Sofina: Unjustified high discount offers great buying opportunity

The family holding company Sofina saw its net asset value fall 16 % to 284 euros per share in 2022 for the first time in 10 years. On the stock exchange, the share lost 50% of its value. Sofina invests heavily in young tech companies, the corner where the hits have been. The hefty premium at the end of 2021 was exaggerated, but now investors seem to have gone too far in their pessimism.

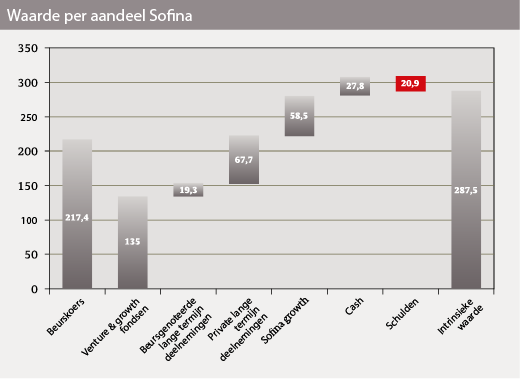

Meanwhile, due to the listed positions, the net asset value recovered somewhat to 287.50 euros, implying an undervaluation of 24.5 %. 89 % of the venture capital funds are thereby still valued on the basis of reports as of September 2022. The remaining 11 % are listed positions in these funds taken at closing prices in 2022.

According to Sofina, a 10 % drop in the value of Private Funds results in a 12 euro drop in net asset value. A drop of 12 euros or even 24 euros implies an undervaluation of 21.2% and 17.6%, respectively. Thus, at current levels, investors are more than compensated for this possible risk.

There are arguments to be made that Sofina does not deserve undervaluation at all. It is the only way for many investors to access Sequoia investment funds and attractive private companies such as ByteDance (TikTok), Cognita and Drylock. Transparency toward investors has improved significantly in recent years. Dividend histocrat status underpins its financially solid history, while its track record of significant value creation speaks for itself.

Sentiment

A holding company’s discount or premium coincides with investor sentiment and risk appetite. In 2021, optimism reigned supreme. The press wrote about one unicorn after another (a startup worth over 1 billion euros) from the portfolio. Everything Sofina touched seemed to turn to gold. This sentiment completely reversed in 2022, following negative news about Byju’s, THG and Zilingo. Each time, this resulted in a sharp price bump.

Investors do not seem to fully grasp the asymmetric risk-return ratio of venture capital. As a rule, in a venture capital portfolio, 20-40% of young companies will fail to deliver on their promise, the middle perform reasonably well, and 10-20% of companies become true successes, more than compensating for the losers and providing attractive total returns. History shows that Sofina has proven above-average at selecting those successes, in part because of its unique and long-term relationships with the best venture capital managers in the world and its own rigorous selection criteria.

The companies that fail are often highlighted excessively. A recent example concerns Forma Brands, a Sofina associate that recently filed for bankruptcy. After publication of this in Belgian media, 900 million euros in stock market value evaporated in two days. However, the latest reporting shows that Forma is not listed as a holding worth more than 10 million euros. 900 million euros of stock market value for a position of less than 10 million euros, that is excessive.

Private valuations

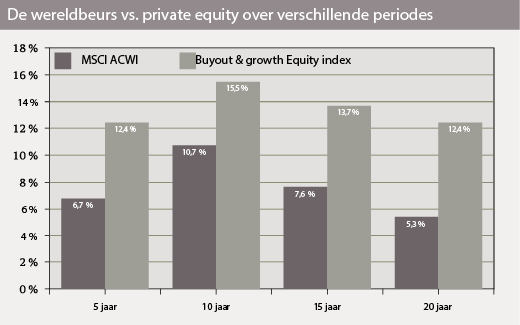

Private equity is an attractive asset class that, according to J.P. Morgan (see chart 2), is well ahead of equity markets. Sofina has been successfully investing in this sector since 1978, giving it access to the best networks and the best managers. Through Sequoia, the holding company was thus behind companies such as Google, YouTube, Facebook, Instagram and WhatsApp.

Access to Sequoia is only possible for the happy few. The network built up in this world is a true competitive advantage for Sofina. Private equity usually requires a minimum investment of more than 1 million euros and is highly illiquid, but through Sofina one buys a diversified portfolio of dozens of funds that is tradable daily.

Sofina’s steep discount exists in part because of investor doubts about valuations within Private Funds. After all, valuations in private markets correct less quickly than in the stock market, so further write-downs are quite possible. However, the discount already seems to take ample account of that.

Valuations in private markets are more robust than their public counterpart in times of crisis. Research by Neuberger Berman based on the 2000-2002 crisis shows that private equity has less harsh declines and a faster recovery than companies in the stock market.

Sofina invests virtually no Buyout but rather venture and growth capital. In the newsletter, Sofina writes, “Early stage investments are better protected from public market volatility than late stage investments, as these companies are further away from an IPO. Moreover, the quality of the underlying portfolio companies and the strength of secular growth themes that support their performance over a longer horizon should temper the downward trend.”

During Degroof Petercam’s holding conference last December, indicated that high-quality companies clearly stand out: “Companies that do not need cash in the short term, therefore have a long horizon and (continue to) do well, have moved little in terms of valuation.”

Boël also shed more light on the rigorous valuation process, using independent experts. Sofina uses a valuation at which it expects to be able to sell the stake at that time. Boël indicated that the exits to date have almost always taken place at or above this valuation, which is reassuring.

Diversification

In the newsletter, Boël emphasizes that regions like India continue to perform well. By investing against the cycle when others are actually pulling back, Sofina has built in protection. Diversification across sectors and regions, as well as a focus on sustainable growth and innovation, have enabled Sofina to meet current challenges and demonstrate resilience.

In addition to young technology companies, a third of the portfolio consists of more mature, profitable companies, which continue to perform excellently. Reports of an upcoming Mamaearth IPO or the sale of Biotech Dental show that it is certainly not all doom and gloom at Sofina.

War chest

The fact that Sofina was able to achieve numerous exits is an important sign that, even in difficult market conditions, the portfolio is able to generate liquidity. Sofina had 900 million euros of cash and 900 million euros of lines of credit available at the end of 2022.

With 1.8 billion in liquidity, Sofina can hunt to take advantage of the difficult market environment to plant the seeds and reap during the next boom phase. Warren Buffett once said, “Be greedy when others are fearful, and be fearful when others are greedy.” That certainly applies to Sofina stock as well.