Team Tresor Capital, from left to right: Jan Groothaar, Michael Gielkens, Erik Klinkers, Maurice Essers, Rob Rutten and Ton Schimmel

Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Report Of Successful Relation Day Tresor Capital

On October 11, we organized our first relationship day at the special location Kasteel Vaeshartelt, located at the end of the Groene Loper in Maastricht. We were able to welcome a total of about 70 relations of Tresor Capital in the morning and evening sessions.

After the reception with a small snack, Erik Klinkers welcomed the guests, with a warm welcome also to guest speakers Andrew Brenton, CEO of Turtle Creek, and Constantin Mang, CEO of MBB. Michael Gielkens then provided a presentation of the distinctive investment propositions we offer for our clients.

The concept of skin in the game came up several times during the relationship day. Investment legend Warren Buffett once said, “To be successful in business and investing, you have to have skin in the game, an ownership stake in the company.” In Dutch, this is also sometimes described as “having something to lose.” At Tresor Capital, skin in the game is a core concept, as we previously wrote about in this white paper on our website.

The majority of partners are now shareholders in our investment boutique and invest with their private assets in the same investment opportunities as for our clients. We invest within the family holding portfolio only in shares of companies where a reference shareholder (a founder or family) is at the helm. Even in mutual funds and private equity funds, we consider it important that the fund managers themselves also invest a substantial portion of their capital in the strategy.

Stock market carried only by handful of companies

With a few slides, we showed that stocks provide the best returns in the very long term. Research by Professor Jeremy Siegel shows that from 1802 to 2022, stocks manage to achieve an inflation-adjusted return of 6.9% per year on average. This more than beats bonds (3.6%), gold (0.64%) and cash (a loss of 1.4%).

The miracle of return on return clearly shows itself here. One dollar invested in shares in 1802 was worth over US$2.33 million at the end of 2021. That same dollar invested in bonds had only grown to USD 2,163, while gold (USD 4.06) and cash USD 0.043) were already completely lagging. Thus, with an investment horizon of more than five years, one would be wise to take a large exposure to equities.

In the long run, profits/cash flows and returns on invested capital determine returns. In the short term, however, investors often behave like lemmings, as the above cartoon from The Economist comically illustrates.

The stock market is being carried by only a handful of companies this year, driven by enthusiasm about generative artificial intelligence. New money put to work in the stock market is flowing almost exclusively to technology companies.

In particular, the “Magnificent 7” benefit. These are Meta (Facebook), Amazon, Apple, Microsoft, Alphabet (Google), Tesla and Nvidia. They achieved returns of 55% in 2023. The S&P 500, an index of the 500 largest stocks in the U.S., shows a 14% return this year. Without the Magnificent 7, however, the S&P 500 is 4% in the plus.

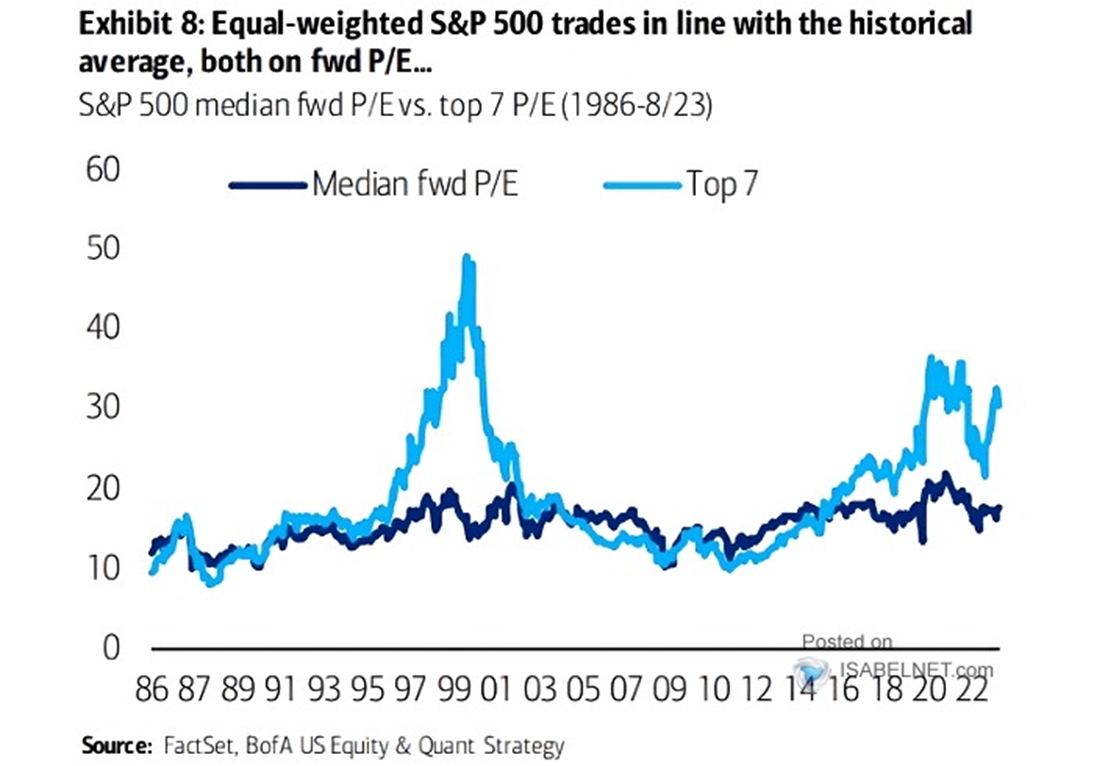

Market commentators often talk about the current (too) high valuations of stocks, but reality shows a more nuanced picture. The chart above shows the valuation of the seven largest stocks (light blue) and an index in which all stocks are assigned the same weight (dark blue) since 1986. The extremely high weighting of the seven largest stocks in the S&P 500 index has only been seen a few times before.

In the late 1990s, technology companies were bought en masse by the hype surrounding the Internet, after which the dotcom bubble burst. Another valuation spike was seen in 2020, when investors thought the growth rate of digitization resulting from the lockdowns would continue beyond corona. When this turned out not to be the case, and central bankers additionally raised interest rates substantially, valuations normalized again. Technology companies in particular suffered last year.

Since the launch of ChatGPT, investors have jumped en masse on the train of generative artificial intelligence. Great innovations can undoubtedly be expected as a result of this technology, but it seems very likely that investors have once again gotten ahead of the music. The recent price implosion of some 50% of Dutch payments company Adyen shows what the consequence can be if investors’ sky-high expectations are not fully realized. We therefore seek refuge in stocks with a much more attractive risk/return ratio.

Family holdings attractively valued

Our family holding portfolio shows similar returns to the equally weighted stock market index this year, as the Magnificent 7 are not part of it. As such, the strong stock market recovery and solid outperformance that family holdings managed to achieve after the credit and corona crises is yet to materialize.

The risk/reward ratio has not been this attractive since March 2020. Historically, our holding selection trades at an undervaluation of 22-24% relative to intrinsic value. By the end of 2021, this had declined to below 18%. However, we are now at an extreme undervaluation of 31%.

Not only did intrinsic value fall in 2022, undervaluation increased. Thus, family holdings have suffered a double blow. This year we see intrinsic values clearly recovering, but undervaluation has continued to increase. In fact, several family holding companies are currently quoted at the largest undervaluation of this century.

A further recovery in intrinsic values plus normalization of undervaluation offers the chance of a significant price recovery. So we see this as a great entry point to participate in our family holding mandate.

Opportunities around private equity

Erik Klinkers provided a presentation on the opportunities of private equity. Private equity funds generally generate higher returns than listed equities. This can also be seen as compensation for illiquidity. The better managers usually still manage to perform significantly better than the average private equity party, so a thorough selection is crucial here. Through a strict selection procedure, we make that selection for our clients.

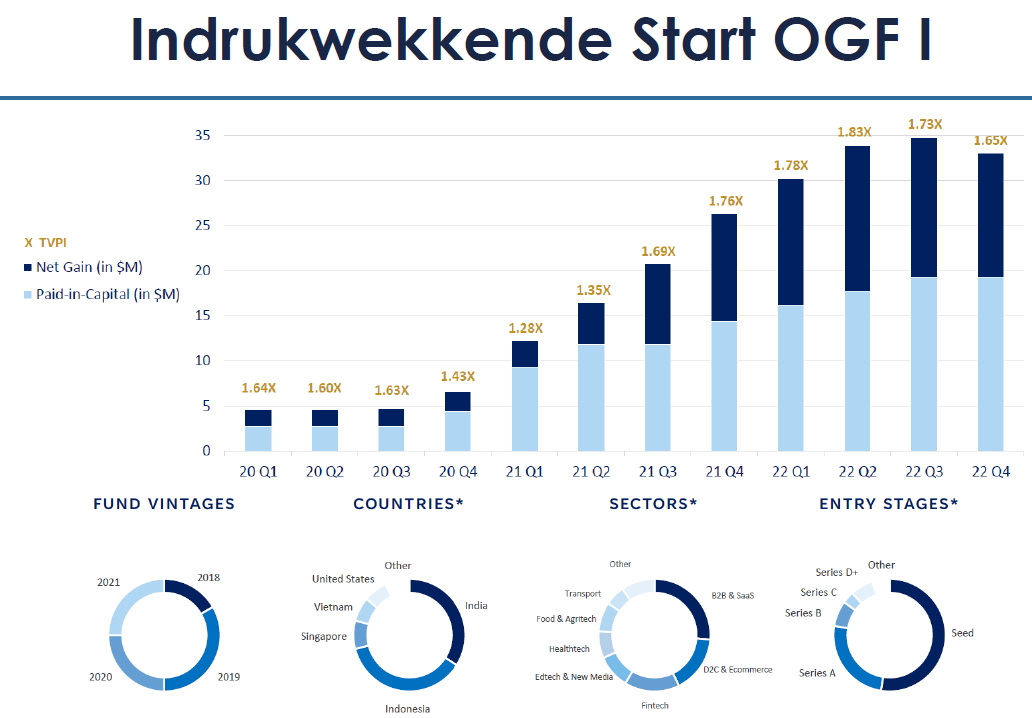

The Orient Growth Fund was discussed as an example. The value development (see image below, click on it for a larger copy) within this interesting proposition, which we already presented to our relations in 2020, shows in practice that a thorough selection of high quality managers can have a clear added value.

Currently, registration for Orient’s second fund is still open. If you are interested, we would of course love to hear from you!

One of the advantages of private equity is that one does not have to deal with the daily price fluctuations of the stock market. The disadvantage is that this is offset by illiquidity: usually the capital is fixed for at least five to seven years.

We provide our clients with access to unique unlisted investment propositions, with a particular focus on Venture Capital (investments in young, innovative companies with high growth potential). In doing so, we believe we can further improve the risk/return ratio in the portfolio.

We offer private equity investments that are typically not accessible/unknown to the general public. Also, we can offer relationships a lower barrier to entry. By subscribing to a fund with multiple relationships, the relationships do not have to individually meet the required subscription amounts, which sometimes exceed USD 1 million per subscriber.

Turtle Creek Equity Fund

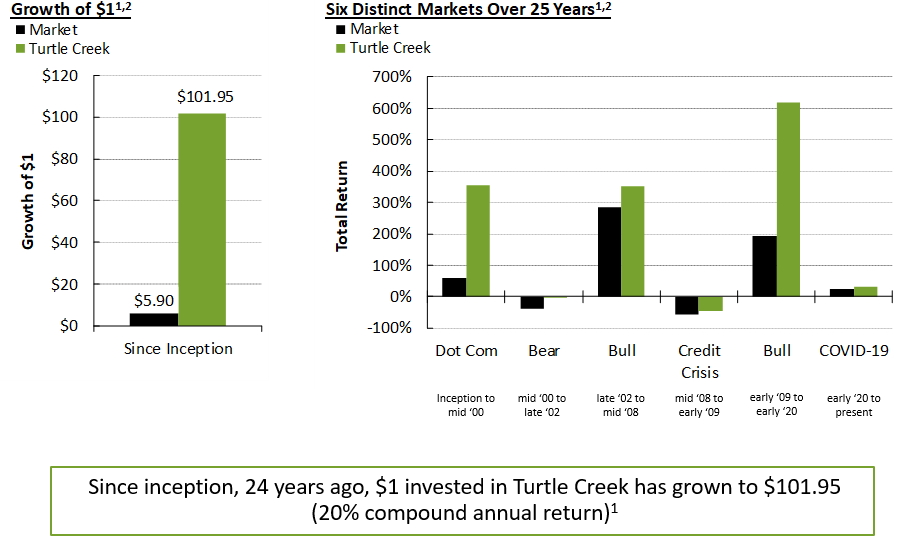

Andrew Brenton, the CEO of Turtle Creek Asset Management, provided an animated presentation. Brenton, along with his two co-founders, is the founder of the Turtle Creek Equity Fund, which has managed to produce impressive returns averaging 20% per year since its inception in 1998.

Its excellent track record, distinctive approach and sound portfolio management are reasons why we have included this mutual fund for clients. We can also offer clients access to the institutional founder share class, which is a distinctive proposition within Europe.

The figure above shows how Turtle Creek’s returns are structured. A dollar invested in 1998 would currently be worth more than $100, where it is “only” $5.90 for the stock market. Moreover, the figure next to it shows that Turtle Creek manages to beat the stock market in both upward and downward phases.

Brenton even showed a very impressive statistic: Turtle Creek achieved a return of 16.4x its investment over the past 15 years versus only 3.6x for the stock market. Moreover, the flagship Turtle Creek Equity Fund only lost money on 2 stocks, which only had a 0.07 impact on this result.

Turtle Creek uses a so-called “continuous portfolio optimization” (CPO) strategy. The portfolio is regularly ranked so that the cheapest companies are at the top. This dynamic strategy complements a “buy & hold” strategy, simply buying and holding the carefully selected companies would already produce a very nice return of over 10%, but CPO boosts this to above 15%.

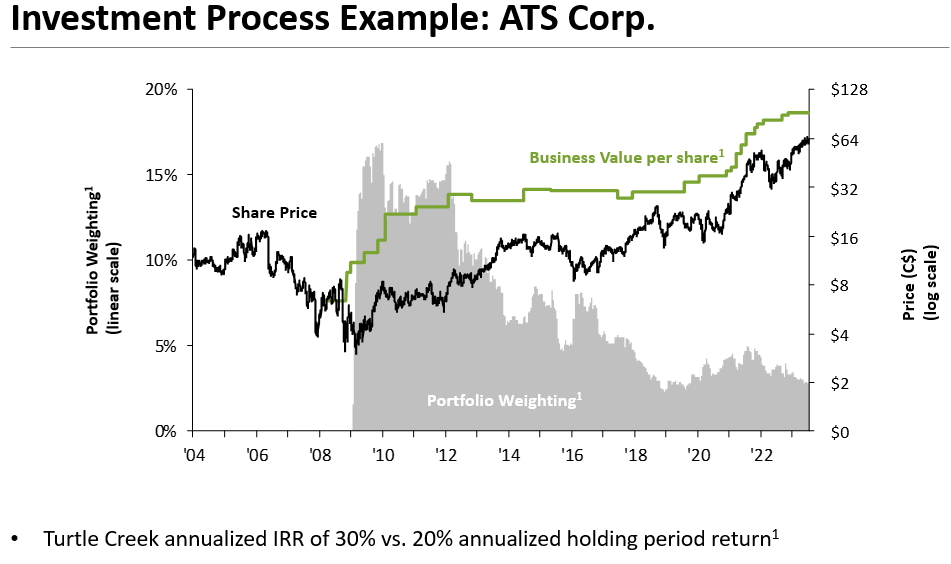

With the figure above, Brenton illustrated Turtle Creek’s investment approach regarding the company ATS Corporation. The black line shows the price chart and the green line the net asset value according to Turtle Creek’s comprehensive valuation model, these follow a logarithmic scale (right axis). The gray area in the background shows the weighting in Turtle Creek’s portfolio, shown on the left axis.

In 2004, Turtle Creek visited ATS. A rock-solid automation company, but it was not being managed optimally. So it was decided not to invest. In 2008, a new CEO was appointed, and they were very impressed. So Turtle Creek built a valuation model, and decided to take a sizable position in early 2009, since after thorough research they were convinced of the company’s quality and attractive valuation.

As the undervaluation diminished, Turtle Creek reduced the weight of ATS in the portfolio. So this is the CPO approach of continuously rebalancing the shares. Buying the shares and simply holding them would have resulted in an average annual return of 20%. However, through the application of CPO, Turtle Creek was able to achieve a return of as much as 30% per year.

The founders and staff have invested the vast majority of their assets in their own funds, which endorses their skin in the game. We are proud to offer this fine investment proposition to clients.

MBB SE

The final presentation was given by Constantin Mang, the CEO of the German family holding company MBB SE. MBB was founded by college friends Nesemeier and Freimuth, who own about 70% of the shares. Mang also has all his money in MBB shares. Through good management and several nice, value-creating transactions, MBB has managed to generate attractive returns for its shareholders since its IPO. We regard this as a hidden gem on the German stock market, still listed at an extremely attractive valuation.

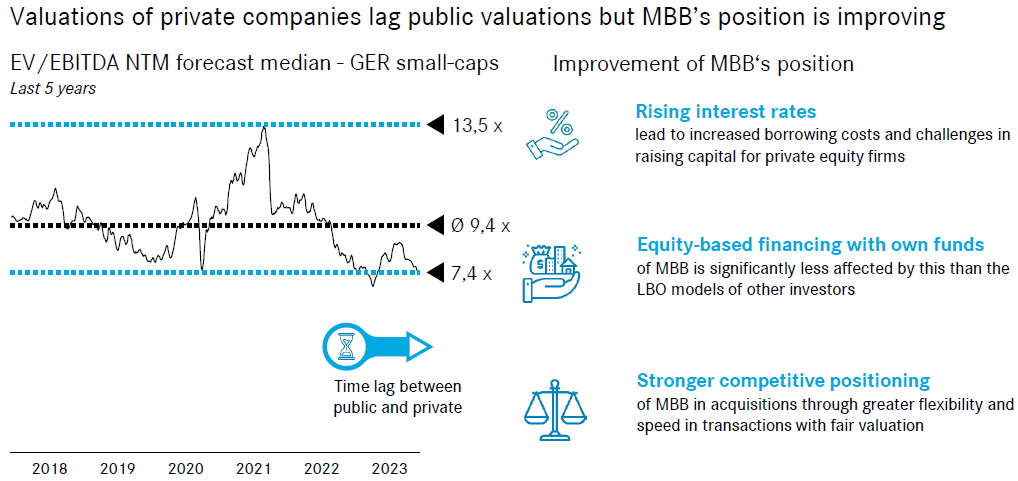

Mang discussed the distinctive DNA of MBB, which takes a long-term view as a family business. The core function MBB has, according to Mang, is to offer solutions to the succession issues many entrepreneurs face. They mostly belong to the baby boomer generation and find that their children do not want to take over the business. Instead of selling their business to private equity, with the risk of the business being pumped full of debt and resold to another party within a few years, they can sell to MBB.

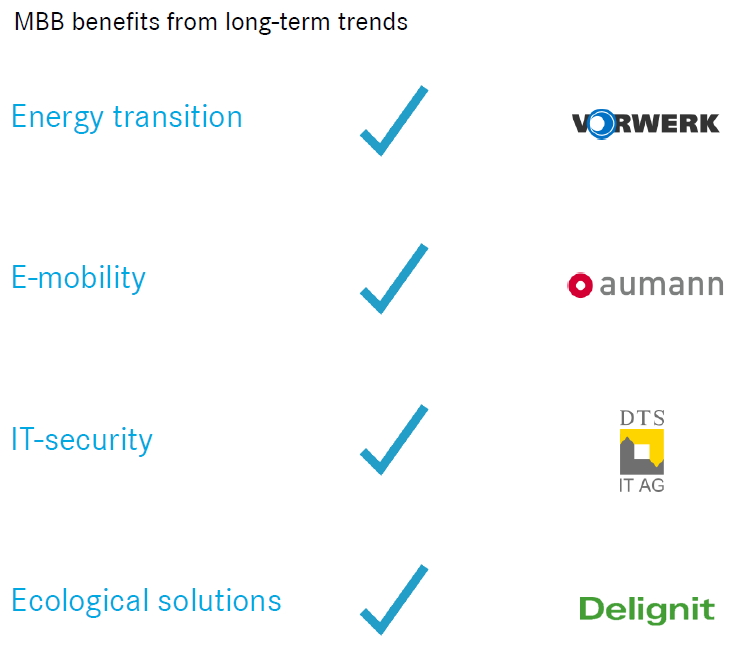

MBB has already successfully acquired several companies. Through strategic acquisitions or investments, these companies are further evolved toward a future-proof growth path. Mang gave a great example regarding the transition of automation specialist Aumann. Partly due to input from MBB, Aumann made a radical strategy change in 2015 to move away from the internal combustion engine to electric driving. At the time, this was very risky, but now Aumann is known as one of the most innovative and progressive companies in the German e-mobility sector.

MBB is benefiting from some megatrends in its portfolio, such as the energy transition, cybersecurity and the demand for sustainably produced raw materials. Although Mang is critical of Germany’s energy transition to a climate-neutral energy grid without nuclear power, going down this path offers tremendous opportunities for MBB.

Billions are involved in the construction of underground power lines, as much as 30 meters in diameter, to move wind power generated in the north to the industrial south. Three mega power lines of more than 1,000 kilometers each are planned, most of which will be built by subsidiary Vorwerk.

Political and social pressures toward electric vehicles are also grist for the mill of Aumann, which provides solutions for the production of electric car components as well as battery systems. The increasing geopolitical uncertainty, with associated corporate espionage and cyber hacking, makes the need for IT security ever greater. DTS IT benefits from this to a significant extent.

Despite that nice exposure to megatrends, MBB’s share price has been under pressure for some time. Political pressure on Vorwerk to quickly connect newly constructed LNG terminals has come at the expense of profitability. As a result, the margin has fallen from 20% to just 7%. The old projects, with less favorable margins, are now being finished. As a result, the new projects with much more attractive margins may soon take over, and there are many of them, judging from the solid order book. By 2024, Mang expects to return to at least double-digit margins.

Even at Aumann, margins have not yet recovered to above 10%, which they were at in the period before corona. However, due to its unique position as an e-mobility specialist, Aumann is facing huge demand and a bulging order book. Margins on new orders are (well) above 10%, so Aumann will soon see a nice recovery.

Furthermore, DTS experienced a drop in sales in the first half of the year, but that was mainly due to the comparison base. Last year there was a unique situation with a lot of pent-up demand in 2022, due to chip shortages in 2021. The second half of the year will show nice growth, and in addition, the share of reciprocal software sales where high margins are achieved is continuing to increase. Thus, in all likelihood, the margin will exceed the current 15%.

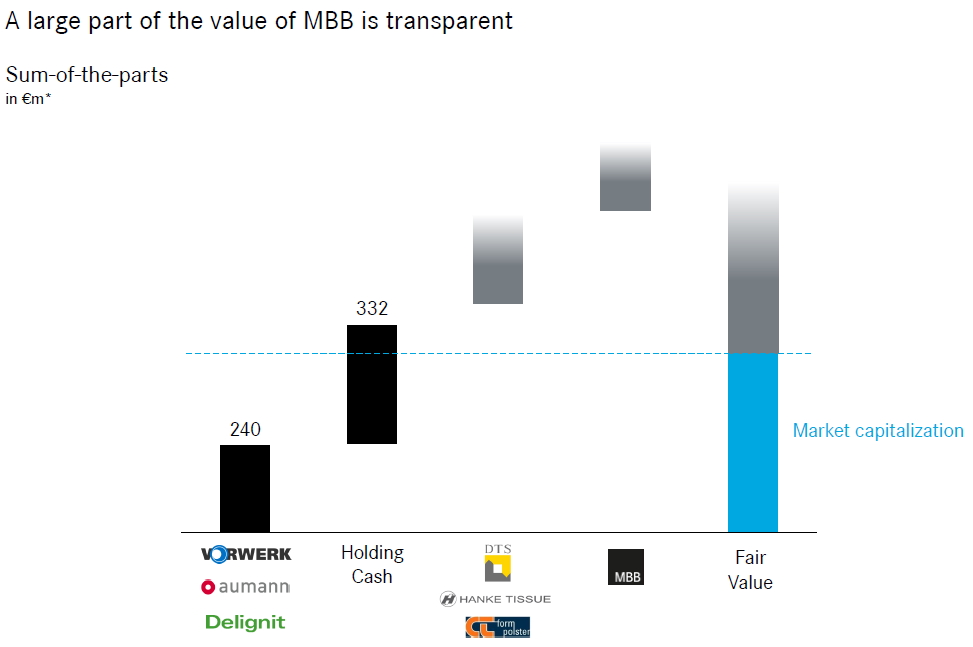

Because of those, by definition temporary, setbacks, MBB is currently listed at a sharp undervaluation. Mang notes that MBB is currently trading at the highest undervaluation in the past decade. If we add just the listed interests and cash, we end up EUR 100 million above the current market value. Then we do not even attribute value to DTS, Hanke Tissue and CT Formpolster. Moreover, Vorwerk and Aumann are also listed at extremely low valuations.

It is prompting Mang to preview further share buybacks. Insiders have also been buying shares heavily for months. A recovery in profitability, continued growth and new acquisitions should lift MBB to new heights, which Mang considers very realistic.

Entrepreneurs are now much more realistic in their sales price expectations. MBB has been criticized for years for not spending the cash (we, too, have expressed our views on this several times), but now that entrepreneurs with no business successor and a possible recession on the horizon want to choose eggs for their money, it has been a stroke of genius to apply the discipline of not being tempted to make overpriced acquisitions.

This is one of the reasons why we are confident that MBB will be able to find its way back up the ladder and (once again) achieve great returns for our clients. Mang’s presentation only strengthened us in that respect.

Finally

One final observation we were happy to share with you was the overlap that Andrew Brenton and Constantin Mang recognized in each other’s approaches. The attributes that MBB has as a family business are exactly what Brenton is looking for for his North America-focused mutual funds. It was yet another confirmation for us and our associates that the long-term investment approach with a focus on family businesses is a rewarding strategy that, judging by past performance, has the potential to deliver superior returns.

Worth repeating

Afterwards, we received overwhelmingly positive feedback about the presentations from our relations, who gained a much better picture of two investments in their portfolios by attending the relationship day. This makes us very happy, because it shows that we succeeded in our objective.

Based on the many positive messages that have come our way, we can safely say that the first relationship day was a success. As far as we are concerned, this will certainly be a reason to continue. We thank all attendees for their participation and hope to welcome even more relations at the next event!

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner