Monthly Bulletin August 2022

Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Monthly Review: Cyclical Versus Secular Trends

Financial markets are the representation of the future expectations of all market participants. A stock price occurs because a private investor, pension fund or asset manager has a view and is willing to act on it. In the longer term, the market price of a stock thus represents the underlying, intrinsic value of a company. In the short term, however, headlines, emotions and sentiment can play a leading role, so stock prices can sometimes deviate sharply from intrinsic value.

Relatives of Tresor Capital will no doubt be able to recall the phrase “we don’t have a crystal ball,” whether through our client conversations or our newsletters. In fact, we regularly receive questions about the future: what will the stock market do; when will stock prices rise; will there be a recession and, if so, how deep will it be?

And the honest answer is invariably that we cannot know. Warren Buffett once said, “predictions can tell you a lot about the forecaster, they tell you nothing about the future.” Based on analysis from market participants, signals from the business community and common peasant sense, you may be able to get a long way, but you don’t know for sure.

No one can predict how long the war in Ukraine will last, whether there will be a recession and if so, how severe it will be, what China will do with the Taiwan issue or what the impact of upcoming elections in Italy and the United States, among others, will be. The economic cycle cannot be predicted, but one can invest in companies that are antifragile and manage to achieve a good return on invested capital throughout a cycle.

Secular megatrends

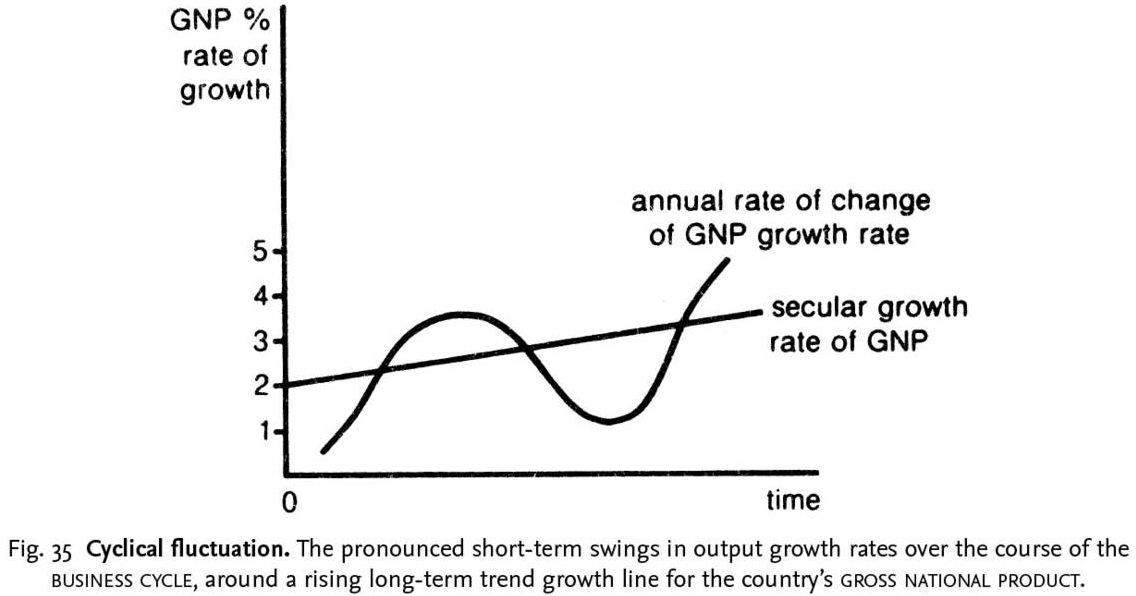

The chart below shows cyclical and secular economic growth trends. From year to year, growth can fluctuate quite a bit, which is called cyclical. In the longer term, however, there is a steady upward secular trend. The economic cycle is volatile by definition, but there are developments that result in long-term secular growth trends that are more persistent.

- Sustainability (energy transition);

- Digitization;

- Automation;

- Health care (aging population, new treatment methods);

- The rise of the Asian middle class;

- The increasing popularity of alternative investments.

The securities in our portfolios have exposure to one or more of these megatrends. For example, we are seeing more and more focus on climate-neutral operations and the ambition to drastically reduce Co2 emissions. Also, more and more business processes are taking place digitally. The companies in our stock selection have deliberately positioned themselves to benefit from such megatrends.Often such a trend represents a market opportunity of tens, if not hundreds of billions of euros in targeted investments. Some examples include the development of hydrogen applications, the emerging digital economy in India and Southeast Asia and the increasingly obvious transition of pension funds from traditional investments, such as stocks and bonds, to alternatives such as private equity, real estate and infrastructure.

Patience is a virtue

In financial markets, short-term predictions are simply a waste of time. The past few years have been anything but easy for investors. A maxim is that a major stock market decline of 20% or more occurs on average once every four years. Now this has already occurred three times in the past four years (late 2018, March 2020 and this year). Predicting inflation in the short term is nothing more than coffee-gazing, but these megatrends mean that the companies in our portfolio sometimes have the wind in their sails for decades.

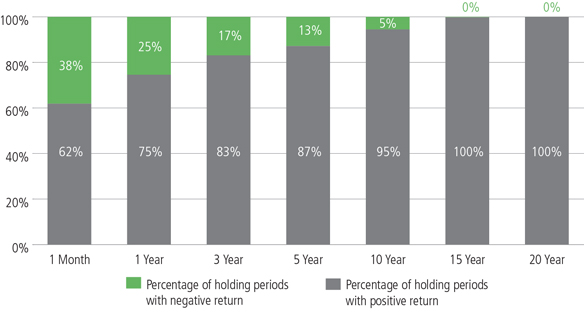

As the picture above shows, sentiment or valuation changes (e.g., the P/E ratio) affect a company’s share price in the shorter term. Our internal rule of thumb is that investing (mostly) in equities is only recommended with a minimum investment horizon of five years.

Over a five-year period, the distinctive characteristics of our selected securities are actually reflected in the stock price. We feel supported in this by a range of studies, as well as our own experience, which show that securities with skin in the game and companies that manage to achieve high returns on their invested capital structurally beat the stock market in the longer term.

Renowned investor Peter Lynch puts it very clearly, “Eventually superior companies will succeed and mediocre companies will fail, and investors in both will be rewarded accordingly. Time is in your favor if you own shares of superior companies.”

Another way to consider this five-year period is shown in the figure above. The probability of a negative return in equity markets within one month is 38%, within one year that probability is 25%, within three years that probability is 17% and within five years that probability of a negative return shrinks to only 13%. Thus, an investor with a horizon of at least five years has an 87% chance of a positive return. An investor with a horizon of at least 15 years, based on the past, has as much as a 100% chance of a positive return.

With three stock market declines of more than 20% in the past four years, it may seem a bit silly to point to the longer term, but the fact is that we cannot control stock market developments in the short term. However, we do actively steer for continuous optimization of the risk-return ratio in our portfolios. Wherever possible, we make grateful use of the excesses that the volatility in financial markets sometimes offers us, by (re)buying securities that are undervalued by more than 30 or 40%, while monetizing positions with too small a safety margin.

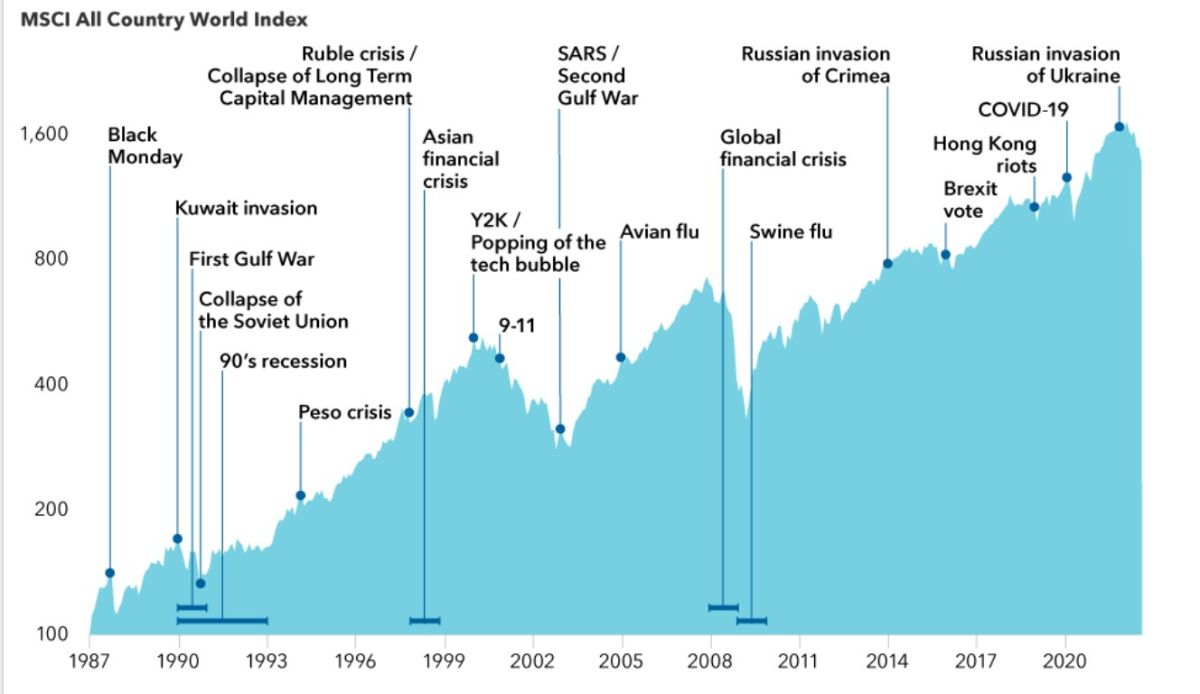

The figure above shows the development of the MSCI World Stock Index, with several major macroeconomic and geopolitical events highlighted. At the time they take place, these events seem so serious that many believe rising stock prices are out of the question. Yet stock markets continually manage to look past these perils and find their way up, “climbing a wall of fear” is what they call it. It is only when there seems to be no trouble that one should really start to worry….

Human ingenuity and innovativeness result in longer-term economic growth, which translates, among other things, into rising stock prices. When those share prices will rise, no one can predict, but by exiting at one of the above events, one would have missed out on a lot of returns. Timing the market may be able to prevent further financial damage in the short term, but it also puts the investor on the block: when to get back in, and what to do with the cash in the meantime? After all, inflation is also doing its destructive work, eroding the purchasing power of that cash.

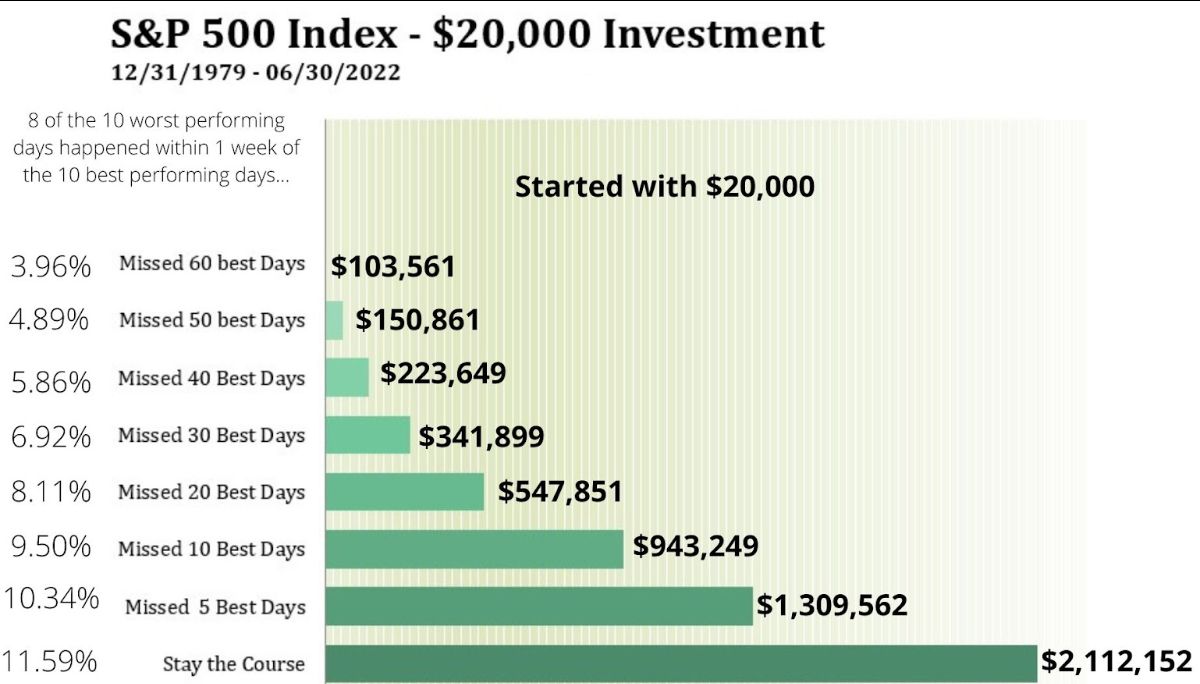

The figure below shows the main argument for staying invested above all else. Eight of the ten worst stock market days occurred within a week of the ten best stock market days. An investor who had remained invested in the S&P 500 index from 1980 through June 30, 2022, made an average annual return of 11.59%. An investor who missed the five best days earned 10.34%, and missing the 10 best days meant a return of 9.5%.

On paper these differences seem small, but due to the return on return effect (compound interest), missing the ten best days means a difference of 55%, or USD 1.17 million in absolute amounts. Price fluctuations seem to invite trading, but sticking to the path taken is often actually the best option. As managers of our clients’ capital, one of our most important roles is to ensure that the “eighth wonder of the world” of compound interest impact is not unnecessarily interrupted.

At a supermarket clearance sale, everyone fills up his or her shopping cart, but at a stock market clearance sale, people actually become more cautious. Equities, however, are actually more attractive now that many risks are priced into prices, making the outlook for longer-term returns relatively much more attractive than at the start of the year. In the words of Warren Buffett, “Be fearful when others are greedy and greedy when others are fearful.”

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner