Recently, issue 4 of 2025 in the Guide to the Best Investor of the Flemish Federation of Investors (VFB) published an analysis of ours on the investment holding company TerraVest Industries. We share the analysis below.

TerraVest: an impressive compounder

TerraVest, like Constellation Software and Lifco, qualifies as a serial acquirer. Freely translated: an acquisition machine. It is a Canadian company that provides products and services to the energy, agriculture, mining, transportation and other markets in Canada and the US. It operates through four segments:

- HVAC equipment: produces fuel tanks, heating and cooling equipment for commercial and residential customers. This component contributes about 55% to profits.

- Compressed Gas: makes storage and distribution equipment for gases such as LPG, LNG and ammonia, targeting gas and fertilizer distributors, farmers and transport companies. This component contributes about 25% to profits.

- Processing equipment: provides oil and gas extraction, water treatment and biogas production equipment to utilities and engineering companies, among others.

- Services: provides water management, environmental services, heating systems, rental and well services.

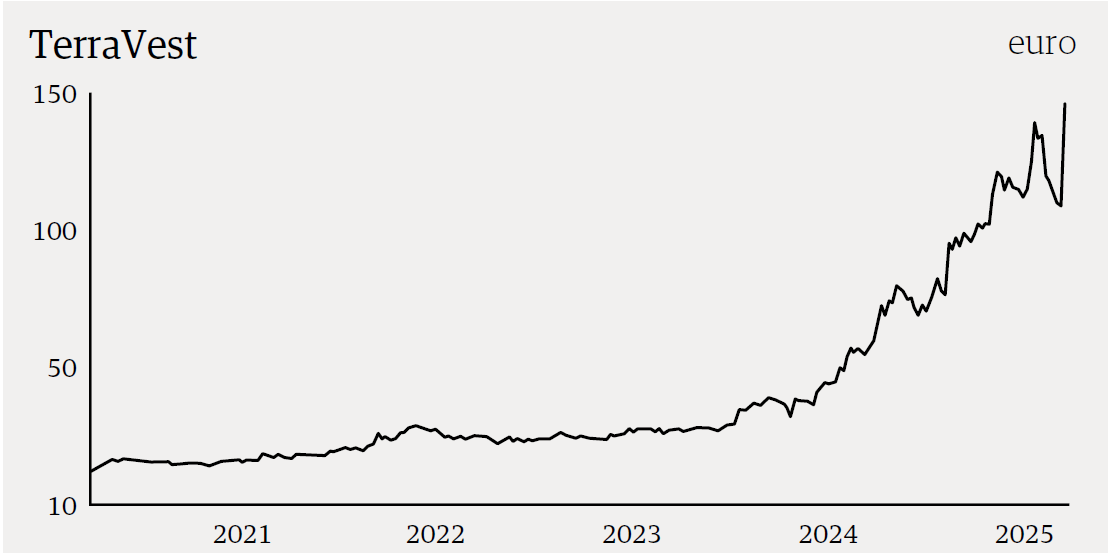

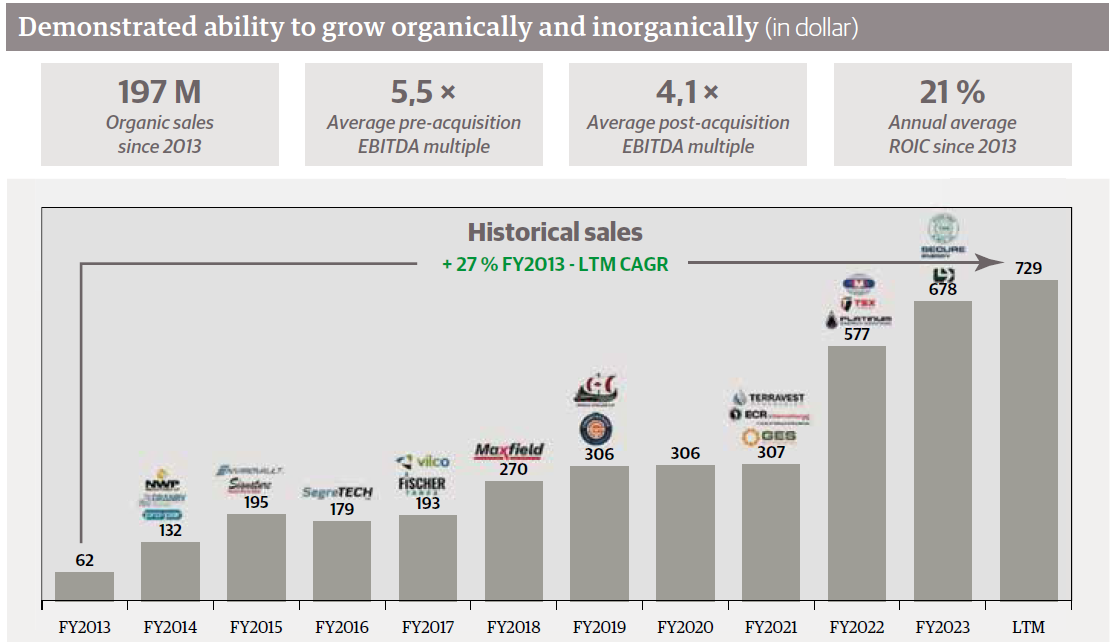

The company specializes in acquiring companies at a low valuation. These companies are then restructured to become largely operationally independent. Although operating in a traditional sector, TerraVest has achieved an impressive average annual return of over 35% over the past 10 years.

This strategy of successful acquisitions is expected to continue for a long time. TerraVest is now the largest player in a market where many smaller companies can no longer operate independently. Its current market capitalization is $1.7 billion Canadian.

We spoke with TerraVest’s management in early 2024 and became very impressed. CEO Dustin Haw has a special background. He has been TerraVest’s president and CEO since February 2017 and joined the company as a director in 2014. Since then, he has played a crucial role in TerraVest’s strategic growth and operational performance. He holds a PhD in physics and holds the Chartered Financial Analyst (CFA) certification. Haw is a rare combination of outstanding operational leader and knowledgeable investor.

Despite the strong share price appreciation, management receives a relatively modest fixed salary; the rest of their remuneration is paid out in shares. Meanwhile, CEO Dustin Haw, Charles Pellerin, and founder Dale Laniuk collectively own 30% of the shares, ensuring a strong alignment of their interests with those of the external shareholders. TerraVest, however, is a fairly closed company: it maintains little contact with banks, analysts and other outside parties.

A recent newsletter explained that the new administration in the U.S. is placing a renewed focus on shale oil and gas. This presents opportunities for TerraVest, which is well positioned to benefit from these developments in the energy market. TerraVest derives half of its sales from the U.S. and the other half from Canada. The products are largely sold in the local market, making the impact of any import tariffs negligible.

Impressive value creation

TerraVest has proven to consistently achieve a high return on invested capital (ROIC) in its acquisition strategy. When NWP was acquired in 2014, the company was acquired at a pre-acquisition valuation of 4.5 × EBITDA (operating profit). Due to operational improvements in operating profit, the multiple dropped to 2.6 × average EBITDA since the acquisition, and based on the most recent figures, TerraVest has paid only 1.5 × EBITDA. Over the entire holding period, NWP delivered an impressive ROIC of as much as 297%. This success was achieved in part through efficiencies in production processes, such as internalizing external operations and automation of welding and cutting processes.

A similar strategy was employed in the acquisition of Maxfield in 2018. Maxfield was purchased at a valuation of 3.6 × EBITDA. Based on average EBITDA since acquisition, that paid valuation drops to 2 × EBITDA, with an ROIC of 219% since acquisition. This was made possible in part by rationalizing product lines, achieving cost savings in steel procurement and sharing production with other portfolio companies.

The 2017 acquisition of Fischer Tanks is another example of a successful acquisition, where the company was bought at a valuation of 6.7 × EBITDA. Looking at the most recent figures, the multiple paid was only 3.3 × EBITDA. TerraVest achieved an ROIC of 127%. Synergies came from savings in purchasing, production expansions and leveraging existing distribution channels.

TerraVest’s consistent focus on increasing operational efficiencies and leveraging synergies has resulted in sustainable value creation and exceptional returns on invested capital. Analyst Chris Waller notes how TerraVest’s economies of scale allow it to realize substantial savings immediately after an acquisition: “While many of the acquired companies buy steel from distributors, TerraVest buys directly from steel mills. Thanks to economies of scale, the company benefits from quantity discounts of 10-30 %. This is a crucial savings, as steel often accounts for more than half of the cost of producing a tank. Similarly, Terravest realizes savings in the procurement of valves and other components.”

According to CEO Dustin Haw, there are still 200 to 400 potential acquisition candidates. They also want to grow in new markets. Examples include equipment for biogas, LNG and hydrogen. Recent examples include TerraVest providing storage tanks for backup energy capacity and cooling at data centers.

Conclusion: a strong compounder with still a lot of potential

TerraVest certainly can’t be called sexy, storage tanks and the like are not likely to become the topic of conversation at parties and celebrations, as is the case with crypto-currencies or artificial intelligence. But the company has one of the best management teams we have come across, is listed at a relatively attractive valuation and has achieved extremely impressive returns on its investments. More importantly, despite its impressive history, we believe the company is only at the beginning of its compounding journey.

On behalf of the entire Tresor Capital team, we wish you an enjoyable weekend. Please feel free to contact us at info@tresorcapital.nl with any questions or comments.

Sincerely,

Investment manager