Tresor Vision: looking ahead 2023

Following our review of the past (stock market) year, we are pleased to share our vision for 2023.

Many parties lately have been sharing their views on inflation, what central banks will do with interest rates and how the economy will develop. We have no unique insights on these matters, and more importantly, it does not directly affect the composition of our portfolios. The main objective remains to select attractive securities that meet our strict criteria, enabling our clients to achieve their investment objectives within the set horizon.

Quality As Protective Factor

In our 2022 outlook last year, we wrote extensively about the building blocks of our portfolio. Among other things, we mentioned that the equity part consists of high-quality, capital-rich companies that can take a beating. Companies with strong market positions, which have pricing power due to competitive advantages, and are therefore well able to pass on inflation. Specifically, we also mentioned the spread between companies, sectors and asset classes within family holding companies. These distinguishing characteristics will continue to be essential in 2023.

As we wrote in our 2022 retrospective recently, 2022 saw a gap between stock prices and fundamentals. Yet it turned out that our portfolio companies fared extremely well, in part because of their foresight and long-term horizons. Using the Swedish family holding company Investor AB as an example, we would like to explain this in more detail.

Investor AB

Investor AB is the investment holding company of the Wallenberg family. Its roots go back to 1856. Since then, the company has had to endure countless trials and tribulations, from world wars and pandemics to recessions and even a depression in the 1930s. The family holding company often had to reinvent itself, constantly adapting to changes in the world.

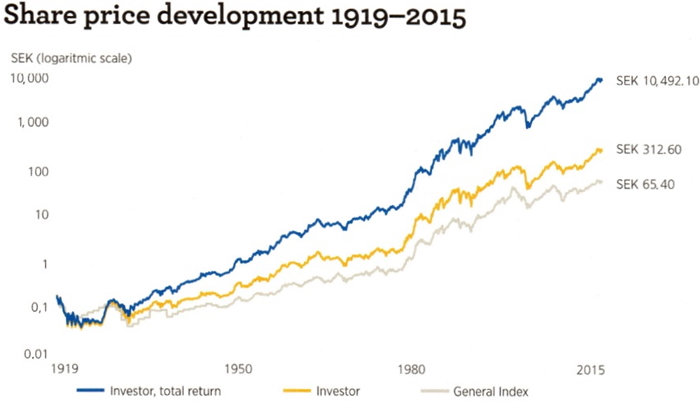

Investor AB fought valiantly, and always managed to pull through the trials successfully. That eventually resulted in the chart above. Investors who had invested capital in Investor AB since its IPO in 1919 and reinvested the dividends would have earned an average return of as much as 11.9% per year. Over the past 20 years, that has actually increased to 17.9% per year, and over the past 10 years to 19.3% per year.

Clearly, the Wallenberg family has built a financial fortress. By now, the sixth generation is already working in the company, a testament to its long-term horizon. This is also evident in the investment portfolio; many positions have been in the portfolio for some 100 years, including industrial supplier Atlas Copco (1916), bank SEB (1916), automaker ABB (1925) and pharmaceutical company AstraZeneca (1924).

The most important investment (15% of net asset value) concerns the publicly traded Atlas Copco, a leading provider of productivity solutions. The results of recent years exemplify the quality of the Investor AB portfolio. Atlas Copco is a market leader in several attractive niche markets, giving it pricing power. The company is therefore well able to pass on inflation. This is also clear from the stability of the operating profit margin in the chart above, in 2022 the margin even increased further.

Atlas Copco is also a prime example of a company with attractive reinvestment opportunities. In 2022, like a veritable acquisition machine, the company completed more than 30 acquisitions, further strengthening its position in niche markets. The fact that the return on invested capital is structurally above 25% shows that these investments create very high value. Moreover, the return on invested capital translates over the longer term into the return on equity, e.g., an investment in Atlas Copco has delivered an average return of 23% per year over the past ten years (despite a 19% price decline in 2022).

Increased inventory levels caused operating cash flow to be slightly lower in 2022 than in 2021. Supply chain problems have caused many problems for companies, but not for Atlas Copco’s customers. The Swedish industrial company was willing to sacrifice cash flow in the short term in order to continue to meet customer demand at all times. By continuing to deliver continuously and being a reliable partner , Atlas Copco gains a better relationship with customers. It can reap the benefits of that in the longer term.

Robust results through portfolio diversification

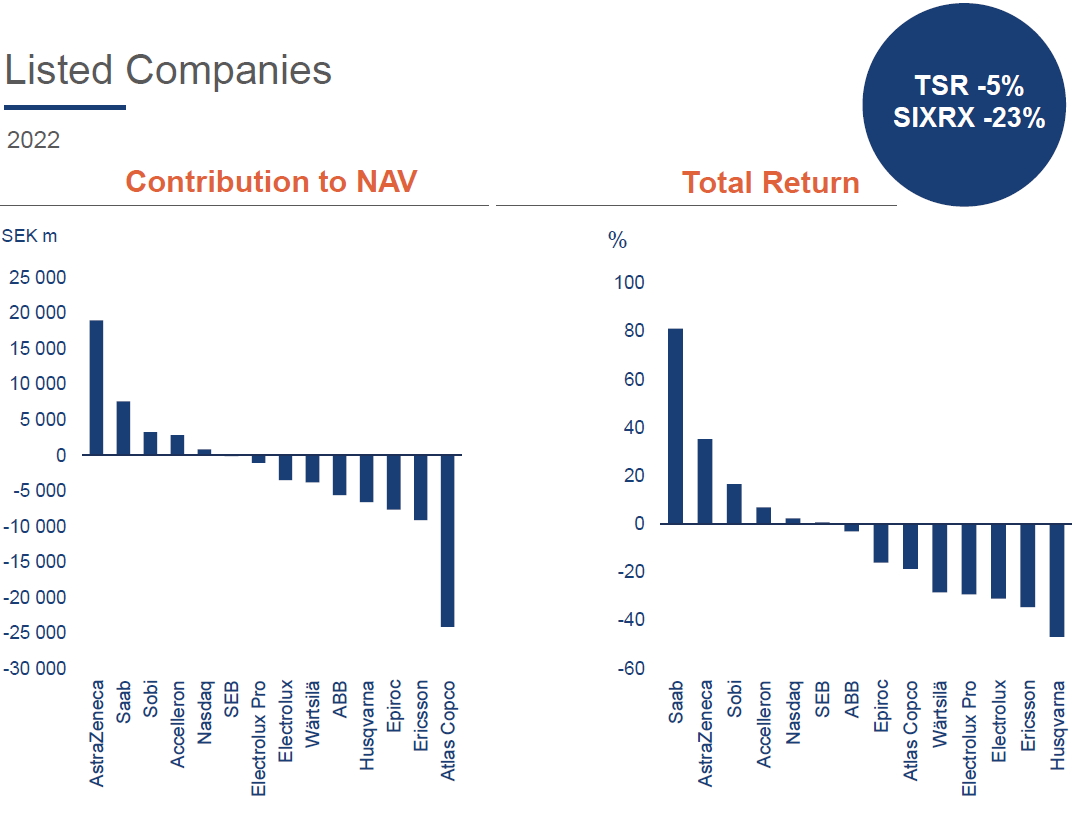

Exemplary of family holding companies is portfolio diversification. After a new, challenging macroeconomic and geopolitical market environment arrived in 2022, financial markets caught fire. Investor AB’s equity portfolio was also affected. However, due to the spread in place, large losses by Atlas Copco and Ericsson were absorbed by the strong performance of AstraZeneca and Saab, as shown in the image above.

The Swedish stock market index fell as much as 23% last year. Investor AB’s equity portfolio showed only a 5% loss. The portfolio is much more robust, so both the stock portfolio and Investor AB itself have managed to beat the stock market for years. Whether that will continue to be the case in 2023 is anyone’s guess, but the high-quality portfolio is able to (continue to) perform fundamentally in all economic conditions.

Ironclad capital structure

The past few years have been excellent for Investor AB and its subsidiaries. Nevertheless, the family holding company has made a conscious effort to reduce the debt ratio so that financial strength is available to withstand more difficult economic times well and even take advantage of opportunities as they arise.

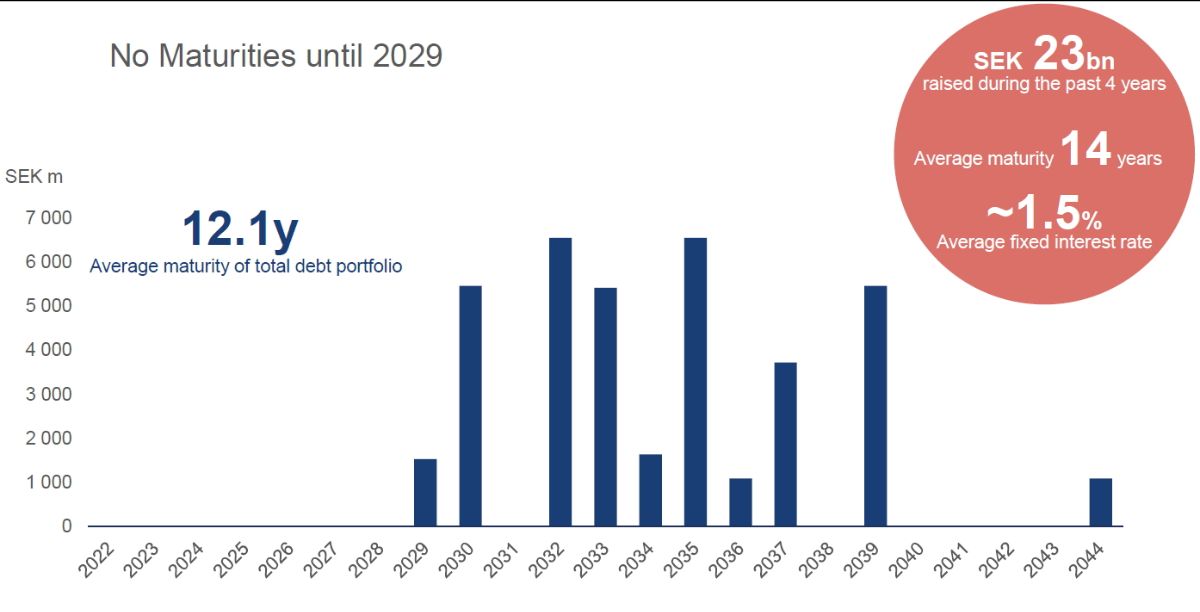

The investment holding company has taken advantage of low interest rates over the past four years, raising SEK 23 billion in loan capital with an average maturity of 14 years, at an average interest rate of just 1.5%. As the management puts it, “You have to raise cheap financing in times when you don’t need it, so that you are well prepared in more difficult times when financing is not available (anymore).”

With this countercyclical business management and excellent capital structure, Investor AB has the financial stability to support its subsidiaries to invest in organic growth or growth through acquisitions, and to be a reliable partner for their staff, customers and suppliers. With its huge war chest, Investor AB will actively seek acquisition opportunities in 2023, and then emerge (once again) stronger from these challenging times.

Johan Forssell, CEO and also shareholder (EUR 6 million) of Investor AB, confidently looked ahead to 2023 in the annual report: “Much of what defined 2022 will undoubtedly define 2023 as well. Although the uncertainty is great, Investor and our companies well prepared to meet the challenges and seize the opportunities ahead. Regardless of the market environment, our companies benefit from being market leaders with good profitability and exposure to secular growth trends .”

Conclusion

Whether inflation will ease, how the situation in Ukraine will develop, whether or not a recession is imminent and how the financial markets will develop are things we cannot predict. We select high-quality securities like Investor AB’s stocks to arm ourselves for all economic conditions, both pros and cons. Our companies are well positioned by their high cash positions to face any recession, and will emerge stronger on the other side through organic growth plans and acquisitions.

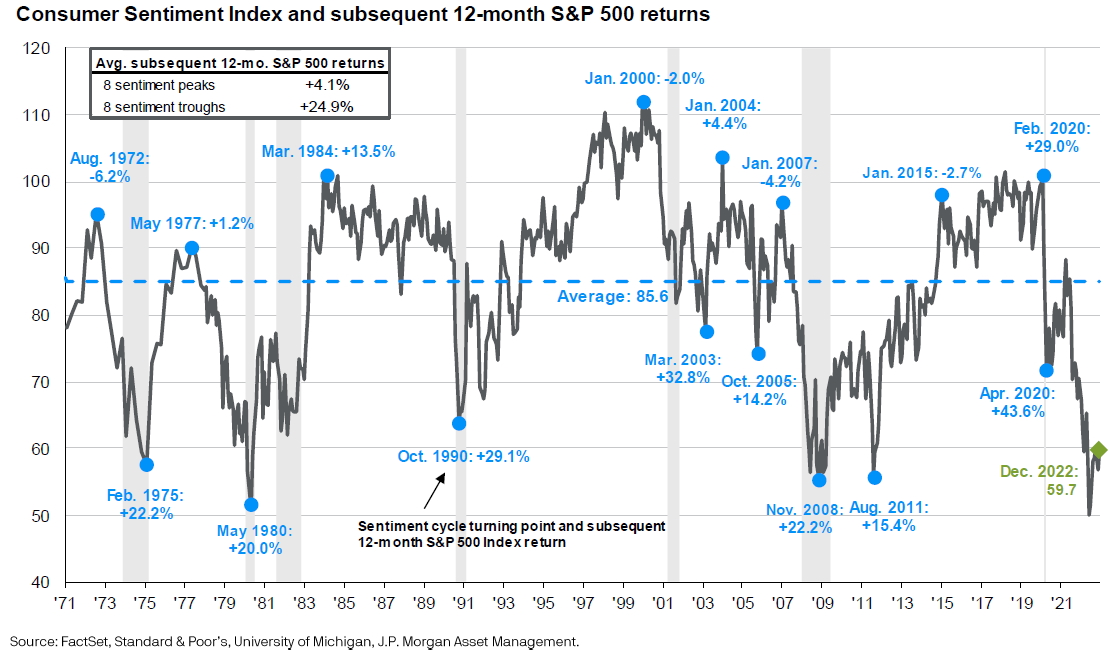

One sentiment indicator we would still like to share with you through the chart above, which may indicate a tipping point. In recent decades, a low in consumer confidence has been a reliable counter-indicator. After confidence reached a low, the U.S. S&P 500 stock index rose an average of 24.9%.

Whether we have already seen the low point in this cycle, however, is as yet uncertain. We have optimized the risk-return ratio of our portfolios, and expect to be well positioned to play solid catch-up in the event of a recovery in financial markets, as we wrote in our retrospective.

As mentioned, we do not have a crystal ball. However, we feel encouraged by the good fundamental developments of the companies in our portfolio, which will also translate into the share price of these stocks in the medium term. Through further diversification with alternative investments, precious metals and private equity (depending on the client profile), we believe we have made an adequate portfolio diversification. As a result, we look forward to 2023 with confidence.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.