Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Short-Term Sentiment Versus Long-Term Fundamentals

We regularly receive feedback from our relations on our newsletters. This shows that our messages are well read, for which we are of course grateful! Another feedback we sometimes hear is that we are too positive about the developments. After all, if things are going so well, why don’t we see this reflected in the share price of all companies?

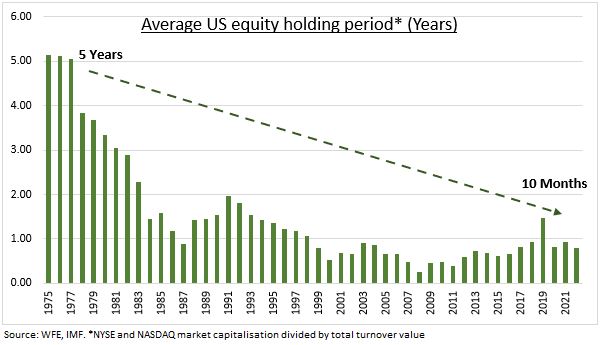

This can be explained from the different investment horizons investors hold. In the 1970s, the average period an investor held a stock in portfolio was about 5 years. Today, that has been reduced to 10 months. That means investors are focusing much more on short-term developments.

In the short term, sentiment determines returns. Thus, a long-term investment horizon is a competitive advantage in the financial markets.

In the longer term, the return a company manages to realize on its invested capital and its corporate culture are determining factors. It is in these quantitative and qualitative factors that we invest most of our analysis time.

So the portfolio is the result of a rigorous selection process, looking both top-down at the sectors and megatrends to which we want exposure, and bottom-up at the individual companies and their (relative) attractiveness in terms of valuation.

As a result, the companies in which we see the most potential secure a place in the portfolio. The corollary is that we automatically look at (and therefore write about) these companies with an optimistic yet critical eye. After all, if the developments were not good, or if the longer-term prospects were under pressure, we would not have the companies in our portfolio in the first place.

Thus, we regularly review the portfolio and focus on continuously improving its quality and risk-return ratio.

Sometimes, however, results are disappointing in the short term, as with Markel’s third-quarter results. The crux of the problem, however, was by definition temporary. We have the patience to wait several quarters for companies that have proven they can beat the stock market for decades.

We did, however, try to put our finger clearly on the problem in our weekly newsletter, pointing out why we think the company is a great long-term proposition.

At its IPO in 1986, Markel shares traded for USD 8.33 each. Today, the stock price is USD 1,388. That represents a compound return of more than 14.8% per year.

With a normalization of valuation, continued good results from investments and Markel Ventures and a return to normal profit margins from the insurance business, we expect that an average annual return above 10% can be achieved.

The above famous quote from investment guru Peter Lynch states that insiders such as executives may sell shares for countless reasons (divorce, estate planning, etc.), but buy shares for only one reason: because they expect the stock price to rise.

Markel’s management not only endorses that they consider the company undervalued, they are also putting their money where their mouth is. At the holding company level, the USD 5.5 billion in freely available cash is regularly put to work buying back its own shares. It is to be expected that these purchases have accelerated following the share price drop.

After the quarterly results, Markel also announced that CEO Tom Gayner (again) bought USD 131,192 shares of the holding company, while commissioners Mark Besca and Lynne Puckett also bought USD 166,277 shares of the family holding company. Gayner has bought shares in 7 of the last 8 quarters with substantial amounts.

We as outside shareholders could not wish for a clearer sign of confidence in the long-term prospects than for the policymakers to buy additional shares with their own money.

Due to the temporary setbacks, short-term sentiment is taking over. As long as the positive long-term developments continue and the insurance industry can prove that these were indeed temporary setbacks, the price will start to follow the fundamentals again. A strong catch-up movement as pessimism makes room for optimism can then also be expected.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner