Monthly Bulletin December 2022

Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Monthly Review: Looking Back At A Turbulent 2022

At the end of 2021, we as partners had a different presentation of the first calendar year of our investment boutique under the new name Tresor Capital. The recovery from the corona crisis and the elimination of lockdowns provided nice economic growth, while financial markets also saw a nice performance. Our portfolios posted a very nice recovery after a difficult start to 2020, the corona pandemic outbreak.

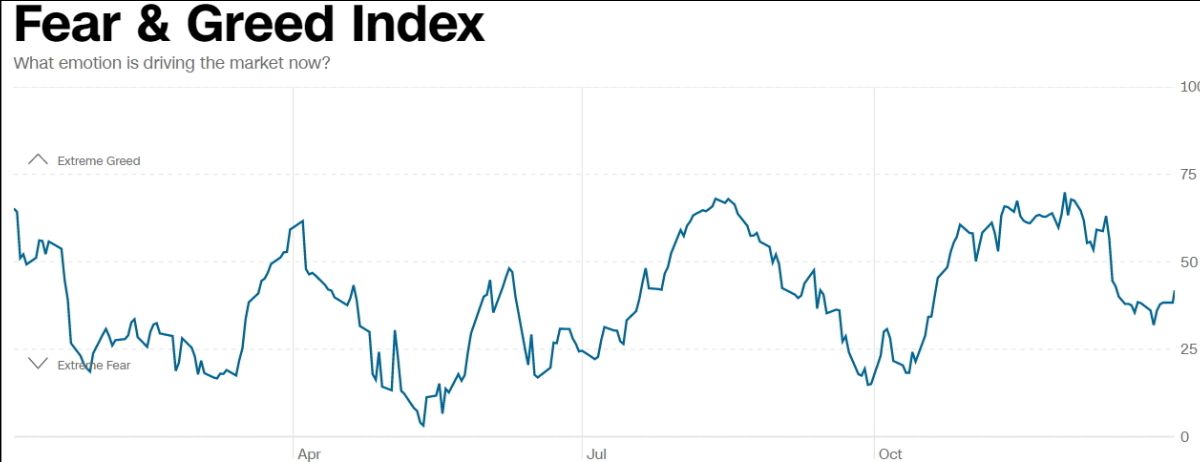

2022 was largely dominated by fear among investors

Rising inflation seemed to be mostly a result of the huge supply-demand shock caused by the coronal shockdowns, only temporary according to central bankers. Unfortunately, Putin decided to invade the sovereign country of Ukraine and use oil and gas as a weapon against the united West, resulting in a sharp exacerbation of inflation.

Although financial markets seemed to look past the vicissitudes of war during March, the focus shifted to a new issue. Indeed, in response to the significant rise in inflation, central banks worldwide decided to raise interest rates sharply, resulting in significant pressure on asset valuations. Persistent supply chain problems and China’s zero-covid policy did not exactly contribute positively either.

It is all the more striking to note that the reported figures can be considered satisfactory by the companies in our portfolio. Sales and order books grew to record levels, inflation was almost entirely passed on to customers, and profit margins actually increased in many cases.

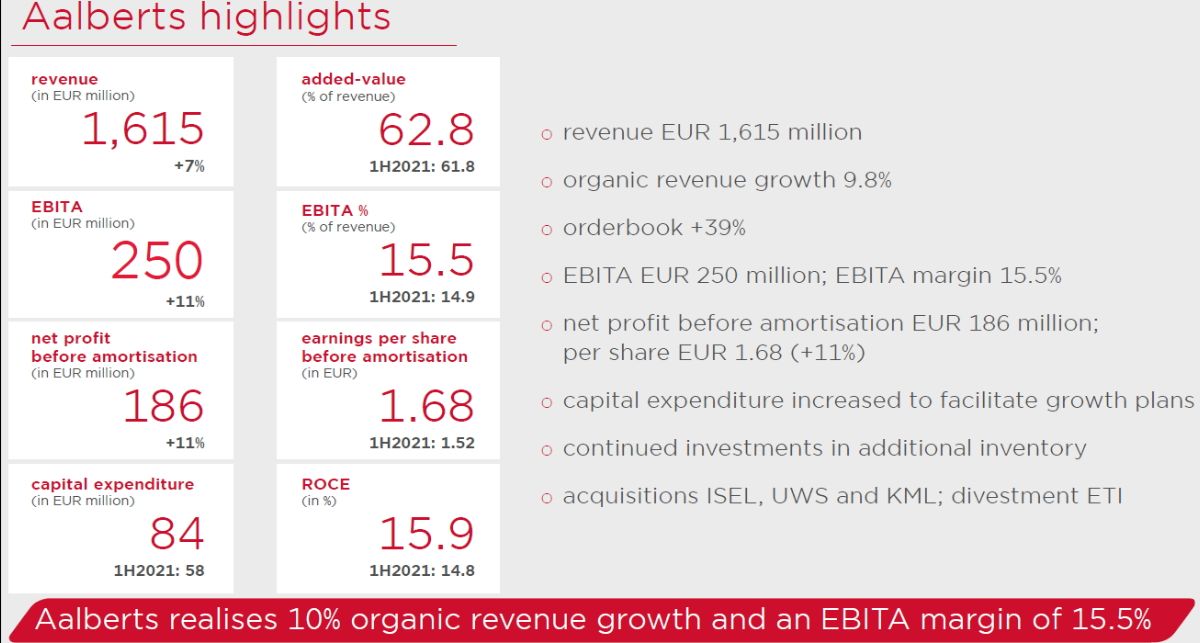

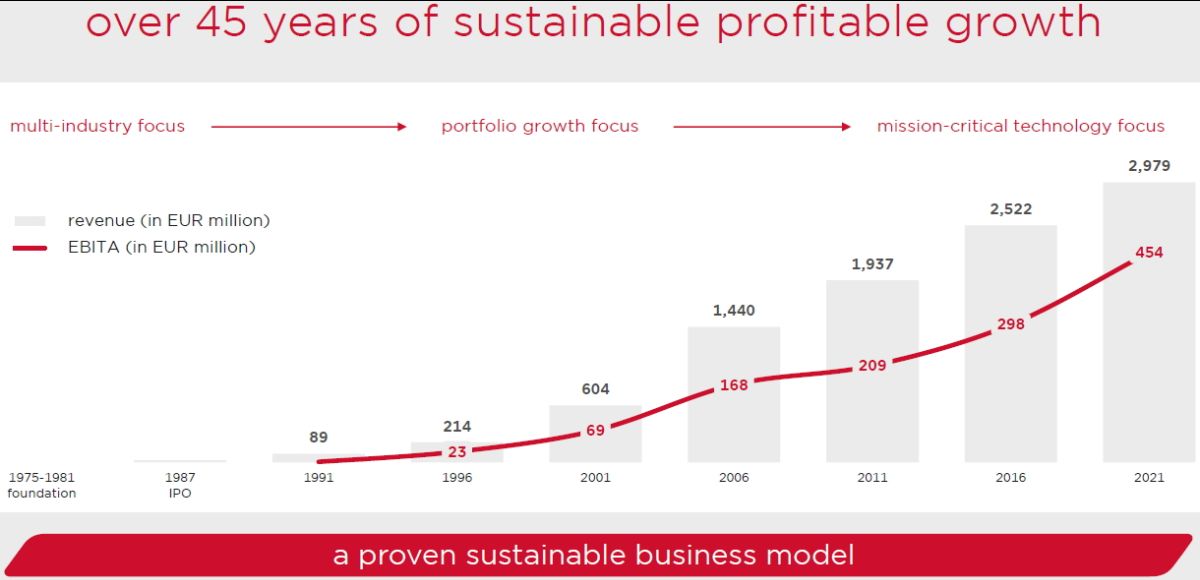

A good example is the Dutch company Aalberts. The figure below shows that the Utrecht-based family holding company posted organic sales growth of 9.8%, an operating profit margin of 15.5% and a return on invested capital of 15.9%. An interim update also showed that these good results continued through October 2022.

These are the fundamentals. How did investors reward these fine results? An investment in Aalberts produced an unrealized loss of more than 30% in 2022. Stock market prices in 2022 in several cases drifted far away from the underlying fundamental reality. In times of uncertainty, fear rules, and reason loses.

Investors consider Aalberts cyclical, for example, because more than half of its sales are related to building preservation. Higher financing costs translate into a slowdown in the construction sector, so Aalberts shares are thrown out without a pardon. The fundamentals, however, say otherwise. More than 70% of construction-related sales are renovations, which is much less cyclical than new construction.

Legislation and regulations require buildings to become much more sustainable (think of energy labels, for example), increasing energy costs and climate awareness mean that governments, citizens and companies want to insulate their buildings better and make them climate neutral. This would not be possible without Aalberts’ technical innovations. A well-filled order book, business-critical products, strong market positions and a rock-solid balance sheet make Aalberts a crisis-resistant investment holding company.

The above track record speaks for itself in that regard. But as mentioned, in 2022 emotion counted, not reason. The undervaluation of Aalberts relative to our calculated intrinsic value (EUR 69 per share) rose above 50%, reason for us to increase the weight of Aalberts in our portfolios.

In the short term, the negative price development is painful, but by increasing the position, we were able to lower the average purchase level, optimize the risk/return ratio as well as the portfolio’s recovery potential. No one can predict the short-term price development, but eventually strong fundamentals will surface and be translated into the stock price.

Fortunately, for the defensive component in portfolios, we have chosen alternatives over bonds in recent years. Bonds we considered “yield-free risk,” with even negative interest rates on government bonds. It was precisely this “safe” component that was hit hardest by rising capital market interest rates in 2022.

Double scissors at family holding companies

Where the share prices of listed companies fell, our family holding companies portfolio suffered a double blow. Besides the fall in the stock prices of their holdings, we also saw an increase in the undervaluations of family holding companies.

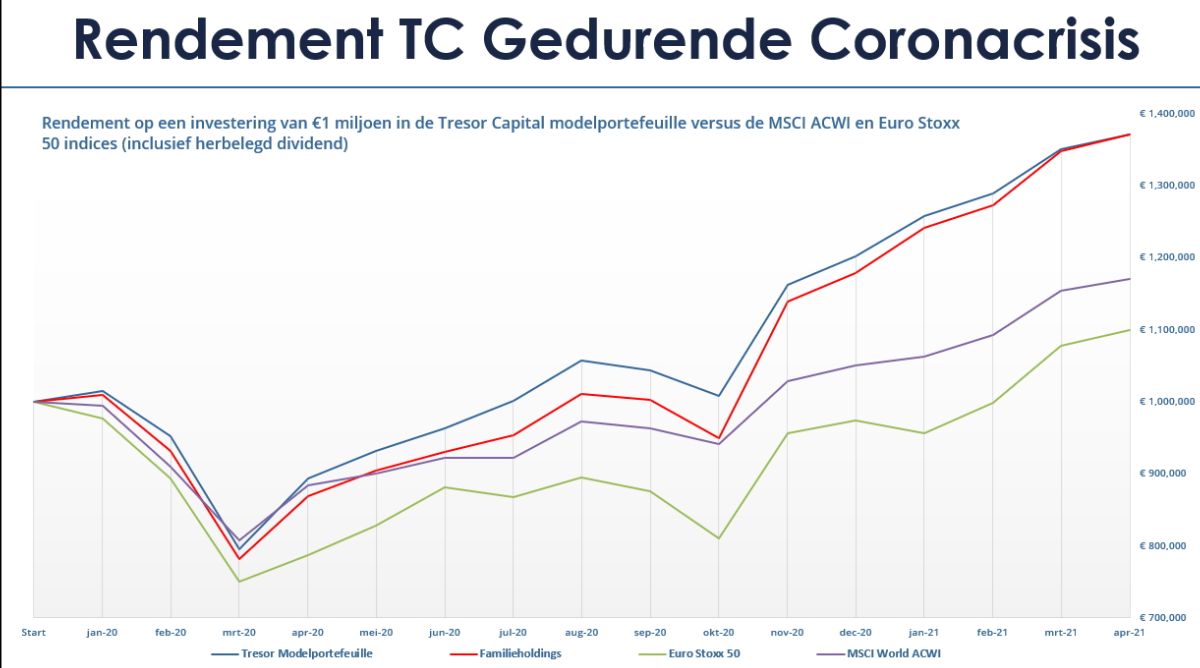

Whereas the average undervaluation of the family holding company portfolio at the end of 2021 was still 18%, by the end of 2022 it had risen to 32%. Although in a declining market this means that on balance these companies are slightly underperforming the average stock market, in the subsequent recovery periods we have also seen these companies rise much faster.

If we consider the last major stock market correction at the time of the corona crisis, the figure above shows both the offensive model portfolio and the family holdings portfolio falling at the same time as the general stock market (MSCI World ACWI and the Euro Stoxx 50) at the time of the corona crash in March 2020.

In the recovery phase, however, our portfolios are clearly performing significantly better, leaving on balance a better return over the entire period. In the recovery phase, the share prices of subsidiaries are rising as well as the undervaluation of family holdings is falling again, creating a two-stage rocket.

Continuous portfolio optimization

In addition, we continually seek to optimize the risk-return ratio in the interim. For example, in the second quarter of 2020, we parted with a company that would be hit above average by the corona crisis and then took positions in Aalberts at attractive levels.

In the recovery phase, Aalberts would then more than double, so the undervaluation had shrunk considerably. Therefore, in 2021 we skimmed the position again around record levels because the margin of safety had become too small, while in 2022 we expanded the position again to position for a recovery.

Conclusion

We realize all too well that the negative returns of 2022 are not pleasant. Even if it is an unrealized loss, no one wants to see his or her portfolio in the minus. Therefore, the maxim is that investing in stocks is only recommended with a horizon of at least five years.

With the above text, we try to reflect that there is light at the end of the tunnel. Our equity portfolio consists of capital-rich companies that fundamentally (continue to) perform strongly, as we wanted to demonstrate with the example of Aalberts.

Moreover, the fourth quarter has seen several clear signs of sharply declining inflation. Problems in the supply chain are diminishing noticeably, commodity prices and oil and gas prices have fallen substantially, and freight costs are already almost back to pre-corona crisis levels.

Inflation rates fell below expectations in the last few months of the year, due to declining goods inflation. Falling house prices will also begin to depress services inflation in a few months, although inflation remains relatively high in absolute terms for the time being (above the central banks’ inflation target of 2%). If inflation continues to decline at this rate, it may just be reason for central banks to stop raising interest rates, allowing investors to look upward again. We will share our outlook for 2023 in a separate newsletter.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner