Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Family Holding Companies Profit From Structural Megatrends

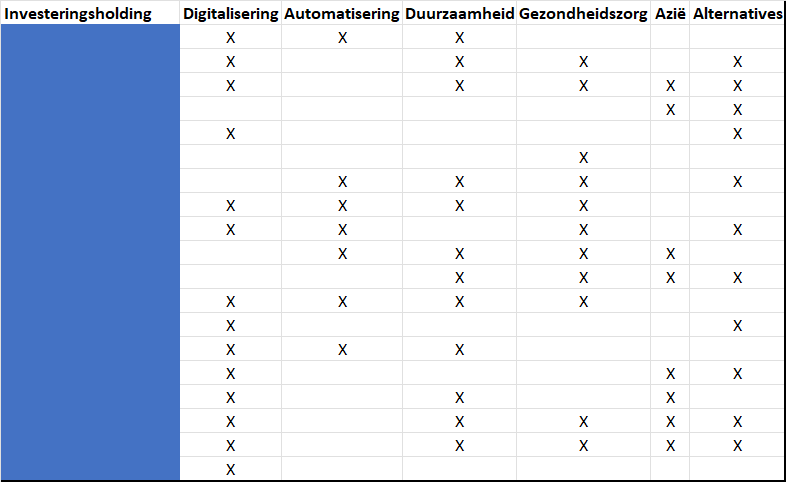

Note: Exclusively for clients, we have described the entire family holding portfolio. For each megatrend, we have indicated which holdings have exposure through which part of their portfolio. The monthly report below is a selection of this information. The entire article is available upon request

The companies in the Tresor Capital Family Holding Mandate are selected according to a so-called bottom-up process. Among other things, we look at whether there is a controlling shareholder and whether the management and SB own enough shares of their own company (skin in the game), what the return on invested capital is, the track record of growth in net asset value, the debt ratio and the portfolio composition. These are all company-specific characteristics.

However, we also look top-down. That is, we consider the composition of the portfolio as a whole, and the role of individual companies within it. Thus, we ensure a sound spread between sectors and regions and monitor the balance between large and small listed companies. Also playing an important role is exposure to so-called structural megatrends.

Megatrends are powerful, transformative forces that can change the trajectory of the global economy by shifting societies’ priorities, driving innovation and redefining business models. They can have a meaningful impact not only on how we live and spend money, but also on public policy and business strategies.

Howard Marks

Howard Marks

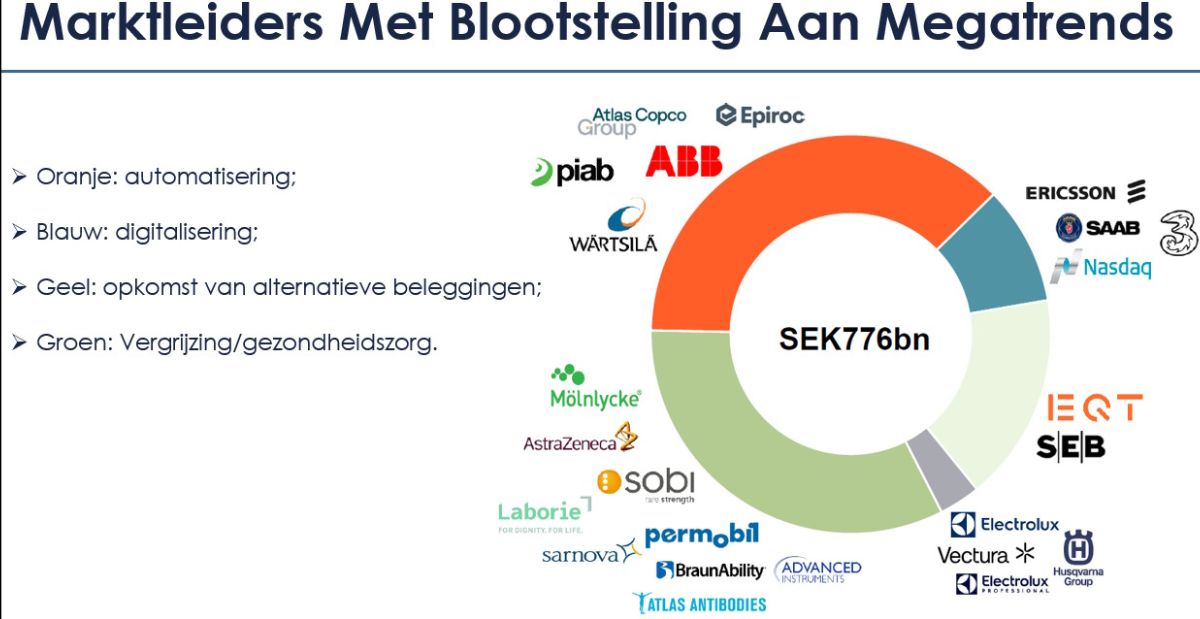

We see that the (better) family holding companies have a conscious strategy of (re)positioning the portfolio towards various megatrends. For example, the Swedish holding company Investor AB of the Wallenberg family divides the companies in its portfolio, as shown in the image above. The companies in the green segment focus on medical technology and healthcare, the tech companies in the orange segment focus on automation, the technology companies in the blue segment focus on digitalization, and the financial services companies in the green segment (especially EQT) take advantage of the growing demand for alternative investments.

Trend 1: Digitization

More and more companies are coming to the conclusion that substantial operational improvements can be achieved by digitizing. By digitizing (manual) processes and procedures, it is possible to exchange, read in and digitally analyze data. By adjusting processes based on this data analysis, significant efficiency improvements and cost savings can be achieved. Digitization has a major impact on society, business models and consumers.

The digital world encompasses broad categories, such as e-commerce, social media, Internet search, and interactive and transactional platforms. However, with the use of more data, cybersecurity must also be considered. With digitalization, however, also consider the rise of the digital economy. In recent years, there has been an increasing focus on learning, working, shopping and having meals delivered via the Internet.

Consider also the infrastructure required. For example, that data must also be stored, often in a cloud environment. Infrastructure also includes computer chips.

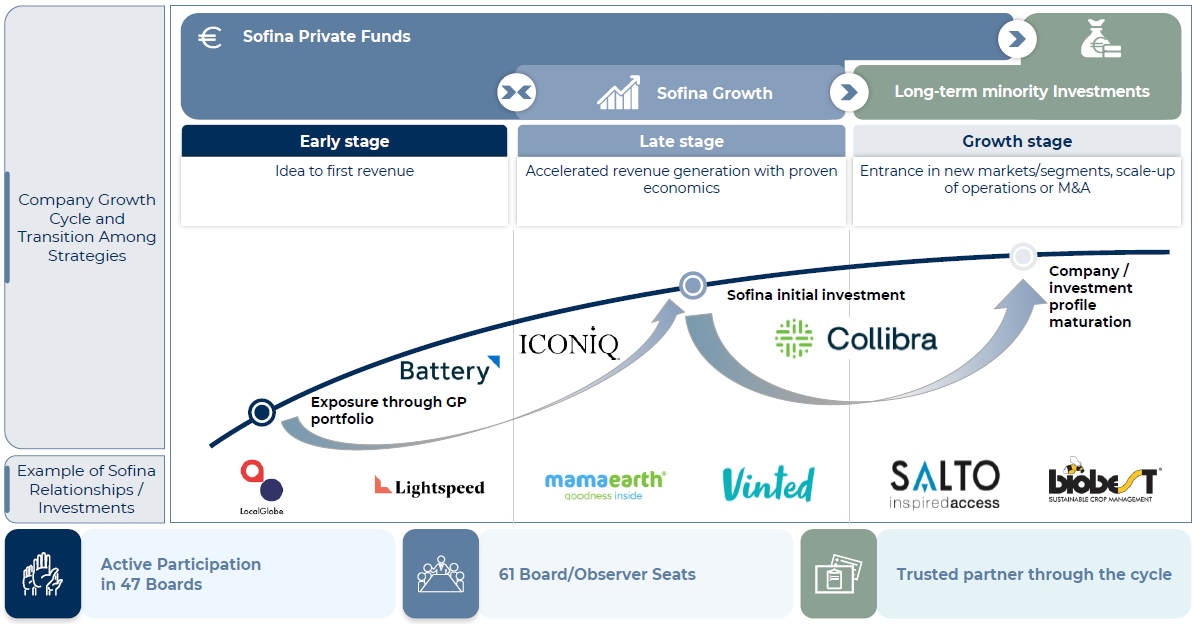

Artificial intelligence, of course, cannot be missing from a consideration of megatrends. In fact, we previously devoted an entire monthly report to this, which we are happy to refer you to. This more recent monthly report, which looks specifically at Sofina, also dives deeper into AI exposure. Also consider all the (renewable) energy required for this (see the third megatrend below).

Trend 2: Automation

Following on from digitization, automation has also gained ground in recent years. In the manufacturing industry in particular, these trends have collectively been dubbed Industry 4.0, or the fourth industrial revolution. The aging of the workforce, as well as increased labor costs, necessitate extensive automation and robotization.

Significant productivity gains can be achieved through automation, boosting economic growth. Investor AB subsidiary ABB, for example, is one of the global market leaders in automating and robotizing processes in the manufacturing industry, among others.

Trend 3: Sustainability

In recent years, sustainability is becoming an increasingly important issue. Since the Paris Agreement this trend has gained momentum, more and more companies are reporting on their CO2 emissions and their contribution to solving the climate problem.

Virtually all investment holding companies report extensively on their contribution to NATO’s sustainable development goals and actively direct their subsidiaries to increase their focus on sustainability. Europe is ahead in this, but the importance is also increasing in other continents.

Trend 4: Healthcare

The aging population and associated increasing demand for better healthcare is also a structural trend. Thanks to innovative treatment methods from the life sciences and biotechnology industries, we as humans are getting older and older. At the same time, we are more aware than ever of the importance of our health, leading us to live healthier lives. Several investment holding companies have deliberately positioned themselves to invest in these trends.

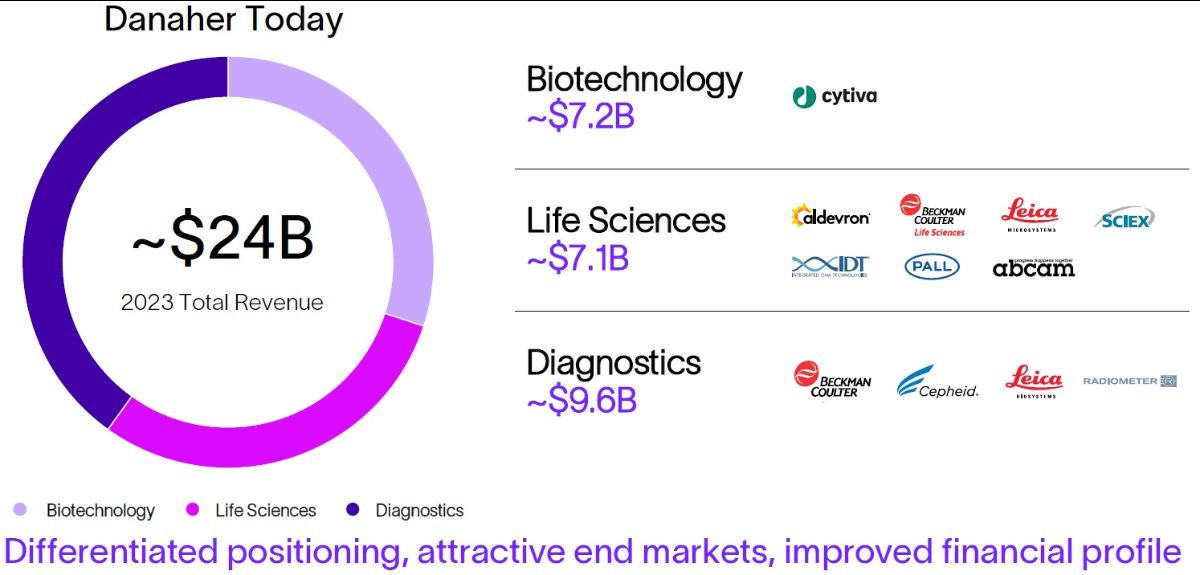

Danaher is a pure player focused on the healthcare market. We recently devoted an entire monthly report to the family holding company, which has an ironclad competitive advantage in the market. From instruments, consumables and software for the development of vaccines or biological drugs to tools such as microscopes or analytical instruments for (bio-)pharma to enable groundbreaking healthcare innovations, as well as analytical instruments for diagnosis, electronic measuring instruments (blood, molecules, etc.), as well as the related software and services in hospitals, laboratories and with doctors.

Investor AB has both listed and unlisted holdings in healthcare companies, including the world’s leader in wound care products Mölnlycke, drug developer AstraZeneca, biotech company Sobi and the company Advanced Instruments, which provides measurement instruments to test osmolality in clinical and biopharmaceutical markets.

Trend 5: The Rise of the Asian Middle Class

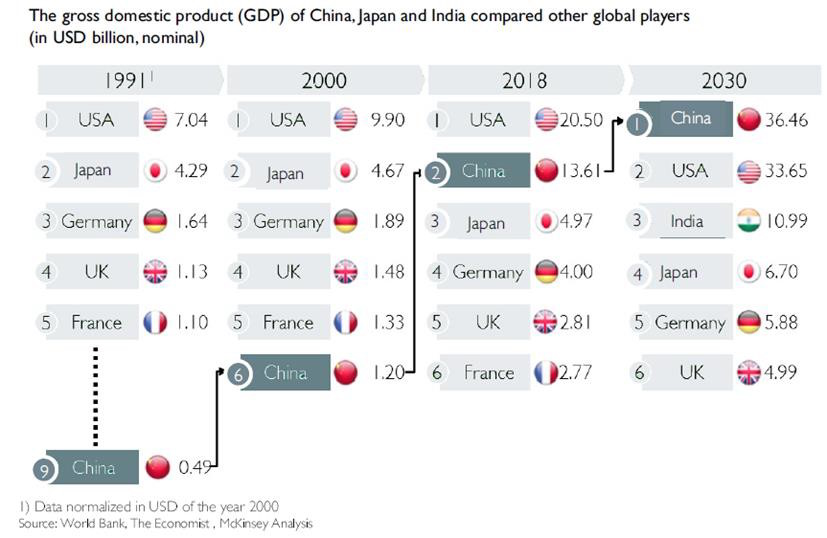

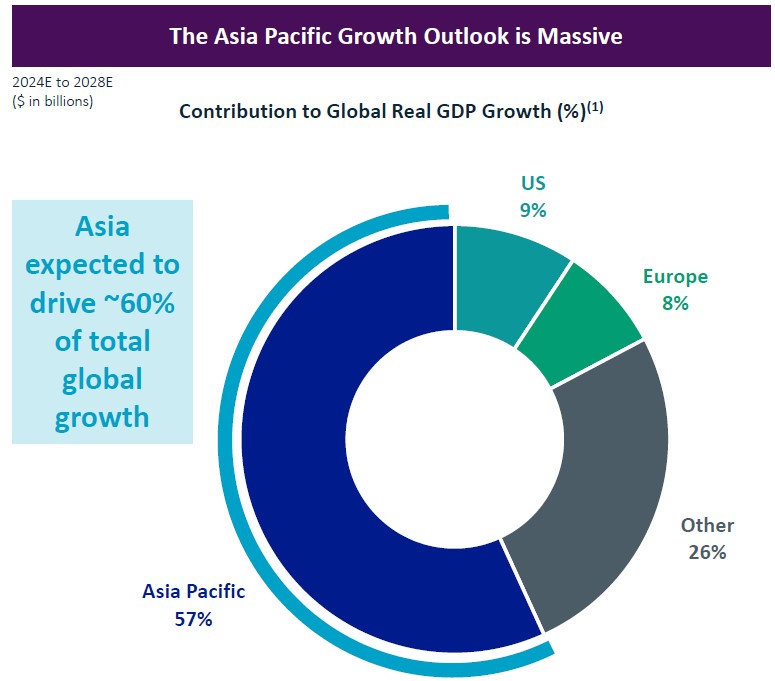

According to projections by the World Bank and research firm McKinsey, China will become the world’s largest economy in the next decade, knocking the United States off its throne. India is also projected to experience significant growth and will be the world’s third largest economy by 2030, as shown in the figure below.

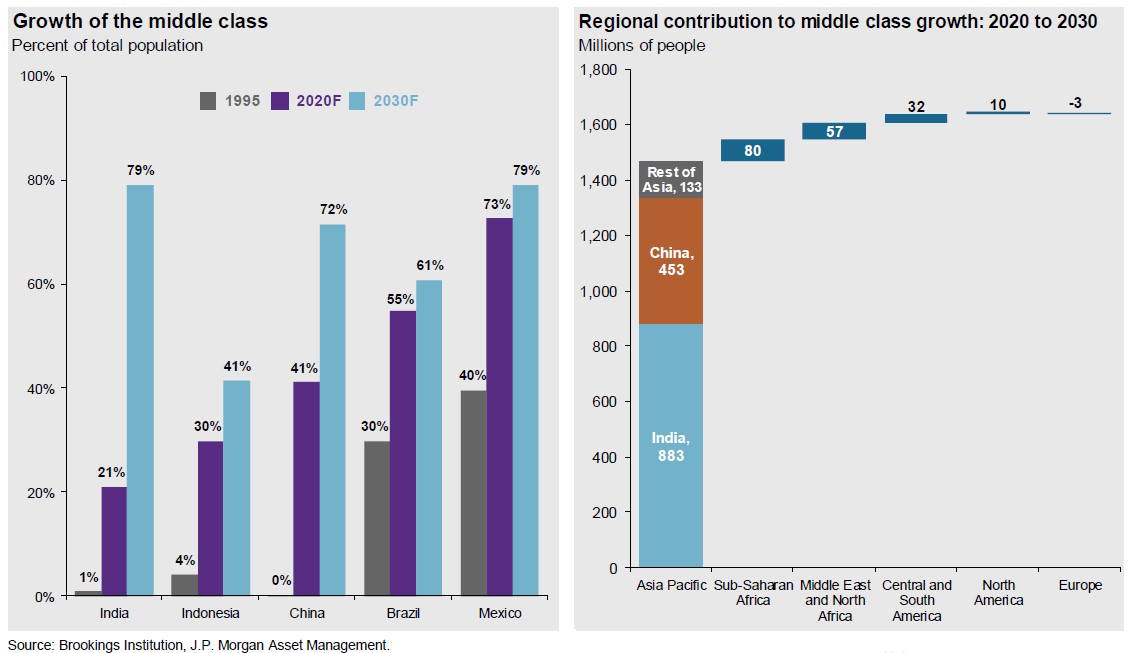

Other countries in Southeast Asia will also experience significant economic growth. These countries have a relatively young average population age, so an economic impact comparable to the baby boom in the West is expected. According to research by the Brookings Institution, as much as 65% of the global middle class will be in Asia by 2030. Many investment holding companies have therefore made a strategic decision to focus on Southeast Asia.

The figure below shows the immense scale of development. Whereas today 21% of the total population in India belongs to the middle class, by 2030 it will be 79%. Such a development can also be seen in Indonesia and China. In total, nearly 1.5 billion people will join the middle class, including 883 million in India, with all the consequences that entails.

Their energy needs and need for higher quality food, for example, will increase. Their standard of living will develop accordingly, so people will want to go on vacation more often, consume more luxury goods, make more credit payments, and a whole new stream of entrepreneurs will emerge, which in itself will create new investment opportunities.

For example, Sofina invests both directly in promising companies in Asia and through investment funds of strategic partners, such as legendary venture capitalist Sequoia, which was even dubbed the best investment company in the world by the late Charlie Munger.

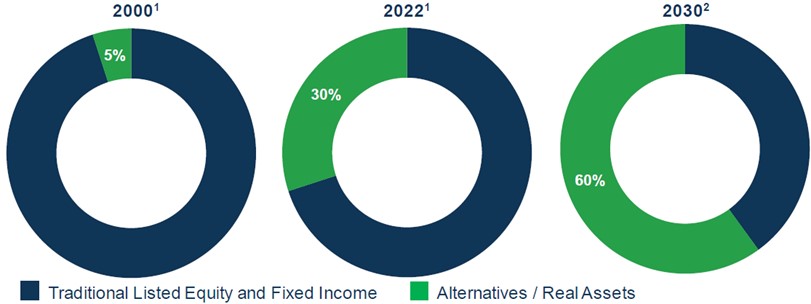

Trend 6: The Rise Of Alternative Investments

More and more investors are seeking alternatives beyond stocks and bonds for their portfolios. Examples include real estate, infrastructure projects, private equity and private credit. Such assets provide excellent returns on invested capital and offer constant, predictable cash flows over a very long period of time. Moreover, cash flows are often linked to inflation, so they retain their real value. Such characteristics are very attractive to (institutional) investors.

Investor AB, for example, plays into this market. The Swedish investment holding company was one of the founders of private equity firm EQT, which has now also become one of the world’s largest investors in alternative investments. Investor AB holds both EQT AB shares and investments in EQT’s mutual funds.

As described earlier, Sofina is also active in this market, see image above.

To some extent, almost all investment holding companies have a (large) portfolio of unlisted investments. That is one of the distinguishing factors for investing in them, since access to such investments can only be obtained through the investment holding companies.

Summary Table

In the table below, we have ticked which investment holding company is responding to the trends discussed.

Note: These names are provided only to clients of Tresor Capital.

We are and always will be fundamental investors at Tresor Capital, but by selecting family holdings with exposure to structural trends, we benefit from the long-term wind that these companies have in their sails.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl