Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

From Holdings To Serial Acquirers: Types of Investment Companies

Family investment holding companies

We regularly write about family investment holding companies in our publications. These are publicly traded investment companies owned by wealthy families, who over the years have amassed their wealth through a distinctive trading spirit and sophisticated entrepreneurial instinct. These companies have mostly stood the test of time and are used by these families to invest and manage family capital in a sustainable way.

Because the family has invested a large portion of its own capital in the holding company that is at stake(skin in the game), family interests are aligned with those of outside shareholders. Holding companies typically invest in a combination of listed and private companies, real estate and private equity funds. So by buying the shares of a holding company, you are already investing in a diversified portfolio.

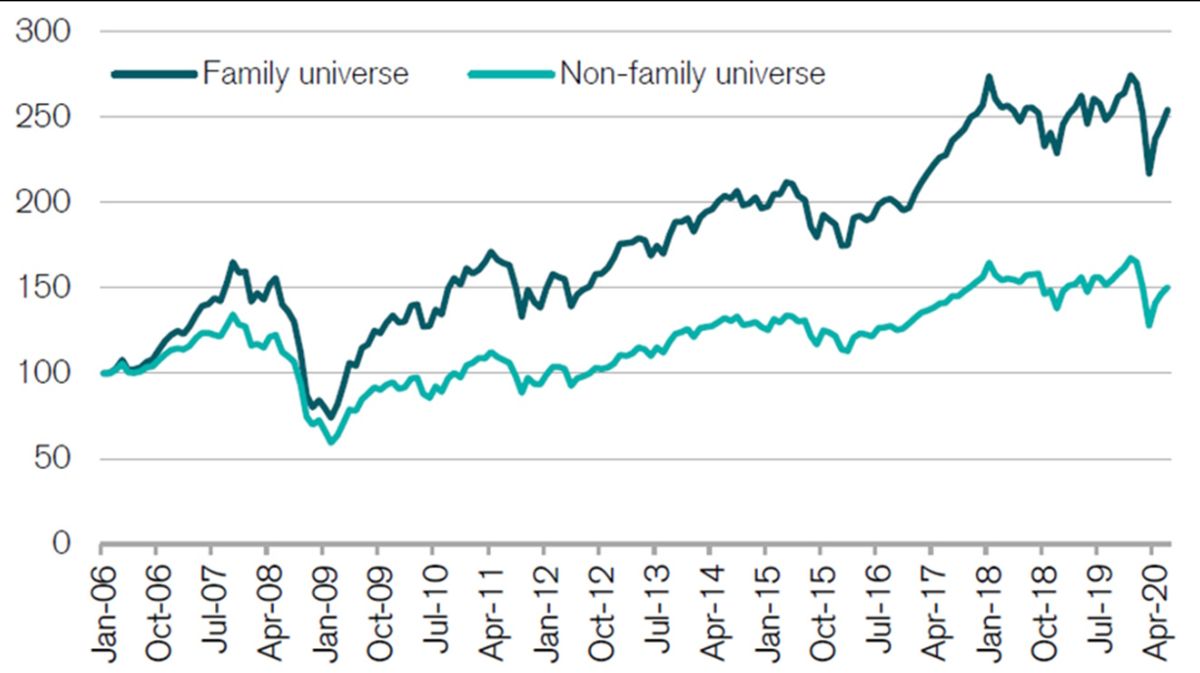

We believe that we can achieve our investment objectives by investing in companies where the founding family owns a large portion of the shares. Research has shown that family-owned companies outperform companies without a family or reference shareholder because of a number of important characteristics.

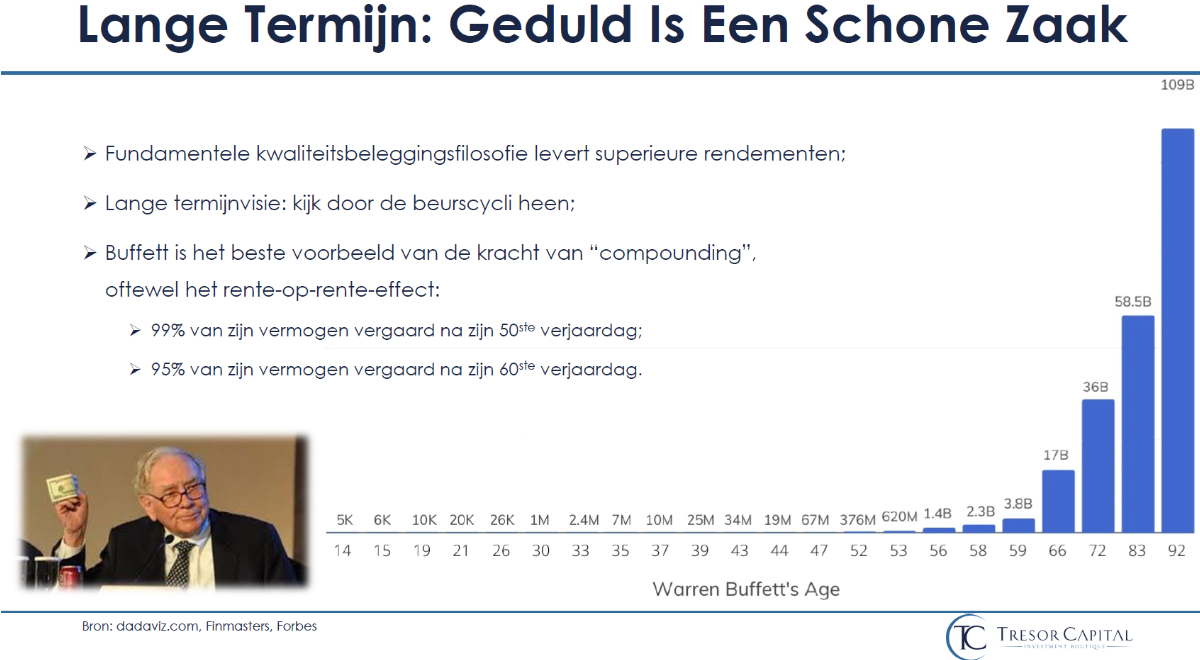

For example, the CS Research Institute found that family businesses produce better returns, as shown in the figure below. Key explanations for this better return include that family businesses have a long-term focus, have lower debt levels and typically invest more in research and development. This results in faster sales growth and higher profitability.

The important feature of family holding companies, without question, is their long-term focus. One thinks in generations, rather than quarterly profits. The controlling interest of the family shields the company from constantly changing strategies due to outside pressures, from shareholders who want a short-term ride rather than longer-term structural value growth.

The family’s stewardship has the preservation of family capital as its primary goal, with the growth of this capital as a second crucial pillar. To achieve this, they manage their portfolio in an active, fundamental way. Viewed this way, an investment holding company can be thought of as an actively managed portfolio with low management costs comparable to ETFs, which are typically relatively low-cost, passive investment products.

Families tend to be risk averse and conservative in management, but that does not mean holding only a savings account. Family investment holding companies are entrepreneurial, and usually have a knack for good investments. Conservative management translates into strong balance sheets and usually an aversion to debt, overambitious expansion strategies and excessive management compensation.

In a nutshell, by investing in the investment companies of such families, we are entrusting our capital to enterprising families that have demonstrated over a long period of time to beat the stock market. Typically, these investment holdings are now trading at a discount to intrinsic value, allowing one to buy the portfolio at a discount.

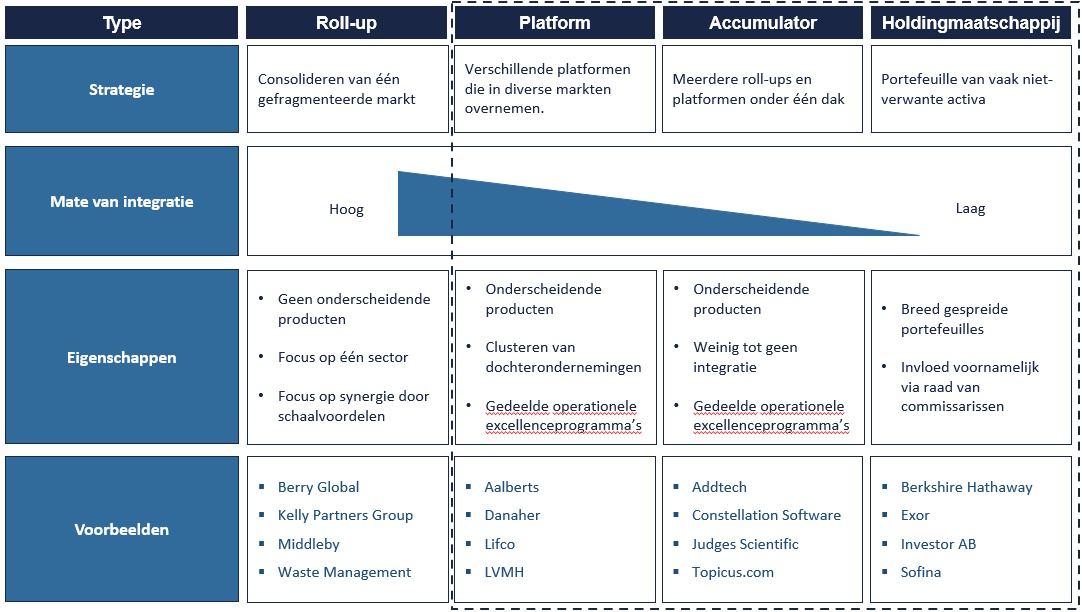

What we have mapped less explicitly so far concerns the different types of investment companies. The figure above (click on it for a larger copy if it is not readable) roughly lays out four types of investment companies. The original design comes from Scott Management LLC, thanks also to José Manuel Castro of Cianca Capital for providing a template, we have adapted this to our approach and vision at Tresor Capital.

One can roughly speak of serial acquirers or serial acquirers (roll-ups, platforms and accumulators) and holding companies as different types of investment companies.

A roll-up is a large central company that focuses on consolidating a fragmented market by acquiring and integrating several smaller players. This focuses on synergy through economies of scale, for example, by centralizing various functions. There is a high degree of integration and usually few distinctive products are involved (think packaging materials).

Michael Gielkens made a presentation on behalf of Tresor Capital on serial acquirers at the annual conference of the Flemish Federation of Investors, which drew nearly 2,000 participants last month.

Roll-ups are generally not our focus area. Through the Turtle Creek Equity Fund, we do indirectly have several of these companies in our portfolio, such as Berry Global and Middleby. More than two-thirds of the Turtle Creek Equity Fund are companies that regularly make acquisitions, often with the founder or family at the helm. So that fits very well with the family holding strategy that we manage ourselves. In doing so, we focus primarily on the edged investment companies: platforms, accumulators and holding companies.

A platform involves a larger company used as a base for further acquisitions. It involves distinctive products and a more decentralized structure than the roll-up. Subsidiaries are clustered into subgroups where there is usually subgroup management. At LVMH, for example, there is the Fashion & Leather Goods division, with brands such as Louis Vuitton and Dior, and the Wine & Spirits division, with brands such as Moët and Hennesy. The focus is less on synergies, and more on sharing operational excellence programs.

LVMH is an example of a platform, growing in part by making acquisitions in its five subdivisions.

An accumulator can be a combination of different platforms or roll-ups. Accumulators can focus on a specific sector or, on the contrary, multiple companies from various sectors. An accumulator focuses primarily on making acquisitions of companies that are decentralized after the acquisition and are basically not integrated, or only integrated to a limited extent. The companies are, however, expected to integrate best practices and operational excellence programs, and one is required to report financial data regularly to top management.

A holding company is an umbrella company that has a broad portfolio of usually unrelated assets that are highly decentralized, often with its own management teams and supervisory boards (SBs). The family or management of the holding company often sits on the SBs of the subsidiaries to oversee and adjust.

Berkshire Hathaway versus Constellation Software: overlap and differences

There are often similarities and differences between various investment companies, the above categorization is often more difficult to make in practice. Accumulator Constellation Software is the epitome of a successful serial acquirer, while Berkshire Hathaway is the figurehead of a holding company.

Berkshire, however, by making several acquisitions, built the company into the holding company it is today, so Berkshire is sometimes referred to as a serial acquirer. Constellation is primarily a conglomerate of more than 1,000 software companies, which are highly decentralized. So one can also think of Constellation as a holding company.

One similarity between the two companies, is that at both Berkshire and Constellation the respective CEOs Warren Buffett and Mark Leonard are the major shareholders. There is also much overlap in business strategy, both companies have a long-term focus, are vehicles of patient and permanent capital, pursue high returns on invested capital, and they treat outside shareholders as partners.

However, there are also important differences. For example, Buffett and a handful of managers at Berkshire are responsible for central capital allocation, while Leonard at Constellation has managed to decentralize responsibility for acquisitions deep down in the organization. At subsidiaries, Berkshire largely takes a laissez-faire approach, while Constellation expects best practices to be implemented and acquired companies to be benchmarked. Berkshire also has a wide range of end markets, from insurance to railroads, while Constellation focuses purely on industry-specific software.

Conclusion

While the explicit nuance between different types of investment companies is relevant, ultimately the core values we focus on at Tresor Capital remain the same. Within the equity piece, we pursue a well-diversified portfolio of high-quality companies, with good and reliable managers and an entrepreneur or family as anchor shareholder, a high return on invested capital and sufficient opportunities to reinvest profits at that high return.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner