Reliance Industries: Responding to the Emerging Middle Class in India.

Michael Gielkens | Partner at investment boutique Tresor Capital

Reliance Industries has been transformed into a holding company that reinvests oil profits in high-growth sectors, writes Michaël Gielkens of Tresor Capital. “The icing on the cake is that this well-run holding company is for sale at a 33% discount.”

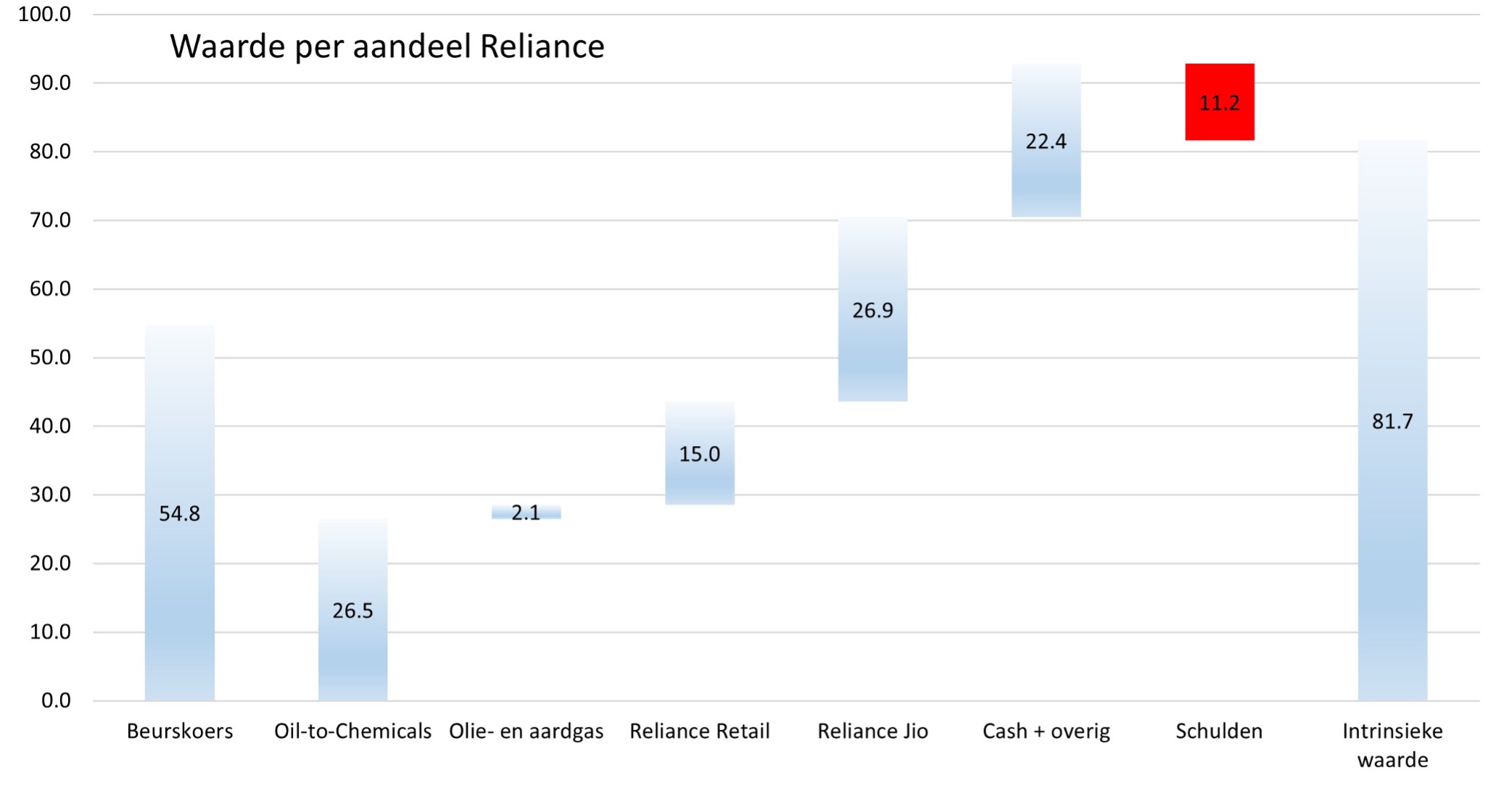

Entrepreneur Mukesh Ambani’s Indian holding company Reliance Industries has fallen sharply in share price recently. The perils surrounding Gautam Adani’s empire, which came under fire from short-seller Hindenburg Research, has pulled the entire Indian stock market down. As a result, the undervaluation relative to intrinsic value has risen to 33%.

The value per Reliance share, according to Tresor Capital’s internal estimates, is shown in the chart below. Since it is difficult for Western investors to buy shares directly in India, the London-registered Global DepositaryReceipt (GDR) is considered. 1 GDR represents two Indian shares of Reliance.

An important observation is that Adani has a substantially different approach than Reliance. In a note, analysts at Bloomberg Economics wrote that Reliance will not be affected by the implosion of Adani’s businesses, which is considered an isolated incident. Corporate governance, debt levels and liquidity are significantly better at Reliance than at Adani.

Bloomberg concluded, “With India’s GDP once again poised to outperform the rest of the world, the country’s companies have an opportunity to take another step on the path from national champions to global majors.”

Emerging middle class India

The Indian economy has proved to be very unruly in recent years. According to World Bank estimates, India will become the third largest country in the world in terms of GDP this decade. In doing so, it will surpass Germany and Japan, among others. The country has a relatively young population age (median: 28 years old), so an economic impact comparable to the baby boom in the West is expected.

India has shown tremendous promise for decades. However, with Modi’s government, a new momentum seems to have emerged and the country seems capable of actually delivering on this promise. In 2019, Modi was re-elected with an even larger majority, a sign that the people of India are far from tired of pro-business policies.

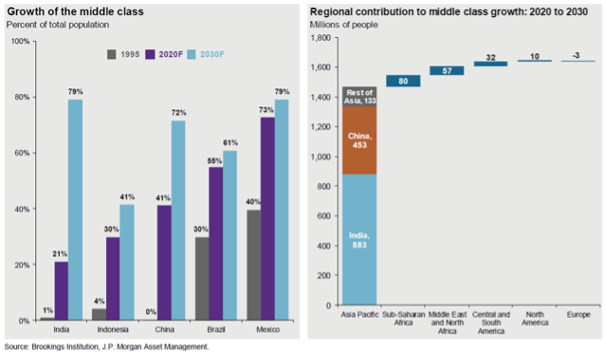

The picture above shows the immense scale of development. Whereas today 21% of India’s population belongs to the middle class, by 2030 it will be 79%. 883 million people will join the middle class, with all its consequences. Their need for energy and higher-quality food, for example, will increase. Their standard of living will develop accordingly: consume more luxury goods, make more credit payments, and a whole new stream of entrepreneurs will emerge. All this is grist for the mill of Reliance, the market leader in such sectors.

Reliance Industries

Since Mukesh Ambani took over leadership from his late father in 2006, he has initiated a stormy transition. The oil division was expanded further, into a full Oil-to-Chemicals (O2C) arm, which is far less cyclical than industry peers due to vertical integration. This includes the world’s largest oil refinery, for which Ambani was responsible in the 1990s.

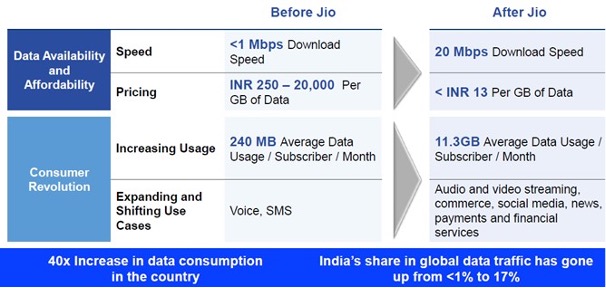

Since 2006, Ambani has built the current retail branch (17,000 locations) virtually from scratch, which is now among the ten largest retail and supermarket chains in the world. The digitalization and telecom branch Reliance Jio was also built virtually from scratch. Within four years, Jio became the market leader in 4G, allowing all of India to digitize. Some impressive achievements are shown in the chart below. By the end of 2023, Jio also aims to provide all of India with 5G coverage.

With renewable energy, Reliance wants to repeat this trick again. Ambani has committed to invest as much as USD 90 billion over the next 15 years with Reliance New Energy. By 2035, Reliance wants to be completely Co2 neutral. To that end, the family holding company wants to use, among other things, its years of experience with (gray) hydrogen. Reliance anticipates that growth at the renewable energy branch will exceed all existing growth engines within the family holding company over the next five to seven years.

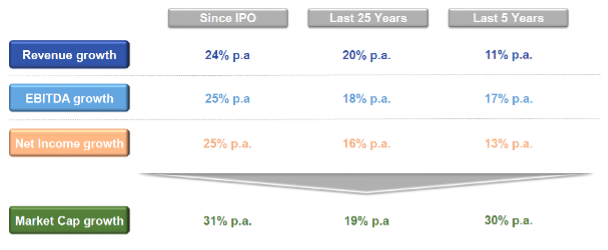

Its impressive track record is shown in the chart below. An investment of 1,000 rupees in Reliance Industries at the time of its IPO in 1977 is worth more than 3 million rupees today. However, with the promising development of India’s middle class, the potential for Reliance lies ahead. The megatrends of digitization and energy transition may provide additional acceleration.

Unlock hidden value

Reliance is very smart about partnering with the big technology companies. As the market leader in India, the company is the ideal partner for multinationals to gain a foothold in the country. In 2020, Reliance sold minority stakes in Jio and Retail for USD 40 billion to private equity parties and strategic partners. This allowed Reliance to pay off the accumulated debt of these companies and cash in on some of the value created.

Reliance also benefits from the technological know-how of these companies. It collaborates with Google on 5G, with Microsoft on cloud services and with Meta to make WhatsApp a super app. Reliance also collaborates in the field of renewable energy, taking strategic stakes in companies with promising green technologies.

The sale of minority interests are a prelude to an IPO of Jio and Retail. Strategic options are also being explored for the O2C branch to cash in on the hidden value. The first announced IPO is now a reality: the financial division Jio Financial Services (JFS) will be spun off in the foreseeable future and distributed by way of a dividend. In particular, Reliance foresees great opportunities for JFS to provide access to the financial system for the large number of Indians without bank accounts.

Conclusion

Led by Mukesh Ambani, Reliance Industries has transformed from an oil conglomerate into an investment holding company that reinvests oil profits in the fast-growing sectors of (online) retail, digitization and renewable energy. With India’s emerging middle class, the future also looks very bright. Its technological edge and strategic partnerships have made Reliance one of the world’s leading technology companies.

At the 2022 shareholder meeting, top executive Ambani indicated that he wants to double the value of the family-owned holding company within five years: “I will work with our board of directors to make Reliance more robust, resilient, purposeful and truly future-ready so that Reliance will more than double its value in the near term by the end of its Golden Decade in 2027, and grow even faster thereafter.”

The icing on the cake is that this well-managed holding is on sale at a 33% discount.