Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Warren Buffett: “Why Stocks Beat Bonds and Gold”

In our conversations with clients, our newsletters and other communications, we often point out the importance of the long term. Sometimes people think this is a bit lame: “in the long term it will be okay, but I want to see a return on investment now” is often the catchphrase.

Active management, as we use in our portfolios, can result in outperformance over the longer term. In the shorter term, however, you run the risk of lagging behind the stock market. Then pointing to the long term is a hard sell that clients sometimes don’t need.

The entry point can also have a negative consequence. In 2018, 2020 and 2022, the stock market fell 20% or more three times. Anyone who has just entered shortly before that has an immediate false start. Then the negative returns must first be made up, only then to benefit from the recovery. However, the investor who got out at such times has an even bigger problem: After all, the recovery after a decline is often very powerful.

It is often advised to add a large proportion of bonds, gold or other financial securities to a portfolio to cope with volatility (price fluctuations). However, for clients who have an investment horizon of more than five years, and who can live with intermediate price fluctuations according to the suitability test, we recommend an offensive profile with a significant equity component.

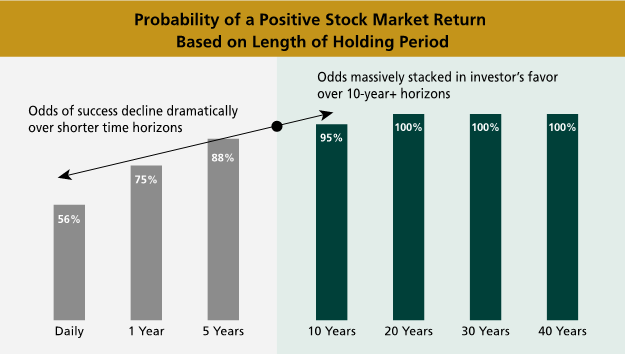

The above illustration actually provides the main justification for this. On a term of less than five years, the probability of a positive return is much lower. At a five-year investment horizon, the probability of a positive return is 88%. At a 10-year horizon, that probability increases to 95%, and at a horizon of 20 years or more, the probability of a positive return is 100%.

It is up to us as managers of our relationships’ assets to navigate between headlines, keep our eyes on the long term and not panic in the interim. Whether it’s a trade war (remember that one, from President Trump?), a pandemic, wars, inflation or interest rate hikes, ultimately the stock market looks past that and follows longer-term corporate profits.

It is very harsh to state, but the stock market has no judgment of right or wrong, no moral compass or opinion of what the world should be like. The stock market does not follow the opinion that an individual or group believes would be “correct. The price is formed based on supply and demand and reflects the collective view of all market participants at any given time.

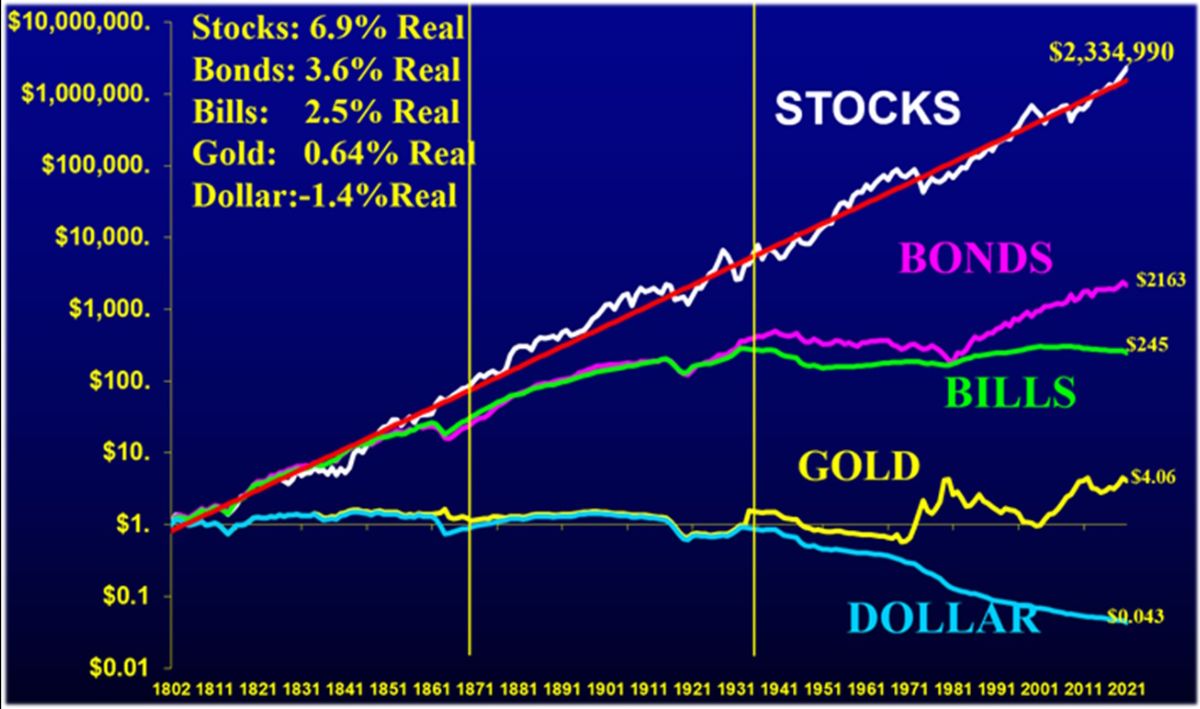

USD 1 growth rate from 1802 to 2022, adjusted for inflation. Source: Stocks for the Long Run, Jeremy Siegel.

Stocks versus Bonds, Gold and Cash

Twelve years ago, Berkshire Hathaway top executive and major shareholder Warren Buffett wrote an article in Fortune Magazine titled, “Why Stocks Beat Bonds and Gold.” The column may be dated, but the lessons one can draw from it are timeless, and certainly very timely now.

Buffett argues that “Investing means foregoing consumption now in order to consume more later.” Buffett:

- “From this follows an important observation: the risk of an investment is not measured by its price fluctuations, but rather by the likelihood that that investment will put its owner at risk of a loss of purchasing power over its intended period of ownership. Assets can fluctuate widely in price but are not risky as long as you can be reasonably certain that they will provide increased purchasing power over the life of the property.”

We can distinguish numerous assets that one can invest in. Buffett roughly distinguishes three categories. The first category involves investments that are denominated in a unit of money, such as savings deposits, bonds or money market funds. Because these assets do not normally fluctuate too much in price, they are seen as “safe. Buffett warns, however,“In reality, they are among the most dangerous assets.

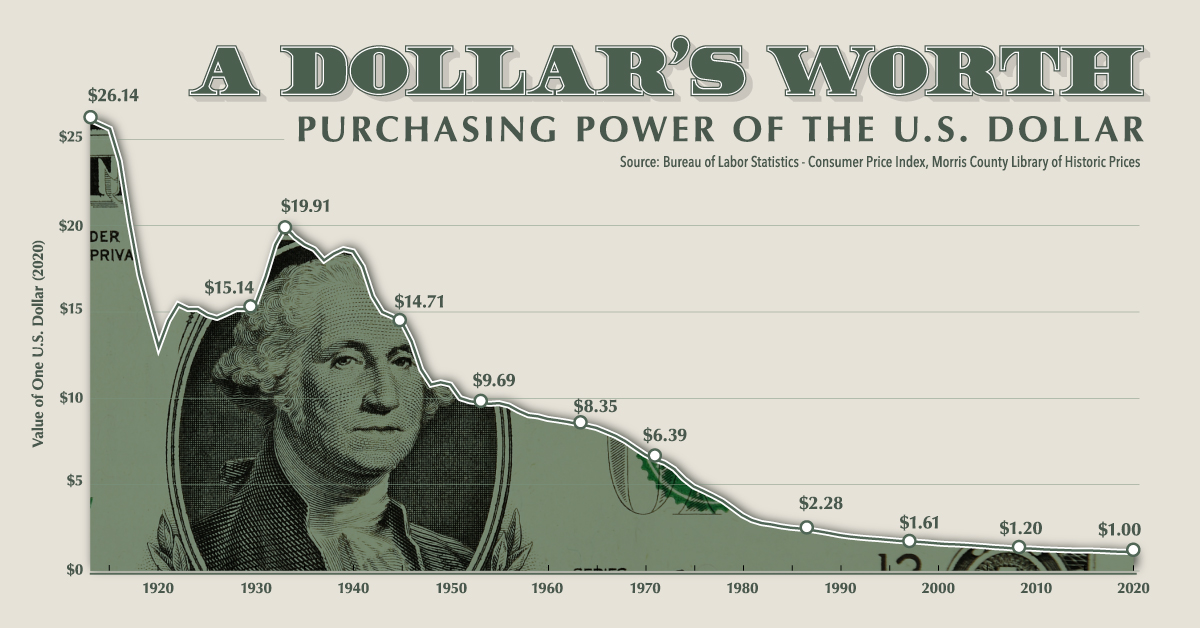

The evolution of the purchasing power of a dollar, backward-calculated from 2021.

Inflation, the diminishing value of money, erodes purchasing power over time. Buffett warns:

- “Over the past century, these instruments have destroyed the purchasing power of investors in many countries, even as they continued to receive timely payments of interest and principal. Moreover, this ugly result will repeat itself forever. Governments determine the ultimate value of money, and systemic forces will sometimes cause them to be attracted to policies that cause inflation. From time to time, such policies get out of hand.”

Intuitively, many already know this because we are confronted with current prices on a daily basis. Things seem to keep getting more expensive, but in reality money is simply becoming worth less. ‘Purchasing power is being eroded’ thus literally means: you can buy less stuff for the same euro than you could one, five or 10 years ago.

Buffett mentions that we are all familiar with visible taxation, we have to pay VAT on our goods and we pay taxes on our wealth or income. Inflation, as it were, is an invisible tax, which can sometimes be much more severe than the visible tax, as we have seen again in the aftermath of the corona crisis. Buffett aptly puts it,“The dollar says ‘In God We Trust,’ but the hand that activates our government’s printing press has been all too human.”

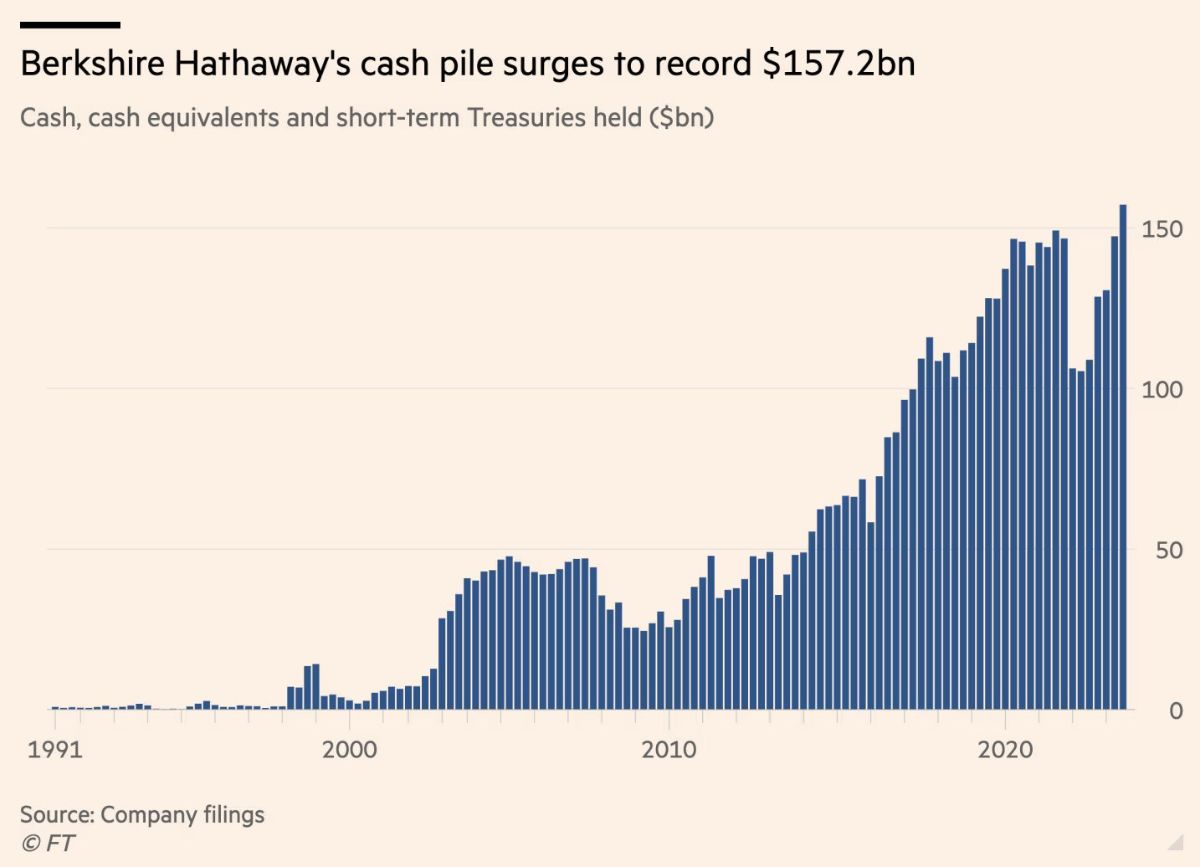

Ironically, Buffett himself has a huge pile of cash on the balance sheet at Berkshire Hathaway. However, this is for deliberate business reasons. First, as an insurer, Berkshire must hold a minimum of USD 20 billion to cover any large claims. “At Berkshire, the need for adequate liquidity is central and it will never fall short, no matter how inadequate interest rates may be.” Second, Buffett has not found enough interesting opportunities in recent years to sufficiently shrink the ever-growing cash mountain (driven by interest income, dividends and subsidiary profits).

The second category of investment involves non-productive assets. Specifically, these are bought in the hope that someone else will pay more for them in the future. Buffett cites the tulip mania of the seventeenth century. Owners of these assets assume an ever-growing pool of investors will desire the asset even more eagerly in the future, further driving up the price.

The best example of this, according to Buffett in 2012, was gold, although in recent years he has increasingly emphatically included Bitcoin and other crypto currencies. Gold has two major shortcomings according to the “Oracle from Omaha.

-

- “It is neither of much utility nor of reproductive potential. It is true that gold has a certain industrial and decorative utility, but demand for these purposes is both limited and unable to absorb new production. If you own one ounce of gold for an eternity, at the end you will still own one ounce.

- What motivates most gold buyers is their belief that the ranks of the fearful will grow. In addition, a rising price in itself creates additional buying enthusiasm, attracting buyers who view the rise as confirmation of an investment thesis. While investors who run like lemmings after the mob create their own truth – for a while. Eventually the bubble is deflated.”

The first two categories, cash and gold, are especially popular when fear reigns, Buffett argues:

- “The fear of an economic recession drives individuals into currency-based assets, especially U.S. government bonds, and the fear of a currency collapse encourages movement into sterile assets such as gold. In late 2008, we heard “cash is king,” just when cash should have been invested rather than held. Similarly, in the early 1980s we heard “cash is trash,” just when investments in fixed dollars were at the most attractive levels in our history due to high interest rates. On those occasions, investors, supported by the large crowd doing the same, ended up paying a high price for that comfort.”

Not very surprisingly, Buffett favors productive assets: businesses, real estate or farmland:

- “Ideally, in times of inflation, these assets should have the ability to provide output that maintains its purchasing power value while requiring a minimum of new capital investment. Farms, real estate and many companies such as Coca-Cola and our own See’s Candy meet this double test. Certain other companies – think of our regulated utilities, for example – fail this because inflation places heavy capital demands on them. To earn more, their owners must invest more. Still, these investments will remain superior to non-productive or currency-based assets.

- Whether the currency of payment a century from now is based on gold, shells, shark teeth or a piece of paper (as it is today), people will be willing to trade a few minutes of their daily labor (their wages) for a bottle of Coca-Cola or some other product. In the future, the U.S. population will move more goods, consume more food and require more housing than today. People will forever trade what they produce for what others produce.”

A little nuance

We wish to add a nuance to the general thrust of Buffett’s piece. Like Berkshire itself, investors may need liquidity to meet (expected) obligations, or may not be able to maintain a long investment horizon of at least five years. Then savings deposits or bonds may offer a solution. Currently, the chart at the top of this monthly report shows that gold, unlike cash, is relatively well able to hold its value (purchasing power) over a very long term (in the short term, however, it is sometimes extremely volatile).

Buffett concludes his article with a clear message that sums up the above article:

- “Berkshire’s goal will be to increase ownership of prime companies. Our first choice will be to own them whole, but we will also be owners by holding significant amounts of marketable shares. I believe that over a longer period of time, this asset class will prove to be the big winner among the three we have examined. More importantly, it will be by far the safest .”

Our preference has been and remains for relationships that have a horizon of more than five years, and are able to see through price fluctuations, to bring a well-diversified equity portfolio of high-quality companies, with good and reliable managers and an entrepreneur or family as an anchor shareholder, a high return on invested capital and sufficient opportunities to reinvest profits at that high return. In the long run, this will produce the best results.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner