Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Berkshire Hathaway, A Cross-section Of The American Economy

Last weekend, the annual “Woodstock of capitalism,” Berkshire Hathaway’s shareholder meeting, once again took place in Omaha. More than 40,000 shareholders made the pilgrimage to Omaha, Nebraska again this year to see the now 92-year-old CEO and major shareholder Warren Buffett, along with his 99-year-old right-hand man Charlie Munger, live in action.

Buffett, Munger, Vice President Ajit Jain (head of insurance) and Vice President Greg Abel (head of non-insurance businesses and intended successor Buffett) spent half a day answering a salvo of questions from shareholders.

Berkshire Hathaway consists of a broad collection of American companies, both publicly traded and wholly owned. These include battery maker Duracell, iPhone maker Apple, soft drink maker Coca-Cola, auto insurance company GEICO and high-end candy retailer See’s Candies. With Berkshire Hathaway Energy, the family holding company includes one of the largest utility companies in the U.S., and with BNSF Railway even a real railroad company.

Warren Buffett, while discussing the figures, emphasized that the past few years have been marked by highly exceptional economic growth. Central banks pumped massive amounts of money into the system, while governments in turn engaged in fiscal easing. On several occasions, money was even deposited directly into Americans’ bank accounts.We are on the road to normalization, according to Buffett: “The extraordinary period of excessive spending due to the stimulus during Covid-19 is over. It is a different climate than it was six months ago. Some of our managers were surprised, some of them had too much stock on order, and then suddenly it was delivered and sentiment had changed.”

Buffett indicates that several companies are now beginning the sell-off, to retire excess inventory. Perhaps the speed of the tipping point is somewhat surprising, but surely a transition from products to services was expected. During the corona pandemic, consumers were unable to take vacations or go to restaurants because of the lockdowns. The money normally spent in these sectors found its way into goods. People renovated their own homes and bought products en masse via the Internet.

Now that the lockdowns are over, consumers are shifting their spending back to services. Postponed vacations are being made up, restaurants are being visited again and the terraces are full again. This also shows up well in the inflation figures, where prices for consumer durables are even depressed.

Buffett expects several Berkshire Hathaway subsidiaries to have lower profit levels in 2023 than last year. That too can be interpreted as a return to a “more normal” situation that characterized the pre-Covid era.

On behalf of Tresor Capital, Michael Gielkens attended Berkshire Hathaway’s shareholder meeting last year. Earlier, colleague Maurice Essers also attended the meeting.

“Rolling recession”

A view that has been gaining traction recently is that the economy is in what is known as a “rolling recession.” A slowdown can be seen in several sectors, while other industries seem to continue to run at a high level. On a broader level, while this means a slowdown in growth, it does not necessarily mean a broad recession.

We also hear this in our companies’ figure presentations. Because of the good spread within the family holding companies and investment funds we have selected, the slowdown in growth within one sector is more than offset by other industries.

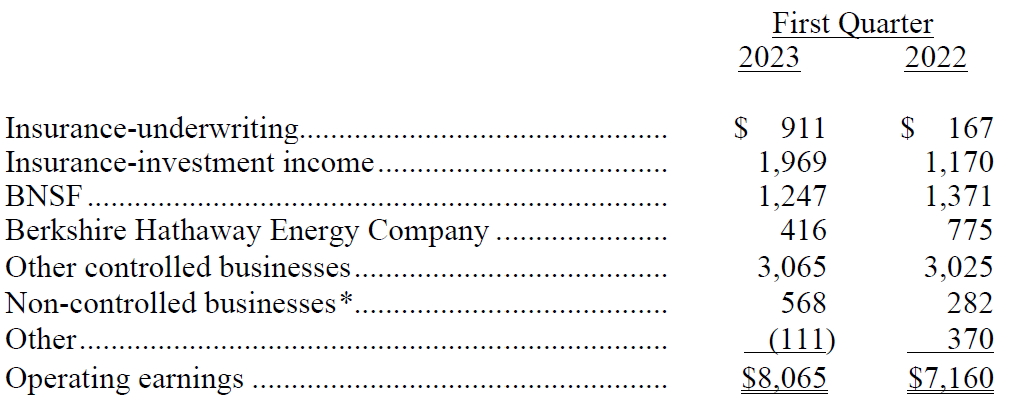

A look at Berkshire Hathaway’s portfolio (see table above) shows a similar picture. In the first quarter of 2023, earnings from the BNSF railroad and utilities declined, while the insurance division and the motley portfolio of “other businesses” posted handsome increases in earnings. Total operating income showed a 12.6% increase from a year ago.

Rail revenues declined due to lower freight volumes, particularly due to a decline in consumer goods transportation, and higher fuel and operating costs. The Berkshire Hathaway Energy division suffered, among other things, a steep decline in revenues at its real estate brokerage business, while utilities suffered primarily from a sharply (USD 359 million) higher reservation of estimated costs associated with the 2020 California wildfires.

On the contrary, the insurance division posted a nice profit, as the broad collection of property-casualty and casualty insurers managed to post a decent increase in profits and auto insurer GEICO saw a recovery after a difficult 2022. Increased interest rates also boosted income from the cash and bond portfolios held by insurance companies significantly.

Among “other businesses,” we also see a mixed picture. Companies in the manufacturing industry for industrial products saw profits rise by 18.5% in the first quarter, while those supplying products for the construction industry and consumer goods actually experienced profit declines of 21.8% and 40.7%, respectively. Despite these last two negative outliers, total earnings from the manufacturing industry fell by only 7.5% during the quarter.

Illustrative here, for example, is subsidiary Forest River, one of the largest U.S. sellers of recreational vehicles such as motor homes, which saw its profits fall 57%. In the retail division, the Berkshire Hathaway Automotive car dealership group and the home furnishings and furniture division were under pressure, resulting in a 6.6% drop in earnings.

This was offset by the heavily weighted group of service companies, where revenues actually increased by 15.6%. This was due in particular to aviation service companies NetJets (private jet rental) and FlightSafety (aviation safety training and simulation) and profit growth at TTI, a major distributor of electronic components.

Wholesale distribution company McLane’s earnings also rose sharply, by as much as 37.8%. McLane supplies beverages and food to stores, restaurants and liquor stores, among others. Well-known customers include 7-Eleven, Walmart, Kentucky Fried Chicken and Pizza Hut.

Conclusion

It can thus be stated that the image of a “rolling recession” is getting some credence in the reported business figures. The construction, real estate and consumer goods industries are showing a slowdown, while the manufacturing industry is already showing signs of recovery. Business services and consumer services-related companies are also showing strength.

Buffett expects that quite a few of the subsidiaries are unlikely to match the good results of 2022, but that Berkshire Hathaway’s overall earnings will still be higher this year than in 2023 because of higher earnings from the insurance division. That is the beauty of a holding company as far as we are concerned, the good spread of the business portfolio can ensure that the slowdown in one sector is more than offset by good numbers from another division.

With sectors experiencing growth slowdowns at different times rather than all at the same time, the broader economy is, for now, able to absorb these blows in turn. Although there is anything but a stable price pattern, it is worth noting that equity markets have made a decent recovery since bottoming in October 2022. Investors seem to be anticipating an economic recovery and the end of central bank interest rate hikes.

Buffett, nicknamed “the Oracle of Omaha,” cryptically observes, “Nothing is certain in the short term, whether predictions about the stock market, business, or beyond. However, longer-term operating profits will be significantly higher than they are at present.”

To conclude with a winged statement by the Berkshire top executive, “In the short term, the stock market behaves like a voting machine, in the longer term like a scale.” In other words, in the short term, sentiment determines stock prices; in the longer term, the stock price reflects fundamentals. In this respect, the underlying earnings figures within our portfolio provide a solid anchor.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner