Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Economy Shows Divided View

For months, the financial press has been writing about the path the economy will take. Analysts and commentators tumble over each other, with various indicators and charts proving them right. Mark Twain once said, “There are three kinds of lies: lies, gross lies and statistics.”

Although we also regularly use graphs to provide insight into certain developments, we are well aware that we do not have unique insights about the development of interest rates, inflation or the economy in the short term. Therefore, we try to select investments that can perform well through an economic cycle. Nonetheless, it is important to keep abreast of fundamental developments in the economy, so we pay attention to this.

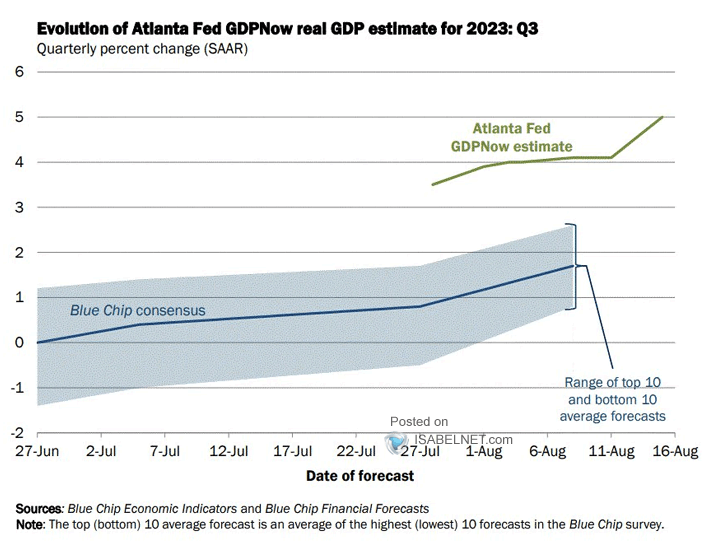

The U.S. Central Bank of Atlanta tracks economic developments based on current figures. This is summarized in an estimate of economic growth for the current quarter. For the third quarter of 2023, the central bank expects the US economy to grow by 5%, much higher than analysts’ growth expectations.

Will we get a hard landing (a recession), a soft landing (a mild recession or a significant slowdown in growth), or even no landing at all (the economy growing steadily) as a result of interest rate increases and tightening central bank policies?

As always, it is difficult to formulate an answer to this in advance, while it always seems easy to explain in hindsight. Making an investment decision in the moment, when uncertainty reigns supreme, is no easy task. Turning off emotions and continuing to look rationally at the outlook and fundamentals of individual portfolio investments is then the motto.

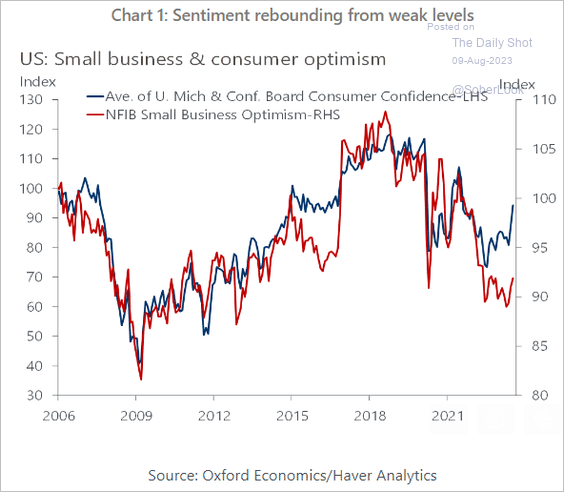

What we can see, however, is that the confidence of both consumers and small and medium-sized enterprises (SMEs) is clearly rebounding from low levels recently (see chart above). Consumers and SMEs are two of the most important variables for economic growth, so that bodes well.

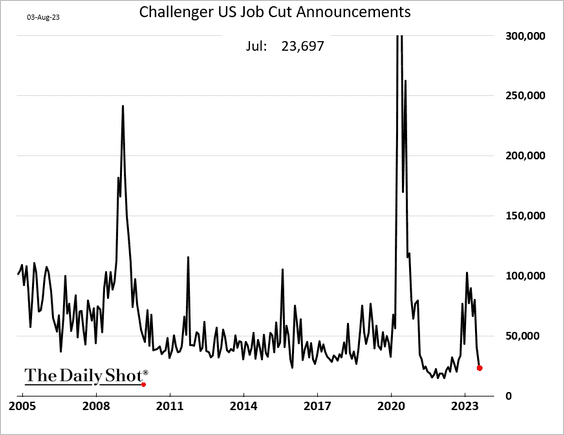

The chart below also shows that corporate announcements about the number of jobs they are going to cut have clearly peaked. High job security and implemented wage increases are increasing purchasing power, at a time when inflation is actually falling solidly in recent months. Higher purchasing power among consumers, and more investment from business (in automation, artificial intelligence, sustainability and strengthening the supply chain) is basically a good omen.

Spread as protection against uncertainty

With family holdings and distinctive mutual funds, we at Tresor Capital have deliberately chosen broadly diversified propositions as the foundation of our offensive portfolios. These investments have broad diversification, allowing large under-the-hood ups and downs to be absorbed by other propositions.

To illustrate: Berkshire Hathaway released its second-quarter 2023 numbers last weekend. Warren Buffett’s investment company demonstrates the beauty of a holding company’s internal spread. Divisions that do less are more than offset by those that do better, in this case a recovery in the auto insurance market from which Geico was able to benefit.

The numbers are basically retrospective, and show that (as Buffett predicted at the shareholder meeting in May) both railroad and consumer and manufacturing companies weakened. This is consistent with the decline in SME and consumer sentiment that we showed in an earlier chart above. So now, fortunately, we see this confidence clearly rebounding from low levels.

The insurance division recovered after a weaker period complicated by corona. Investment portfolio income also increased substantially, with Berkshire finally getting a handsome return on its cash mountain, which now stands at USD 142 billion.

The latter is also the beauty of family holding companies with strong balance sheets: they can actually take advantage of any weaker economic conditions by acquiring companies at attractive(er) prices. This inherent diversification makes a holding company attractive as a foundation in an investment portfolio.

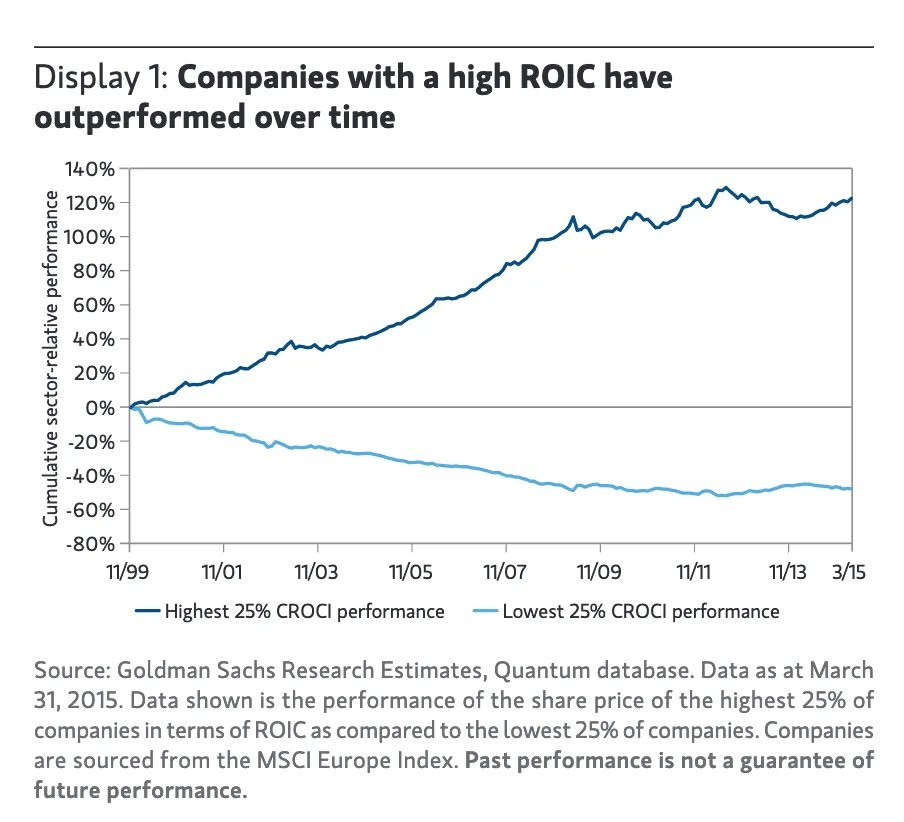

Return on Invested Capital

Recently, the chart above caught our attention. We regularly argue that return on invested capital is one of the most important indicators of the expected return on a company’s stock. The chart above graphically illustrates this.

Goldman Sachs examined the European stock market and sorted companies based on Return On Invested Capital (ROIC). The 25% of companies with the highest ROIC show clear positive returns, while the 25% of companies with the lowest ROIC exhibit extremely negative returns.

As Charlie Munger, Warren Buffett’s right-hand man at Berkshire Hathaway, once aptly described it, “In the long run, it’s hard for a stock to earn a much better return than the company underlying it. If the company earns a 6% return on its capital over 40 years and you hold it for those 40 years, you’re not going to deviate much from a 6% return, even if you originally bought it at a huge discount. Conversely, if a company earns 18% on its capital over 20 or 30 years, you end up with a nice return even if you pay an expensive-looking price.”

An important addition pointed out to us by a reader of our newsletter: the prerequisite for that nice longer-term return is that the company always knows how to reinvest the income from the business against that high return on capital.

Fortunately, this is inherent in the business model of family holding companies: finding attractive investments that can meet high yield requirements. Family holding companies still manage to do that well, which lays a nice foundation for future share price returns.

If you have any questions or comments about this publication or other matters, please kindly contact us using the information below.

Sincerely,

Michael Gielkens, MBA

Partner