Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Company Visit: Sofina Excellently Positioned For Innovation And Further Growth

On May 8, we attended Sofina’s shareholders’ meeting with a delegation from Tresor Capital. Before beginning the report, perhaps a brief introduction to the company is in order.

Brief introduction

Sofina S.A. (Brussels: SOF) is a Belgian investment holding company founded in 1898. Since the 1950s, a significant proportion of the shares have been held by the influential Boël industrial family. Today, with Harold Boël as CEO, the fifth generation of the family is at the helm of the investment holding company.

Sofina pursues a long-term strategy in which it considers itself the partner of families and entrepreneurs whom it provides with patient capital and advice. The holding company considers the entrepreneurial spirit as a source of progress that characterizes many family businesses. Sofina believes that growth and innovation result in economic and social growth. The Boël family’s sophisticated investment approach has resulted in an average growth in net asset value of 9.9% per year over the past decade.

On the occasion of the preparation for the shareholders’ meeting, we organized a presentation together with the Flemish Federation of Investors that went deeper into the company. You can watch the recording of this presentation by clicking here, or by clicking on the image above.

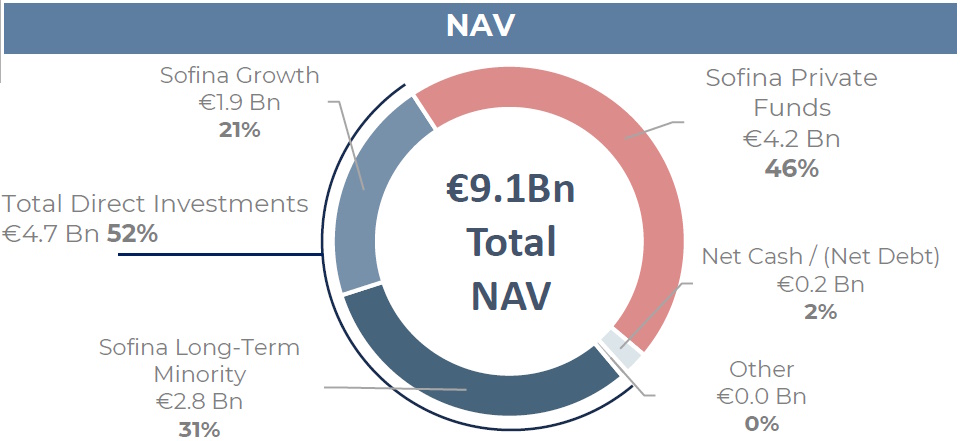

Sofina invests primarily in relatively young companies with a focus on growth and innovation. Sofina invests in two ways, with direct equity investments and through funds. In relatively young startups, the family holding company invests mostly through venture capital funds, while investing directly in scaleups or already somewhat larger, more mature and profitable companies. The split between direct holdings and funds is about 50/50, as you can see in the picture below.

Shareholder meeting

Sofina has had a turbulent period. Since the company invests a significant portion of its portfolio in young growth companies, higher interest rates have a significant impact on the valuation of that portfolio. Due to the sharp increases in interest rates, both Sofina’s share price and net asset value had a turbulent year in 2022. 2023 was marked by stabilization, while 2024 should be the year of further growth. The omens are clearly positive, CEO Harold Boël jabbed at us during the meeting in Brussels.

Chairman Dominique Lancksweert opened the meeting by noting that uncertainty and volatility (price fluctuations) can be worrisome. However, Sofina’s Supervisory Board has already experienced several cycles. Uncertainty and volatility can also be an opportunity to further increase the conviction of the investment style and various positions.

The family holding company president cited the above image of annual rings of a tree trunk, which also adorned the cover of the annual report:

- “As a tree grows, the tree grows wider and stronger. However, not every year is the same. One year is marked by hard growth, the next year conditions are more difficult. Creating long-term value requires purpose and patience.

In recent years, we have learned important lessons. In the new normal of higher interest rates, Sofina has proved robust. We have diversified well, both geographically and in asset classes. Our largest individual position is only 5% of the total portfolio.

We think in decades, the long term through generations. Over the past decade, we have more than doubled our intrinsic value and paid a growing dividend. We have unique assets and special networks. We support entrepreneurs and are discreet with decisiveness.

The interactions between management, the supervisory board, and the controlling shareholder family are regular, deep, and genuine. You don’t see this as an outsider, but it does happen behind the scenes.

We have and will maintain a focus on quality and innovation, in order to hand over the portfolio in good order to the next generation.”

With those words, Lancksweert handed over the baton to Harold Boël. Unfortunately, the top executive could not be physically present, having been felled by corona. “Life sometimes presents setbacks, but technology allows me to be there,” the CEO stated.

The top executive used these slides to give an introduction about Sofina and to briefly summarize 2023 developments. We would like to refer to the video cited above, in which we use similar slides.

Resurgence private equity market

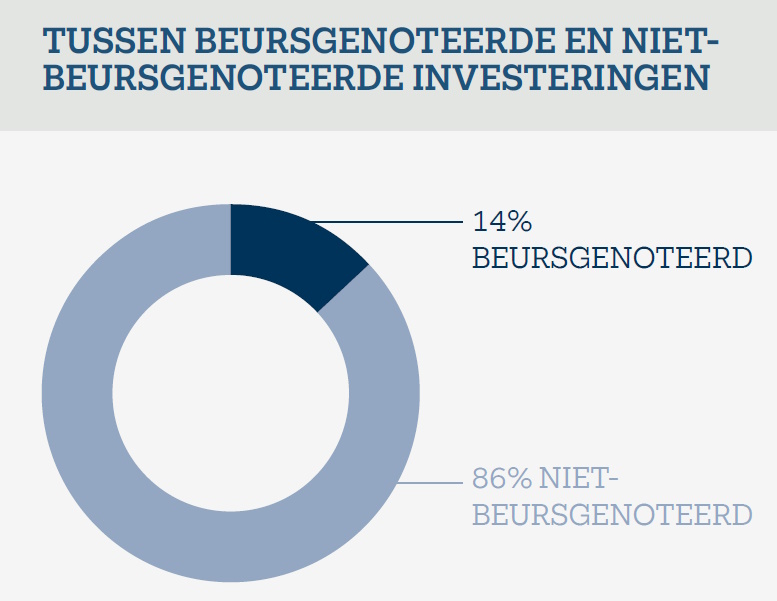

Since more than 85% of the portfolio consists of unlisted companies, developments in this so-called private equity market are important for Sofina. Boël sees a clear improvement in the sector, after a difficult period:

- “We are seeing a clear recovery in the market. There is more activity: more capital calls from fund managers, more IPOs and more deal activity. The question is whether this is a temporary upturn, or the start of a new cycle. Making predictions is difficult, especially about the future.”

Last year, India’s stake in Mamaearth went public, with Sofina selling some of its shares to take some profits off the table. In a recent Dutch-language interview with De Tijd newspaper (click here to watch the video), Boël offered the following explanation:

- “As for a recovery in valuations, it is more difficult to estimate, that will depend on the development of interest rates. Companies are valued on the basis of future cash flows, so the underlying growth of the companies is an important factor besides interest rates. Interest rates are not in our control. We focus on identifying companies that have the wind in their sails. For portfolio companies, we focus on making sure they continue to grow.In the long run, the stock price is driven by the development of the net asset value per share. That depends on things we don’t control, such as interest rates, but what we can do something about is that underlying growth. That’s what we continue to focus on.”

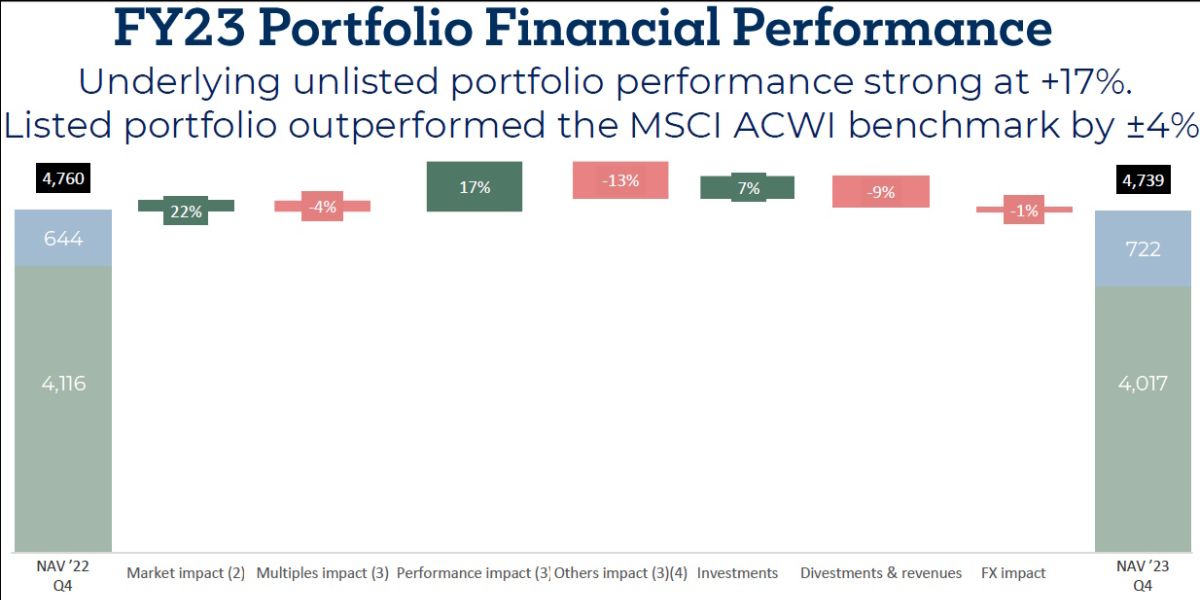

Corporate growth offset by decline in valuations

We would like to highlight the above slide from Sofina’s annual results presentation. In it, the factors affecting intrinsic value that Boël cited above are clearly illustrated. First, we see an increase of 22%, that relates to the rise in the share price of listed companies that recovered last year after a turbulent 2022.

The three cubes after that are actually the most interesting. The green block shows an increase of 17%. That refers to the increase in value due to growth in sales and profits of unlisted companies. However, that 17% increase is completely offset by the decrease in valuations (the cubes with -4% and -13%). The sharply increased interest rates put pressure on the valuations of unlisted companies.

The main conclusion of this slide is twofold. On the one hand, we see that Sofina’s businesses continue to perform well underlying, they continue to grow. That is the most important measure that Sofina has in its own hands, and shows that the family holding company has an attractive portfolio that is creating value. On the other hand, the interest rate impact is now almost fully incorporated into the portfolio. Therefore, if there are no further interest rate increases, this will no longer weigh on Sofina’s net asset value and share price .

In other words, if the companies in Sofina’s portfolio continue to grow and interest rates no longer rise, or they even fall, one can look upward again in terms of stock price and intrinsic value.

Unique network is a competitive advantage

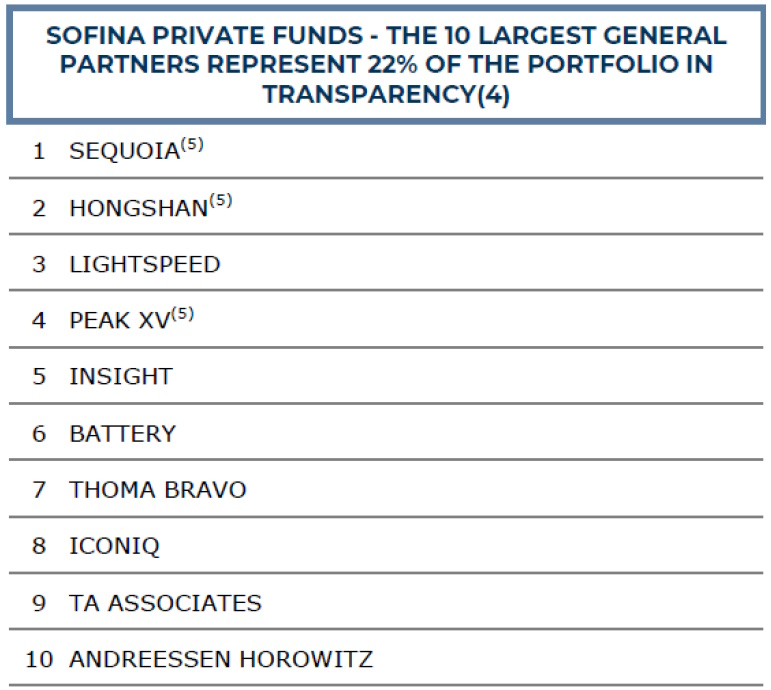

One of Sofina’s main achievements, without a doubt, is the unique network it has built over the past decades. Half of the portfolio is invested in the investment funds of Sofina’s venture capital partners. Boël explains:

- “Google, YouTube, Airbnb, Snowflake, Pinduoduo, Meituan Dianpin and ByteDance (TikTok) are all companies that were funded by one or more of the top 10 funds. So through these funds, we have been at the cradle of some of the most successful technology companies we know today. These funds can not only select the winners, but also select the very big winners.”

These venture capital investors are so successful that they can self-select who invests with them, being loyal to their regular investors. Boël:

- “We have invested in TA Associates’ funds since the 1970s, and in Sequoia and Hongshan (Sequoia’s Chinese spin-off) since the 1990s. These funds choose their investors, and existing relationships are preferred over new ones. That’s a rule within the private equity world, and certainly within Venture Capital.”

Artificial Intelligence

Sofina has exposure to Artificial Intelligence (AI) with several companies (see figure above) in its portfolio. Through multiple venture capital funds, Sofina has in its portfolio the company OpenAI, the developer of ChatGPT. Thanks to her unique network, Sofina was also able to co-found the French answer to ChatGPT: Mistral.AI. Through its venture capital partners, Sofina had the opportunity to take a stake directly.

Harold Boël stressed several times that this was only a modest position. Sofina invested when the company was valued at EUR 200 million. Another round of investment followed a few months later at a valuation of EUR 2 billion and, according to the Wall Street Journal, Mistral is on the eve of another round of capital at a valuation of USD 6 billion.

Even if Sofina’s initial investment amount was only EUR 5 million, it has now grown to more than EUR 130 million, a substantial amount on the family holding company’s total portfolio. It is a clear sign that the venture capital market is gradually recovering, with companies focused on artificial intelligence leading the way.

Tresor Capital partners Rob Rutten (left) and Michael Gielkens (right) flank Harold Boël during the 2023 shareholder meeting. Boël was unable to physically attend this year due to illness.

Selection by AI

In addition to good returns, the portfolio of venture capital funds provides another benefit: it provides Sofina with a glimpse into some 7,000 companies in the portfolios of these fund managers. Sofina has developed tools based on Artificial Intelligence to extract special data from these, to pick out the most interesting propositions. Sofina can then invest in these directly in subsequent rounds of capital.

At the shareholder meeting, we asked Boël if he could provide more insight into how Sofina is applying AI. Boël:

- “We have an internal tool that we use to continuously search information on the Internet and special publications. Our software tracks the evolution of those companies, and we apply filters to see who the other shareholders are, what the traction is, how the number of people hired develops on LinkedIn, etc. That’s how we arrive at the 5 to 10 companies we want to connect with before there’s an investment round. AI is a growing part of that.The tool can pull all the internal and external information together into the right questions to ask. Again, the 80/20 rule applies. AI delivers a big improvement in terms of productivity. We hired a software developer and an infrastructure/tooldevelopment team to help improve our tools in terms of security and knowledge. At the risk of appearing immodest, I can say that we are doing this very well. We are a forerunner.”

Net asset value

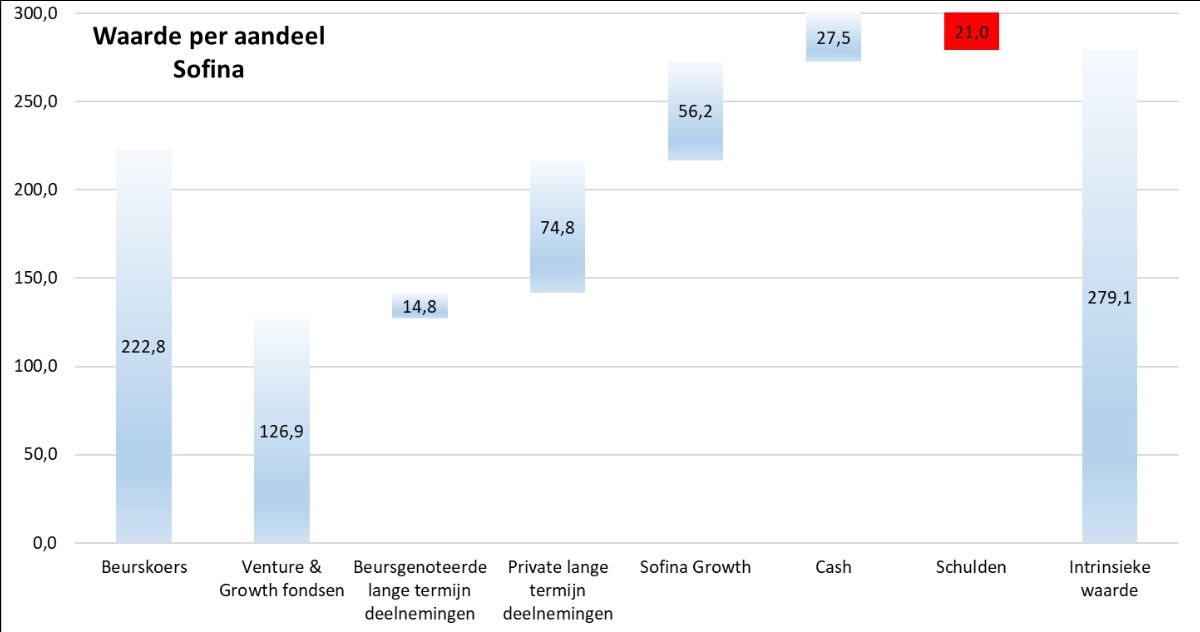

The net asset value at the end of March 2024 was about EUR 278 per share. This is based on the net asset values of the venture capital funds, stock market prices and currencies received after December 31, 2023. Direct investments in unlisted companies are revalued only twice a year. Sofina did already take into account the signed agreement to sell the stake in refrigerated truck rental company Petit Forestier.

As a result, the valuation of this company has risen above 5% of its net asset value, which seems to indicate that Sofina is making a profit of EUR 100-150 million on top of the valuation it itself had placed on it. As far as we are concerned, this again marks the conservative way in which Sofina values its holdings in the direct portfolio.

Based on stock price changes (in particular a solid price jump by Luxempart), the net asset value increased a bit further to EUR 279, according to our calculations. According to analyst Joren van Aken of Degroof Petercam, the net asset value amounts to EUR 285-290 per share, due to the rise of comparable technology and growth stocks. The family holding company is currently trading at a discount of about 20%.

Given its unique portfolio and the fact that the venture capital industry is currently in recovery, we still see the company as an attractive proposition.

With the sale of Petit Forestier, Sofina has EUR 1-2 billion (including lines of credit) available to invest. So just when venture capital investments are picking up and valuations are much more attractive, Sofina has a nice war chest to put to work and plant the seeds for future growth.

Drinks

We end our report with an anecdote about the afterglow. After the shareholder meeting, it is possible to talk for a while over a snack and a cup of coffee, including with several people from Sofina. There was also a large delegation from the Flemish Federation of Investors (VFB), who responded well to the VFB’s wonderful initiative to increase the attendance of private investors at general meetings.

In 2021, champagne was still served at Sofina afterwards, but given the developments since then, this may have been less appropriate. Now one only gets coffee, water, cola or orange juice. With a wink, we asked chairman Lancksweert when champagne would be served again, to which the chairman replied wittily:

- “If we sold ByteDance for a nice amount,” he said.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl