Attached please find the monthly report, in which we share our views on conditions in the financial markets.

What Does Artificial Intelligence Mean For Your Investment Portfolio?

Since November 2022, Artificial Intelligence (AI, artificial intelligence) has been a hot topic due to the launch of ChatGPT. ChatGPT is a prototype artificial intelligence chatbot developed by the American company OpenAI, which specializes in conducting dialogues with a user. As a result, the responses displayed resemble a dialogue with a human being. The chatbot is a large language model refined with artificial intelligence learning techniques. We would like to point you to this beautiful infographic by Visual Capitalist, which explains this concept in more detail.

The imagination has now run wild to figure out the myriad applications of artificial intelligence. One of the main implications is that generic tasks can be automated, which could result in huge productivity improvements in numerous industries. This could result in improved economic growth for the overall economy.

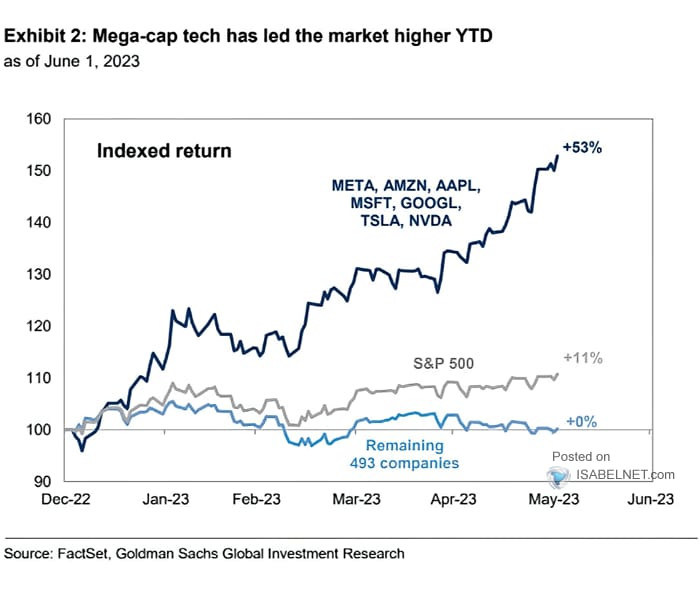

It is no wonder then that investors are trying to figure out which companies will benefit most from this. This has implications for stock market mutations. Because of the enthusiasm surrounding artificial intelligence, it is technology stocks in particular that have risen sharply in price. Because these companies have a very heavy weighting in stock market indices, these indices such as the AEX or the S&P 500 paint too rosy a picture.

The figure above shows that the 11% positive return of the U.S. S&P 500 index is entirely due to the positive stock market performance of only seven stocks: Meta (Facebook), Amazon, Apple, Microsoft, Alphabet (Google), Tesla and Nvidia. In the Netherlands, it is ASML, ASMI and BESI that lead the way. These companies are considered the biggest winners in the field of AI by investors.

Hype or structural growth trend?

In the dot-com bubble (Internet bubble) of 2000-2002, the enthusiasm surrounding the Internet and its potential applications was the cause of a surge in the stock price of technology companies. At the time, we already knew that the Internet meant enormous change, but could not yet grasp in what way. More importantly, which companies would emerge as winners was completely unknown.

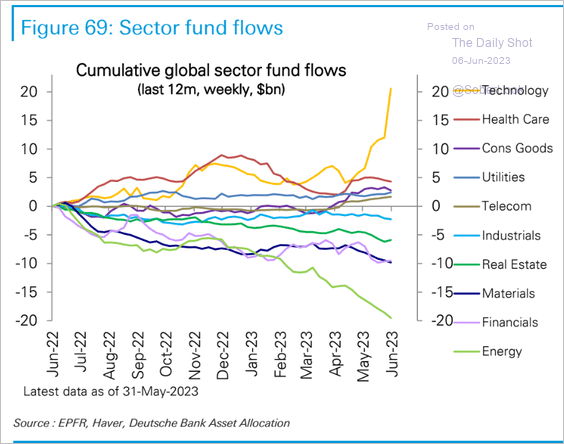

Investors have invested massive amounts of money in tech stocks, especially at the expense of the energy, basic materials, real estate and industrial sectors.

Even with the recent hype surrounding AI, it is not yet known how this technology will change our lives and in what time frame these changes will occur, let alone which companies will be the winners and benefit from them. A similarity with the Internet bubble is that these companies are, again, grossly quoted with very optimistic valuations, an important difference is that these companies are now (extremely) profitable and also well capitalized.

Artificial Intelligence in your investment portfolio

At the recent shareholder meeting of investment holding company Constellation Software, shareholders raised the question of whether AI poses a structural risk to software companies in the longer term, and whether AI has an impact on the pipeline of acquisition candidates (Constellation reinvests excess cash in acquisitions of new software companies).

Chairman John Billowits: “I think every decade this kind of potential risk has surfaced. What usually happens is that these usually evolve much more slowly than people think they will. Nevertheless, they are changing a dynamic, especially in the technology sector. And so it will probably have some impact, but it will probably have less impact than people think right now.”

Constellation’s chief investment officer Bernie Anzarouth added: “We have not seen any impact on our acquisition pipeline of companies we are looking at. There will be AI in some companies and not others. We know that customers in our industries take a very, very long time to turn off software and move to the latest hype simply because it’s so hard to get rid of the software and use something new that may not have all the functionality you want as a business owner. So that’s the attraction of our software, whether AI is going to change that? It’s very hard to predict, but I think we’re a long way from it.”

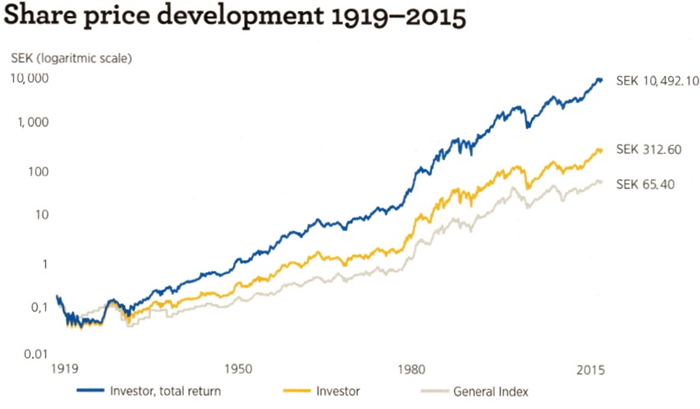

Over periods of more than 100 years, investment holding companies like Investor AB have demonstrated continuous success in adapting to new developments. In fact, the family holding company’s company slogan reads, “The transition from the old to what is to come is the only tradition worth preserving.” This also applies to subsidiaries such as industrial conglomerate Atlas Copco and automation company ABB, where Investor AB has played a guiding role in strategy transitions from the supervisory board.

Investor AB managed to successfully weather trials and adapt to new trends over the past century. This ultimately resulted in the chart above. Since 1919, a share of Investor AB (including dividends) produced an average return of as much as 11.9% per year. Over the past 20 years, that has actually increased to 17.9% per year, and over the past 10 years to 19.3% per year.

Due to their decentralized organizational structure, the companies in our portfolios are highly dynamic, focusing on megatrends that will define the world of tomorrow. Investor AB chairman and major shareholder Jacob Wallenberg explained this at the shareholder meeting recently as follows: “We try to support our subsidiaries with knowledge and capital in terms of future-proofing in terms of digitalization/AI.

It is very important to ensure that our companies are at the forefront. We encourage this through general dialogues with companies, with supervisory board representatives. And a few times a year we have direct dialogues with CEOs and board chairmen in a more focused way. Artificial Intelligence has become the main topic of conversation in these.”

Investor AB CEO Johan Forssell explained another crucial advantage that an investment holding company has: “We have a big advantage within Investor. We have non-competing companies. Our companies don’t compete with each other, we don’t own shares in both Epiroc and Sandvik, for example, just to give a simple example. And that’s a real advantage because it means we can bring together key people in our companies and have them share experiences in these important areas, whether it’s sustainability, technological transition or, for example, China. We can share experiences and discuss important issues. It’s a very crucial part of our business model.”

AI Infrastructure

In addition to adjustments within companies, we also have exposure within our portfolios to companies providing the critical infrastructure for the AI megatrend. Indeed, hugely advanced chips are needed to support AI applications.

For example, investment holding company Aalberts is one of the five main global suppliers to chip machine manufacturer ASML and many other important chip companies. We recently visited Aalberts’ shareholder meeting, where CEO Wim Pelsma indicated that he sees tremendous opportunities in the semiconductor market, in which the investment holding company is investing heavily.

Pelsma: “We see the market development as very positive. Artificial Intelligence, data centers, autonomous driving, 5G; it’s going further and further with intelligent, digital solutions. We are a supplier, codeveloper with customers like ASML. There are very few players like Aalberts with scale. Many smaller players do not know how to take advantage of further growth opportunities, such as the newly incorporated company KML. That offers (acquisition) opportunities for us. In terms of semiconductors, the next 10 years look great for Aalberts.”

Brookfield Corporation is one of the largest global investors in real assets such as real estate, renewable energy projects and infrastructure. CEO Bruce Flatt was recently asked about the impact of AI on the investment holding company. Flatt said, “I think AI will be supportive of our largest businesses.

If AI is going to scale up to the level talked about in the headlines today, the two biggest things needed are more data centers around the world and very, very significant increases in electricity capacity to power those data centers, and the biggest users of green power are the tech companies. So two of our biggest asset classes, renewable energy and infrastructure, should benefit immediately from the growth in AI.“

Direct exposure

Investment holding company Prosus offers broad exposure to the application of AI throughout its organization. The company began developing its AI capabilities five years ago. Recently, Prosus published an extensive article in which it announced it was rolling out AI applications on a large scale within its organization through a partnership with ChatGPT. Moreover, in the cited article, Prosus concretizes the application of AI through some practical examples. In doing so, Prosus emphasizes that it actively manages the input variables itself

Prosus is benefiting from its capabilities in AI through its main subsidiary Tencent. During its annual earnings presentation, the Chinese technology giant revealed that it is gradually integrating Artificial Intelligence into all its products and platforms, including WeChat, China’s largest social media platform with 1.3 billion monthly active users. In addition, Tencent is working on an AI tool similar to ChatGPT specifically for the Chinese market, which is shielded from major Western tech companies.

We recently visited the shareholder meeting of Belgian family holding company Sofina(you can read a report of that here). We asked top executive and major shareholder Harold Boël about his view on AI. Recently, for example, AI was mentioned as a potential risk for (online) education companies. Boël does not see AI as much of a risk for education companies; Sofina has interests in private school groups on the one hand and very specific education applications on the other. According to Boël, Sofina has an interest in a company that applies AI intelligently, with promising and impressive outcomes. More attention will be drawn to this in upcoming reports.

Rob Rutten (left) and Michael Gielkens (right) attended Sofina’s AGM in May, which included discussions with CEO Harold Boël (center)

A few weeks ago it was announced that Sofina, through five of its venture capital funds, co-owns OpenAI, the parent company of the AI application ChatGPT. This is the great advantage of the family holding company’s extensive venture capital portfolio and unique network. For example, Sofina has also previously been an early shareholder in Google, YouTube, Facebook, WhatsApp, LinkedIn, Uber, AirBNB and Instagram.

The companies Sofina holds directly in its portfolio are also working on Artificial Intelligence. One example is ByteDance, the largest individual position in Sofina’s portfolio and the parent company of the very popular social media app TikTok, among others, which is competing with Tencent to develop a Chinese counterpart to ChatGPT.

Other exposure

Of course, there is a much broader scope of AI within our selection of equities, mutual funds and other securities. For example, in the area of insurance, Markel has partnerships with and participations in fintech companies to better identify future claims risks through AI. Through its investment portfolio, Markel is exposed to the aforementioned large technology companies. Berkshire Hathaway, with more than 15% of net asset value, has a large exposure to Apple, which seeks to integrate AI into its products and services through numerous applications.

A sober closing word comes from Berkshire Hathaway icons Warren Buffett (age 99) and Charlie Munger (age 92). They usually have little use for new technologies, as was evident at the recent shareholder meeting. Buffett reached out to his good friend and Microsoft founder Bill Gates, and sees both opportunities and threats from AI. “I’m personally skeptical of some of the hype around AI,” said Munger. “I think old-fashioned intelligence works pretty well.”

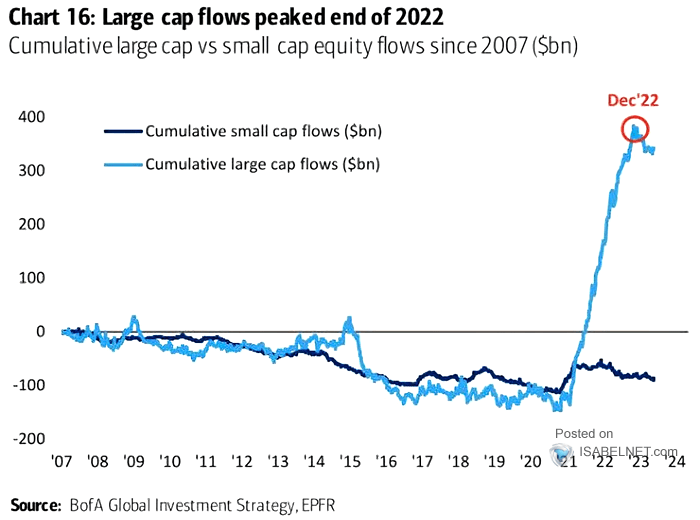

Investors have massively invested money in the big (technology) companies, while smaller companies have not (yet) benefited.

Widening stock market rally?

So the question remains open whether (the stock market reaction to) artificial intelligence is hype, or whether we are only at the beginning stages of a new era of robust economic growth and corporate profit growth. In any case, through our investment portfolios, we have exposure to various applications of AI in a variety of ways, so it is to be expected that the companies we invest in can also benefit from the productivity improvements and opportunities this new technology has to offer.

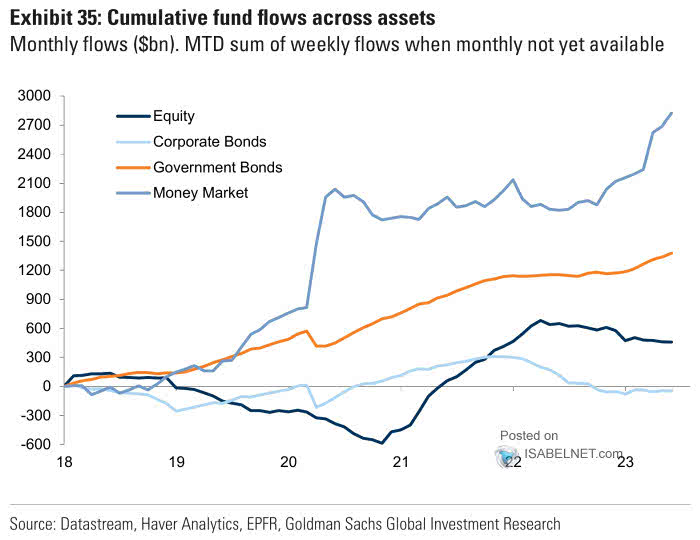

Investors have pulled a lot of money out of stocks and corporate bonds since 2022. Government bonds and especially money market funds have benefited, a sign of a very large amount of money on the sidelines.

Although the stock market rally has so far been mainly limited to the large technology companies, it may nevertheless result in a gradual return of investor confidence. Capital is currently still flowing into the aforementioned technology companies, but it is quite possible that the large amount of money investors took out of the market last year could find its way back into the stock market. That could result in a widening of the stock rally, which could potentially allow other stocks to have their moment in the sun as well.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner