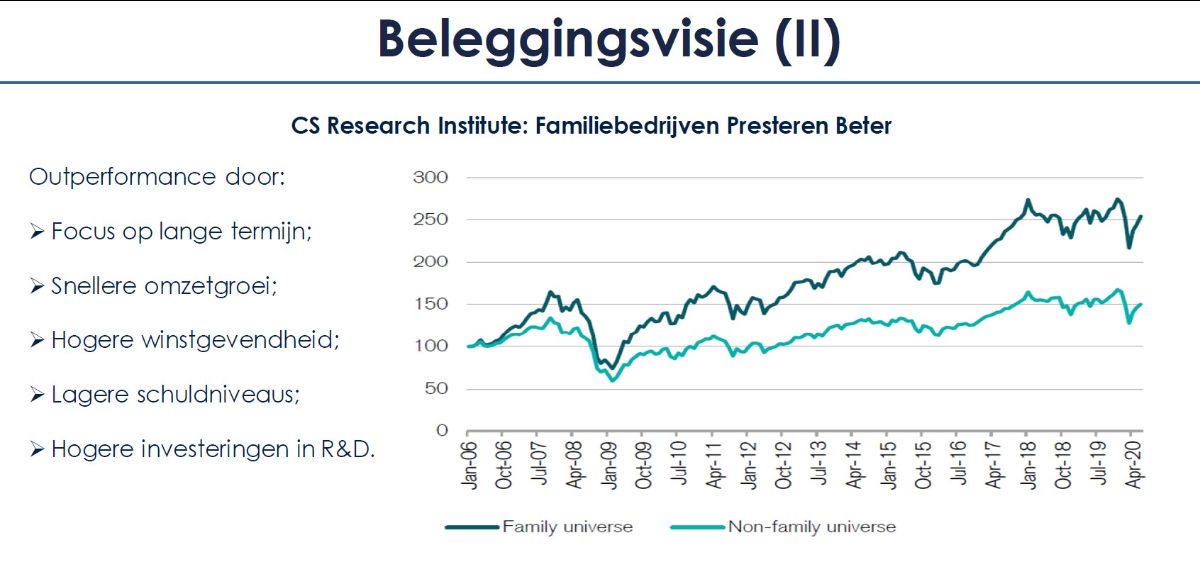

One way we do this is through the Tresor Capital Family Holding Mandate. The CS Research Institute found that family holdings produce better returns than companies without anchor shareholders, as shown in the figure below.

Key explanations for these better returns include the fact that family businesses have a long-term focus, have lower debt levels and typically invest more efficiently in research and development. This results in faster sales growth and higher profitability.

The fact that the family has a solid ownership stake allows the holdings to keep their eyes on the longer term. We at Tresor Capital also value this so-called skin in the game. On our website you can read in a white paper how we apply this in our own company.

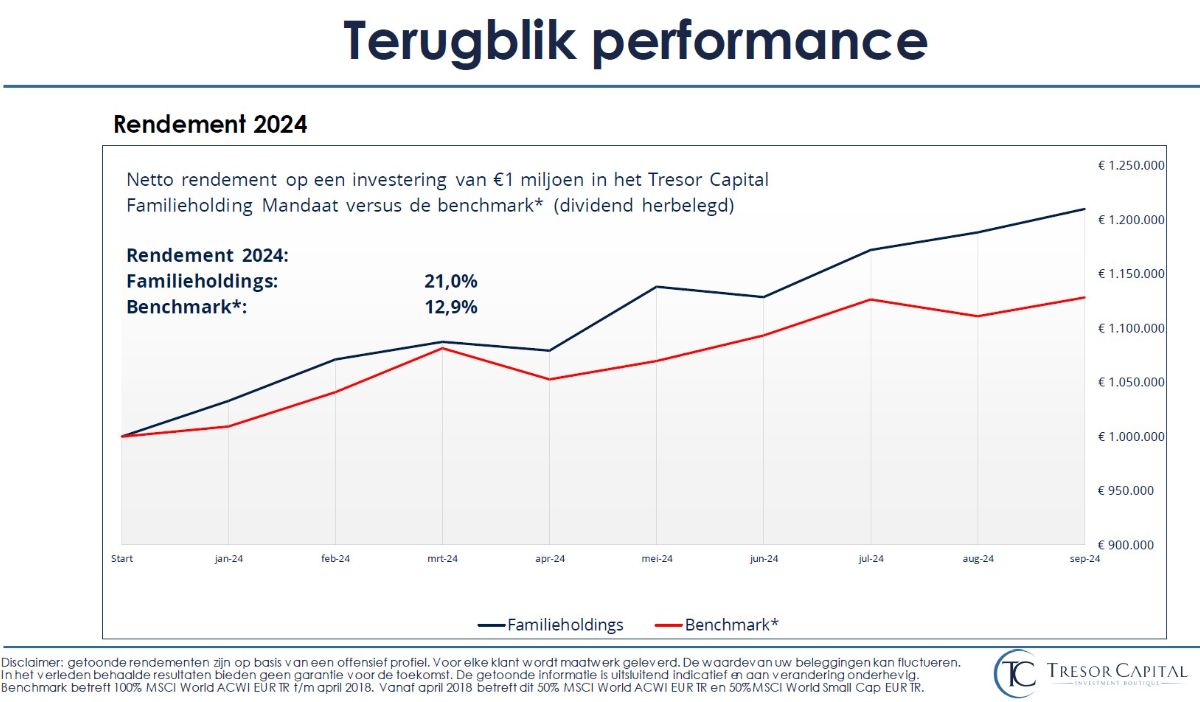

During the previous relationship day in October 2023, we highlighted that the family holdings portfolio showed the most attractive risk-return ratio since the corona crash in March 2020. Taking stock one year later, we see that the portfolio has achieved very significant outperformance relative to the benchmark (see figure above).

Michel Salden then took over to explain the outlook for the period ahead, against a macroeconomic background. Central banks are lowering interest rates, and they seem to have regained control of inflation while avoiding a severe recession. Lower interest rates offer prospects for (small and medium-sized) stocks and private equity, while bonds seem somewhat less attractive.

Along with opportunities, there are, of course, also risks. Consider the U.S. elections on Nov. 5, but certainly also the tensions in Eastern Europe, the Middle East and the growing tensions between the West and China.

European companies seem to be struggling, but the U.S. and Scandinavia (especially Sweden) continue to perform well. The Chinese government also seems to have the penny dropped, they are going to boost the economy substantially. We see all this as an ideal environment for active management and stock selection.

Responding to structural growth themes and trends offers opportunities, such as digitalization (including artificial intelligence) and robotization, aging/health care, sustainability, the rise of private markets and the growing Asian middle class. Using some real-life examples from the family holding portfolio, the various megatrends were explained. Please refer to this monthly report for more information.

The conclusion was that we continue to see bright prospects for the family holding companies portfolio. The first half of the year in the stock market was again dominated by technology companies, but in the second half of the year we saw a clear broadening in terms of performance in the financial markets.

Despite the reduction in the undervaluation of the holding portfolio from the extreme levels of 12 months ago, lower interest rates and the widening of the stock market rally may result in further normalization of valuations. In the meantime, the intrinsic value of family holdings continues to grow.

Despite the reduction in the undervaluation of the holding portfolio from the extreme levels of 12 months ago, lower interest rates and the widening of the stock market rally may result in further normalization of valuations. In the meantime, the intrinsic value of family holdings continues to grow.

We believe the two-stage rocket of higher valuations and continued growth in net asset value could result in further outperformance of family holdings.

We continue to continuously optimize the portfolio, keeping a close eye on the risk-return ratio. For example, we recently reduced a position in client portfolios close to intrinsic value in favor of a new family holding that traded at an attractive undervaluation. As a result, the undervaluation and growth prospects of the overall portfolio remain as attractive as ever.

Determining when it is interesting to start investing is always difficult. We wrote recently that it is better to be in the market than to try to time the entry moment. We thus concluded our presentation with a Chinese proverb: “The best time to plant a tree was 20 years ago. The second best time is now.” Legendary investor Warren Buffett has also often quoted this proverb, urging people to start investing especially for a rainy day.

With the relationship day, we aim to give our relations a better idea of the building blocks of our portfolios. After the introduction by Tresor Capital, three representatives of current investments from our portfolio spoke.

Turtle Creek Equity Fund

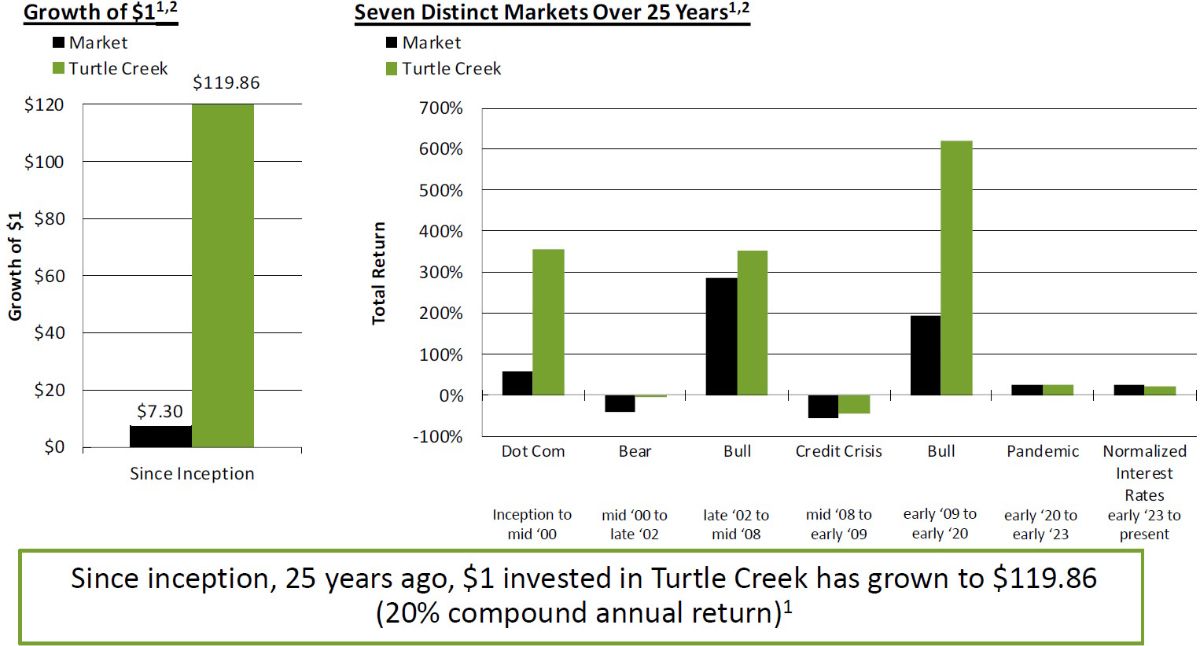

First up was Andrew Brenton, the CEO of Turtle Creek. Brenton, along with his two co-founders, is the founder of the Turtle Creek Equity Fund, which has managed to produce impressive returns since its inception in 1998. The excellent track record, distinctive approach and sound portfolio management are reasons why we have included this mutual fund for clients. We can offer clients access to the institutional founder share class, which is a distinctive proposition within Europe.

During Tresor Capital’s presentation, the top three best and least performing positions over the past 12 months were briefly explained. Canadian investment holding company Constellation Software seems to have a subscription to this, as it has been among the top performers for years. Brenton also heard the name dropped, and as a Canadian in the financial sector, he has run into top executive Mark Leonard in Toronto as well.

From left to right: Michel Salden, Michael Gielkens, Erik Klinkers, Michael Bowen (Turtle Creek), Rob Rutten, Andrew Brenton (CEO of Turtle Creek), Jelle Vermeulen and Maurice Essers

It led him to cite an anecdote about a major client of Turtle Creek. A long time ago, a loyal client of Brenton’s contacted him to inform him that he wanted to take money out of Turtle Creek’s funds. “I am a huge fan of yours and sincerely believe in the success of your approach, but I have now come across a company I want to invest all my money in,” Brenton said.

That company was Constellation Software. With Turtle Creek, the investor would have made an extremely impressive return averaging about 20% per year. However, with an average return of 30% per year, Constellation managed to do even better. We are pleased to have both in our portfolio.

Brenton kicked off after his anecdote with an explanation of Turtle Creek’s approach. In this podcast, he explains in his own words the Canadians’ approach. The figure below shows that a dollar invested in 1998 would currently be worth nearly $120, where it is $7.30 before the exchange. Moreover, the figure next to it shows that Turtle Creek manages to beat the stock market in both upward and downward phases.

Last year, Brenton cited the automation company ATS Corporation to demonstrate Turtle Creek’s continuous portfolio optimization. This example really captured our imagination, so we are happy to refer to this passage from the 2023 Relationship Day report.

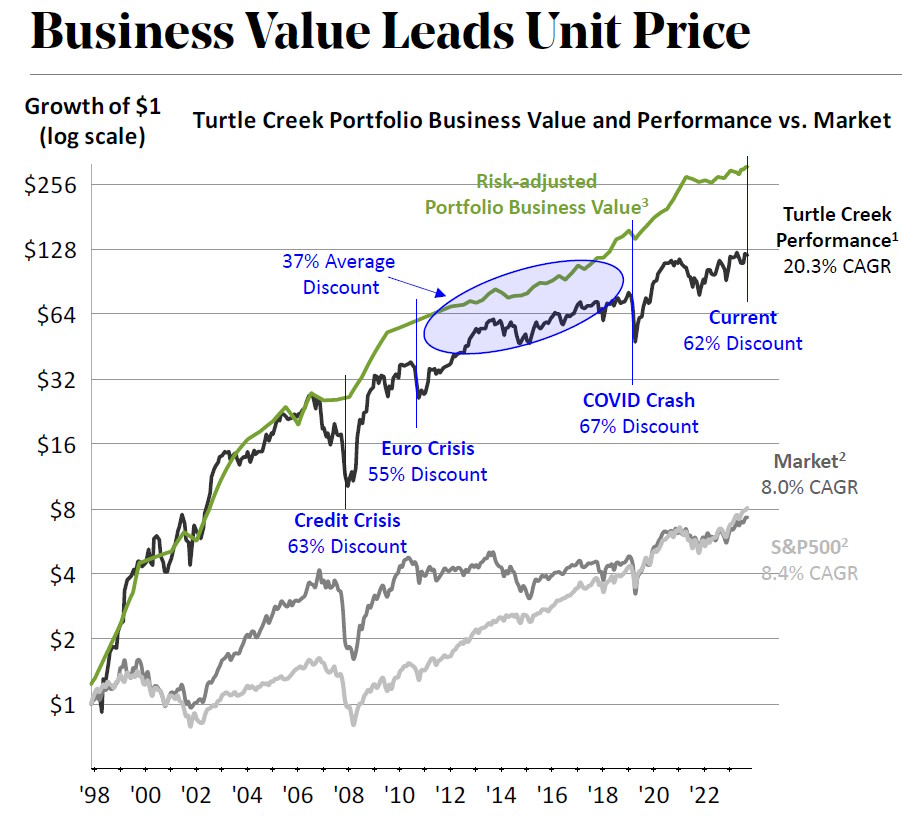

For the 2024 relationship day, the focus was on an interesting fact. Namely, the fact is that the price of a share in the fund is at a historically large distance from the intrinsic value calculated by Turtle Creek. In short, the fund is extremely attractively valued relative to its fundamental enterprise value. The undervaluation is as much as 62%.

Brenton emphasizes that there has rarely been a better entry point to invest in Turtle Creek’s funds. The last three times Turtle Creek noticed such a large discrepancy was during a significant crisis. And each time the undervaluation was so high, it was attractive to invest in the Turtle Creek Equity Fund, the examples below show:

- At the end of February 2009, around the nadir of the credit crisis, the undervaluation was 63%. Investing at that date had yielded an average annual return of 49% and 39% in the following three and five years, respectively.

- Those who had invested at the end of September 2011, amid the Euro crisis (undervaluation 55%), had averaged 30% and 18% annual returns over the following three and five years.

- During the corona crash, the undervaluation rose to 67% at the end of March 2020. Those who had invested then would have earned an average return of 28% per year in the following three years.

Michael Gielkens and Constantin Mang (CEO of MBB)

MBB

After a short break, the program continued with a presentation by Constantin Mang, the CEO of the German family holding company MBB SE. MBB was founded by college friends Nesemeier and Freimuth, who still own 70% of the shares. Mang has also invested all his own money in the shares, a strong example of skin in the game.

Through good management and several attractive, value-creating transactions, MBB has managed to generate impressive returns for its shareholders since its IPO. We regard this as a hidden gem on the German stock exchange, which has the wind in its sails from various megatrends and is still listed at an extremely attractive valuation.

During our presentation on macroeconomics, we showed the image below, with Germany as the sick man of Europe. Mang picked up on that, mentioning that despite Germany’s major economic problems, there are also opportunities to be seized, for which MBB’s portfolio is well positioned.

Specifically, Mang touched on the malaise in the German automobile sector, which faces stiff competition from Chinese automakers. Subsidiary Aumann is a major player as an automator of production lines for batteries and electric vehicles. European carmakers have reduced their investments in electrification, but the transition to electric driving is unstoppable, according to Mang. Aumann still offers a very interesting proposition.

Mang emphasized MBB’s uniqueness as a family business with a long-term vision. MBB helps entrepreneurs with succession issues, especially for baby boomers whose children have no interest in taking over the business. Instead of selling to private equity, which risks saddling the company with debt and reselling it quickly, entrepreneurs can sell to MBB. MBB has already successfully acquired and grown several companies.

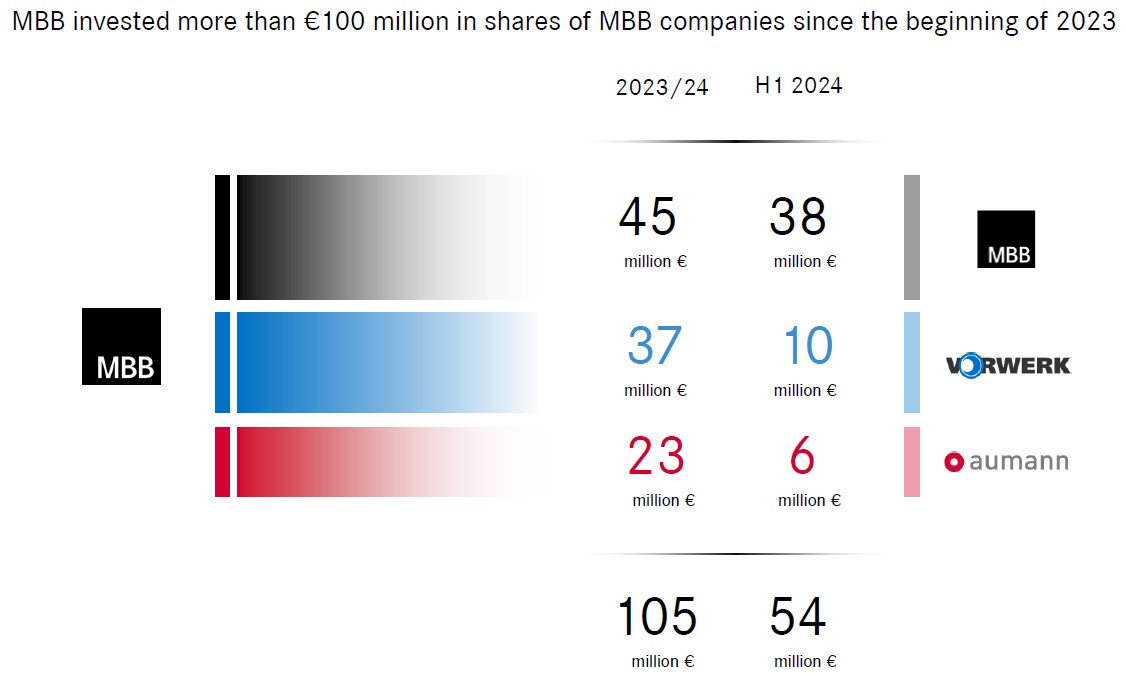

Over the past 18 months, MBB invested mainly in its own portfolio rather than making acquisitions, as shown in the figure above. The valuations demanded by entrepreneurs were too high for MBB, according to Mang, while its own shares and those of subsidiaries could be picked up for next to nothing. The family holding company invested more than EUR 100 million in its own portfolio. On that, MBB has already made very nice returns on average.

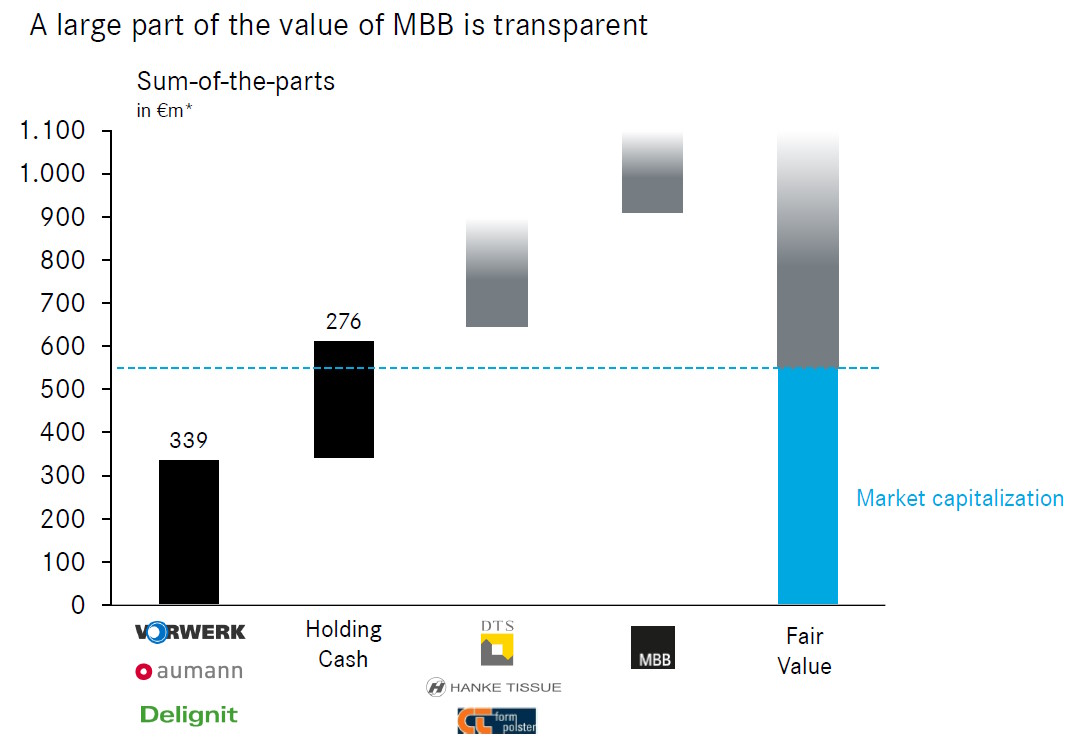

The sharp rise in interest rates has somewhat leveled the playing field for MBB. The lowered valuations that have accompanied this have resulted in Mang and his team currently engaged in several research projects that could lead to an acquisition. With EUR 276 million in cash and no debt, MBB is actively looking for ways to profitably invest this money in new mid-sized companies. Mang is optimistic that one or more acquisitions will materialize in the near future.

MBB continues to quote at a substantial undervaluation, as Mang demonstrated with the figure above. We conservatively set the net asset value at EUR 168 per share, which at the time of writing results in a sharp undervaluation of 38%. Then we include the listed companies at the stock price, but these are also quoted at a very low valuation. If we consider this “double discount,” it can be said that the undervaluation is even approaching 50%.

Subsidiary Friedrich Vorwerk continues to benefit from the extensive need for new infrastructure that accompanies the energy transition, while increasing dangers as well as regulations in IT security are grist for the mill of MBB’s cybersecurity company DTS. These are structural trends that continue to push the value and profits of these companies upward. Given its bright prospects and substantial undervaluation, MBB is one of the cornerstones of our family holding portfolio.

6Degrees Capital

Finally, it was the turn of Wouter Volckaert, managing partner of 6Degrees Capital. 6Degrees is a venture capitalist that invests in early-stage technology companies (start-ups and scale-ups) from seed capital up to series B. 6Degrees invests mainly in Europe and focuses on disruptive technologies that solve a real customer pain, with a target return of 300% per fund (after fees). The main sectors are Fintech, Software as a Service (SaaS) and AI (Artificial Intelligence).

In addition to distinctive propositions in the area of listed investments, as an investment boutique we also see a role in providing our clients with the opportunity to participate in attractive investment propositions in private markets.

To that end, we look for distinctive parties, and we think we have found them again with 6Degrees. In particular, we are impressed with the strong track record that 6Degrees can provide, and can provide our clients with access to the third fund 6DC III on attractive terms.

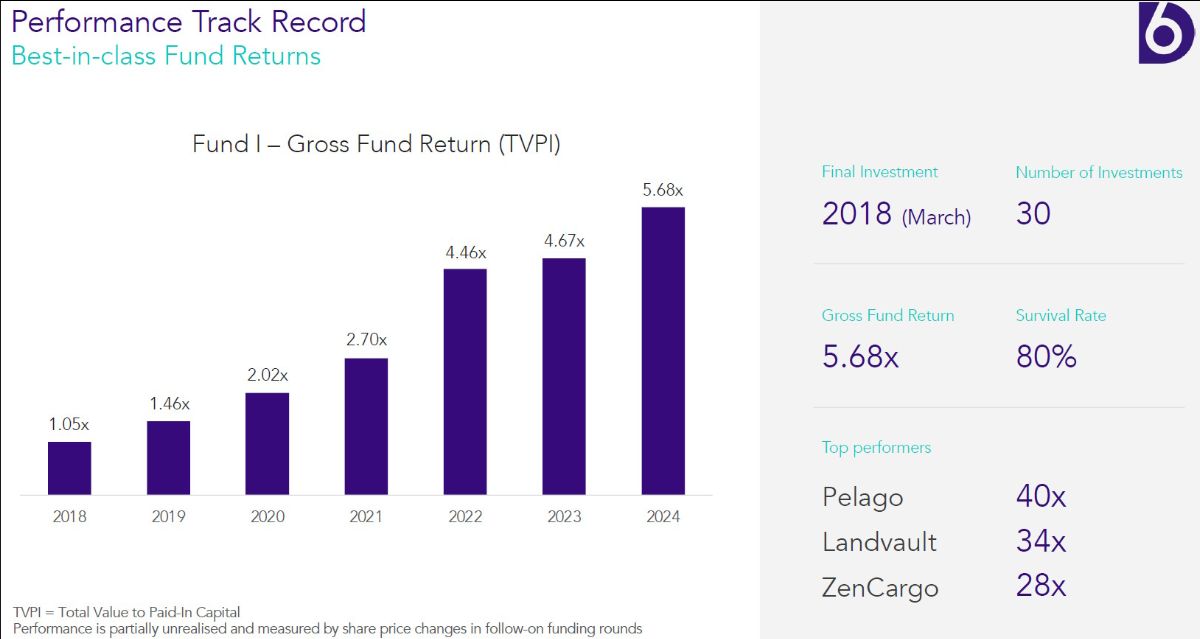

The image above shows the key facts surrounding 6Degrees Capital and specifically the third mutual fund. Two crucial things that stand out are returns and survival rates.

In the past, 6Degrees already managed to earn back more than 5x the deposit for its investors, and these are only interim figures. The figure below shows the impressive returns. An important explanation of this performance is the so-called fund returners.

6Degrees typically selects 30 companies for a fund. Thus, if one company gains 30x in value, they have recouped the investors’ investment in the fund. The top performers from the first fund (see figure below) have been able to do this. So three of the 30 companies apiece have already recouped almost all of the investors’ deposit.

One explanation for those good returns includes the survival rate. 6Degrees is extremely picky in its selection process. More than a thousand potential investments are analyzed annually, and a rigorous selection process leaves a group of only 15 names to be considered for the portfolio.

Ultimately, six companies are included in the 6Degrees fund each year, so less than 1% survive the critical selection criteria. The fact that more than 80% of the investments survive is very exceptional in the venture capital industry, and demonstrates 6Degrees’ special way of working.

We can provide our clients with access to the 6Degrees Capital III fund at attractive terms. If you are interested, we invite you to contact us.

In short: a successful event

The feedback on the 2024 Relationship Day was overwhelmingly positive. Both the content of the presentations and the ambiance and location were well appreciated. We can therefore say that the 2024 event was a success. We will certainly follow this up.

We expect to host a presentation with Swedish family holding company Investor AB in May 2025. More information will follow at a later stage.

We thank all attendees for their participation and hope to see you again at a future event!

If you have any further questions or comments, please kindly contact your relationship manager or via the details below.

Sincerely,

Michael Gielkens, MBA

Partner