Attached please find the monthly report, in which we share our views on conditions in the financial markets.

The Sentiment Indicator By Howard Marks

How can you measure current investor sentiment? That’s the question Howard Marks asked himself in his new memo. As co-founder of Oaktree Capital, Marks is a renowned investor in private markets, with a particularly excellent track record in distressed debt. Oaktree is known in the Netherlands, among other things, as the 2021 buyer of the High Tech Campus in Eindhoven.

Howard Marks: a brief introduction

Excellent returns in the private debt market prompted investment holding company Brookfield to acquire Oaktree in 2019. Marks serves as a commissioner at Brookfield and continues to lead Oaktree Capital.

Marks, however, amassed followers not only because of his good returns, but mainly because of his sharp and witty analyses, which he publishes in memos from time to time. Legendary investor Warren Buffett of investment holding company Berkshire Hathaway is a big fan, and has even said he will drop everything from his hands to read Marks’ new memo when it appears in his mailbox.

This week Marks published a new memo entitled “Taking the Temperature.” Some passages we would like to share with you, as well as an application to some of the companies in our portfolio.

Five times correctly gauged sentiment

Marks writes very sporadically about macroeconomic developments and sentiment in the financial markets. However, the times he writes about them are very noteworthy. Five times in 50 years he has gauged sentiment and warned of market excesses, each time he has been proven correct.

For example, in the 2000 “Bubble.com” memo, he warned investors about the extreme bubble formation in Internet companies: “I define a bubble as an irrationally optimistic view of a stock or sector, and the Internet bubble craze of the late 1990s was an example of this definition.”

Marks also warned about the housing market crisis in 2004 and 2005: “I noted that expected future returns on most asset classes were extraordinarily low and that the search for risk by investors seeking to ameliorate those low returns had led them to embrace riskier investments. One such investment was residential real estate, because investors there embraced the most egregious misconception: the belief that house prices can only go up.”

What does this mean for selecting effects?

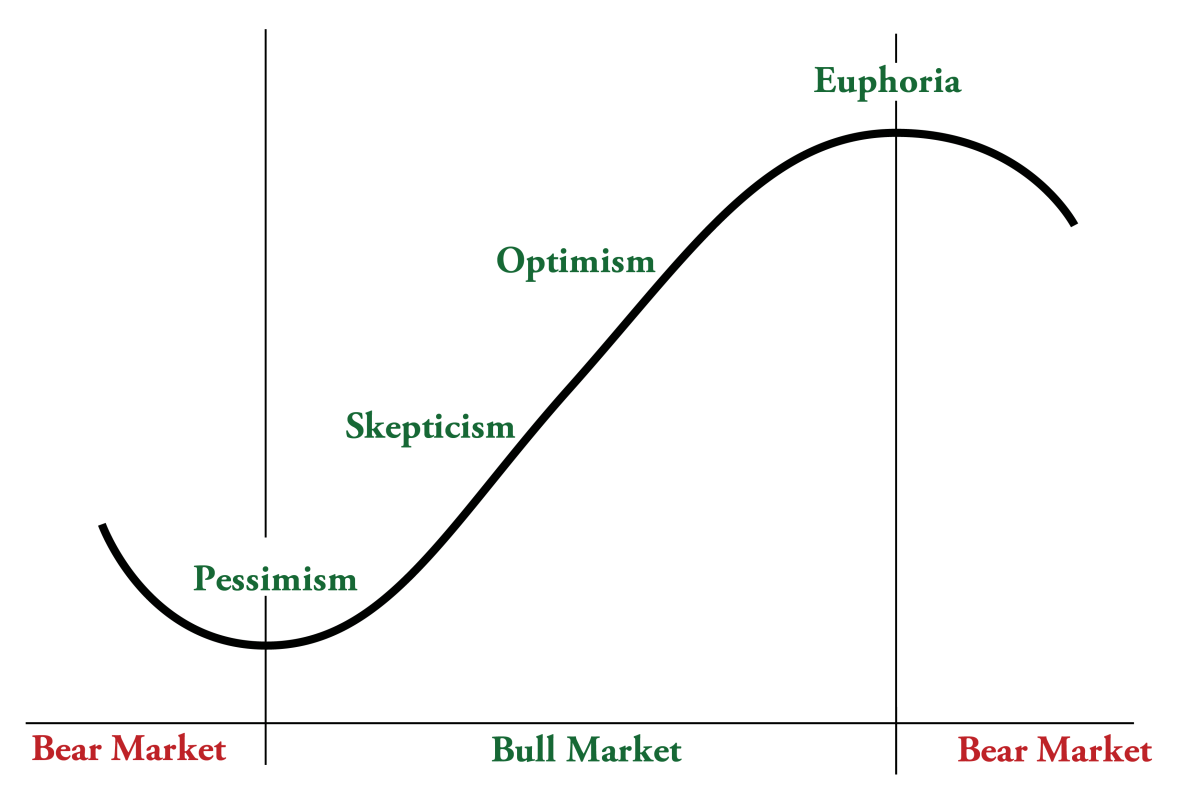

It’s nice and all that Marks correctly knew how to “gauge the temperature of the stock market in the past,” but how can you apply the lessons he learned in practice? Marks is a proponent of thinking in cycles. The economy and also the financial markets follow a certain cycle.

To make good investment decisions, it is important to be able to recognize which phase of the cycle you are in. The key question here is: Are investors overly optimistic or pessimistic about the stock market in general, or a company or sector in particular?

Marks writes: “In the third phase of a bear market, everyone agrees that things can only get worse. However, its risk is just as obvious: missed future returns. The third stage of a bear market does not mean that the stock market cannot continue to fall, or that a bull market is about to begin. But it does mean that the negative news is on the table, there is a lack of optimism, and the greater long-term risk probably lies precisely in not investing.

When the temperature of the market is too low, there is too much fear and too little greed, too much pessimism and too little optimism, and too much risk aversion and too little risk tolerance. Negative possibilities are then accepted as fact. It then goes without saying that (a) investor expectations are low; (b) stock prices are unlikely to be excessive; (c) there is little chance of investors being disappointed; and (d) there is thus little chance of permanent capital loss and a good chance that prices will rise. In other words, this is the epitome of a buying opportunity.”

Buying opportunity

The bear market of 2022, fueled by high inflation and sharp interest rate hikes by central banks, presented an interesting buying opportunity for equities in our view. However, the recovery after the bear market of 2022 was not exactly unequivocal and is still pending for various sectors and specific companies. Last month, we already wrote extensively about AI (Artificial Intelligence or artificial intelligence) and the fact that technology companies in particular have benefited as a result of the breakthrough of the popular ChatGPT.

Although a substantial portion of the positions in our portfolios have recovered nicely since the recent low in October 2022, this is partially offset by three major laggards: Brookfield, MBB and Sofina. However, according to Howard Marks’ “thermostat,” we see precisely that sentiment here is extremely low, there is far too much pessimism and thus a potential buying opportunity.

Brookfield, MBB and Sofina

We have written about these cases before(see also our website), and recently published comprehensive business analyses for our clients. The underperformance of these stock prices and the extremely large undervaluations relative to intrinsic values (undervaluations: Brookfield 47%, MBB 44% and Sofina 31%) can be explained by macroeconomic developments and business reasons.

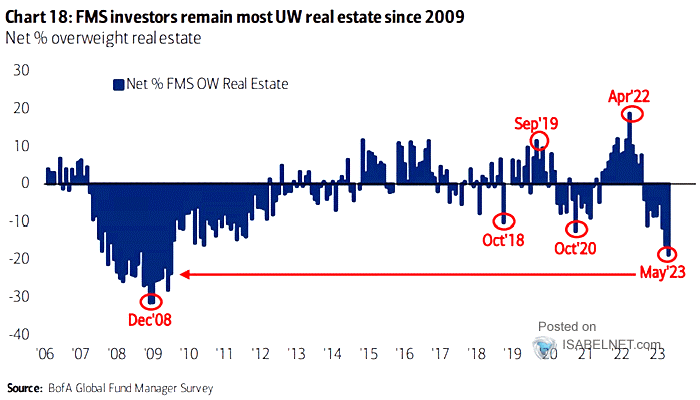

At Brookfield and Sofina, hard-hit capital market interest rates and the recent banking problems in America play an important role. Real estate and young technology companies are assigned lower current values when interest rates are high. When interest rates declined in January and February of this year, a nice recovery was seen at both Brookfield and Sofina.

Investor sentiment toward commercial real estate is at its lowest level since the nadir of the credit crisis.

However, banking problems in March threw a spanner in the works. Regional banks have relatively large numbers of real estate loans outstanding, so might run into trouble and be less inclined to (re)finance, which put pressure on Brookfield. Silicon Valley Bank was precisely the bank where young technology companies were affiliated, including many of Sofina’s portfolio companies and venture capital funds.

Investor sentiment flipped mercilessly and share prices fell sharply. Crucial to note is that Brookfield has identified only 5% of its real estate portfolio as potentially problematic. but even if we value all real estate at 0, the undervaluation is 32%. At Sofina the situation is possibly even stranger, the company has announced that it has not experienced any negative impact, both directly and within its portfolio, but the share price has not moved forward.

MBB is struggling with specific problems at Vorwerk. That is annoying on the one hand, but on the other hand it has been clearly communicated that 2023 will be a transition year, but that they expect to have put their house in order towards the end of the year. Then Vorwerk will be excellently positioned for the energy transition. No value seems to be assigned to cybersecurity company DTS IT, while regarding the margin increases already in the order book at Aumann, investors take an attitude of “first see, then believe.”

The interesting thing about these three cases is that the risk-return ratio has become extremely attractive. If, in the coming quarters, the aforementioned family holding companies can demonstrate at the figure presentations that the supposed negative impact, now expected by the pessimists, turns out to be not so bad, there is a real chance of a substantial share price recovery. In any case, an extreme amount of negative news has been priced into current share prices.

Reliance Industries: things could go hard

A good example of a recent reversal of negative sentiment concerns Reliance Industries, which we wrote about earlier this year. In January, a known short-seller opened its sights on Adani’s companies (see our analysis for more information), allegedly rigging its figures. As a result, the entire Indian stock market fell sharply, including Reliance Industries.

Reliance was operationally unaffected by this and had no exposure to the Adani empire. In the meantime, one reported fine first-quarter figures and showed through an external valuation of the retail division (USD 93 billion) how much hidden value there is in the holding company.

Marks states in his memo, “The accumulation of negative news and excessive pessimism causes investors to throw in the towel just when the time is right for the contrarian investor to become optimistic. The great irony here is that the pessimist assumes the continuation of a negative trend that is underway. However, it is not the recent history of a stock price rise or fall that is relevant, but rather the fact that most things eventually turn out to be cyclical and tend to swing back from the extreme to the mean.

Cycles result from “excesses and corrections. A strong movement in one direction will sooner or later be followed by a correction in the opposite direction .” The case of Reliance Industries demonstrates the validity of this statement. From its March low, the stock price has already recovered by more than 27%.

Conclusion

It is appropriate to end with a quote from Marks’ memo, “In extreme times, the secret of making money lies in being contrarian, not in conformity. When emotional investors take an extreme view of an investment’s future and as a result drive the price to unwarranted levels, the “easy money” is usually made by doing the opposite.

However, this is very different from simply deviating from the consensus all the time. So to be successful with a contrarian approach, you must understand (a) what the herd is doing, (b) why it is doing it, (c) what is wrong with it, and (d) what should be done instead and why.” We have tried to take you succinctly through our thought process regarding the cases cited.

The stock market rally has been mostly limited to the big technology companies, but last month we saw the first signs of the rally broadening. When investors will also shift their attention to other companies, particularly the laggards we outlined above, is impossible to predict. What is clear, however, is that the risk-return ratio is particularly attractive for these propositions. As we have seen in the past (most recently with Reliance), the laggards may become the drivers of the investment portfolio in the next phase.

If you have any questions or comments about this publication or other matters, please kindly contact us using the information below.

Sincerely,

Michael Gielkens, MBA

Partner