Our analysis of the company MBB SE appeared in the June 2023 edition of the Flemish Federation of Investors’ Guide to the Best Investor.

MBB SE: German Mittelstand, the Energy Transition and Cybersecurity in one Holding

Michael Gielkens | Partner at investment boutique Tresor Capital

German holding company MBB SE, in which founders Nesemeier and Freimuth hold a 66% stake, has recently undergone quite a share price correction. Subsidiary Vorwerk has been branded the growth pearl’s worry child by investors, causing its undervaluation relative to net asset value to rise to 45%.

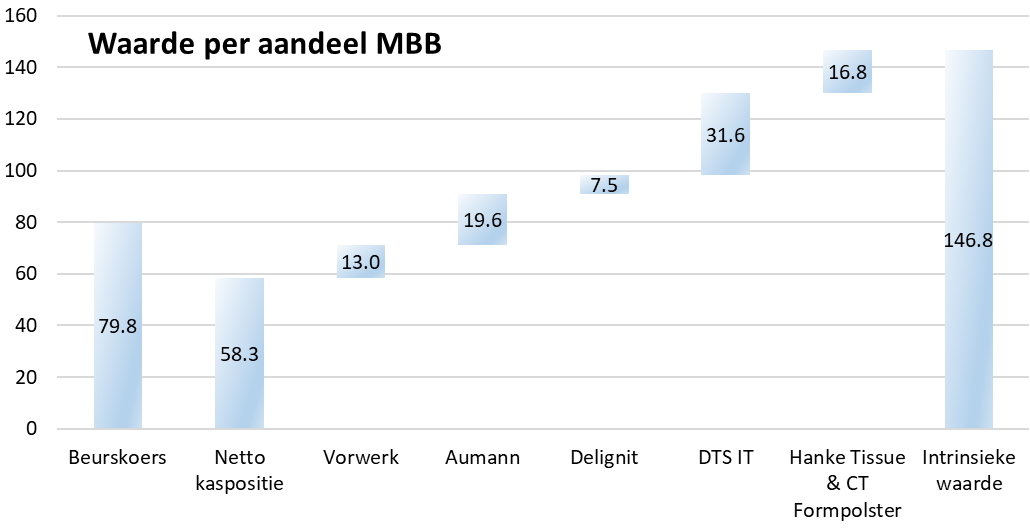

The value per MBB share, according to Tresor Capital’s internal estimates, is shown in the chart below. The holding company has a huge cash position, as a result of the Vorwerk and Aumann IPOs. Cash now accounts for 73% of MBB’s market capitalization, an indication of its low valuation.

Vorwerk

Vorwerk is a specialist in civil engineering and plant construction for underground gas and power lines. The German government has characterized natural gas as a transition fuel and does not want high-voltage pylons to transport sustainably generated energy, so Vorwerk, as one of the largest players in its sector, is a crucial link in the “Energiewende.” Also, Vorwerk is one of the forerunners in hydrogen, with extensive expertise in electrolysis plants.

After years of achieving a fine operating profit margin above 20%, profitability took a nosedive at the end of 2022. Vorwerk was responsible for the connection of several crucial LNG terminals, which allowed Germany to partially offset the lost Russian gas supply. Staff shortages forced it to hire pricey subcontractors and outside labor. To make matters worse, Vorwerk was hit by a cyber attack in December. Its effects will be felt until 2023, which will be a year of transition, to the disappointment of investors. The share price of Vorwerk as well as MBB took a nosedive in response.

What is important to note is that these are temporary setbacks. Vorwerk is trading at around 4.6x 2024 operating profit (EV/Ebitda), which seems like a very low valuation for a company at the heart of the energy transition. With an order book of EUR 449 million, Vorwerk already has 1.5 years of sales in the pipeline, while MBB’s management expects Vorwerk to be able to return to a 20% margin relatively quickly. Analysts do not currently expect that, which could mean a solid recovery.

Aumann

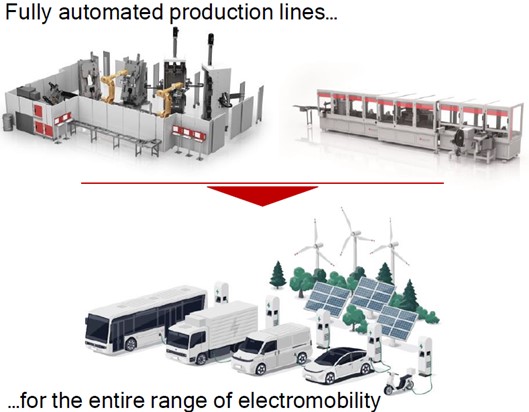

Aumann develops, manufactures and distributes special machines and automated production lines, particularly in the field of e-mobility. Leading car manufacturers such as Volkswagen group, BMW, Mercedes-Benz and Stellantis rely on Aumann’s solutions for series production of electric motors and battery systems for electric and hybrid vehicles, as well as solutions for production automation.

After several difficult years for the automotive industry, a solid recovery is clearly underway. Aumann is benefiting, and has already seen the operating profit margin of negative return to 6%. As old orders are translated into sales, more and more of the new orders will be at margins above 10%.

Despite the significant potential of electric driving, associated battery systems and the megatrend of automation, Aumann is trading at just 4.8x 2024 operating profit (EV/Ebitda). Reason for Aumann to launch a EUR 7 million share buyback program, and also for MBB to boost its stake by EUR 18.3 million to 48% over the past 12 months.

DTS IT

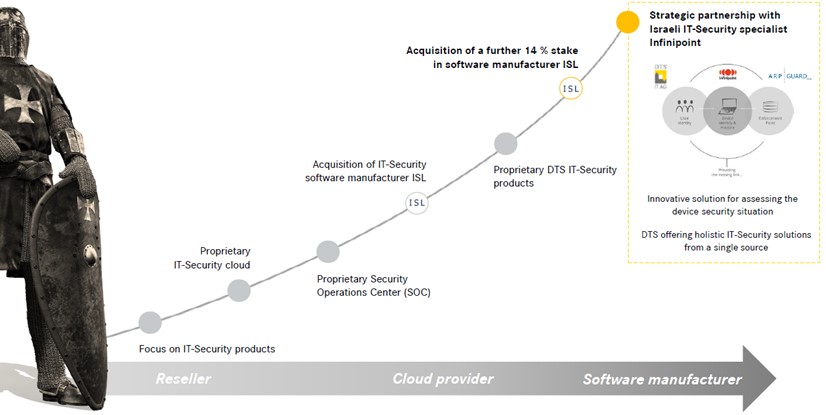

DTS is one of Germany’s leading providers of cybersecurity for IT infrastructure, both physically on-site, in the online cloud environment and a combination thereof. DTS benefits significantly from digitalization and associated demand for IT security. Hackers are trying to extract trade secrets or defraud entrepreneurs of large sums of money with hostage software.

DTS is a great example of MBB’s buy-and-build approach. The company began as a reseller of Palo Alto software. Through strategic acquisitions, more and more competencies were added, such as cloud storage capabilities (including backups) and a fully equipped security center where IT security specialists monitor customer systems 24 hours a day for anomalies and attacks. The most attractive (growth) business concerns software to secure Internet access points.

The operating profit margin of over 16% is very attractive given the revenue mix. This is increasingly shifting to software, which is a business with predictable, reciprocal cash flows and high margins. Despite the attractive margins and growth profile (revenue growth of 15-25% per year), we use an operating profit multiple of 15x for DTS. A higher valuation is quite possible in an IPO, cybersecurity companies typically trade for multiples above 25x.

Acquisitions

At EUR 333 million, there is a hefty bag of cash waiting to be invested. MBB’s management recently revealed that the pipeline of attractive acquisition targets has not been this full in a long time. Many entrepreneurs do not have a business successor, so are looking for a party like MBB to sell their business to. Unlike private equity, MBB finances an acquisition with equity rather than debt, which is an advantage as banks tighten their belts.

Also, after the takeover, MBB will continue to run the company in the spirit of the entrepreneur, and will not immediately close factories, lay off staff or make all kinds of “optimizations.” That was the main reason for Friedrich Vorwerk’s widow to choose MBB as the buyer, despite the fact that the family holding company offered a lower price than several competitors.

Finally, entrepreneurs seem to realize that 2021 valuations are no longer realistic at a time of high inflation and interest rates. The aforementioned should result in interesting acquisition opportunities for the family holding company, according to MBB management. In the meantime, cash is invested in short-term bonds, stocks (think Nestlé and Microsoft) and gold.

Conclusion

Excluding cash, MBB is currently trading at only 1.4x 2023 operating profit. Both management and MBB itself have bought back millions of euros worth of its own shares in recent months, once again demonstrating its attractive valuation.

During 2023, improvement at Vorwerk is expected, making the company ready to translate large projects into nice profits. Margins and sales at DTS and Aumann will also continue to pick up, but this is not currently being priced in by investors. In the short term this could make for a nice share price jump, while in the long term MBB is perfectly positioned for the megatrends of sustainability, automation and cybersecurity.

When the undervaluation runs out, no one can predict. However, patience is a virtue. In the words of Warren Buffett, “Some things just take time. You can’t have a baby in one month by getting nine women pregnant.”