Looking Back 2023, Looking Ahead 2024 And The Lindy Effect

Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Retrospective 2023

Two of the fundamentals of our equity portfolio are our family holdings portfolio and the Turtle Creek Equity Fund. The family holdings portfolio clocked the year with a return of just over 12%, a recovery from the 2022 decline. The Turtle Creek Equity Fund managed to post a top year with an annual return of 33% (in USD terms), after a solid correction in 2022. Both investment propositions are still substantially undervalued relative to history, so offer ample room for further recovery, in addition to the growth in intrinsic value.

Private equity funds showed a slight decline overall, on the one hand due to normalization of valuations within the funds after a huge spike during the corona period, and on the other hand due to a slightly negative impact of the U.S. dollar, the currency in which these funds usually quote. The dollar weakened by 3.1%. Still, we are mostly positive about the robustness of these portfolios, which have held up relatively well against similar investments.

Two positions weighed significantly on returns, namely a gold-related mutual fund and a fund investing in China. The gold-related fund posted a positive but lower return of +5.6%, while the China mutual fund experienced a loss of about 20%. As you would expect from us, we remain dynamic in our portfolio composition. If a fund does not perform (as expected), we do not turn a blind eye. Within the investment committee, we therefore consult regularly on all aspects of the portfolio.

Increase quality in portfolio

We sought to improve the quality of the portfolio again in 2023. Temporarily depressed industries, particularly due to a period of normalization following the peak in demand during the corona period, have allowed us to purchase some quality holdings at attractive valuations. As a result, we firmly believe that the portfolio as it stands at the end of 2023 has rarely had such an attractive risk-return ratio.

Finally, as a company, we look back on our first relationship day with pride. Partly because our relations showed up in such large numbers, but also because of the mostly positive feedback and that people now have an even clearer picture of why we invest in family holding companies (specifically MBB), the Turtle Creek Equity Fund and private equity.

You can read back our report of the relationship day here, in which you will also find our general vision of the 2023 market environment.

Outlook 2024

We have written it before, and yet repeat the message again: we have no predictive gift regarding future developments in geopolitics or macroeconomics. To quote legendary investor Warren Buffett of investment holding company Berkshire Hathaway:

- “Predictions can tell you a lot about the forecaster; they tell you nothing about the future. We consider the only value of stock market forecasters to be that they make soothsayers look good. Short-term market predictions are like poison and should be kept away from children and also from adults who behave like children in the stock market.”

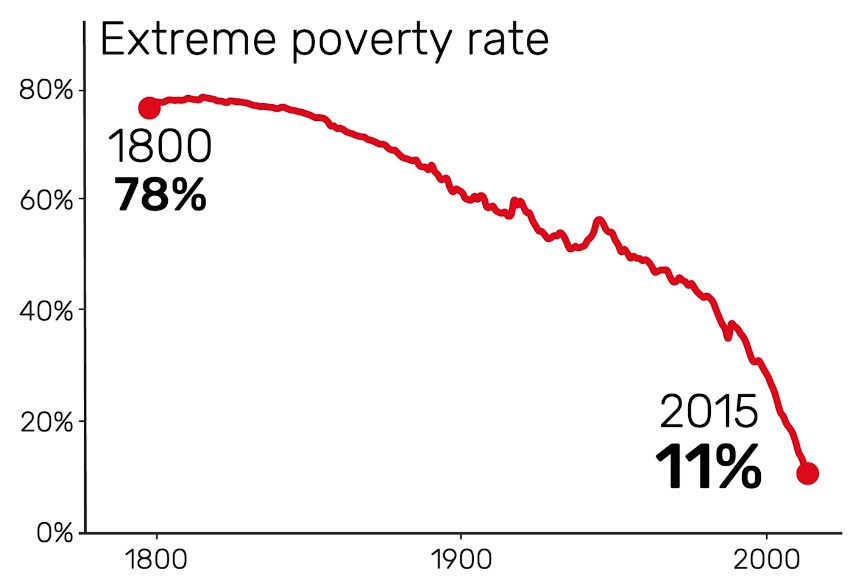

Figures from the United Nations show that the percentage of the world’s population in extreme poverty has declined dramatically in recent decades. Click here for a short video explaining more about Gapminder.

There are always uncertainties in the world. We are inundated with them daily in the media. In the stock market, however, investors eventually look past the sensational headlines, which by definition paint a more pessimistic picture than reality, simply because it translates into higher sales. A look at the website of the Gapminder foundation shows, based on objective sources, that historically, the world has rarely looked as good as it does right now.

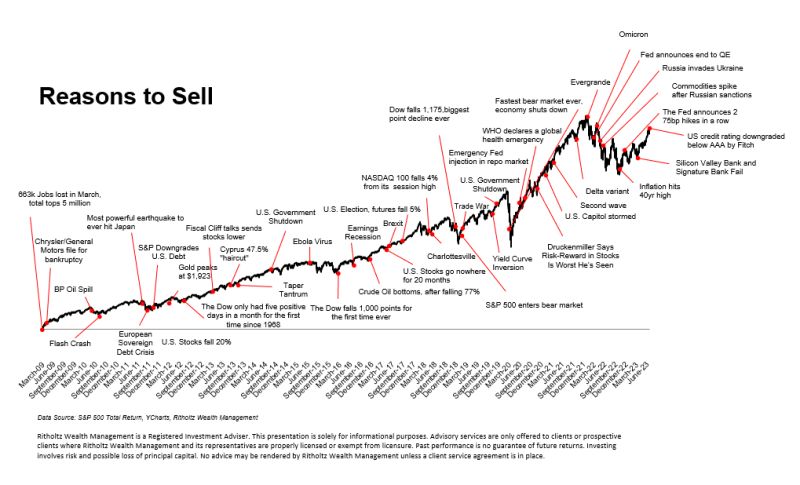

We can only point out that the stock market is always climbing a “wall of worry.” There are always reasons why it is not a good time to invest, or even to sell investments. We have cited the chart below many times to back this up. Despite all these uncertainties, the stock market was already approaching new highs at the end of 2023.

Most economists predicted a U.S. recession in 2023. However, it did not come; the U.S. stock market set new records. Those who had exited in 2022 would have missed out on a nice return in 2023.

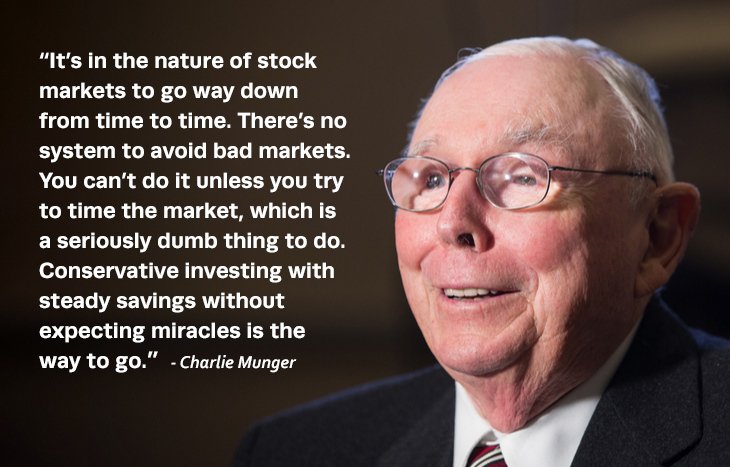

Also, the speed of the stock market recovery in the tail end of 2023 shows that it is virtually impossible to time the market. September and October still saw a sharp decline in stock prices, followed by a powerful recovery. Few saw that coming. In that regard, we would like to refer to the below, telling quote from Buffett’s partner Charlie Munger, who sadly passed away from us in 2023 at the age of 99.

As advisors to our clients, it is our job to navigate through these stock market cycles and to let the longer-term investment objectives prevail over the short-term noise (being the price fluctuations). At times when greed is rampant in the stock market, that means pulling on the handbrake for a while, while actually pulling on the bright spots when fear reigns.

We have and maintain confidence in our carefully selected portfolio of quality companies. Growth in free cash flow and return on invested capital are, by and large, excellent, while some of the best entrepreneurs (families) are at the helm to navigate these companies through the cycles and use their strong balance sheets to take advantage of opportunities that present themselves. This strengthens our longer-term outlook, because as you can see in the figure below, these are ultimately the factors that matter.

Family Holdings

In order not to rehash the catchphrase “we don’t have a crystal ball,” we will nevertheless try to outline some possible scenarios for 2024 and beyond. But be warned: these are only scenarios based on the information currently available. We will share the Turtle Creek Equity Fund shareholder letter in a separate mailing (it is not yet available), we will limit ourselves here to the selection of family holdings.

First, interest rate sensitive holdings may benefit from a double recovery. Companies with a lot of unlisted real estate (Brookfield) or private equity (Brederode and Sofina) in their portfolios have taken heavy hits as the current value of these assets has been questioned. Now that the bulk of interest rate hikes appear to be behind us, an important uncertainty has been removed. That justifies a lower discount to net asset value.

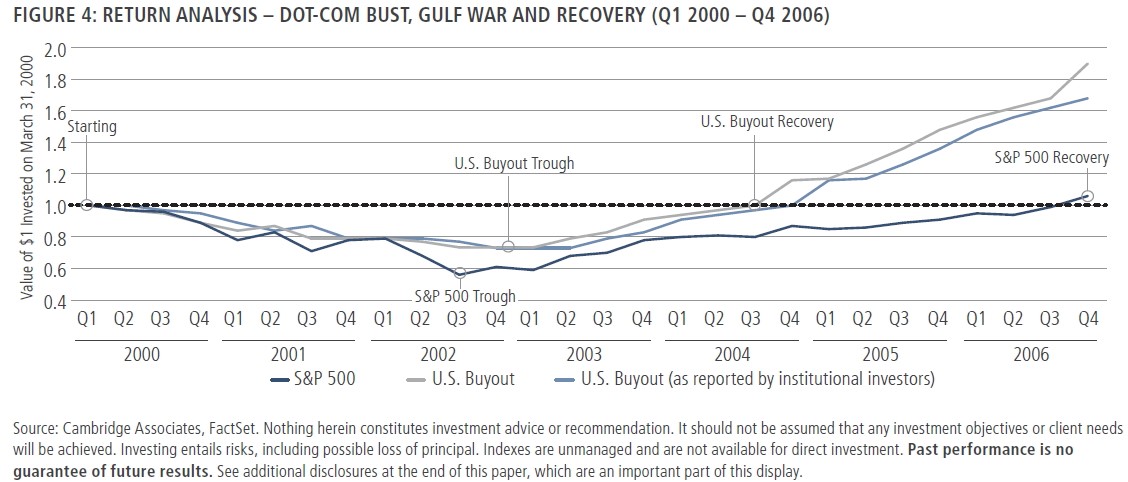

Moreover, the intrinsic value of these companies may recover and resume growth. With the spike in interest rates, deal activity and thus pricing appears to be picking up, allowing real estate or private companies to be monetized again, through transactions or an IPO. Moreover, history shows that private equity declines less sharply and a strong recovery usually follows a period of lull (see figure below).

Research by Neuberger Berman (click here to download the report) based on the 2000-2001 crisis and the 2008/2009 credit crisis shows that private equity shows less harsh declines and a significantly faster recovery than publicly traded companies. This is illustrated graphically in the image above.

We have deliberately further strengthened the portfolio by buying shares of holdings that are less dependent on the economic cycle and have good internal diversification in terms of end markets and geography. Still, by definition, the more industrial companies remain exposed to the (expectations about) the economy.

For example, the slowdown in the construction and chip sectors recently prompted one analyst to lower the recommendation on Aalberts from “buy” to “hold.” By including holdings that benefit from secular megatrends and provide critical products and services, we have sought to make the portfolio even more robust.

MBB CEO Constantin Mang provided a presentation during our relationship day. You can read an account of it here.

A special mention deserves the company MBB SE. This German family holding company is preparing for a comeback after a year of transition. Third-quarter figures already showed that the lights are slowly returning to green. We think MBB is one of the most attractively valued holdings, with some potential price triggers for the next 18 to 24 months:

- A recovery in profitability at Vorwerk and Aumann could take both stocks to share prices well above EUR 20 per share;

- A resumption of growth at private companies DTS IT and the two consumer goods companies could reduce the holding discount to well below 30%;

- There is over EUR 300 million left in the bank (more than 60% of the stock market value), which can be used to buy sizeable, new platform companies or make strategic acquisitions;

- A new share repurchase program is explicitly among the possibilities, which could provide further support to the stock price;

- An IPO of DTS IT may also make investors rediscover MBB stock.

For the holding portfolio as a whole, we see a further reduction in undervaluation in 2024 as a real scenario. A further recovery of intrinsic values and a broadening of investor attention from large tech companies to other propositions such as companies with smaller market capitalization could ensure that (the stock prices of) the holdings have the wind in their sails in 2024. As always, we will keep you informed of developments in this area through our newsletters.

The Lindy Effect

As long-term oriented investors, we are interested in the works of Nassim Ben Taleb, who wrote about the “antifragility” of companies and some other relevant concepts, among others. It is going too far to describe his full works at length here, but recently we came across an interesting consideration of the Lïndy effect, also described by Taleb.

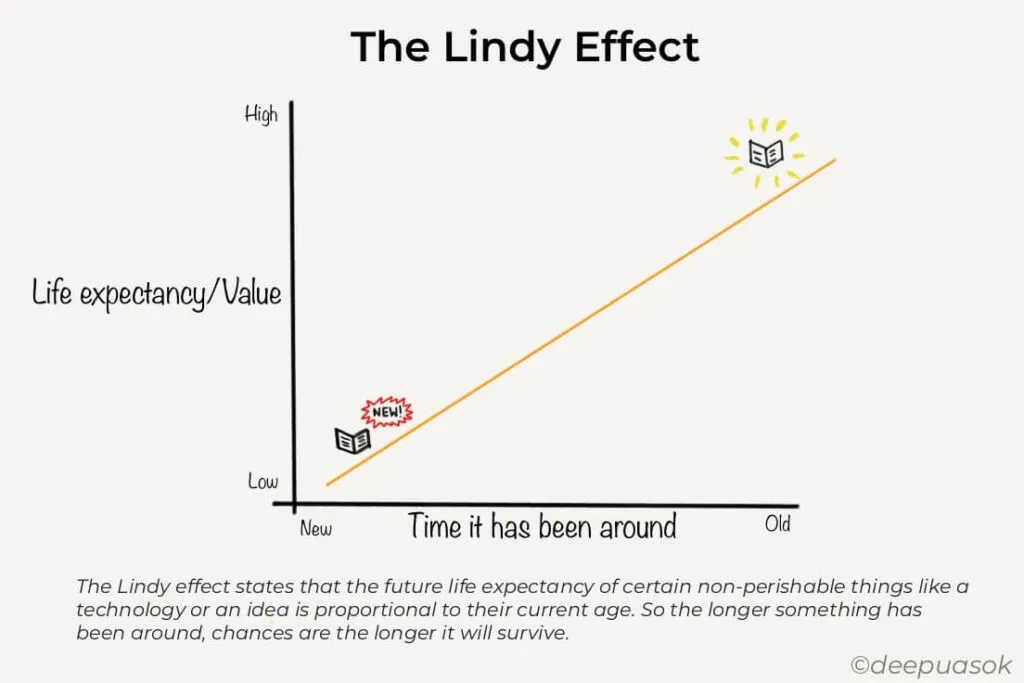

The following definition is given on Wikipedia:

- “The Lindy effect is a theoretical phenomenon in which the future life expectancy of some things, such as a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes that the longer a period of time something has survived and is currently in existence, the longer its remaining life expectancy. Long life implies resistance to change, obsolescence or competition and a greater chance of survival in the future.”

This effect is shown graphically in the figure below.

Analyst “Market Sentiment” published an interesting reflection on this effect in the stock market on analysis forum Substack:

- “Half of all companies fail within five years, and 80% fail within the first 20 years. However, some companies become outliers and survive for hundreds of years. So in theory, the Lindy effect applies to stocks.Take Coca-Cola, for example: the company was founded in 1892 and survived the Great Depression, two world wars and the Cola wars of the 1980s, to name a few. Not only has the company survived all this, it has prospered and increased its dividends for the past 61 consecutive years. Based on the Lindy effect, Coca-Cola is more likely to make it into the next century than, say, Google.As an investor, this is an important but often overlooked factor. Ultimately, business valuation is based on the present value of future cash flows. The problem with the current valuation technique is that we always assume the company will survive forever.”

The contention, then, is that the Lindy effect supports selecting companies whose longevity will also ensure a long-term, future existence.

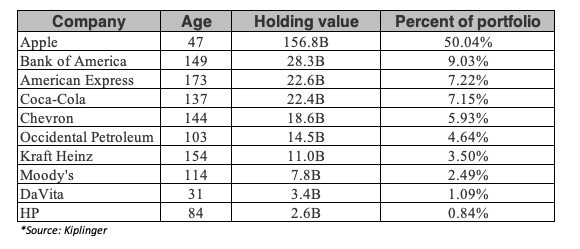

Berkshire Hathaway’s portfolio is cited as an example of the Lindy effect through the image above. The average age of the ten largest equity positions is a whopping 100 years, with seven of them even older than 113 years.

Cleaning up the data, according to analysis author “Market Sentiment,” results in surrendering the outperformance of “Lindy stocks,” and such a portfolio manages to keep up with the stock market. Thus, active selection remains critical. We see the concept as a valuable idea to consider with quality companies. After all, as Warren Buffett often quotes: “Time is the friend of the great company, but the enemy of the mediocre.”

Lindy case from the holding portfolio: Investor AB

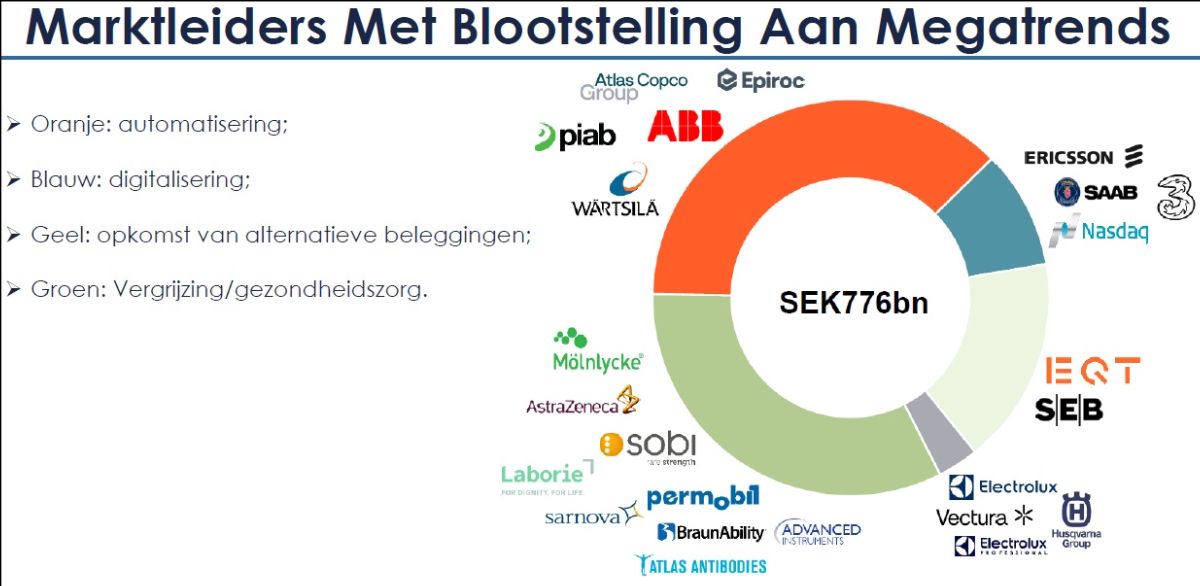

Another case we find noteworthy is that of the Wallenberg family’s Swedish holding company Investor AB. The investment holding company has itself existed for 108 years, and also has several very long-term holdings, such as Atlas Copco (since 1916), SEB (since 1916), AstraZeneca (since 1924), ABB (since 1925) and Saab (since 1937).

The special added value of a family holding company has rarely been as clear as in the Investor AB business case. The family holding company supports and steers the strategic direction of its subsidiaries from the Supervisory Board.

The family motto is not for nothing: “Passing from the old to what is to come is the only tradition worth keeping.” This speaks volumes about the family holding company’s future orientation. Investor AB, for example, has consciously taken exposure toward the above mega-trends.

On the one hand, the investment holding company has made conscious investment choices to select future-proof companies, for example with the acquisition of progressive healthcare companies such as Mölnlycke Healthcare, Advanced Instruments or Sarnova in the unlisted portfolio. For the private companies, more than 100 strategic acquisitions have already been made in order to strengthen market positions and further boost growth and profits.

However, Investor AB has also ensured that the long-term holdings in its portfolio have become more future-proof. On the one hand by optimizing the corporate structure (e.g. through a new, decentralized organizational structure at ABB or by divesting non-core holdings at ABB and Atlas Copco) and/or on the other hand by making acquisitions in promising sectors, and by investing heavily in organic growth, research and innovation.

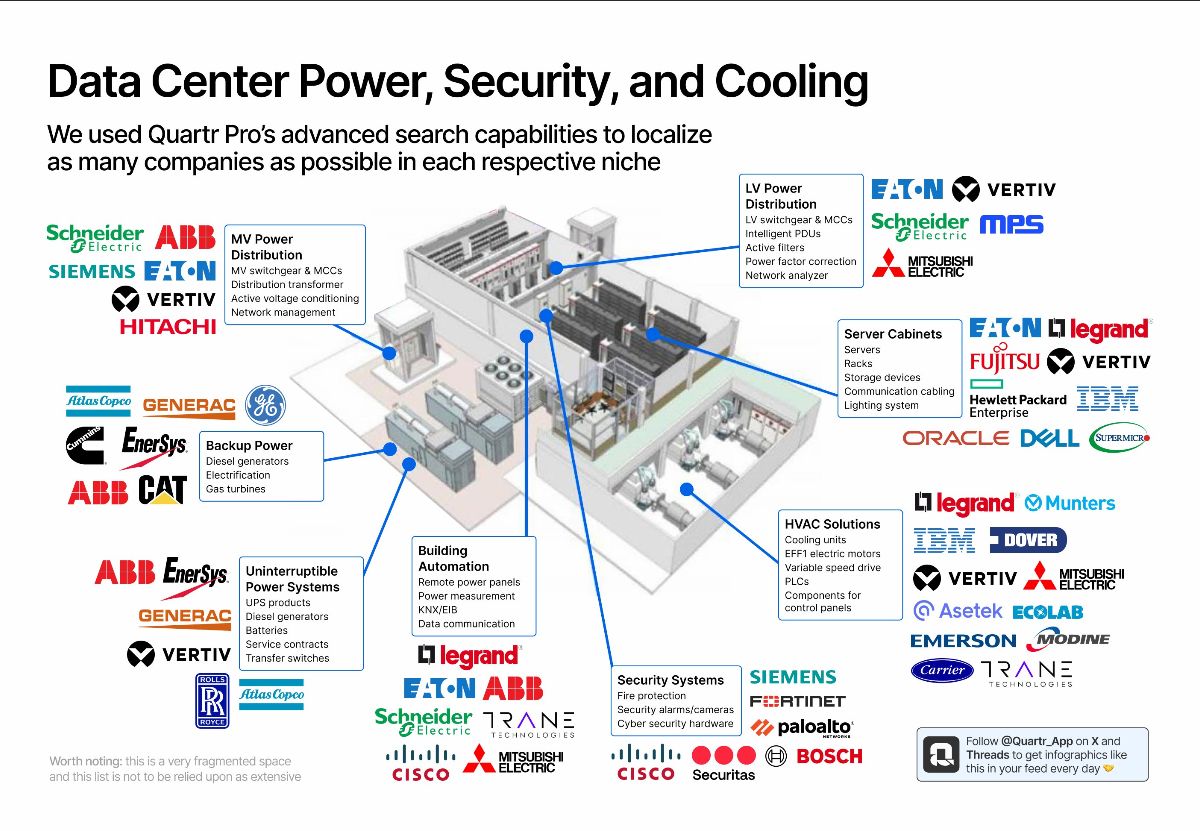

This is best illustrated through the figure above(click here or on the image for a larger copy). Quatr Research recently published this interesting overview of the data center sector. With the breakthrough of Artificial Intelligence due to ChatGPT and similar applications, the demand for computer chips is increasing significantly. A company like Nvidia saw its stock price explode as a result.

However, to enable the associated large language models (LLMs) requires insane amounts of computing power and data storage. Companies that benefit in part from this are those providing power distribution, security and cooling solutions for data centers. The two most important companies in Investor AB’s portfolio (Atlas Copco and, in particular, ABB) are clearly highlighted in this overview, and are thus ideally positioned to benefit from this megatrend. This is by no means based on coincidence.

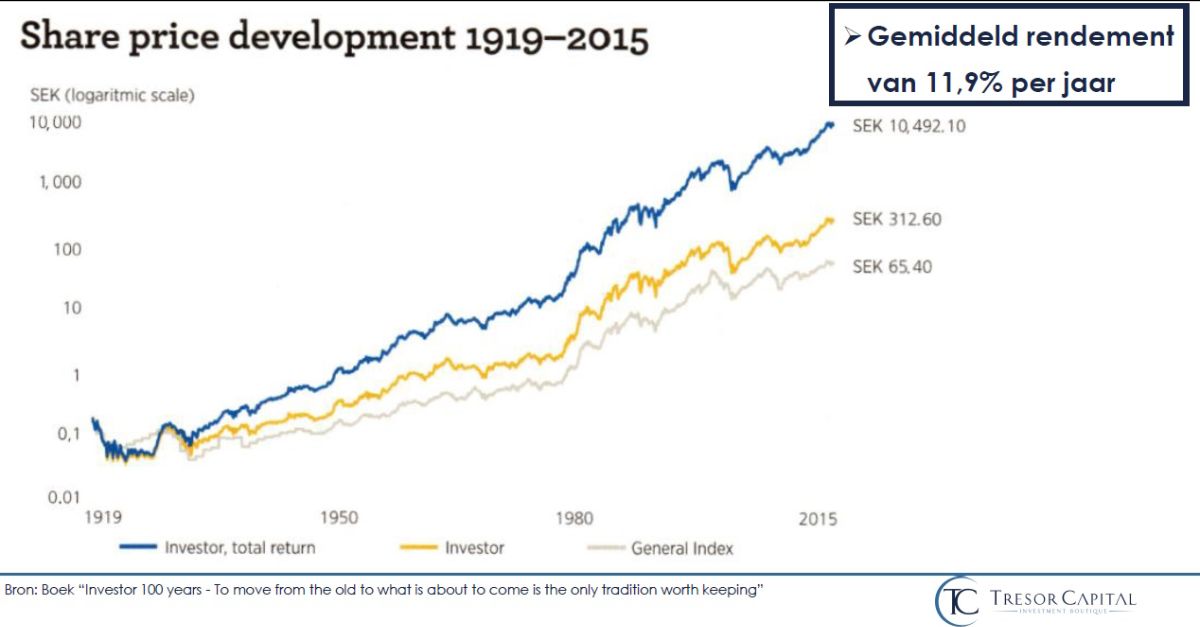

The chart below shows that all this translates into Investor AB’s impressive return of more than 11.9% per year since 1919.

It strengthens our confidence that the entrepreneurs (families) behind these investment holding companies continually keep the long-term view in sight. This is characterized by thinking in generations rather than quarters. Thus, it is no coincidence that many family holding companies contain exactly the characteristics to exhibit the Lindy effect.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner