Tresor Capital Visiting Family Holding Sofina

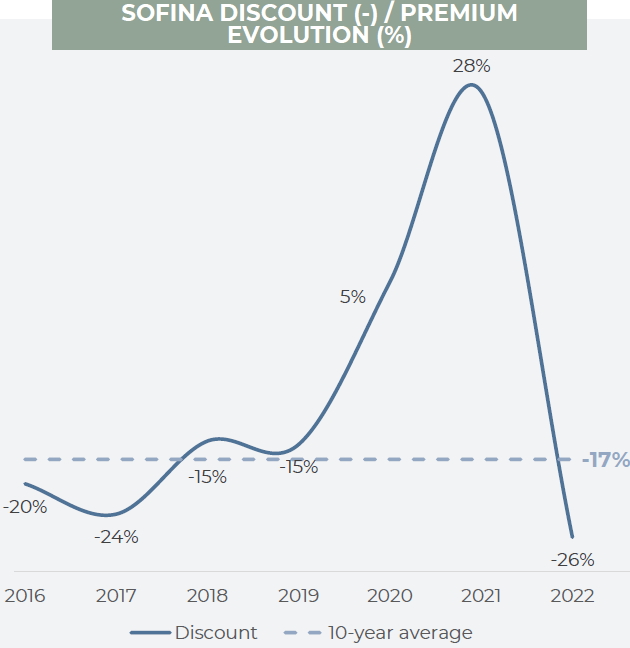

This week, colleague Rob Rutten and yours truly visited the shareholder meeting of Belgian family holding company Sofina (Brussels: SOF), in which the Boël family holds a controlling stake. A relaxed CEO Harold Boël and chairman Dominique Lancksweert provided an update, and answered several questions from shareholders. With the telling photo below, Chairman Lancksweert opened the meeting. 2022 was a year in which the Sofina board had to navigate a turbulent market environment. “The current undervaluation of 25% relative to intrinsic value, seems a sign that investors no longer see a light at the end of the tunnel,” Lancksweert said.

“That’s why now more than ever we have a focus on fundamentals. We have a broad talent base, which makes us dynamic and innovative. Thanks to a family anchor shareholder, we have a deep-rooted focus on longer-term intrinsic value growth, as opposed to daily share price fluctuations. We are also resilient, due to a broad spread across sectors, geography and vintages.”

Lancksweert emphasizes that Sofina’s business model is to invest in relatively young, promising and innovative companies: “That model means that out of 10 investments, about five to six will achieve the intended return, two or three will fail and one or two will be a great success. On average, out of 10 investments, you get a nice return.”

Update from CEO Harold Boël

CEO Harold Boël then gave an update on corporate strategy: “We strive to be the partner of leading entrepreneurs and families, providing them with patient capital and supportive advice to enable sustainable growth in their businesses. The emphasis here is on the words partner, patient and sustainable growth.”

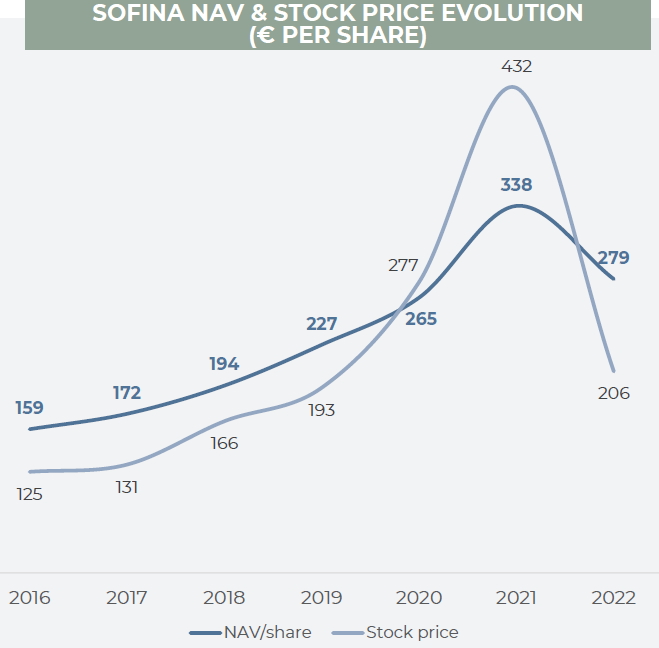

Enough has already been said and written about the market environment; with the end of the “free money” era, holdings focusing on young companies with their profits further into the future have had a tough time. Boël: “Holdings with more mature companies in their portfolios have proved more stable. Holdings with a focus on young growth companies experienced a 20 to 25% drop in net asset value. So with an 18% decline, our portfolio has proven to be relatively robust.”

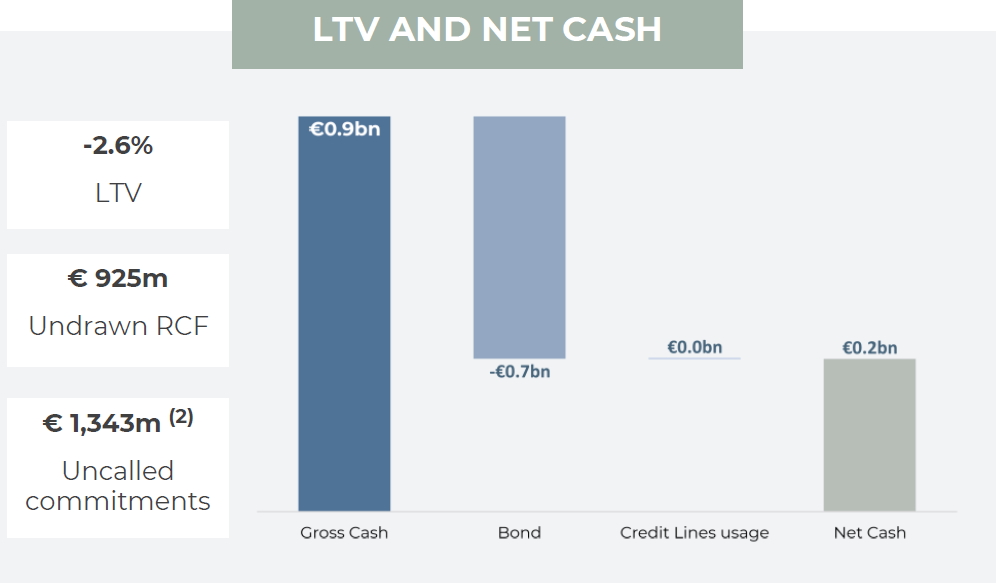

Boël draws attention to the figure above: “We have EUR 900 million in cash and EUR 925 million in available credit facilities. In more difficult financial times, our current liquidity is a luxury. This liquidity is available for both opportunities and needs. On the one hand, it serves to finance the EUR 1.3 billion we have committed to venture capital funds. On the other, it serves to seize interesting investment opportunities. This financial flexibility is an essential part of our robustness, and we have spent a lot of time as management to get into this position.”

One excellent move that we don’t want to leave unmentioned is that Sofina issued another long-term bond at 1% interest in late 2021. The free money era may be over, but Sofina provided itself with extremely cheap financing at an excellent time.

The Sofina top executive then points to the figure below, which clearly depicts the turbulent past two years: “The net asset value has returned to the level of early 2021. The price rise in 2021 and fall in 2022 were both excesses. However, if you look closely at the chart of intrinsic value (dark blue), you will see that we have returned to the multi-year, ascending trend line.”

Based on the figure above, Sofina has achieved intrinsic value growth averaging 10% per year over the past six years despite a disappointing 2022. The stock price rose an average of 8.7% annually during this period, and that’s after the sharp decline.

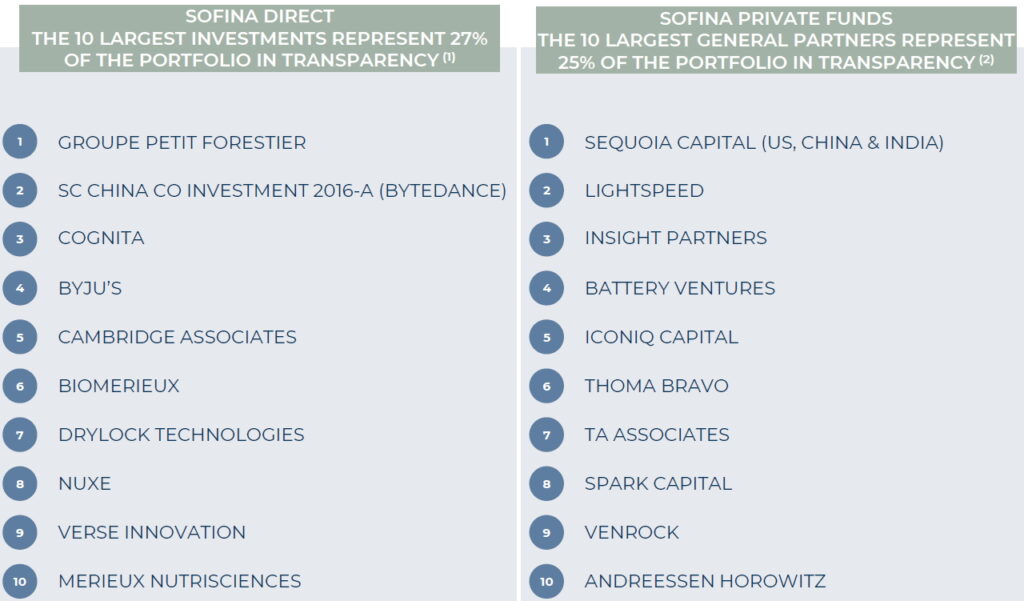

Boël is shifting the focus to the portfolio. By communicating the ten largest direct investments and the largest mutual funds (see figure below), Sofina has provided transparency on the composition of half of the net asset value. Still, recognition regarding most companies (Byju’s, for example) will not be because of positive associations. Boël: “Many companies you will recognize have had negative press coverage.”

In the words of Charlie Munger, “show me the incentives, and I’ll show you the outcome.” In other words, the media is increasingly driven by sensationalism, because an alarming or catchy title generates more viewers, listeners or readers. So the fact that things are moving in the right direction in the longer term is less interesting for the media to report on than negative developments.

Boël: “So the companies you know less well, about which you have read less, are doing well. Biomérieux, for example, is performing exceptionally with its diagnostic equipment, even after Covid-19, for example, as a forerunner in in vitro diagnostics. Cambridge Associates has been growing its sales and cash flows for years, and makes a significant contribution annually with its dividend.”

Although Boël looks somewhat modest by nature, he speaks proudly of the top 10 fund managers with whom the family holding company has invested capital: “This is the cream of the venture and growth capital world with whom you want to do business in this industry. Here you can see how important the network we have built is. It sometimes takes decades to access such parties. We first invested in the industry with TA Associates in the 1970s and with Sequoia since the 1990s. Both are still highly valued partners.”

Lessons from 2022

Boël takes a critical look back at 2022 and shares lessons learned by the family holding company. The reversal of tailwinds from 2019-2021 means the growth sector has been hit and fundraising has become more difficult. Sofina focuses on the companies in her portfolio, their cash position and runway. “Companies that have fallen below their two-year trend line in terms of growth we contact with the question of whether we may need to adjust strategy.”

From an extremely optimistic premium of 28%, sentiment shot completely the other way, to an extremely pessimistic undervaluation of 26%, as shown in the chart above. That 26% is well below the multi-year average of 17%.

The negative sentiment toward growth companies results in many viewing the glass as half-empty. At Sofina, on the contrary, people see the glass as half full, Boël stressed, “We need to further improve our communication in this regard to ensure that investors better understand our business model and diversified portfolio.”

Boël says Sofina wants to open up and broaden the closed circle that the company has long been, with a small, private group of shareholders. To that end, the company has been meeting regularly with investors in recent months, participating in conferences and roadshows.

However, one is also realistic: not every company will survive the challenges, but there are many that will emerge stronger and create lasting value. Sofina critically assesses the quality of business models. One is extra conservative in determining intrinsic value; Sofina tries to reflect the latest news in the valuation of its companies.

Why invest in Sofina?

Harold Boël showed the five reasons above why someone should invest in Sofina, and highlighted the third point. “Access to the best ideas is crucial in a world where more and more capital is looking for less and less good investment opportunities,” Boël stressed. Sofina’s network is extremely crucial in this regard. On the one hand, Sofina looks over the shoulder of the best venture capital managers in the world, such as Sequoia, for example.

The family holding company has also developed its own tool, which searches online for interesting investment ideas. For example, based on companies that have many job openings, are aggressively hiring new people, or companies that are gaining traction in certain tech circles. Says Boël, “This tool provides us with a weekly or monthly list of the 10 or 20 most interesting companies. It’s a very disruptive development to get new ideas outside of our existing network.”

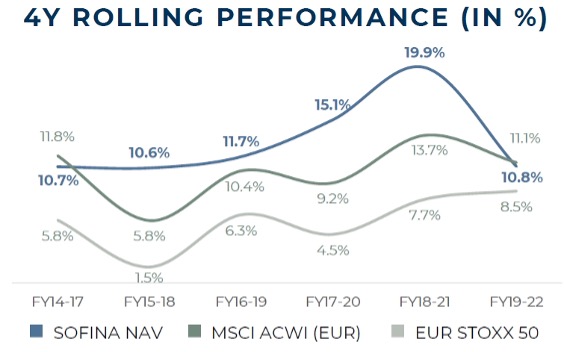

The figure above shows the average performance of Sofina’s net asset value over average four-year periods (since the management is judged on this for its bonuses). Boël highlights that in most four-year periods Sofina comfortably beat its benchmark (the MSCI All Country World Index), or was very close to it. Indeed, a return averaging 10.7% or 10.8% over a four-year period is certainly not something to sneeze at.

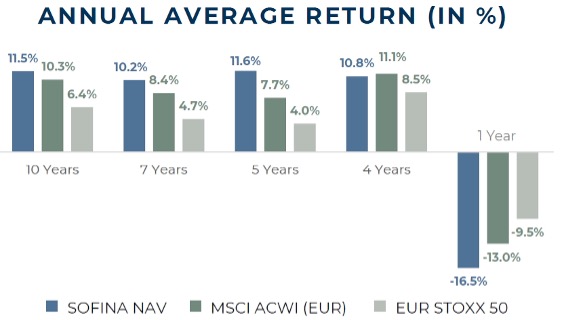

The figure below shows that Sofina performs slightly worse at 1 and 4 years, but clearly beats the benchmarks at 5, 7 and 10 years. Boël sees the glass half full and is confident that Sofina can continue this track record over the long term.

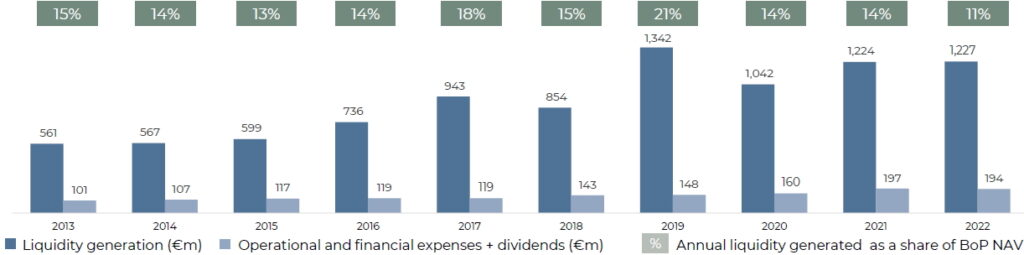

In addition to net asset value generation, Sofina has a track record of generating liquidity even in difficult times. The figure below shows absolute liquidity generation (dark blue), annual operating and financial expenses plus dividends (light blue), as well as liquidity as a percentage of net asset value generated annually.

Even in 2022, Sofina managed to liquidate 11% of its portfolio, bringing in EUR 1.227 billion. In previous years, this was invariably between 14 and 21%. Boël: “The continuous cash/liquidity generation provides us with the necessary financial flexibility.”

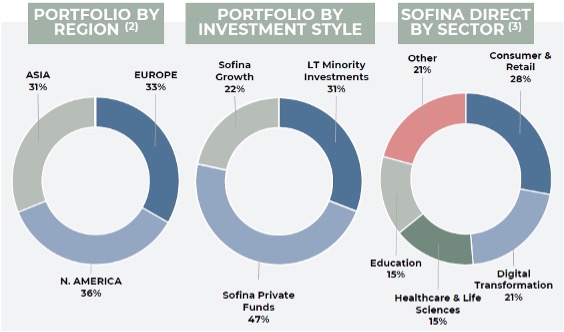

Sofina’s entire portfolio is well diversified by region, investment style and sector, as shown in the chart above. Boël emphasizes that the decision to shift focus to Asia 15 years ago was driven by the tremendous opportunities seen there.

Sofina wanted exposure to the emerging Asian middle class, primarily in China and India. Says Boël, “We deliberately chose to invest in companies that were internally focused on the local economy, rather than export-oriented companies. As a result, these companies are better insulated against conditions in foreign economies.”

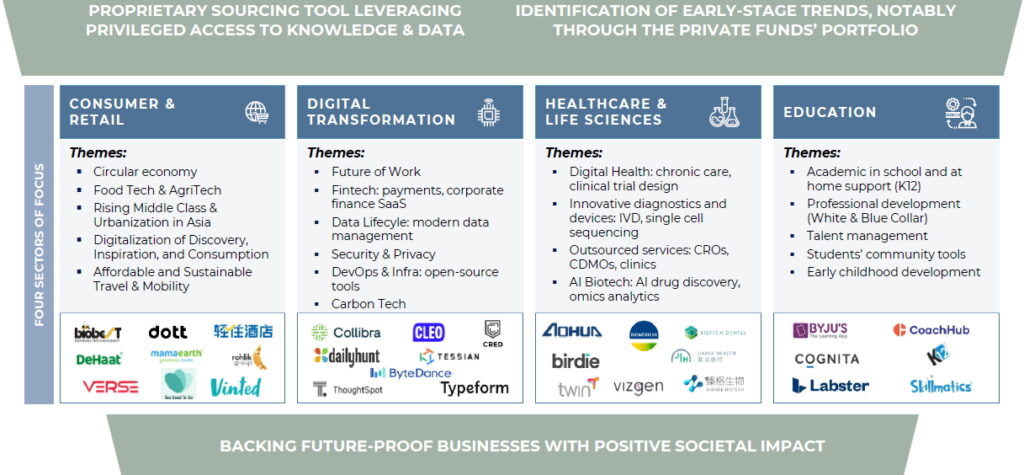

In particular, the portfolio is composed with a focus on megatrends. Growing companies backed by innovative and transformational trends with sustainable business models. In this regard, the four focus sectors are consumer goods & retail, digital transformation, healthcare & life sciences and education. The figure above shows some examples of the sub-trends and portfolio companies.

Boël concluded his part of the presentation with an optimistic message: “I have confidence in the future, and that is founded on our solid foundation from the past. There is a lot of uncertainty right now, but there are also a lot of opportunities.” According to Boël, the best “vintages” come from more difficult financial vintages, so in that sense, with a solid war chest, Sofina is laying the seeds to reap nice returns in the future.

New commissioners

Of course, the shareholders’ meeting would not be complete without formalities. The dividend was set at EUR 3.24 per share. Sofina will list ex-dividend on May 12, and the payment of the dividend will follow on May 16. Furthermore, the mandates of auditors Jacques Emsens, Robert Peugeot and Guy Verhofstadt expired.

They were replaced by three candidates, which, as far as we are concerned, further strengthens the knowledge on megatrends. For example, Rajeev Vasudeva is a commissioner at Brookfield Infrastructure Partners and at two Indian family-owned companies, with a broad knowledge of digital transformation. For his part, Leslie Teo is a director at AI Singapore and an authority on Artificial Intelligence. From the Boël family, Felix Gobled D’Alviella joins the SB, working at renowned impact finance company Kois Invest.

Q&A session: hedging currency risk

One of the shareholders present asked Boël about the large dollar exposure. How does Sofina hedge the currency risk? Boël: “We do not hedge our currency risk. Because of the composition of the portfolio, with many dollar-denominated venture capital funds, we do indeed have quite a bit of exposure, but because we are constantly getting capital back and reinvesting it, we are buying and selling dollars at different exchange rate levels, so to speak.

This creates a natural risk hedge over time. A few years ago we still hedged currency risk at the portfolio level, but an extensive analysis on its actual contribution in the longer term showed that on balance it yielded nothing. The only parties earning from it were the banks, which pocketed a fee for it.”

Earlier this year we wrote a business analysis on Sofina, you can download it here

Questions Tresor Capital

We asked about Sofina’s current net asset value. Boël: “The net asset value per share was EUR 274.79 as of March 31, 2023. This is based on venture capital fund reports received through March 15, with valuations as of December 31, 2022. Exchange rates and stock market prices were taken as of March 31, the direct private investments were still valued as of December 31, 2022.”

At the end of the presentation, Chairman Lancksweert overlooked the fact that we were still raising our arms to ask one last question. He was already closing when it was pointed out to him by Boël. When we asked three questions in one question, the chairman could not suppress a smile: “That was more than one.”

We were interested to know what the developments were in the private markets, whether people see investment opportunities with the EUR 1.8 billion of available liquidity at attractive(er) valuations, and whether they are considering launching a share buyback program given the large undervaluation.

Boël: “At the moment everyone in the private markets is still kind of looking at each other, not much is happening yet. In buyout private equity though, there opportunistic transactions consisting of 100% equity are starting to take off, with the aim of raising debt capital in improved financing conditions.

In our branch of venture and growth capital, we see a dichotomy. Among the top assets, we see few transactions, but the valuations there are holding up well. Often those valuations are still too high, is my personal opinion. Non-top assets are having more difficulty raising capital. However, we are seeing the first signs that the venture capital industry is also slowly but surely starting to pick up, but it is still early days. A share buyback program, other than buybacks to cover employee stock options, is not on the table at the moment.”

From left to right: Rob Rutten, Harold Boël (CEO Sofina) and Michael Gielkens

Afterword

After the meeting, we had a brief afterword with Harold Boël, including the photo above. We asked the top executive about his take on Artificial Intelligence (AI), which has been in the spotlight lately since the rise of ChatGPT, recently also as a potential risk for (online) education companies.

Boël does not see AI as much of a risk for education companies, Sofina has interests in private school groups on the one hand and very specific education applications on the other. According to Boël, Sofina has an interest in a company that applies AI intelligently, with promising and impressive outcomes.

We emphasized that our focus at Tresor Capital is on investing in family holdings. It is interesting to see how the various families are able to find each other. For example, Robert Peugeot (Peugeot Invest holding) was until recently on the supervisory board of Sofina, current supervisory board member Charlotte Strömberg is on the supervisory board of Kinnevik (Stenbeck family), supervisory board member Laura Cioli held an executive position at one of Exor’s companies (Agnelli family) and supervisory board member Michèle Sioen is also a supervisory board member of family holding D’Ieteren.

Last year, Exor also bought a 10% stake in Institut Mérieux, formally linking the Agnelli and Boël families. With BioMérieux and Mérieux Nutrisciences, we find two of these companies in Sofina’s top 10.

Boël agrees with our observation. Family holdings have a large overlap in long-term thinking, people think several generations ahead. Then it is nice to do business with like-minded parties. For example, Sofina had looked at several investment files together with Jacobs Holding, until they finally arrived at private school group Cognita, currently the third position in Sofina’s portfolio.

After we mentioned that we have offices in Maastricht, Boël told us that he lived in Maastricht for four years during the time he worked for the family steel company Usines Gustave Boël, until its acquisition by Hoogovens in the late 1990s. After a pleasant conversation and a final cup of coffee, we returned home, with yet another confirmation that Sofina is one of the better family holdings to invest in.