Monthly Bulletin June 2022

After the war in Ukraine and tightening central bank policies already caused a noticeable correction in financial markets earlier this year, last month fear of recession was the culprit. Notably, companies with above-average sensitivity to an economic cycle came off considerably. Capital market interest rates also fell slightly again, providing some air to the hard-hit technology sector.

The media are eagerly seizing on the fear of a recession to boost ratings and newspaper circulation. Economist Mathijs Bouwman recently wrote an interesting column in the FD, in which he shared a sober view amid all the media hooting. Economic growth, which was largely artificially stimulated by the unprecedented fiscal and monetary support during the corona crisis, is returning to a more moderate, “normal” level. But it is certainly not all doom and gloom.

Unemployment is low and state finances are healthy, so Bouwman foresees at most a mild slowdown or stagnation in growth, but a severe recession with economic malaise and fundamental problems is still a long way off, he says. You can read the entire column by clicking on the image below.

We agree well with Bouwman’s vision. In addition to a strong labor market, we also want to emphasize that, unlike the credit crisis, for example, there are no large-scale problems in the financial system. Banks are well capitalized; in the U.S., for example, banks once again passed the Federal Reserve’s stress test.

Governments continue to invest, including in energy independence, renewable energy and defense. Consumers are buying fewer products and shifting their spending to the service sector, where they are still catching up on plenty of vacations and patio visits after the corona lockdowns.

Whereas we in the West are instead pursuing tightening monetary policies and weakening economic growth, China is a clear white raven. The Chinese want to put the economic malaise of lockdowns and “zero-covid” policies behind them and are stimulating both monetarily and fiscally. The Chinese did not participate in the free-money party of Western central banks, so they now have room to stimulate the economy. Because of the great importance of the Chinese economy to global economic growth, this is another sign that a (severe) recession is unlikely.

How much is already factored into the rates

Whether merely an economic normalization or a (mild) recession, financial markets are always looking ahead. One stock market wisdom is that the formal determination of a recession is often an excellent entry point, because when it is well and truly clear that a recession has occurred, financial markets have already begun to price in an economic recovery. Waiting for the dark clouds to lift is a very costly exercise in this regard, for no bells ring when financial markets have hit bottom.

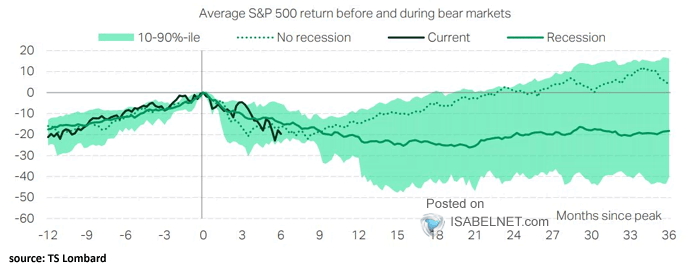

The question now is how much of the bad news has already been factored into prices. Financial markets typically look six months to two years ahead and try to estimate which scenarios are most likely. The chart above from TS Lombard shows the ranges of historical bear markets (price declines of more than 20%). The black line shows the current price trend of the S&P 500 stock index, the dark green line shows the average price trend at the time of a recession and the dotted line shows the average price trend at the time of a bear market when there is no recession.

If there were not currently a recession, then according to the historical price trend, we are already near the bottom, as shown in the chart. If there is indeed a recession, the stock market could possibly fall some more, but we have already put the bulk of the decline behind us.

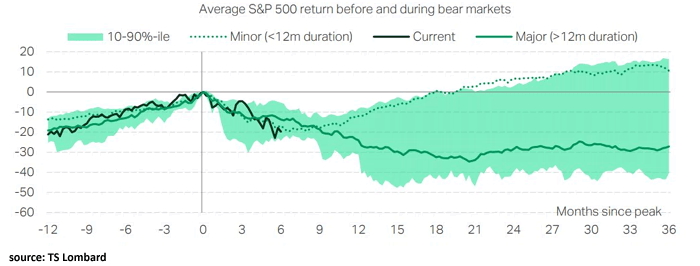

Even more relevant is to distinguish between a mild and a severe recession. The dark green line in the chart below shows the average price movement at the time of a severe recession lasting longer than 12 months, the dashed line shows the average price movement at the time of a mild recession (shorter than 12 months).

If there were a severe recession, an overall decline of 30-35% in the S&P 500 stock index is possible, based on historical price trends. However, as indicated, we see no indicators of a severe recession at this time. If there is a mild recession, the average price trend of the S&P 500 is almost identical to the chart when there is no recession.

Thus, based on the charts above, it can be argued that the scenario of no or mild recession is currently in the equity markets. If that scenario materializes, we could be near a bottom in the stock market, given past scenarios. In the unlikely event that a severe recession does occur, the stock market could fall further. However, the obvious disclaimer applies here: past results are no guarantee for the future.

Inflation and interest rates

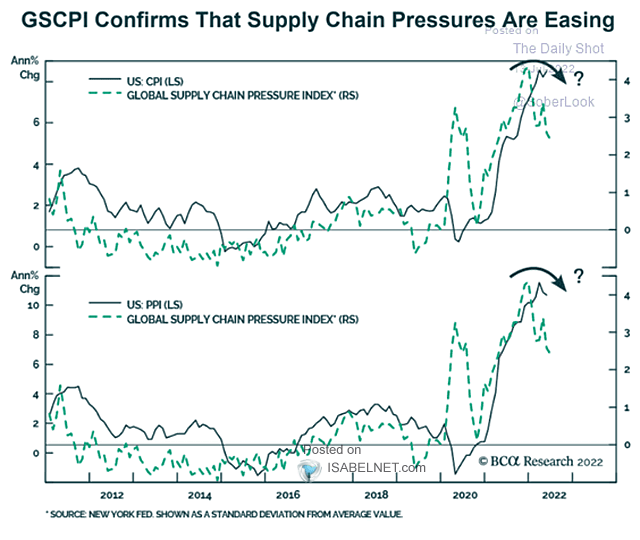

Several conditions that play an important role in short-term inflation are noticeably easing. For example, there are signs that supply chain conditions are noticeably improving, as shown in the graphic below from the New York Central Bank. A significant portion of inflation, both in consumer prices (CPI) and producer prices (PPI), has skyrocketed due to a surge in supply chain pressures. As these pressures ease noticeably, their impact will gradually spill over from the inflation figures.

Numerous commodity prices are also falling quite sharply in recent weeks. The price of grain, for example, had risen sharply due to the Russian invasion of Ukraine, since it is known as the “granary of Europe.” Grain prices are now back below pre-invasion levels, while oil prices have also clearly come off. This also normalizes the impact of energy and food prices, two significant factors in the high inflation rates of recent months.

Also, some of the inflation was caused by the fact that companies wanted to respond to feared shortages, so they held higher inventories. With supply chain issues noticeably easing and consumer demand shifting from goods to services, inventories are being reduced, which is having a dampening effect on inflation. Supply and demand are rebalancing in several sectors, following the shock of the corona pandemic and associated lockdowns.

Pricing power

The concept of pricing power is the ideal protection against inflation. If you have high profit margins as a company and are able to sustain them by raising prices, you can pass on higher inflation in your cost price and have a much larger buffer to absorb inflation. The companies we invest in, either through holdings or through mutual funds, have, by and large, a higher profit margin (and thus pricing power) than the average company in a stock market index.

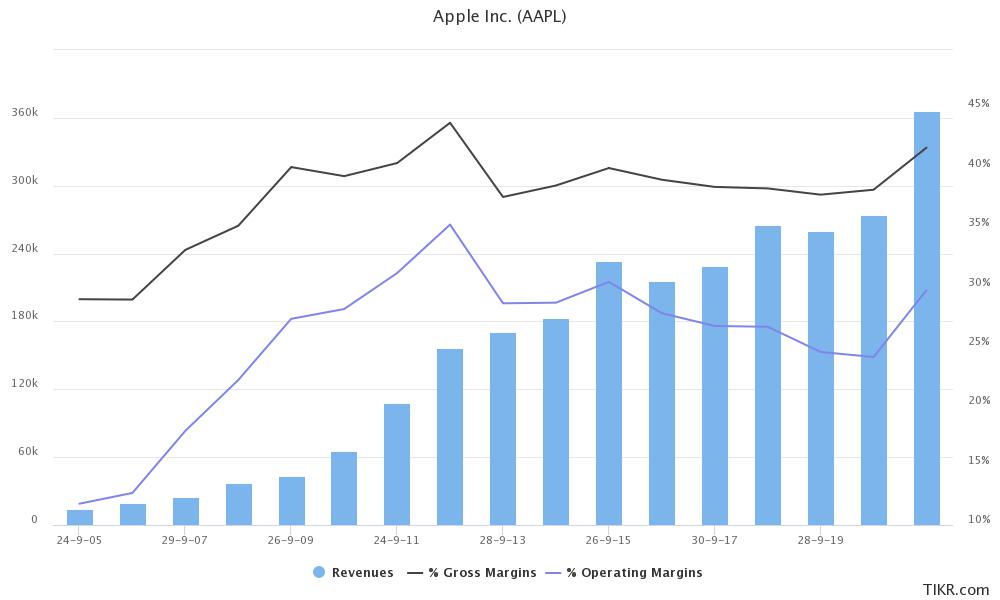

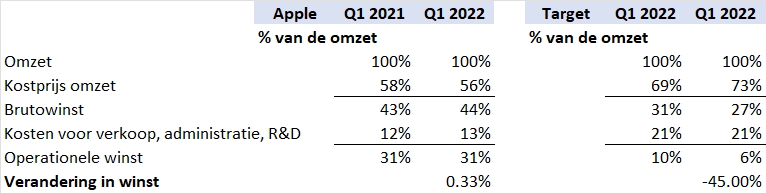

A textbook example is the company Apple, by far the largest publicly traded position in the portfolio of Berkshire Hathaway, the investment holding company of veteran investor Warren Buffett. There is an obvious reason Buffett has so much confidence in Apple, namely the company’s rock-solid brand name. That gives Apple an exceptionally strong competitive position and pricing power, which translates into a high gross profit margin and a high operating profit margin, as can be clearly seen in the chart above.

An example of a company with low margins and little pricing power is the also U.S. supermarket and retail chain Target. In the first quarter, this company suffered inventory write-downs, a decline in sales in non-essential goods, higher transportation costs, supply chain disruptions, and higher salaries and staffing levels in distribution centers.

The table above compares Apple and Target’s first-quarter 2022 figures with those for the same period last year. Apple was able to withstand the various setbacks, and actually saw a slight increase in operating profit. At Target, the economic challenges had a disastrous impact, with operating profit falling by as much as 45%.

Although both companies have fallen by more than 20% from their highest share price, it can be objectively established that Apple is a much better performing company than Target. In the long run, this is always reflected in the growth of intrinsic value, which in the medium term also translates into a rising stock price. We feel comfortable with our carefully selected portfolio, where the focus is particularly on pricing power, high profit margins and return on invested capital, and thus the impact of inflation is well considered.

Conclusion

What we wish to demonstrate with the example of Apple versus Target is that it is primarily important to focus on high-quality companies with a strong competitive position. Companies with a high return on invested capital and a talented management team manage to maintain, or even increase, high profit margins in the medium term (see the example of Apple). In this regard, the corporate culture is very important. If the founder of the company, his family or a reference shareholder has a significant stake, this significantly enhances the focus on long-term value creation.

We focus on companies where these factors are present and analyze the intrinsic value of the company. These are the fundamentals. A company’s stock price reflects emotion. “In the short run the stock market behaves like a voting machine, but in the long run like a weighing machine” Buffett’s teacher Benjamin Graham once said. In other words, in the short term emotion rules, in the longer term the stock price reflects intrinsic value.

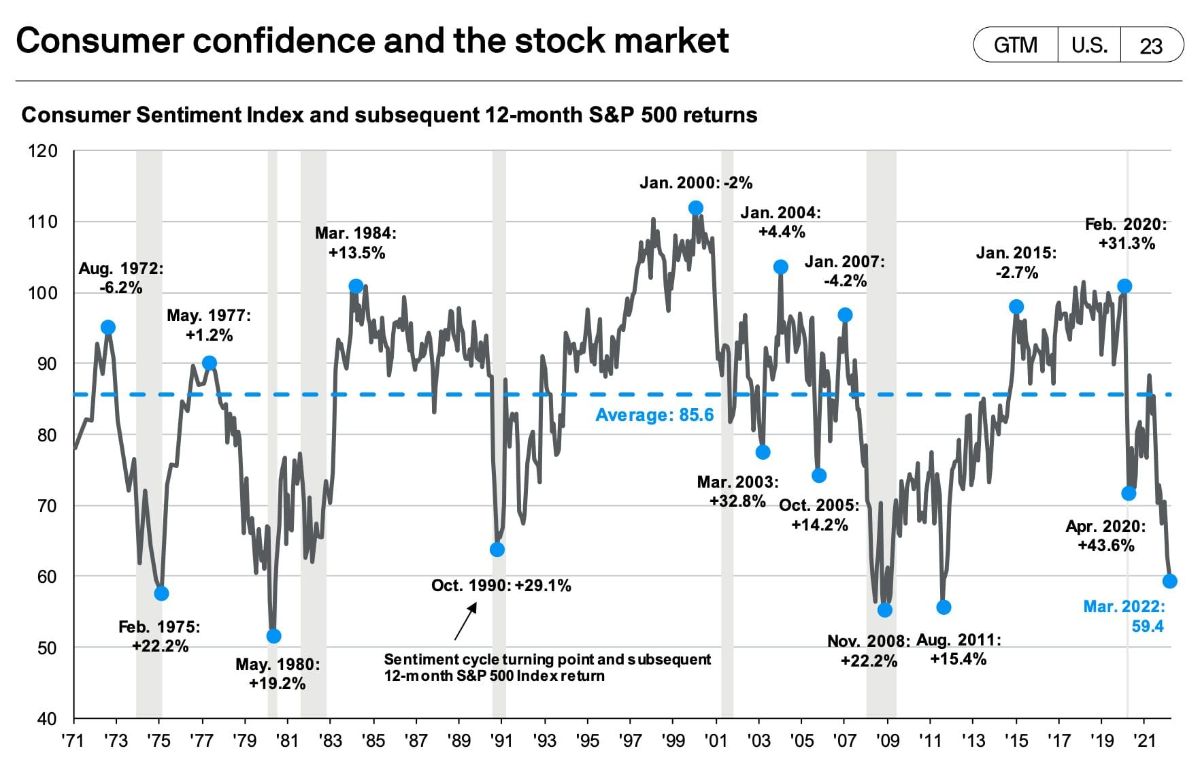

Investors would do well to pay close attention to the emotion rampant in the stock market. Financial markets are under considerable pressure this year. One negative headline follows another. Recently, media outlets wrote about the most negative consumer sentiment in years, which would portend economic malaise.

History in financial markets paints a different picture. The more negative the sentiment, the more positive the stock returns over the next 12 months, as shown in the chart above. Each low in consumer sentiment was followed in the following year by (high) double-digit returns of between 14.2% and 43.6%.

Past results may not guarantee the future, but the past has repeatedly proven that it pays to invest against the grain. To conclude with a quote from Warren Buffett, “Be fearful when others are greedy and greedy when others are fearful.”

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner