We would like to inform you about the latest developments concerning the family investment holdings that we have in our portfolio or are considering adding to your portfolio. We regard these companies as the cornerstone of our investment portfolio. From time to time, we also make room to discuss other investment propositions.

Optimism or Realism

A slightly longer introduction than you are used to from us this week. Fortunately, we receive a lot of feedback on our newsletter, sometimes very nice compliments, but sometimes also the message that we may be looking at things through rose-tinted glasses. In our monthly report from last October we already wrote that we sometimes ” We have received feedback that we are too positive about developments. After all, if things are going so well, why isn’t this reflected in the share prices of all companies?

We established the relationship between short-term sentiment and long-term fundamentals. Research shows that in the 1970s, investors held shares in their portfolios for around five years. That has now been reduced to 10 months. This means that investors are focusing much more on short-term developments, and the investment horizon has been drastically shortened.

A long-term investment horizon is therefore a competitive advantage in the financial markets. We therefore focus on the long term, using benchmarks such as return on invested capital, profit growth and corporate culture. However, a disappointing quarterly report or a negative analyst report can sometimes throw a spanner in the works, putting the share price under considerable pressure.

Take Aalberts, for example. During the coronavirus pandemic, we took an initial position at less than EUR 23 per share. Investors often regard Aalberts as cyclical, which we do not always consider entirely justified. In January, an analyst at Bank of America issued a sell recommendation, arguing that end markets such as the semiconductor sector would come under pressure. This resulted in a share price decline of almost 4%. When Aalberts published its excellent 2023 annual results a month later, it became clear that too much pessimism had been priced in, and the share price shot up by more than 7%.

In reality, the intrinsic value of a company does not fluctuate as much as its share price, but investor sentiment can have a significant impact in the short term. Both positively and negatively, as is nicely illustrated by the cartoon from The Economist at the top of this newsletter. As the caption shows, it is our job to navigate through the daily noise on the stock market and the prevailing sentiment at any given moment.

With an active approach and a broadly diversified portfolio, it is not always possible or realistic to beat the stock market on a weekly, monthly or even annual basis. Netflix has a documentary about the “Monster of Wall Street”. Bernie Madoff seemed to be able to consistently beat the stock market. He turned out to be the biggest fraudster in stock market history. This just goes to show that fluctuations in returns are simply part of the game. We will continue to focus on the (quality of the) portfolio for the long term.

The composition of the portfolio is the result of a rigorous selection process. The companies in which we see the most potential in the long term are included in the portfolio. As a result, we naturally take an optimistic yet critical view (and therefore also write) about these companies. After all, if developments were not favourable, or if the longer-term outlook were under pressure, we would not have included the companies in the portfolio in the first place.

This week, we are writing about the positive figures reported by Constellation Software, a Canadian family holding company that continues to perform well and has once again exceeded expectations, resulting in a new record share price. The tone of this article is therefore positive.

However, we also refer to the shareholder letter from Markel CEO Tom Gayner. Gayner is realistic and takes responsibility for the disappointing performance of the insurance division. This was a major setback in both the third and fourth quarters of 2023, and investors have significantly lowered the share price twice. Although the share price recovered twice to USD 1,500, if Markel had managed to perform more consistently, the share price would normally have been significantly higher.

Christian Dior as a practical example

Just how quickly sentiment can change was demonstrated by Christian Dior, the holding company behind luxury goods group LVMH. Shortly after we acquired a stake at the end of December, the share price fell sharply in January, based on figures from Hugo Boss and Burberry, as well as analysts’ caution about the luxury goods sector. We saw a 10% loss on the boards, which was not a pleasant start for our clients.

Nevertheless, we continued to write positively about the holding company of luxury tycoon Bernard Arnault, as the long-term prospects were excellent. We also saw a ray of hope in the figures from competitor Richemont, which reported a clear recovery for its luxury brands in the fourth quarter. A clear distinction can be made between premium brands and luxury brands. Premium brands (such as Boss) target the (upper) middle class, while luxury brands appeal to an even higher segment. The decline in the share price made the risk-return ratio even more attractive, prompting us to double our position on 24 January.

At the end of January, excellent figures were published, clearly demonstrating that luxury companies such as LVMH attract a clientele that is much less sensitive to economic slowdowns or inflation. They can afford a lifestyle that does not require them to tighten their belts. Sentiment has now turned positive, with a 10% gain on our first purchase and around 20% on our second purchase.

It is rare for an investment case to pay off so quickly, and we agree that various cases need a little more time to prove themselves. So far this year, we have seen predominantly positive figures from the companies in our portfolio, which has translated into favourable share price developments, but there are still a few heavyweights that have yet to publish their (final) figures. We will continue to report on these developments as you would expect from us: realistically, predominantly positively, but critically when justified.

Summary of the Newsletter

A shareholder who, thanks to Berkshire Hathaway became a billionaire, donated USD 1 billion to a medical university to make education free. Indutrade made a major acquisition.

Constellation Software once again published excellent figures. In this newsletter, we take a closer look at a few acquisitions and delve deeper into the business model of the family holding company, which we sometimes refer to as the Berkshire Hathaway of the software sector.

Exor acquired a 10% stake in Clarivate, a British technology and healthcare company, for EUR 450 million.

MBB announced that it had repurchased 6.9% of the outstanding shares. Among others, founder Freimuth offered part of his stake, which means that the number of freely tradable shares and the liquidity of MBB remain reasonably stable.

Markel Group CEO Tom Gayner was realistic yet combative in his letter to shareholders, in which he discussed, among other things, the disappointing results of the insurance division.

In Brief: Magnificent Gesture by Berkshire Billionaire, Acquisition of Indutrade

The American investment holding company Berkshire Hathaway (New York: BRK.B), owned by major shareholder Warren Buffett, has created tremendous value for shareholders. Since Buffett took the helm in 1965, Berkshire has generated an average return of 19.8% per year, compared to 10.2% for the S&P 500 index. That translates into a total return of 4,384,748% versus 31,223% for the stock market index.

This is beneficial for shareholders, but society also benefits. On the one hand, from the tax that shareholders pay when they spend their wealth, but also from the countless donations. Warren Buffett has already donated USD 50 billion to charity, and his remaining wealth of more than USD 100 billion will also go to charity.

Sandy Gottesman, a director and shareholder of Berkshire and a close friend of Buffett, passed away in 2022 at the age of 96. Suddenly, his wife, Dr Ruth Gottesman, inherited several billion pounds in Berkshire shares. His message to her was: ‘Do with it what you think is right.’

This month, she announced that she is donating USD 1 billion to New York Medical School so that students no longer have to pay tuition fees. The announcement can be seen in the short video below, followed by a group of students cheering wildly. 93-year-old Ruth Gottesman has a 55-year relationship with the Albert Einstein College of Medicine, where she is chair of the board of trustees. She is professor emeritus of paediatrics at the school.

- I have never seen anyone behave better with a billion pounds. She will change the lives of all these people by giving up something that was not really important to her and will, over time, be hugely important to thousands of people.

De Zweedse investeringsholding Indutrade (Stockholm: INDT) van de familie Lundberg deed deze week alweer de vijfde overname van 2024. Het Noorse bedrijf Matriks AS werd ingelijfd, is een technische handelsonderneming gespecialiseerd in analyse-instrumenten, systemen en verbruiksartikelen voor chemische en biochemische laboratoria.

The company offers a wide range of products in the fields of liquid and gas chromatography, mass spectrometry, atomic and molecular spectroscopy, and systems for protein, cell and DNA/RNA analysis, as well as various types of consumables and aftermarket services. Its customer base consists mainly of hospitals, universities, research institutes, chemical laboratories and energy companies. Matriks was founded in 2002, has 31 employees and an annual turnover of approximately SEK 205 million.

- “We are delighted to be able to strengthen our position within the life sciences sector in Norway with the acquisition of Matriks. The company has strong technical expertise and a high-quality offering based on products from leading suppliers, which provides excellent conditions for continued sustainable, profitable growth.”

Berkshire Hathaway and Indutrade ended the trading week on the New York and Stockholm stock exchanges at prices of USD 403.15 and SEK 274.50 per share, respectively.

Constellation Software Publishes Excellent Results Once Again

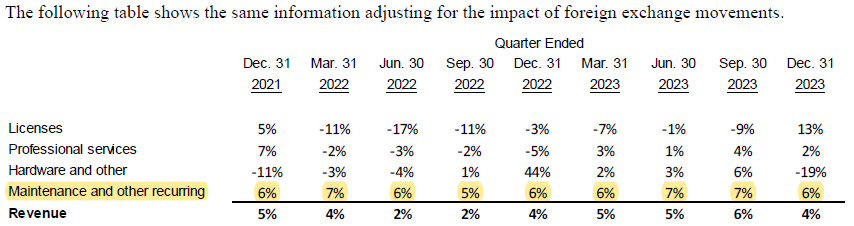

Canadian investment holding company Constellation Software (Toronto: CSU), founded and majority-owned by Mark Leonard, published excellent figures for the fourth quarter of 2023 this week. Revenue rose by 26% to USD 2.32 billion, of which 6% was organic growth (4% adjusted for exchange rate effects). For the full year 2023, revenue rose by 27% to USD 8.4 billion, of which 5% was organic.

The organic growth is particularly striking. Years ago, Constellation experienced somewhat disappointing organic growth, partly driven by the fact that investments (in organic growth and acquisitions) are weighed against required return targets. As a result, the company regularly acquires companies that are not growing too rapidly, or are even shrinking, if this can yield a return of more than 20-25% per annum on the investment.

However, the image below shows that substantial progress has been made in terms of organic growth in recent quarters. Maintenance revenue in particular shows substantial growth. This is crucial, as it concerns maintenance subscriptions with recurring annual income. In total, this accounts for more than 70% of Constellation’s revenue, resulting in relatively predictable cash flows.

Cash flow

As a shareholder, you naturally want to see that turnover translate into a healthy cash flow. Due to relatively low operating costs, margins are high, and more than 20% of turnover translates into freely disposable cash flows. This allows the Canadian family holding company to make new investments, particularly acquisitions.

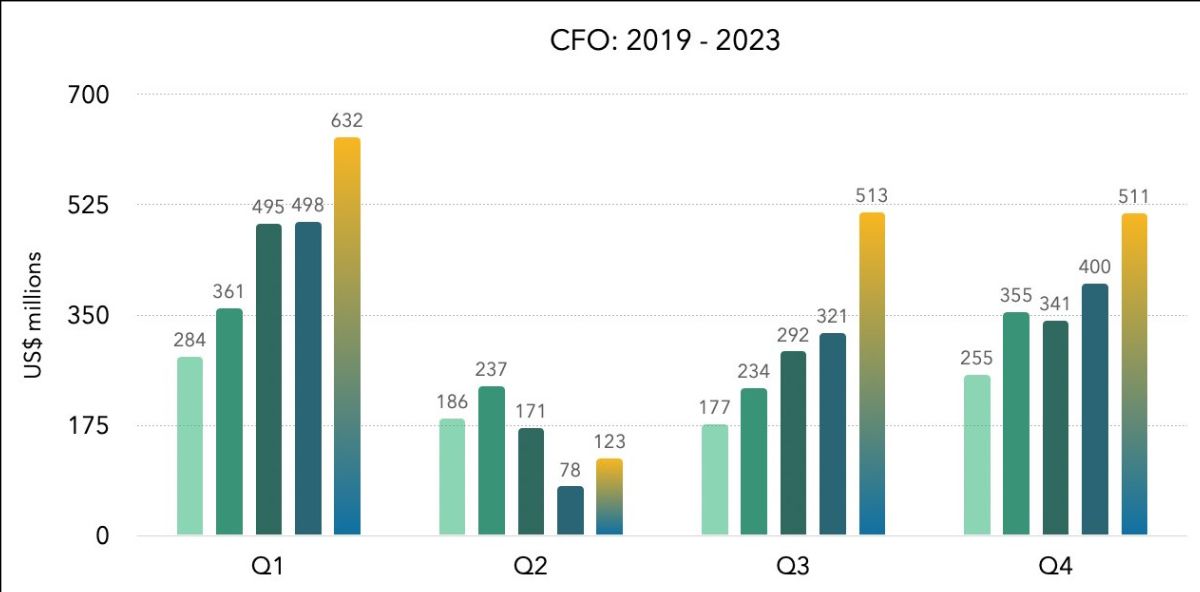

Operating cash flow in the fourth quarter was USD 511 million, an increase of 28% compared to the fourth quarter of 2022. For the full year 2023, operating cash flow was USD 1.8 billion, an increase of 37% compared to 2022.

The figure below shows the development of cash flow from operations (CFO) per year for the period 2019-2023. Source: Twitter user CJ Oppel.

Acquisitions

The main growth driver is the acquisition machine. It ran at full speed in 2023, with more than 100 acquisitions once again. Constellation Software now consists of more than 1,100 companies. In the fourth quarter, USD 463 million was spent on acquisitions, and for the whole of 2023, USD 2.6 billion was spent on acquisitions.

Constellation is therefore able to invest much more in acquisitions than the cash flows it generates. This is a crucial observation, because a few years ago investors and analysts still had doubts about whether it would be able to continuously reinvest its cash flow. Moreover, Constellation does so at high returns of more than 20% on its investments. We know of very few companies that are able to consistently achieve such attractive returns, especially on ever-increasing investment amounts.

Acquisitions this week

The Canadian investment holding company has once again made several acquisitions. Sometimes there is a kind of matryoshka structure, with subsidiaries of subsidiaries making acquisitions. It is a sign that Constellation has proven to be extremely capable of decentralising responsibility for making (small) acquisitions deep within the organisation.

For example, the Polish listed company Sygnity, itself a subsidiary of the Dutch listed subsidiary Topicus.com, acquired the Polish company Sagra Technology, a software company specialising in the development of IT solutions to support sales, marketing and analysis in the SaaS model.

In Australia, Auto-IT, a leading supplier of dealer management systems for franchise markets in the automotive, agricultural, truck and construction equipment sectors, was acquired. In Ecuador, Seriva, a supplier of liquidity management software for financial institutions in Latin America, was incorporated.

In Hungary, the company Béker-Soft Informatika was acquired, a leading supplier and developer of complete software solutions for Hungarian healthcare institutions. Their products include fully integrated and comprehensive software systems for patient management and radiology.

Constellation has also managed to invest a large portion of its cash flow by making several major acquisitions. Last year, for example, we wrote about the acquisition of Optimal Blue:

-

- The most striking development, of course, was the acquisition of Optimal Blue, which the Canadians managed to acquire for an absurdly low price of USD 700 million, and which, incidentally, was largely pre-financed by the selling party. We would like to refer you to our newsletter dated 6 October, where the incredible terms of the deal are explained. Suffice it to say that Constellation has made one of the most attractive deals in the company’s history, and that’s not even taking into account last quarter’s cash flow and revenue figures.

-

- Once again, the investment holding company managed to reinvest its entire cash flow in attractive acquisitions that meet its high return requirements. Constellation now acquires around 100 companies per year. According to a recent publication, the database of acquisition targets contains around 200,000 companies, so from that perspective, there is still a long way to go…

Altera Digital Health

In 2022, Constellation Software acquired the hospital software division of Allscripts, which was later renamed Altera, for USD 700 million. As a division within a larger publicly traded organisation, Altera received little attention from senior management, who seemed intent on gradually phasing out the division.

Constellation has a comprehensive roadmap for making acquired companies (more) successful, but due to the size of the acquisition, investors and analysts had doubts about whether Constellation could apply that roadmap in the case of Altera. Now that we have several quarters of figures, we can take stock.

An interesting fact that emerged during Constellation’s shareholders’ meeting was that the large Altera company has been divided internally into several small subsidiaries, all of which are benchmarked independently. This creates a much greater sense of ownership and responsibility among the individual teams.

Constellation also set to work raising the prices of contracts that had not been indexed for years. The focus was also clearly on transforming the business model, moving more towards software rather than hardware and related services. When a customer did not go along with the change, Constellation was unyielding: profit and cash flow are crucial, and if one is not prepared to pay a market-based price, then it is better to focus on other customers.

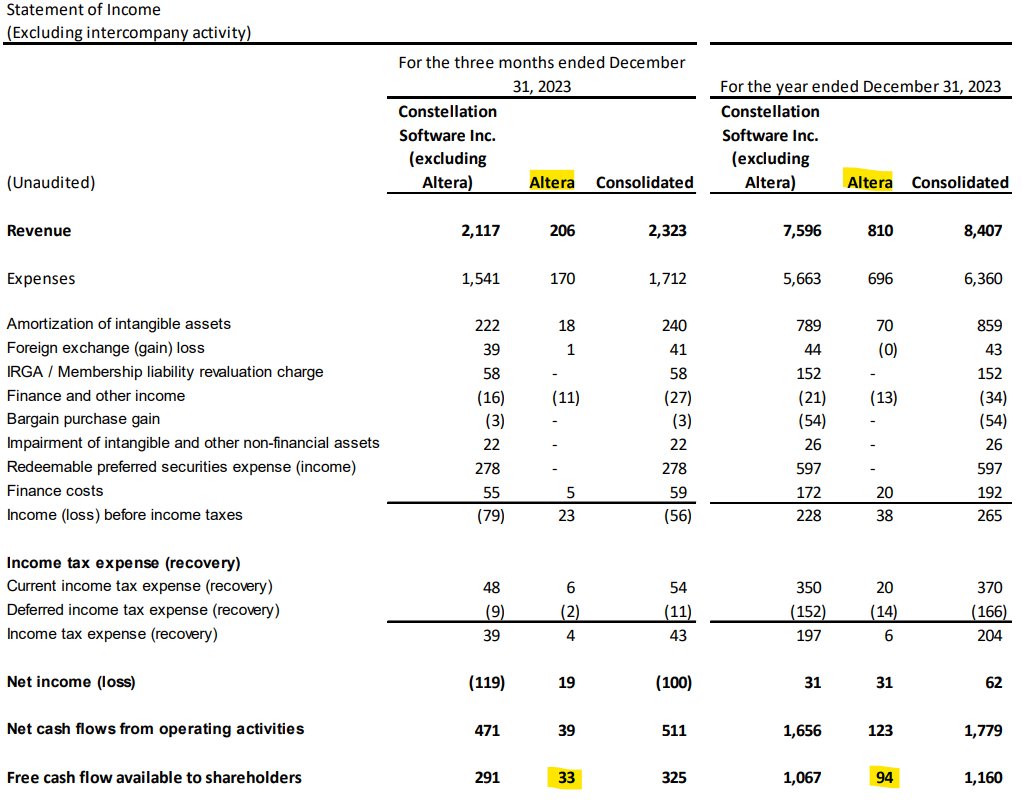

After several quarters of declining turnover, largely as a result of these deliberate strategic choices, the fourth quarter of 2023 finally saw a turnaround. Turnover rose by 4%, as shown in the figure above. It is too early to speak of a definitive turnaround, but it seems that the focus can gradually shift back to growth.

It is also important to note that Altera now makes a significant contribution to revenue and operating cash flow, as shown in the table below. Operating cash flow amounted to USD 123 million in 2023, while free cash flow amounted to USD 94 million. Twitter user Kip Johann-Berkel calculated that Altera, based on the figures for 2023 and the amount Constellation paid for it, already had a has yielded a return on investment of more than 20%.

The Berkshire Hathaway of the software world

Constellation’s business model primarily involves acquiring smaller software companies that are market leaders in specific niches. Because these niches are highly specialised and sector-specific (e.g. software for golf courses, local authorities, etc.), larger software companies are not interested in focusing on such sectors. This gives Constellation a sustainable competitive advantage.

Furthermore, thanks to the market-leading position held by more than 1,000 subsidiaries in hundreds of markets, customers are unlikely to switch to other providers. After all, expenditure on the software package is generally quite limited in relation to total turnover (often less than 1%), while implementing a new software system is very time-consuming. This ensures Constellation long-term customer relationships and predictable, recurring cash flows. Furthermore, the investment holding company can pass on virtually all inflation costs to its customers.

The organisational structure is highly decentralised. At holding company level, the focus is primarily on sharing best practices, setting return targets for acquisitions, creating an innovative, long-term-oriented organisational structure and, of course, allocating capital (especially for large acquisitions). In many respects, it is reminiscent of the organisational structure of Berkshire Hathaway.

In 2019, Michael Gielkens, representing Tresor Capital, asked CEO Mark Leonard and Vice Chairman Larry Cunningham at the shareholders’ meeting what they considered to be the most important similarities and differences between Berkshire and Constellation. Mark Leonard was charmed by the comparison, but nevertheless sees some important differences:

-

- “The main difference is that we are a group of colleagues, whereas Berkshire is purely a holding company. I believe we try to share best practices much more within the group and look for lessons for the whole group, compared to the Berkshire model with two exceptional investors at its core.

-

- I think that when the managing directors of our operational groups think about their individual companies, they think about the great leaders of those companies. And in turn, they try to provide these leaders with input from other colleagues’ best practices. So we had to filter it down a bit, keep it small, approaching the breakdown at the business unit level, not only in terms of comparable activities, but also in terms of capital allocation. So it’s a slightly different configuration.”

Leonard then asked Larry Cunningham to answer the question. Thanks to his research into companies such as Constellation, Berkshire (he co-authored a book with Buffett) and Markel (where he is also a director), he is able to offer a unique perspective:

- ” The main difference is that this company focuses on vertical software markets, whereas Berkshire invests in all kinds of sectors. The main similarities are a corporate culture based on patient and disciplined capital allocation, which is focused on the long term, takes owners/shareholders into account, and is highly focused on the return on invested capital. As a shareholder and fan of both Constellation and Berkshire, I find this a very apt comparison.

Constellation Software ended the trading week on the Toronto Stock Exchange at a price of CAD 3.793.84 per share.

Exor Invests in Clarivate

The Dutch investment holding company Exor (Amsterdam: EXO), in which the Italian Agnelli family has a controlling interest, announced this week that it has acquired a 10% stake in the British company Clarivate, a leading global provider of transformative data. Financial details were not disclosed, but given the market capitalisation, the deal appears to be worth around EUR 450 million, or about 1% of Exor’s net asset value.

As part of the deal, Suzanne Heywood will be nominated for election to Clarivate’s supervisory board at the company’s next annual general meeting of shareholders on 7 May 2024. Under the terms of the agreement, Exor, which currently owns 10.1% of Clarivate, may increase its stake to 17.5% of Clarivate’s outstanding share capital.

Jonathan Gear, the Chief Executive Officer of Clarivate, stated:

- “We welcome Exor’s commitment to our strategy as a long-term investor. I am encouraged by their show of confidence, which expresses trust in our ability to deliver solutions that our customers rely on to fuel the world’s greatest breakthroughs.”

Andy Snyder, Chairman of the Board of Directors of Clarivate, said:

- “We look forward to Suzanne joining the board of directors. She will bring a wealth of in-depth experience from multiple board positions at major global companies, and her guidance will be invaluable as we continue to transform Clarivate into a leading intelligence provider.”

The video above on Exor’s LinkedIn channel provides more information about Clarivate. Click on the image to watch the video.

Suzanne Heywood, Chief Operating Officer of Exor, said on behalf of the family holding company:

- “We are delighted to be shareholders in Clarivate, a global provider of data, analytics, technology and expert services to various sectors, including healthcare. By bringing our experience in building great companies at board level, we look forward to helping Clarivate achieve ambitious goals and realise its full potential.”

This is yet another step towards technology and healthcare, areas in which the family holding company is deliberately seeking to increase its exposure. Significant amounts have already been invested in the Dutch company Philips, the French family business Institut Merieux and Lifenet, all of which are also active in technology and/or healthcare.

Exor ended the trading week on the Amsterdam stock exchange at a price of EUR 101.40 per share.

MBB Acquires 6.9% of Outstanding Shares

The German investment holding company MBB SE (Frankfurt: MBB), in which founders Nesemeier and Freimuth hold a controlling interest, announced the results of the tender offer this week. Through the tender offer, MBB offered to purchase up to 10% of the outstanding shares at a price of EUR 96 per share.

A total of 393,522 shares were offered by investors. This corresponds to approximately 6.9% of the share capital and a total purchase price excluding acquisition costs of EUR 37.8 million. The settlement and payment of the purchase price to the custodian banks is expected to take place on 13 March 2024.

In addition to external shareholders, one of MBB’s two largest shareholders, Gert-Maria Freimuth, also offered part of his shares. Major shareholder and Executive Chairman of MBB, Dr Christof Nesemeier, did not participate in the buyback.

It comes as no surprise that Nesemeier did not participate, as the founder has been buying shares worth millions of euros for years. He truly considers MBB his baby and wants to increase his stake at attractive levels. However, we have learned from MBB CEO Constantin Mang that Freimuth also has other investments outside MBB in which he is putting capital to work.

Nesemeier and Freimuth in 2012

Freimuth’s participation means that the so-called free float, the number of shares that are not in fixed hands remains relatively stable. This benefits liquidity. We have often suggested that Freimuth could sell part of his shares to MBB. This would allow the family holding company to kill two birds with one stone: make a big dent in its substantial cash position and reduce the number of outstanding shares without affecting the free float. It is good to see that this has now happened in part.

MBB wrote in its press release:

- Against the backdrop of the Group’s unique character and high cash flow, MBB aims to increase the value per share through the buyback and still has sufficient financial resources for organic growth and growth through acquisitions.

On 26 March, the family holding company will publish its annual figures, which all shareholders will be eagerly awaiting. We will, of course, keep you informed via this newsletter.

MBB ended the trading week on the Frankfurt Stock Exchange at a price of EUR 94.20 per share.

Markel CEO Tom Gayner Shows Himself to Be Realistic and Combative

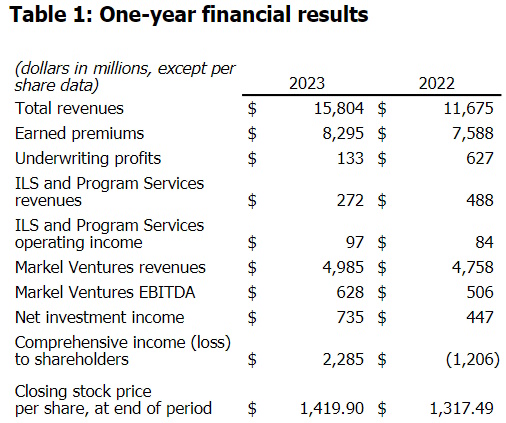

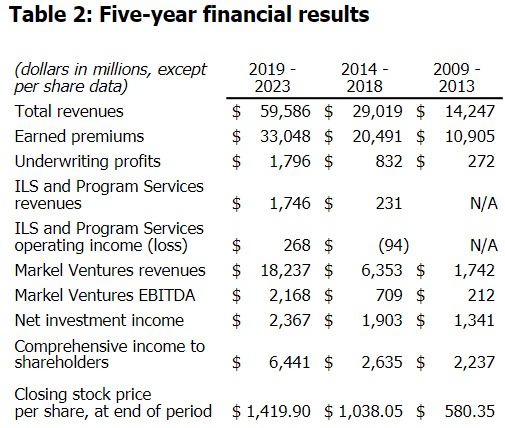

CEO Tom Gayner of the American investment holding company Markel Group (New York: MKL) recently published his letter to shareholders. In our monthly report for February, we will take a closer look at the timeless lessons that Gayner and Buffett conveyed in their shareholder letters. This week, we will focus more on discussing the figures.

Gayner says that 2023 is a year of two halves. On the one hand, the investment portfolio and the non-insurance companies within Markel Ventures did really well, but on the other hand, the insurance division was a bit of a let-down. Gayner starts with what went well:

-

- In 2023, we achieved excellent returns in our Markel Ventures activities, investment activities and certain parts of our insurance activities. The raw figures for 2023 only tell part of the story. Figures follow the story of our dedicated service culture, but never fully reflect the spirit it creates. Numbers are “the map, not the territory”.

-

- I am pleased to report that the spirit and culture of the Markel Group are alive and well. I am also pleased to report that we will be sharing many positive figures, along with a few that disappoint us.

-

- In 2023, we implemented a number of important management changes in our insurance activities and made some difficult decisions. This is nothing new in our long history. Change and difficult decisions are part and parcel of being an organisation with more than 20,000 people and decades of history. To create the future we are all looking for, we need to embrace change and be prepared to make difficult decisions.

- Change often unsettles people. Reality requires us to put aside our discomfort and embrace it. There is no way to remain relevant to the world of 2024 and beyond without doing so. As always, our values will continue to guide us as we adapt.

Gayner discusses the three-branch architecture that Markel has deliberately built in:

-

- Over the past decades, we have designed a three-engine system to propel the Markel Group forward. We believe that three engines create a superior system, with more self-reinforcing resilience and sustainability than is possible with a single-engine machine.

-

- In our first annual report in 1986 as a listed company, we wrote that we would ‘specialise and diversify’ to achieve excellent financial results. We believe that the three-engine system creates an environment in which we can do just that. Three engines also work together to strengthen our ability to maintain a long-term perspective.

-

- Three powerful engines ensure that we can make progress in a given year, even if one (or two) of the engines is not running at full capacity. In 1930, we started with the only engine of our insurance company. Every insurance company has a number of investments (usually in fixed-income securities), but we wanted to get more out of our investment activities.

-

- Since our initial public offering in 1986, we have placed additional emphasis on our investment activities and expanded them to include substantial holdings of public equities. We wanted to achieve better returns than were possible with the traditional focus on fixed-income securities that is common among most insurers. We designed our investment system to be a separate and distinctive engine for Markel.

-

- In 2005, with the acquisition of a controlling interest in AMF Bakery Systems, we expanded the scope of our investment engine to include majority interests in non-insurance businesses. This acquisition gave rise to the third engine, Markel Ventures.

-

- The beauty of this system is that it increases the resilience and sustainability of the Markel Group. Each engine on its own can provide enough thrust to propel us forward. We can absorb shocks and difficult conditions in any one engine, because the other two engines can keep us moving forward.

-

- We also believe that the three-engine system helps us adapt to an ever-changing world. We recognise that new opportunities and challenges are constantly emerging. With the Markel Group’s three engines, we can accommodate and adapt to challenges and opportunities, regardless of their form or industry. We believe that this system also strengthens our ability to remain focused in the long term. We do not depend on individual companies for the growth of the Markel Group. We also keep our debt levels low.

-

- Everything we do is designed to strengthen our ability to remain focused solely on doing what is right for the long term. The three-engine system acts as an adaptation and volatility absorption machine. Our culture has helped to create this system. And the system works to reinforce and strengthen our culture.

Insurance

What does success look like in an insurance division, Gayner asks the reader:

-

- It starts with a combined ratio of less than 100%. In 2023, we reported a combined ratio of 98%. This fell short of what we had planned at the beginning of this year.

-

- One of our competitive advantages at Markel is that we underwrite complex and difficult types of insurance. Few organisations are able to handle the risks that we regularly take on. Our decades-long track record of profitability in our insurance operations is a testament to our skills and culture of tackling complexity and difficulty – and doing it well.

-

- Complexity is, by definition, difficult. We don’t always get it right. Our results for 2023 fell short of our targets. We faced more than our usual challenges in using our competitive advantage to generate underwriting profits, and we did not achieve sufficient returns on the capital we used to write insurance.

-

- Despite our challenges in 2023, we enjoyed a number of bright spots. Aggregated combined ratios add up the results of multiple product lines. The single, combined number does not reflect the excellent results achieved in different parts of our business.

Gayner mentions a few positives; many things did indeed go well. But there were also a few setbacks:

-

- Unfortunately, we also had areas within our Specialty activities where the results were unacceptable. Part of the shortfall was the result of unforced errors on our part.

-

- In particular, our first attempt to insure intellectual property with collateral did not go well. The original product was not well designed. The risk share between us as the insurer and the purchasers of that insurance was not right.

-

- In response, we have changed the terms, conditions and nature of these coverages. We have also changed the management teams responsible for that product. We will strive not to repeat these mistakes.

-

- We must always be prepared to accept new risks and adapt. The world continues to change at an ever-increasing pace. Insurance must change too. We would stagnate if we did not embrace change. We must also never forget the basic principles of insurance. This means that we must take full account of the overall circumstances of what we are insuring, why people might buy that insurance and what the possible outcomes might be.

-

- We are committed to experimentation, innovation and continuous learning in order to remain relevant in a changing world. Sometimes this will be costly and difficult – this was certainly the case with intellectual property collateralised lending. We could and should have done better. We are taking steps to learn more efficiently and effectively in the future.

-

- We have also suffered losses in our insurance results as a result of large-scale natural disasters such as this year’s wildfires in Hawaii. Every year seems to bring a new crop of large-scale insured losses. 2023 was no exception. Whether these events are the result of climate change or not, we continue to reduce our exposure to this type of event.

-

- We will also continue to raise rates to reflect the higher costs of covering catastrophe losses. As part of the insurance industry, we will also continue to support efforts such as updating building codes to create stronger and more resilient properties.

-

- Rising costs and reduced availability of insurance in places such as California and Florida appear to be influencing where people live. Although it takes time to balance risk and return, the market continues to struggle to find the right balance in a way that is fair to both consumers and insurers.

-

- Consumers need insurance cover to protect their homes, businesses and personal lives. Insurers must provide the necessary cover. They must also do so in a profitable manner so that they have the resources to pay claims when they fall due.

-

- In 2023, we continued to navigate the effects of inflation. Inflation comes in many forms. Core inflation is higher prices for the same products or services. Car bumpers, boxes of breakfast cereal, supplies for improving or renovating your home, labour hours, replacement chargers for mobile phones, tuition fees, doctor’s visits and anything else you can think of continue to rise in price.

-

- As insurers, we purchase everyday products and services to help our policyholders. Historically, we predict what those costs will be. We then incorporate these estimates into the pricing of the insurance policies we write today. This is not a new phenomenon, nor is it unique to Markel.

-

- Historically, we have been able to predict these costs with sufficient accuracy to ensure that our final claims costs are comfortably covered by our initial estimates. This remained the case in 2023. At the same time, it became more difficult to predict costs due to persistent and widespread inflation. We expect to be able to adequately price and reserve future loss costs in 2024 and beyond. That is the core of what we do.

-

- ‘Social inflation’ describes a different kind of inflation. Social inflation (the ‘new new’ term for loss trend) is a recurring cycle in the insurance industry. As was the case in the inflationary climate in the US in the 1970s and early 1980s, spikes in legal costs and jury awards, fuelled by factors such as litigation financing, cause a dramatic increase in total loss costs.

-

- At the time, the asbestos crisis was the main reason for the rise in loss costs. Nowadays, this is referred to as social inflation. Insurance remains a crucial part of our economic system. Modern society cannot do without it. Very few people or companies can buy houses, start and run businesses, enter into long-term commitments and find the necessary financing without insurance cover.

-

- Just as happened in the aftermath of the ‘insurance crisis’ of the 1970s and 1980s, issues such as tort reform, loser pays changes in liability legislation, changes in insurance coverage limits and other forces combined to bring the ‘inflation’ of that era under control.

-

- Today seems to me to be a similar era of rebalancing. Ongoing actions in key states such as California and Florida will show how we can find a way forward to improve and rebalance insurance markets.

-

- This is nothing new. The problems of social inflation can and will be solved. It will take time and compromise to stabilise the markets, but it will happen. As economist Herbert Stein said in the 1970s: ‘Things that cannot happen will not happen, and things that must happen will happen.’

-

- We need functioning and balanced insurance markets to keep our economy on track. It is a “must do” and it will happen. In 2023, we fell short in anticipating and predicting the extent of social inflation in certain parts of our insurance business.

-

- In response, we have increased our discipline in order to operate profitably, as we face significant impacts from inflation. Where necessary, we are lowering policy limits and tightening conditions. We are charging more per unit of risk and increasing the data intensity and pace of feedback loops to ensure we can adapt more quickly to changing environments.

-

- We place responsibility for our results directly with proven insurers. We are refining our methods for aggregating total exposures and rebalancing our risk portfolio, thereby achieving greater diversification in our product mix. We are acting with discipline to move away from activities that do not meet our profitability requirements. Together, these actions should ensure a better balance between risk and reward.

-

- Finally, another factor behind our higher combined ratio in 2023 came from our product mix. The 2023 property insurance results for the sector showed the benefits of several years of higher prices and fewer large-scale natural disasters making the headlines. As such, insurers with larger property exposures generally benefited more from a good year than accident-focused insurers.

-

- Although we construct a balanced portfolio of both accident and property risks, we lean modestly towards accidents, including those with long-tail risks. Given our historical product mix, our results in 2023 have not captured as much of the profitability available in property categories. Over time, results for accident lines are typically less volatile than those for property. There should be no inherent difference in the overall economics between the two classes over the longer term, but they can and will perform differently in any given year.

-

- Fortunately, we have benefited from strong market conditions in the property market. Both through the property risks we continue to underwrite and through the economy we earn from our activities at our Nephila company. Several years ago, we transferred a significant portion of our larger property exposure to Nephila. We did this because we believed that Nephila’s capital providers operated with different capital cost barriers.

-

- That is why we believed that large property risks for the Markel Group would be better served through the ILS market than through the balance sheet of a traditional insurance company. This idea worked. You can start to see it in the results for 2023.

-

- Nephila delivered excellent returns for its investors this year. And, as it should be, they earned both management fees and profit-sharing compensation in 2023. (Note that the profit-sharing contribution remained modest as some funds started below their highest level in 2023. Now, virtually all funds are above that level. This will significantly improve Nephila’s future profitability.)

-

- These results are beginning to validate our original thesis for acquiring Nephila. We are pleased to report that they earned USD 22 million in pre-tax profits this year, compared to a loss of USD 16 million in 2022. There are also accounting and timing dynamics arising from the fact that our large real estate exposures are covered by capital from the Nephila investor base rather than our traditional activities.

- We will recognise our income from property exposures through management fees and profit shares from Nephila, as opposed to the combined ratio profitability points reported by the insurance engine.

-

- Writing large property risks through Nephila also covers the Markel Group’s downside risks of large losses when the wind blows, earthquakes shake, and things go wrong at night. However we recognise the good news of the Markel Group’s profitable property insurance activities, it works to the advantage of our shareholders.

-

- We expect Nephila’s results to attract positive attention from their investors. We expect assets under management to start growing again as a result of the underlying performance of what Nephila investors earned in 2023.

-

- Furthermore, Matt Freeman and his team at State National continue to achieve excellent results. Given the outstanding results at State National, we will expand State National’s activities globally in 2024. We look forward to reporting more on their progress in the coming years.

- In summary, I believe we have the necessary leadership, responsibility, tools, licences, technology and skills to put Markel back at the forefront of global specialist insurance organisations. As Robert Frost said, ‘The best way out is through.’ The work is hard. It will take time to see results. But I believe we can do it. “

You can read Gayner’s full letter to shareholders here.

Markel ended the trading week on the New York Stock Exchange at a price of USD 1,496.64 per share.