Monthly Bulletin December 2023

Attached please find the monthly report, in which we share our views on conditions in the financial markets.

2023 Optimistically Started

Where 2022 was dominated by declining markets, 2023 got off to an optimistic start. Economists rapidly adjusted their estimates. While at the end of 2022 they were still convinced of a recession, they now seem much more lenient in their assessment. The soft landing envisaged by central banks after the adjustment of the “free money” era is considered a real scenario.

Financial markets have also echoed this optimism. Major price components of inflation are coming down rapidly, winter in Europe is softer than expected, and even central banks seem to be easing headwinds. From four consecutive 0.75% rate hikes, the U.S. central bank temporized with a 0.5% increase in December.

As recently as February, the US central bank raised interest rates by only 0.25%. Chairman Jerome Powell signaled a desire to wait and see the impact of sharply tightening monetary policy from 2022. The effect of monetary tightening is seen in the economy only with a lag. Thus, the end of interest rate hikes seems to be in sight.

Although Powell emphatically stated in a commentary that the fight against inflation is far from won, he also admitted that the process of disinflation has begun. Despite the recovery in financial markets, Powell still does not see financial conditions as easing. That was music to investors’ ears.

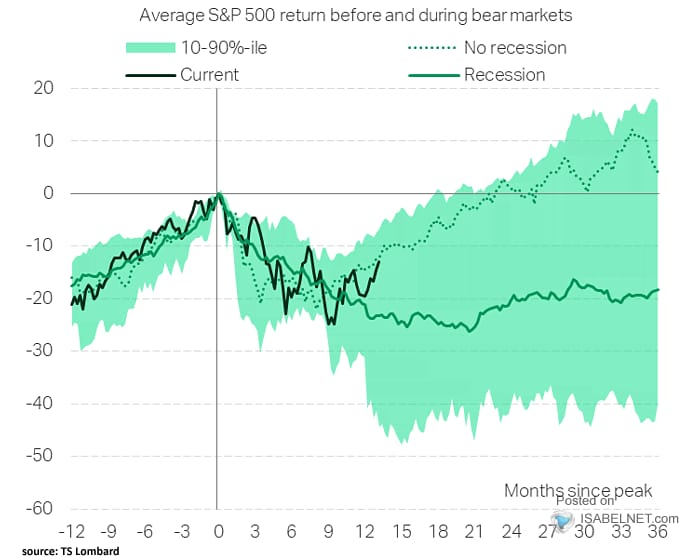

If there will indeed be a soft landing, with inflation falling without a (severe) recession, then recovery in financial markets may only be in its infancy. The above chart from TS Lombard shows by ranges the average movement of the U.S. S&P 500 stock index in a bear market (a falling stock market, usually with a drop of more than 20%).

The black line shows the trend since the start of the current bear market in 2022. The dark green line shows the average price trend during recessions, the dashed line shows the average price trend when there is no recession. A tipping point seems to have occurred, investors are increasingly betting on a soft landing.

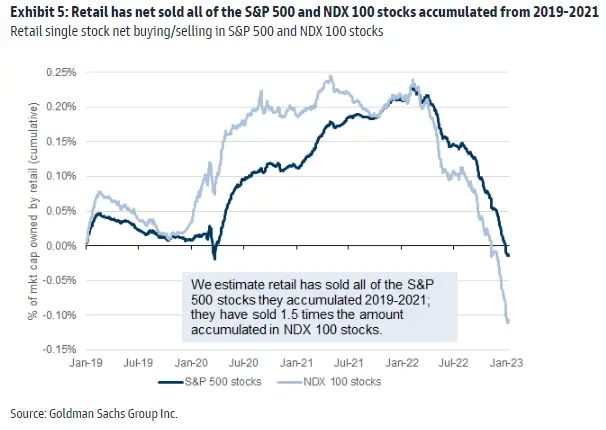

The chart above from Goldman Sachs shows that private investors threw in the towel in 2022. They sold all the stocks they had bought during 2020 and 2021. They even sold 1.5x as many technology companies (NDX is the Nasdaq), which the US investment bank says is a sign of capitulation among investors.

The capitulation phase usually coincides with the bottom in a falling market. Whether this is the case this time around is hard to say, but such pessimistic sentiment has been an interesting counter-indicator in the past.

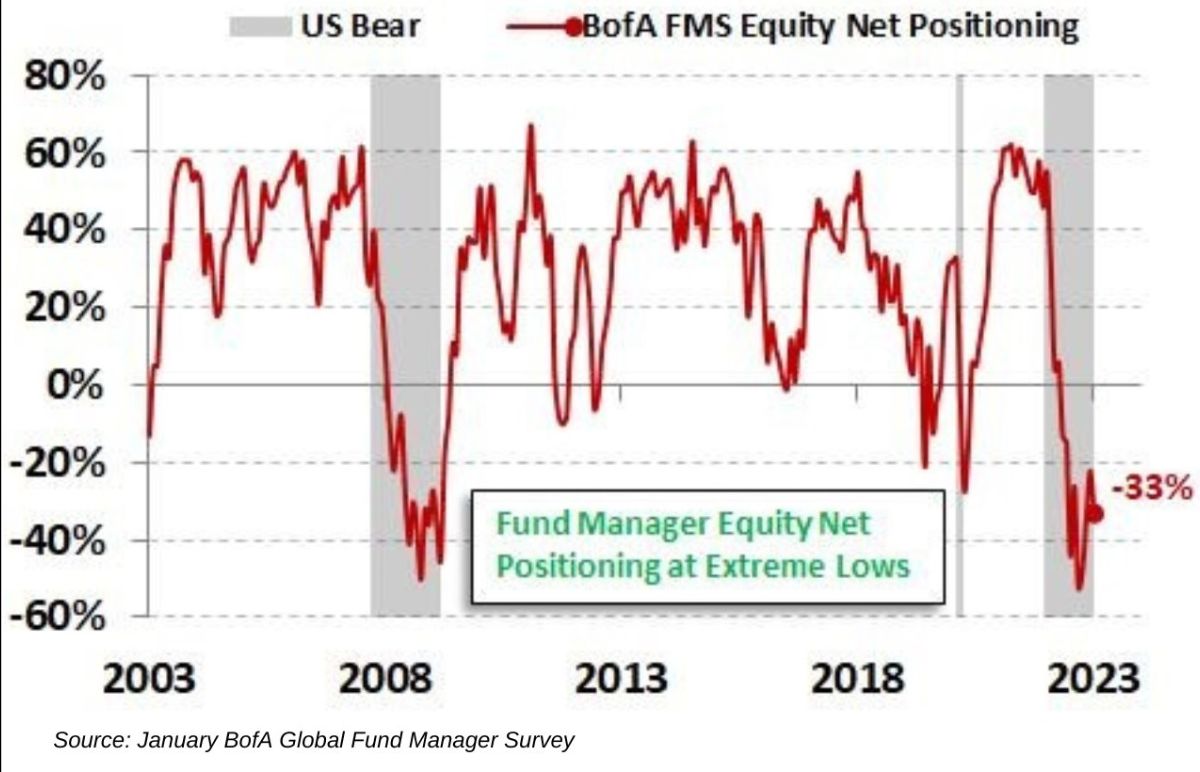

Professional investors also faced pessimism in 2022. Bank of America’s latest survey of fund managers shows that professional investors have not had such low exposure to equity markets since the credit crisis. If the trend of the above graph from 2008/2009 repeats itself, investors may look forward to a nice price recovery in financial markets when professional investors return to the stock market.

Both retail and professional investors fall prey to the emotional extremes of fear and greed. The above sentiment barometers can be interesting counter-indicators, showing how much pessimism is already factored into share prices. If the actual economic or inflation numbers are slightly less bad than what investors were previously pricing in, that can be a major trigger for a stock market price recovery. This is also what we could observe in financial markets since the turn of the year.

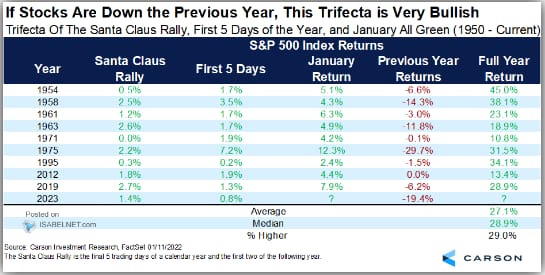

Whether the stock market recovery will continue into the remainder of 2023 is, of course, pie in the sky. However, we cannot resist citing again the chart from our Jan. 13 newsletter. There are several stock market securities to which investors assign predictive value. One speaks of e and “Christmas rally,” the “five-day effect” in January or the well-known stock market wisdom that “so goes January, so goes the year.”

According to stock market legends, a Christmas rally, a rally in the first five stock market days or a positive stock market month in January are indications for the entire year. Much research has been done on these indicators, but rarely has such an effect been consistently demonstrated based on these indicators in isolation. However, when the three effects occur simultaneously, while the previous stock market year was negative, there is some “predictive value.”

The table above shows that in the past this resulted in an average return of 27% in the next calendar year. There was a Christmas rally at the end of 2022, the five-day effect was observed, and January ended very positively. We are the first to caution against having a crystal ball and the above table does not give any guarantees, but it is at least an interesting fact.

Recovery candidate: Sofina

One of the companies with the potential for (further) recovery in 2023 is Belgian family-owned holding company Sofina. Earlier this month, a brief analysis of Sofina, written by us, appeared in the Flemish Federation of Investors’ “Guide to the Best Investor.”

Sofina’s share price fell heavily in 2022, and the hefty premium has since turned into a discount to net asset value. We believe this discount is unfairly high, and substantiate why we believe Sofina still offers an attractive investment proposition for investors.

You can download the analysis by clicking on the image below.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner