Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Balance Sheet & Cash Flows Offer Protection Against Financial Misfortunes

After an optimistic start in January, financial markets have since taken quite a tumble. Just last week, Jerome Powell, the chairman of the US central bank, announced to Congress that it could not be ruled out that interest rates would be raised by more than 0.25% at the next central bank meeting on March 21 and 22.

A few days later, Silicon Valley Bank (SVB) ran into trouble. Due to sharply increased interest rates, a significant mismatch between the asset and liability sides of the balance sheet, failing risk management at the bank and an extreme concentration in the type of customers (young technology companies and venture capital funds), the bank had put itself in a predicament. An announcement that the bank was planning a capital increase prompted customers to book away their money en masse.

This bank run marked the end for SVB, which was eventually shut down and put into administration by the regulator. Over the weekend it was announced that all customer balances would be fully refunded, and that the central bank had taken additional measures with the government to prevent similar problems at other banks. This ensured clarity and financial stability.

The very intense turbulence in financial markets was a logical consequence, investors’ thoughts led back to the credit crisis and bank bailouts . Yet this is not entirely justified, as SVB’s case is very specific. Moreover, the banks are many times better capitalized than in 2008, so the comparison with the credit crisis is not valid.

The perils surrounding SVB reaffirm our position that we do not want to invest directly in banks. A bank’s balance sheet is a black box; it is never clear what unexpected risks one is exposed to. A bank has a double risk in more difficult economic times. On the one hand, parties to whom one has lent may get into trouble, requiring money to be put into the slush fund. On the other hand, assets of the bank may come under pressure. Not to mention the increased risk of fines from regulators.

One consequence of the situation at SVB, like the earlier problems at UK pension funds, is that central bankers are facing the unintended side effects of sharp interest rate increases. In one year, policy interest rates have been raised from 0% to nearly 5%.

With significant signs that major components of inflation are falling, central banks can argue that interest rate hikes are having the desired effect. Fighting inflation is an important mandate, but central bankers are allergic to financial instability.

The perils surrounding SVB and the necessary intervention by central banks, could just mean that the end of interest rate hikes is in sight. That would be good news for financial markets, which have been weighed down by hefty interest rate hikes since the end of 2021.

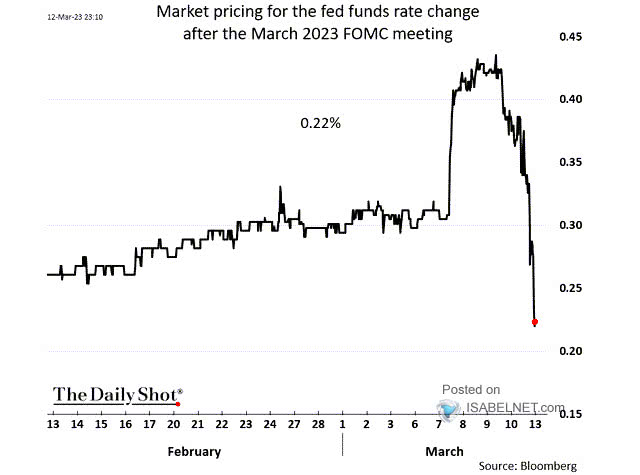

Investors have significantly downgraded their expectations about the upcoming interest rate hike by the U.S. central bank

Capital-rich companies offer protection

In our selection process for securities in client portfolios, capital structure is a very important criterion. Companies should have a strong balance sheet so that they can withstand tough economic times. A strong balance sheet means that a company can continue its operations, and is independent of external financing. In other words, we want to invest in securities of companies that do not need to raise capital from banks or on the stock exchange.

It is precisely at times when the need for capital is greatest that it is most difficult to obtain (and also at a very high price). The companies in our portfolio generate strong profits and cash flows, due to the strong market positions they have acquired. Their products or services are essential to their customers, putting them in a good position to cope with economic downturns.

Because of their strong capital position, in many cases even a significant net cash position, they may even be able to benefit from the current vicissitudes by increasing their market share, by continuing to invest in innovation and organic growth initiatives. Our companies can also benefit by acquiring competitors, or using their large cash positions to invest in securities of publicly traded companies that are on the sell-off due to decreased share prices.

We entrust capital to families, entrepreneurs and seasoned investors who have put a substantial portion of their private wealth on the line(skin in the game) to make their company or fund a success. This is one of the strongest drivers, and gives us confidence towards the future.

Relying on the past toward the future

Of course, the above feels like cold comfort if you are currently facing a loss in your investment portfolio. We understand that, and we would have preferred it to be otherwise. Nevertheless, it is wise to remain patient, because it is precisely at times when there no longer seems to be any light at the end of the tunnel that sentiment in the financial markets can tilt.

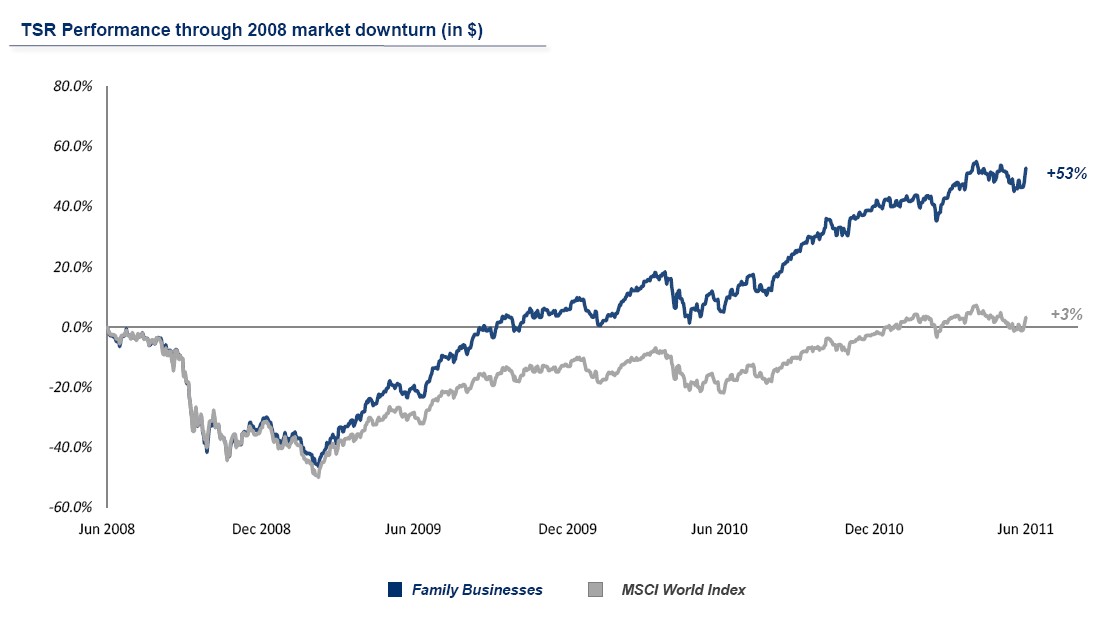

For two practical examples of this, we can consider the last two crises. The chart above considers the credit crisis and zooms in on the period June 2008 through June 2011. Initially, one notices that both the MSCI World global stock index (the gray line) and family offices (the blue line) drop in price during the center of gravity of the credit crisis.

When a stock market crisis occurs, investors often sell their shares out of fear, regardless of whether they are good or poorly performing companies. During the recovery phase, however, it can be seen that family companies are already back on top within a few months of the low point, where it took the MSCI World Index until 2011 to return to parity. At that time, family offices are already back at a positive return of 53%.

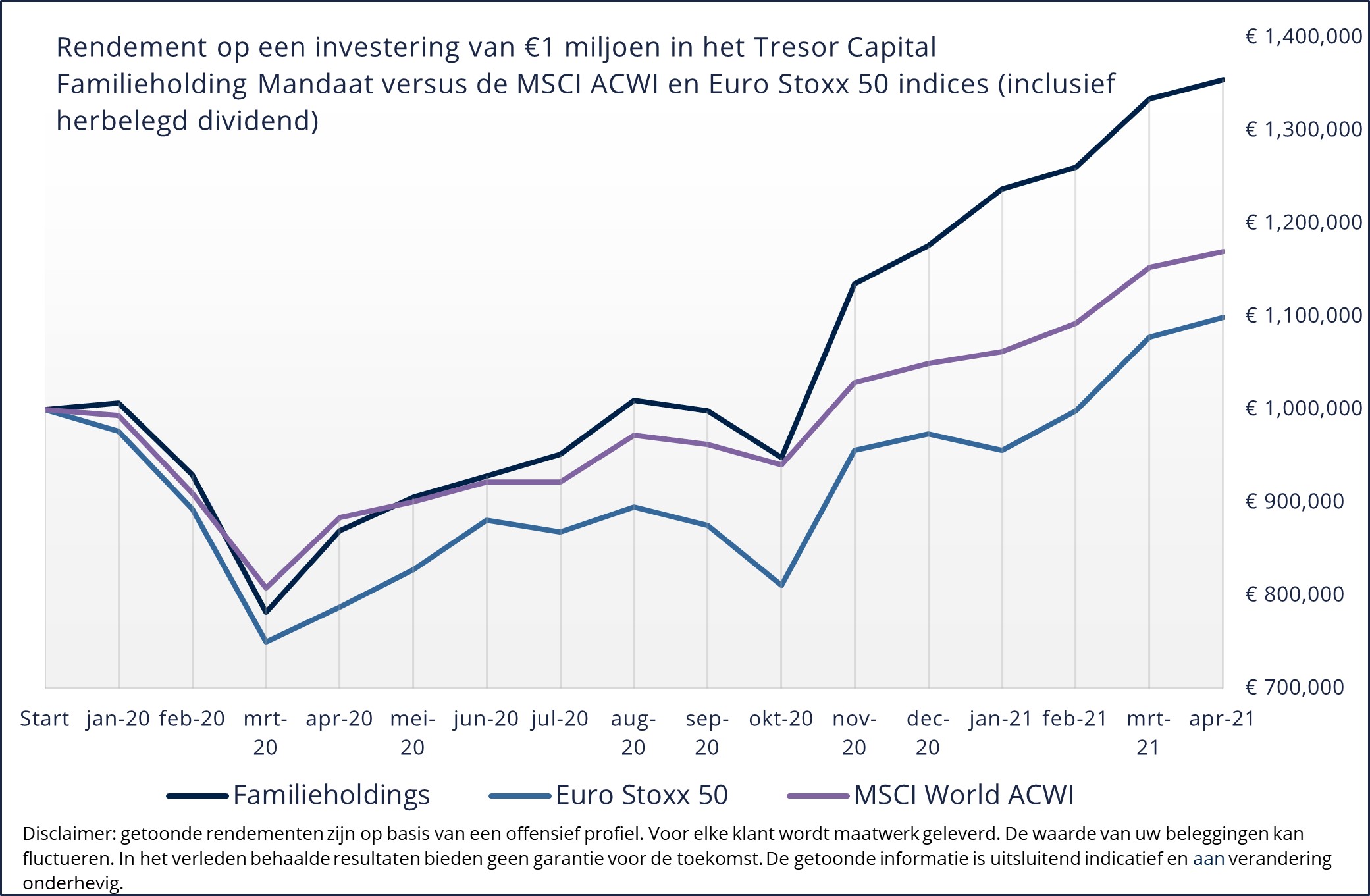

The chart below shows that during the corona crisis in 2020, our selection of family holding companies (the dark blue line) managed to recover faster than the MSCI World ACWI (the purple line) and the Euro Stoxx 50 index (the light blue line). A EUR 1 million investment in the Tresor Capital Family Holding Mandate was already above its starting level by August 2020, while it took the MSCI World ACWI index until November to do so and the Euro Stoxx 50 index even until March 2021. A year after the trough of the corona crash, in April 2021, the family holding portfolio was at a 36% return, the MSCI World ACWI at 17% and the Euro Stoxx 50 at 10%.

Family businesses owe this strong performance to the factors we mentioned above. Because they have relatively much less debt on their balance sheet than the average company on the stock market, they are more flexible during a crisis and can continue to invest where other companies have water up to their lips. Family businesses often come out of a crisis even stronger.

For example, the fact that a seasoned investor such as Warren Buffett with his investment holding company Berkshire Hathaway is ready to put USD 125 billion to work, or that the Wallenberg family with their family holding company Investor AB has more than SEK 23 billion at 1% interest with a maturity of 14 years at their disposal, gives us great reassurance and optimism.

Berkshire and Investor have managed to beat the stock market since 1965 and 1919, respectively, by being prudent with their capital in good times, and able to strike mercilessly in more difficult economic times. Thus, we still have numerous high-quality companies in our portfolio that have excellent track records. As we have tried to show above, these companies are not immune to share price declines, but their sophisticated policies often help them emerge stronger from a crisis.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner