Monthly Bulletin July 2022

Last month was marked by a clear recovery, after the prospects of a possible recession, higher interest rates and continued inflation weighed on stock prices in the month of June. In our previous monthly report, we discussed how much economic pessimism has already been priced into stock prices.

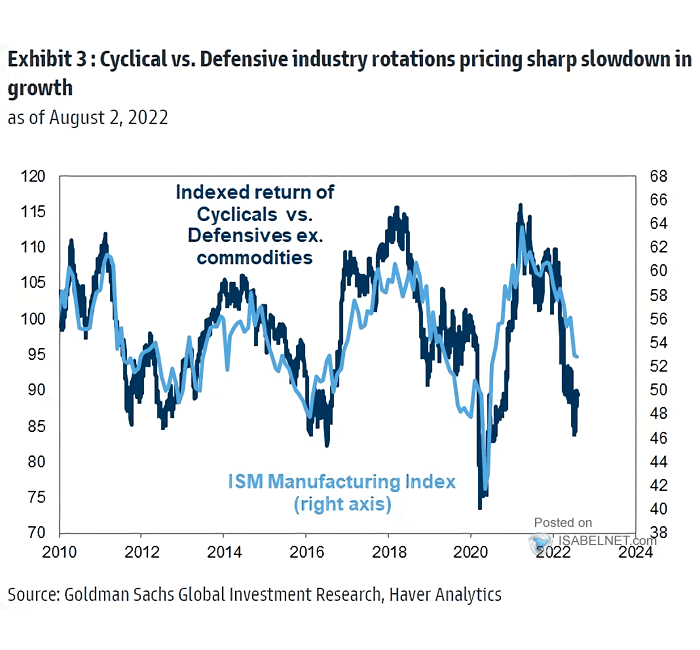

The chart below shows an index of the returns of cyclical companies compared with defensive sectors (dark blue) on the one hand and the purchasing managers’ index (light blue) on the other. The purchasing managers index is considered a reliable predictor of economic growth. When investors fear a recession, they swap their cyclical stocks (e.g., consumer discretionary or industrials) for defensive stocks (consumer staples or health care), which they have done en masse in recent weeks.

The question of how much bad news has already been priced in is anyone’s guess, but it is clear that despite the price recovery since June, investors have still factored a clear economic slowdown into prices. The stock market is always ahead of the economy, so if things are actually down economically, it is not inconceivable that the worst is already behind us in the stock market. This was the case after March 2022, for example.

Reported figures for the second quarter so far have been largely positive. Several commentators argued in advance that analyst expectations were far too optimistic, but a clear majority of companies managed to match or even exceed them. Management teams give a generally optimistic outlook, due to continued positive demand, the ability to pass on price increases and the gradual improvement in supply chain disruptions, but they acknowledge the potential risk of any economic slowdown.

Peak inflation…?

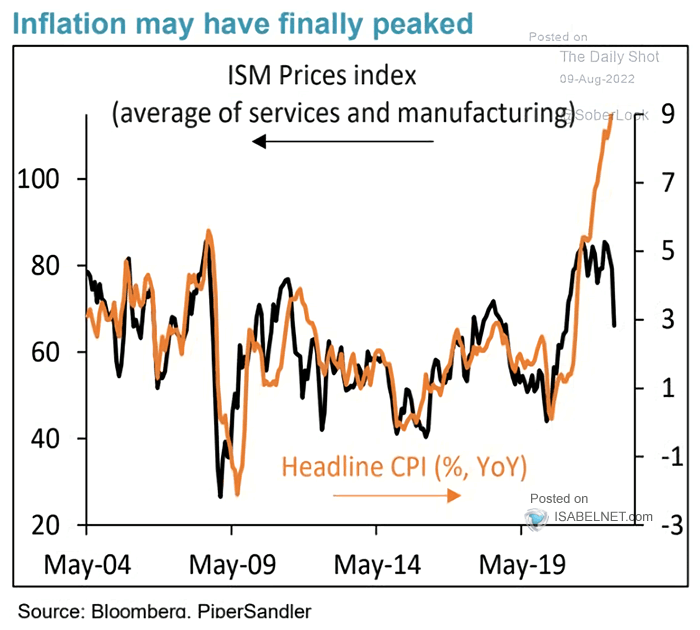

There was also positive news on the inflation front for the first time in a long time. The consumer price index (CPI) showed a slight decrease in the month of July compared to the month of June. Compared to July 2021, although inflation was still up 8.5%, month-to-month inflation in particular is relevant to get an indication of whether there is any normalization. Central banks also look to this indicator in particular to determine whether they need to tighten the reins even more with interest rate hikes, or whether they can slow down.

The purchasing managers’ index ISM is usually a good leading indicator of the consumer price index, as shown in the chart above from Bloomberg. Based on the ISM, inflation would now have fallen markedly, with the difference between the headline inflation rate and the ISM in this one largely explained by disruptions caused by the coronal shockdowns and the war in Ukraine. However, central bankers immediately warned that one swallow does not make a summer, but it may be a good first indicator that the peak of inflation is now behind us.

Insiders remain positive

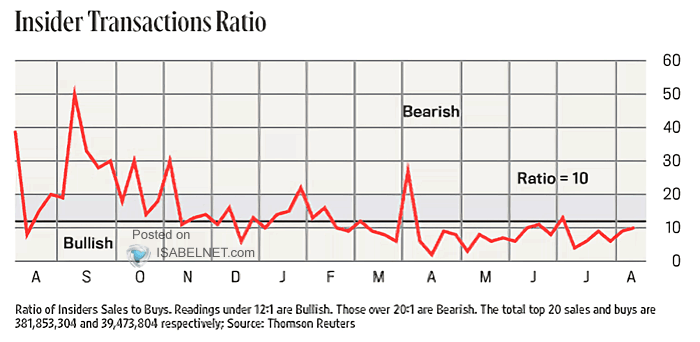

Despite the rise in equity markets in July, insiders are still positive. The so-called insider transaction ratio is still in the “bullish” zone, as shown in the chart below from Thomson Reuters.

If insiders are predominantly buying more than selling, they anticipate that current stock prices are attractive, which usually bodes well. There can be several diverse reasons why a director, auditor or major shareholder divests an equity stake. If they predominantly buy shares of their own company, however, there is only one reason: they find the stock price attractive relative to the intrinsic value and think it can rise (further).

By and large, company figures are in the prick or even slightly better than expected. Companies that cite things like geopolitical and macroeconomic developments, supply chain issues or inflation as explanations for worse-than-expected results often turn out to have no pricing power or underlying problems. This shows once again the importance of a well thought-out strategy with a focus on high-margin companies, barriers to entry and high returns on invested capital. It will come as no surprise to you that these are core criteria we apply to the companies in our portfolios.

Investors still cautious

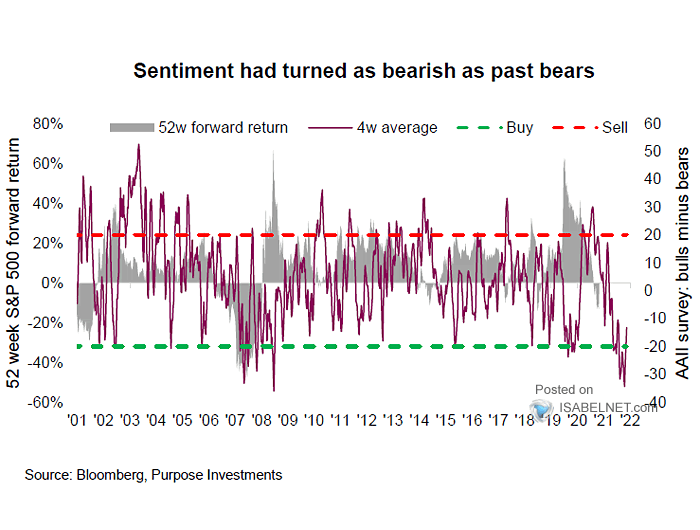

Investors remain cautious for now, despite the stock market recovery, better-than-expected company figures and a better-than-expected inflation rate. The chart above from Bloomberg shows that investors are still very pessimistic and that the bears (pessimists) outnumber the bulls (optimists).

If this ratio passes the green dotted line, it is a signal that there are too many pessimists, which historically is an excellent counter-indicator. The green line then gives a buy signal, so to speak. For now, investors remain close to this green dotted line, which shows that it can still be interesting to buy shares now.

Stocks are the best asset class over the long run

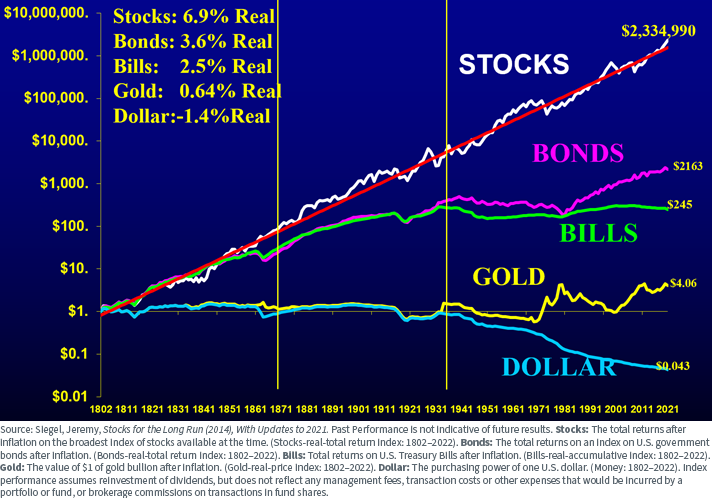

Professor Jeremy Siegel wrote in his book Stocks for the Long Run about the returns of various asset classes from the year 1802, net of inflation. Recently this chart was updated through 2021, and in times of higher inflation it is not wrong to consider which asset classes do best over the long run.

Equities achieve an average return of 6.9% after inflation over this period of nearly 220 years. For long-term bonds it is 3.6% and for short-term bonds (bills) 2.5%. Gold manages to hold its value well, with an average return of about 0.64%. Only cash, measured in dollars, loses an average of 1.4% in value per year (the dollar has been decoupled from the gold standard since 1971).

During the period 1946-1981, bond yields were negative; bond yields were lower than inflation levels. Bonds produced an average loss of 2.5% per year, while cash produced even an average loss of 4.5% per year. Equities produced a positive return of 5.3% per year on average, while gold produced an average return of 2.2% per year.

The title of his book already suggests that Professor Siegel recommends investors with a long-term horizon invest in stocks. Companies with pricing power can raise their prices in times of high inflation, such as today, thereby passing on inflation and protecting their profit margins. Investors had better not park their money in savings accounts or invest in bonds during times of high inflation. Stocks and possibly gold offer better protection.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner