Monthly Bulletin May 2022

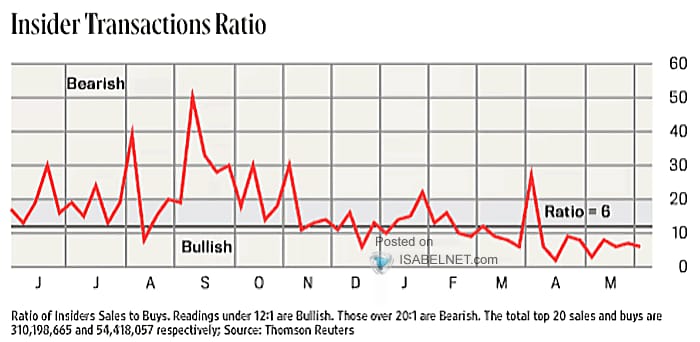

Last month, financial markets presented a mixed picture. April’s correction initially continued, only to recover somewhat in the tail end of May. As you could read in our previous monthly report, sentiment did veer toward the pessimistic. CNN’s “fear and greed index” and insiders’ buying behavior again proved to be reliable indicators here.

What the financial markets will bring next is uncertain. There are many uncertainties, so the stock market must climb the proverbial “wall of worries.” The question, however, is whether and to what extent this negative news has already been priced into stock prices. For now, the fear and greed index indicates that pessimism prevails.

In contrast, insiders’ behavior remains constructive, as shown in the picture below. More relevant to our relationships, is the fact that within our portfolios, both insiders and the companies themselves continue to very actively buy back their own shares.

It is interesting to note that the behavior of insiders differs from the statements they make. Several survey results have been released in recent weeks showing that insiders are gloomy about the economic outlook. An economic softening is being signaled and expectations are being tempered.

So that is not entirely consistent with insiders buying their own company’s shares briskly. In fact, insiders are even buying back their own shares in higher volumes than in March 2020, around the low point of the corona crisis. That turned out to be an excellent counter-indicator and, in retrospect, proved to be a signal that we were near a bottom in financial markets. Even then, insiders were pessimistic in their reporting, but turned out to be an excellent entry point for stocks.

The conclusion that can be drawn from this is that people seem to believe that prices have fallen enough. After all, the stock market is ahead of the economy. Insiders usually have a good nose for an attractive buying opportunity, since they are close to the fire.

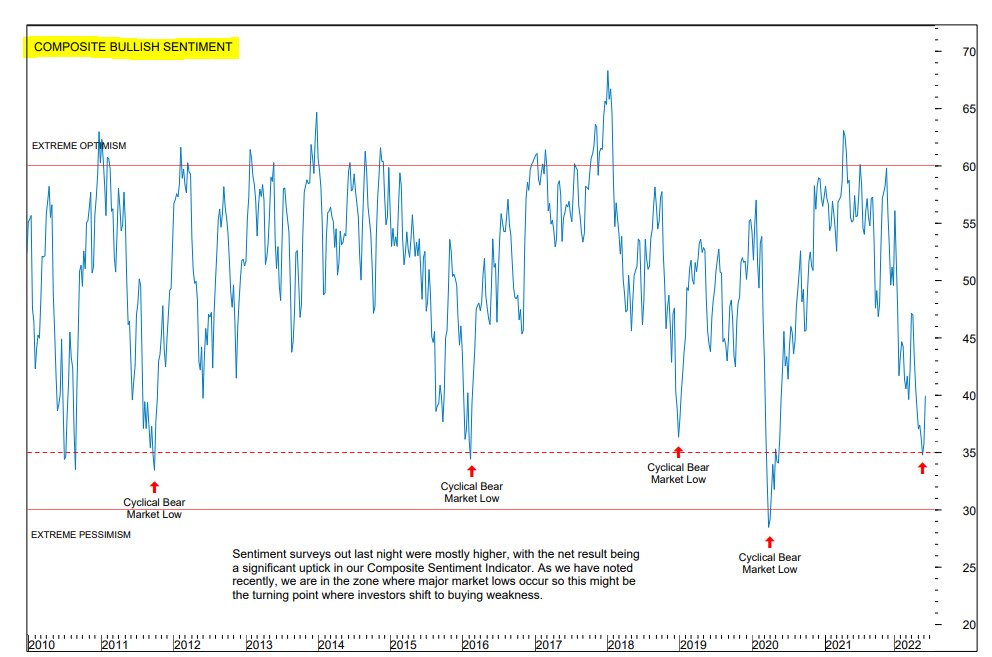

A comparison of current sentiment relative to the past 12 years shows that another bottom has been reached recently. Similar pessimistic levels in 2011, 2016, 2018 and 2020 proved an excellent counter-indicator pointing to a bottom in equity markets.

Oil, technology and health care

An important exception is the behavior of insiders in the energy sector, they are selling their own company’s shares en masse. They apparently see the current oil price as a temporary phenomenon. This is evidenced by the fact that oil companies are not investing heavily to take advantage of this high oil price. In fact, it may take years for that to bear fruit. So capital discipline is higher than it has been in the past.

In the technology and health care sectors, insiders are actually shooting out to the upside. They are buying back their own shares en masse, a trend we also see in the companies in these sectors in our portfolio.

To conclude this piece once again with the quote from renowned investor Peter Lynch, “insiders may sell their shares for a variety of reasons, but they buy them for only one reason: they think the price will rise.”

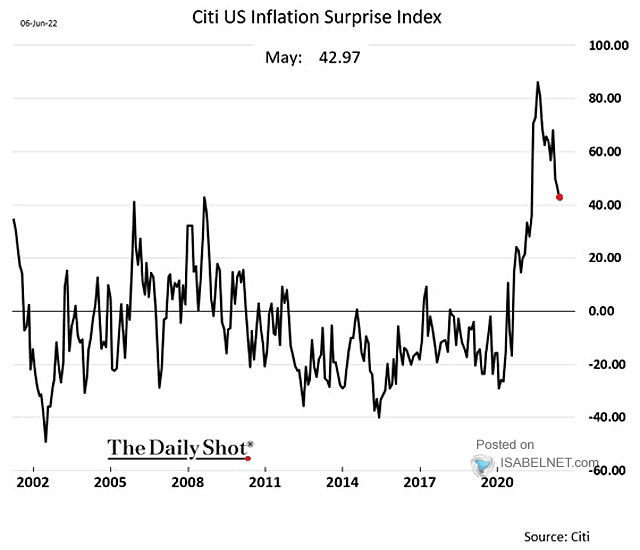

Inflation surprise index

Despite the negative sentiment, there also seems to be some light at the end of the macroeconomic tunnel. Financial markets are under pressure as central banks raise interest rates. In doing so, they are trying to combat high inflation.

Therefore, if that inflation normalizes a bit, it also means that central banks may resume somewhat more gradual interest rate increases, or even cease further increases. Citi’s inflation surprise index seems to indicate that the negative surprises of too-high inflation have been declining for a while, which is an interesting development.

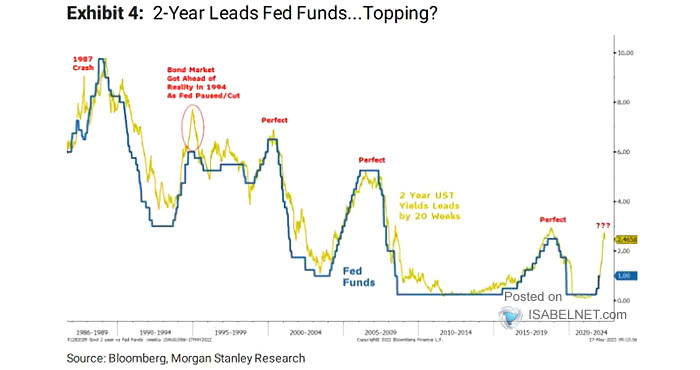

U.S. 2-year government bond yields also present an interesting picture, as shown in the figure below. These 2-year treasuries are typically about 20 weeks ahead of U.S. central bank policy rates.

This has proven to be a very reliable indicator of policy interest rates, possibly showing that the central bank is following market expectations. This indicator now seems to indicate that the central bank will not go much beyond a policy rate of 2.5%, which may be good news for financial markets.

Interview Howard Marks

Recently, Brookfield commissioner Howard Marks gave an interview to Bloomberg. Marks may count Warren Buffett, among others, among his followers because of his often accurate and rational reflections on financial markets. Asked about current market sentiment, Marks reveals that he sees that any optimism or greed has disappeared from stock prices. He sees attractive opportunities to invest and bargains abound, he says.

Howard Marks

When asked by the interviewer how to prepare for any further price declines, Marks responded clearly, “One of the basic tenets of our investment philosophy is that we cannot time the market. That means two things. One, we will never sell positions to go liquid, to be ready for any falling stock prices.

And two: we will not wait for a stock to get even cheaper. If it’s attractively valued today, we’ll buy it today. If it’s even cheaper six months from now, we’ll buy more of it. That works many times better than predicting that the stock market will be lower in six months, because that’s something no one is capable of doing.”

Again, to conclude with a quote from Peter Lynch, “Far more money has been lost by investors trying to anticipate corrections than the losses during an actual correction.”