Herewith you receive our monthly report in which we share current insights. Each month we discuss different topics, ranging from trends and opportunities in the financial markets to in-depth analyses of relevant developments or strategic themes. Our goal is to provide you with valuable information in line with the constantly changing investment environment so that you are better informed about the dynamics of today’s financial world.

Retrospective 2024: Stock Market Recovery Continues

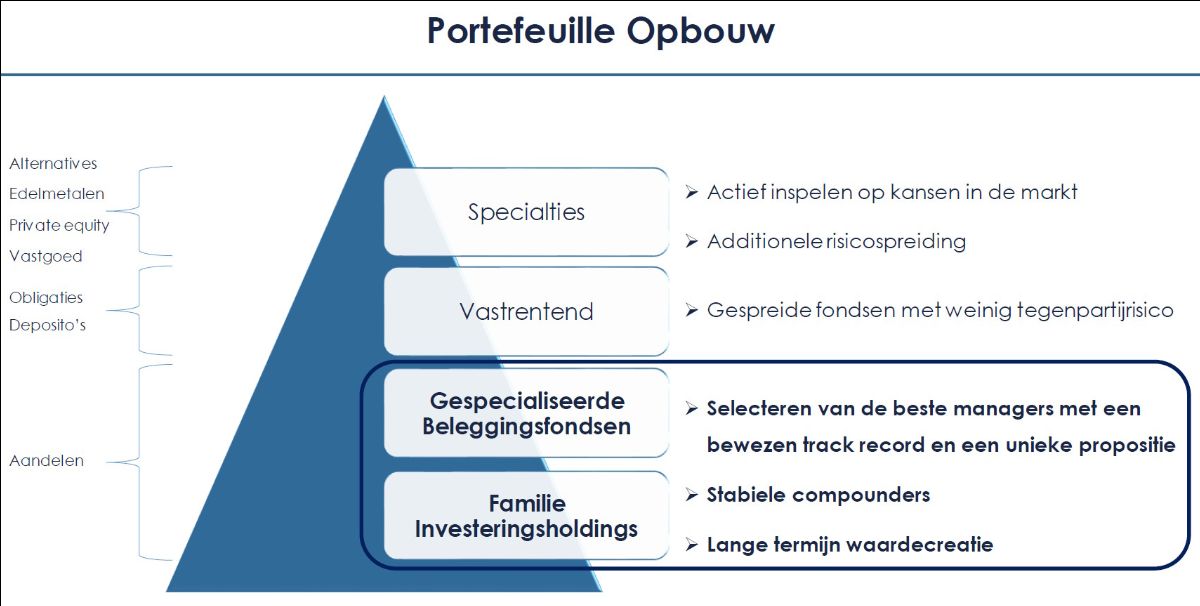

2024 marked another year of recovery, in which our strategies proved their worth. For our clients, the figure below will not be new. They are the building blocks by which we typically fill out a portfolio. The foundation of the equity portfolio consists of our family holding strategy and specialized investment funds. Depending on client needs and risk profile, we supplement this with fixed-income investments and specialties, such as hedge funds and private equity.

Financial markets experienced a further dichotomy last year. The bulk of the share price recovery in 2023 was limited to major technology companies, driven by optimism around the groundbreaking innovation of generative artificial intelligence (think ChatGPT). In 2024, we saw a broader rebound in financial markets. Still, U.S. technology giants remained dominant, while European stocks lagged.

Family holding companies

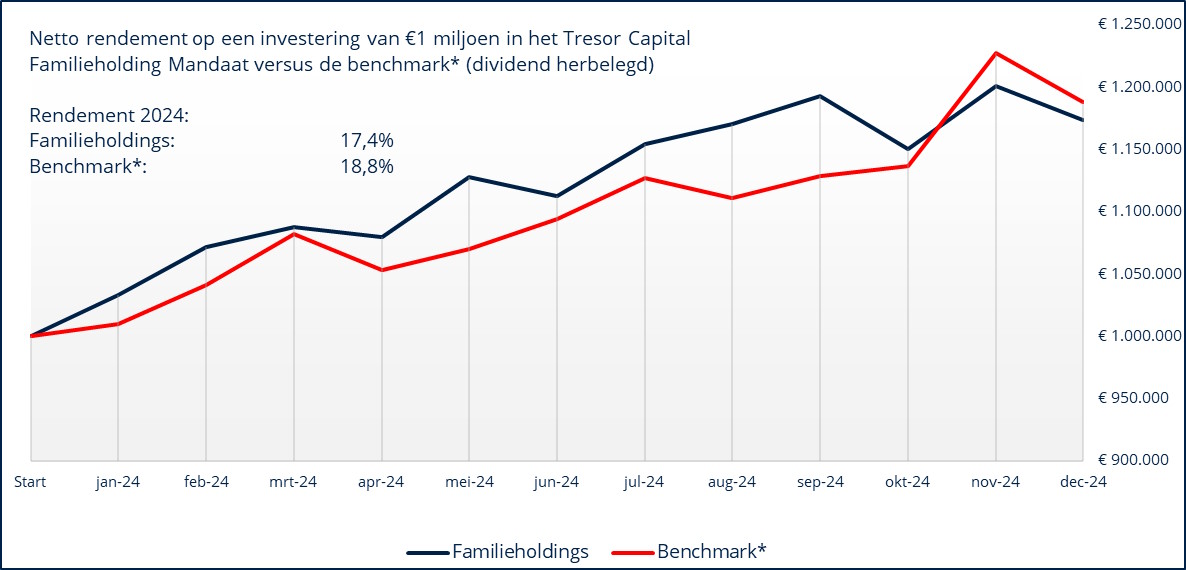

After the dip in 2022, 2024 also saw a further recovery. The family holding portfolio managed to achieve a net return of 17.4%, versus 18.8% for the benchmark. For a long time, the family holding portfolio lagged the benchmark, but the election of Donald Trump as the new U.S. president in November caused a turning point.

Our benchmark, consisting of a combination of global large and small caps (aligned with the market caps of our portfolio) is predominantly composed of U.S. stocks. It goes without saying that the election of Trump, considered pro-business , created enthusiasm among investors. American stocks were bought en masse, while Europe and Asia were sold off on balance.

Technology funds are not set up like family holding companies and carry greater market risk because of their growth ambitions. This contrasts with family holding companies, which tend to operate more defensively and are less sensitive to market fluctuations. Consequently, family holding companies can be expected to lag somewhat in sharply rising markets.

Over several cycles, however, we believe our actively selected family holdings offer better risk-adjusted returns. Nevertheless, the absolute return of 17.4% is an excellent performance, especially when measured against more defensive European equity indices.

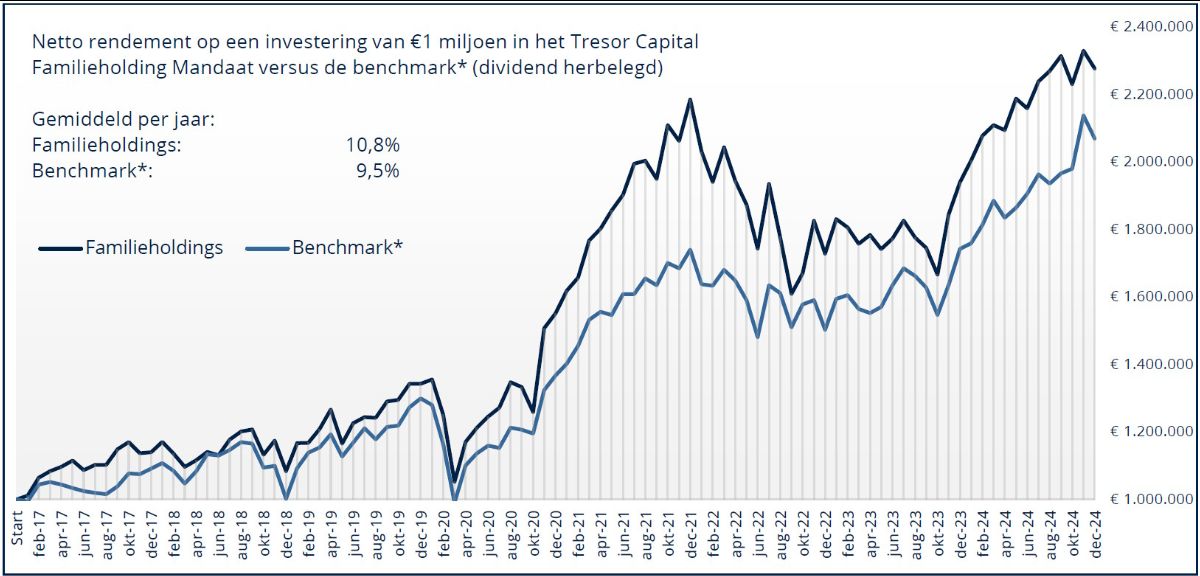

Looking at a somewhat longer term (see figure below), the strategy still manages to beat the benchmark by a comfortable margin.

We continued the increase in portfolio quality already described last year in 2024. Companies that are by and large more sensitive to the economic cycle were exchanged for those with a more consistent growth profile.

The focus is increasingly on companies with high levels of reciprocal cash flows, strong returns on invested capital and attractive opportunities to reinvest cash flows at those high returns.

Of course, core principles such as a high degree of insider ownership(skin in the game), a solid balance sheet and a well-diversified portfolio per family holding company remain crucial. We believe this will allow us to (continue to) beat the stock market.

The financial media is increasingly writing about the high valuations. At the end of 2024, the family portfolio was undervalued by 25% against a deliberately conservatively calculated net asset value. Given the further increase in quality, we note that in recent years we have rarely seen such an attractive risk-return ratio in the family holding portfolio, especially relative to the valuation of the broader equity market.

Specialized mutual funds

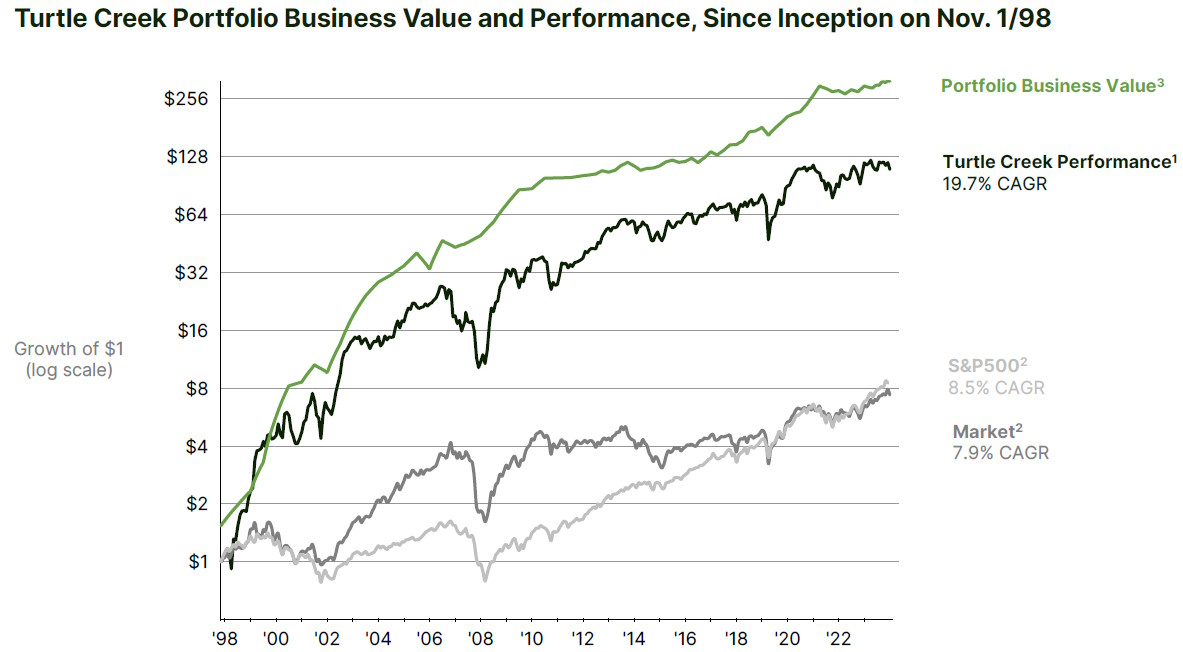

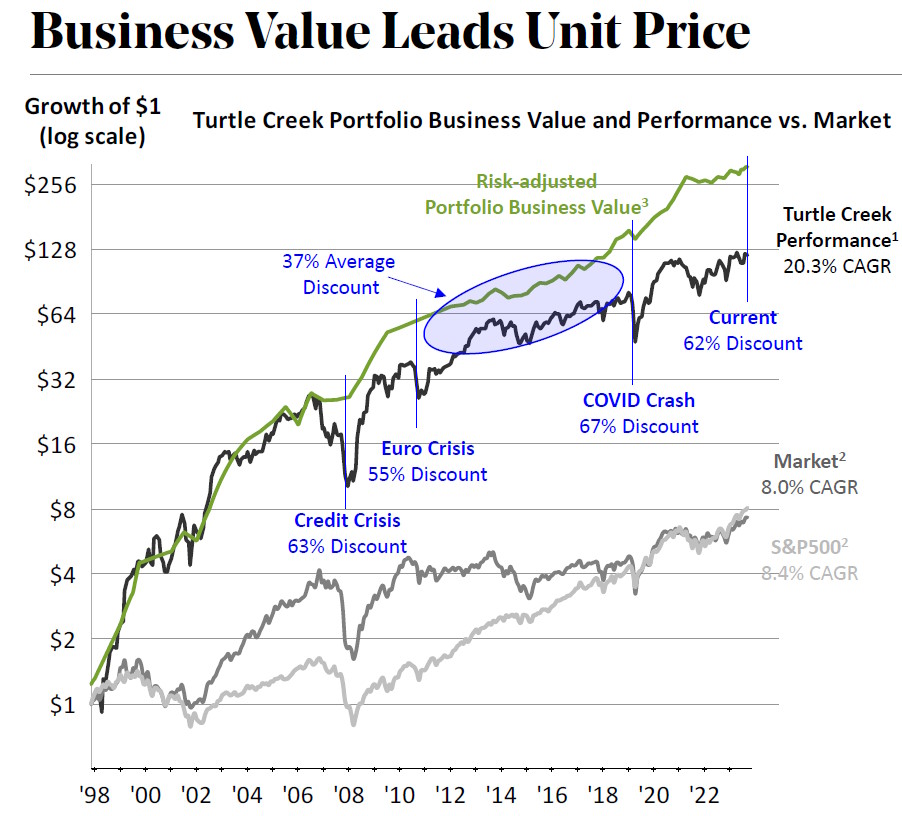

The Turtle Creek Equity Fund, which we wrote about in last month’s report, experienced a downturn in 2024 after a rock-solid 2023. While the fund’s share price fell more than 6%, its calculated net asset value increased 5%.

As a result, the portfolio has the largest undervaluation outside of crisis periods (over 60%) since the fund’s inception in 1998. In the longer term, the stock price (the black line in the figure above and below) follows the net asset value (the green line in the figure above and below).

During our relationship day, CEO Andrew Brenton emphasized that there has rarely been a better entry point to invest in Turtle Creek’s funds. The last three times Turtle Creek noticed such a large discrepancy, there was a significant crisis.

Each time the undervaluation was so high, it was attractive to invest, as the examples below show:

- At the end of February 2009, around the nadir of the credit crisis, the undervaluation was 63%. Investing at that date had yielded an average annual return of 49% and 39% in the following three and five years, respectively.

- Those who had invested at the end of September 2011, amid the Euro crisis (undervaluation 55%), had averaged 30% and 18% annual returns over the following three and five years.

- During the corona crash, the undervaluation rose to 67% at the end of March 2020. Those who had invested then would have earned an average return of 28% per year in the following three years.

In the wake of the tech correction in 2022, we also took position in a distinctive technology fund in our model portfolio during 2023. This fund managed to achieve a return of 63% in 2024, a particularly handsome performance. Thanks to contacts with the fund manager, we were also able to offer clients the opportunity to subscribe directly to a capital round of the promising private company SpaceX.

Targeted investments in companies like Spotify and Tesla have not exactly done this fund any favors. The smart optimizations applied by the fund manager reinforce our confidence that this fund will (continue to) provide nice added value for our clients in the future.

We parted ways with the China-related mutual fund during 2024. We prefer to have only indirect exposure to the China market.

Specialties

With the specialties we actively respond for our clients to opportunities we see in the market. Last year, for example, we took a modest position in a fund with exposure to digital assets for a select group of offensive clients who are able and willing to bear the risk.

The gold-related fund within the specialty block posted excellent returns of more than 20% last year. The alternatives also had an excellent year, with returns ranging from 9% to 11.7%. Since we mainly fill in the lower risk part for clients with these alternatives, we can say that the defensive and neutral profiles had a nice year.

Private equity funds had a mixed year, with further consolidation following the extremely strong start of an India- and Southeast Asia-focused fund. With Trump’s election, blockchain venture capital funds ended 2024 with a clear high.

With the 6Degrees Capital III fund, we added yet another new proposition to our growing private equity arsenal. During our relationship day, Wouter Volckaert gave a presentation that was enthusiastically received. Note: clients of Tresor Capital can still subscribe at favorable conditions until the end of the first quarter.

Organization

Of course, we are also very proud of the fact that more and more relations know how to find us. Clients who are satisfied with the returns and our service refer relations to us, while we also manage to reach more and more people by participating in conferences, seminars, podcasts and our activities on social media.

This also results in further growth of the team. After all, we want to continue to provide our customers with good service and add new investment propositions to our offering. Last year we welcomed Michel Salden and Jelle Vermeulen.

Michel brings knowledge about markets and macro and experience from pension funds and international investment banks, Jelle makes a strong contribution in the operatonal support and also takes on part of the risk management. This month we have welcomed with Joep Dikken the ninth team member of Tresor Capital. Joep will perform research on companies for us.

We thank our customers for the trust placed in us, and look forward with placed optimism to the further expansion of our company.

Looking Ahead 2025: The Year Of The Foundations?

After the turn of the year, we continued the evaluation of portfolios within the Tresor Capital investment committee. During our relationship day, colleague Michel Salden already gave a foretaste, explaining that we see opportunities for (small and medium-sized) stocks and private equity, while we still considered bonds less attractive.

For 2025 and beyond, we see opportunities in the United States, where economic growth remains strong and the economy is exhibiting higher dynamism and labor productivity. Europe is a two-part story.

The European Union, with Germany in particular leading the way as the “sick man,” has made some choices in recent years that have not worked out too well. Perhaps the German elections in February can help restore consumer and business confidence. Scandinavia, however, is a clear bright spot, as we recently wrote in our first weekly (family holding) newsletter of 2025.

We also look at portfolios thematically, including with our six identified megatrends. Often positions have exposure to multiple trends. For example, as one of the largest investors in real assets, Brookfield Corporation is benefiting from the rise of alternative investments.

Exposure to the megatrends of digitization and sustainability are reflected in the rise of artificial intelligence. For example, Brookfield is building a new USD 30 billion chip factory with Intel. Because of its renewable energy expertise, Microsoft has now signed a groundbreaking USD 10 billion agreement with Brookfield to purchase over 10.5 gigawatts of renewable energy capacity to power its data centers over the next few years.

Thus, we can provide examples of exposure to megatrends from all the positions in our portfolio. The most important thing to note is that the family holdings we select are forward-looking. For decades, the famous motto of the Wallenberg family, major shareholder of Sweden’s Investor AB, has not been for nothing: “The only tradition worth preserving is the transition from the old to what is to come.” That resonates in all aspects of the carefully constructed portfolios.

In 2025, the gradual optimization toward even higher-quality businesses will continue. In particular, the companies that have been falling short of our return target for several years now will be critically examined. It is not that these companies are necessarily bad, but thanks to the growth in capacity within Tresor, we can now screen new candidates faster and more efficiently.

Our relationships have already seen some mutations over the past period, which will continue in 2025. The focus remains on a relatively low turnover in the portfolios, but opportunities for improvement will be seized. In doing so, we do not even hesitate to kick against sacred cows.

We will again host several meetings in 2025. For example, a presentation by Theta Blockchain Ventures is scheduled for February 4. In May we will organize a presentation with family holding company Investor AB, and again in the fall you can expect a reprise of our annual relationship day. In principle, all these events will take place at La Butte aux Bois in Lanaken, further information will be sent out in due course.

Conclusion

With large undervaluations in both the family holding portfolio and the Turtle Creek Equity Fund, the risk-return ratio of our portfolios looks as attractive as ever. Over the longer term, the growth in intrinsic value will also be reflected in stock prices.

With a recovery in the private markets, we also see great opportunities for private market solutions, such as private equity and unlisted real estate. As you would expect from us, we will continue to do our best to deliver great returns and interesting investment propositions to you in 2025.

For more information about any of our propositions, please contact your contact person or send an email to info@tresorcapital.nl.

Michael Gielkens