Herewith you receive our monthly report in which we share current insights. Each month we discuss different topics, ranging from trends and opportunities in the financial markets to in-depth analyses of relevant developments or strategic themes. Our goal is to provide you with valuable information in line with the constantly changing investment environment so that you are better informed about the dynamics of today’s financial world.

Why Active Stock Selection Works – And How Tresor Capital Is Addressing It

The debate over active versus passive investing has raged for decades. Much academic research argues that most fund managers cannot consistently beat the market. In particular, broad U.S. indices such as the S&P 500 are structurally beaten by only 5 to 10% of active fund managers. This helps explain the growing popularity of ETFs and the “hammock investing” often referred to in the media.”

Yet there are compelling examples that demonstrate that active management can indeed add value. Investors such as Warren Buffett, certain hedge funds and specialized investment boutiques prove time and again that careful stock selection (so-called stock picking) pays off. Characteristically, these successful investors do not pretend to be able to make perfect predictions about market developments, but rather manage to create long-term value with a disciplined approach and a focus on structural risk premiums.

A recent article in The Globe and Mail also highlights that active stock selection does work, if executed with a clear strategy and a long-term horizon. This fits perfectly with the investment philosophy of Tresor Capital, an investment boutique that consciously takes an active and fundamental approach. Tresor Capital focuses specifically on family holdings and companies that create value structurally, using a proprietary selection process that is very similar to the principles of renowned investors such as Warren Buffett.

The Power of Stock Picking – Why Does It Still Work

George Athanassakos, distinguished professor of finance and holder of the Ben Graham Chair in Value Investing at the Ivey Business School (Western University, Canada), highlights in a recent article in The Globe and Mail that the enormous popularity of ETFs suggests that financial markets are more efficient than ever before. Indeed, more capital now flows into passive ETFs than into actively managed funds.

But are ETFs really the best solution? That depends a lot on how efficient the financial markets actually are. Does it still make sense to actively seek out managers trying to beat the market, or is it wiser to simply choose the cheapest provider of a passive index?

Athanassakos concludes that rational behavior by dominant market participants is essential for the emergence of efficient markets – markets in which no one has a structural information advantage and in which it would be impossible to consistently achieve additional returns over and above the market (index).

However, the recently deceased behavioral economist and Nobel laureate Daniel Kahneman argued that investors are especially bad at making rational decisions in times of uncertainty. It is precisely then that people behave in a stressed, irrational and unpredictable way – exactly the opposite of what the efficient market hypothesis assumes. In times of stress, investors become overly risk averse, while in times of prosperity they seek out too much risk. In short, investors over-extrapolate the recent past, resulting in herd behavior.

Although we are not psychologists or behavioral economists, an apt stock market wisdom holds true in the financial world: those who walk behind the herd keep walking in cow dung.

A thought experiment

In this context, the following thought experiment is also interesting: suppose the Trump administration establishes a sovereign wealth fund with a budget of one trillion dollars, the Netherlands does the same, as does China, and Warren Buffett is also given a similar mandate. Despite each fund being managed by rational, professional investors, it seems out of the question that these four parties would end up building the same portfolio or replicating the same market index. Different frameworks, horizons, objectives, investment experience and management incentives lead to different choices and allocations.

It seems to be mainly the capital flows of such dominant parties that determine or disrupt the degree of market equilibrium, and thus provide room for active management. When it is difficult to anticipate the behavior of the majority of investors – here not derogatorily referred to as “herd,” since investing is left to professional parties – it is essential precisely not to move with the masses. Only by deviating from the herd can you beat the market.

Look at successful investors and try to identify the risk premium they want to receive. What is striking about this is that the longer the patience required to cash in on that risk premium, the greater the expected return is usually. This calls for portfolios that deliberately deviate significantly from the benchmark. Athanassakos even explicitly states that too broad diversification into very many stocks often leads to disappointing performance from active managers. He also warns that simply naively copying stocks from successful investors does not create outperformance. Portfolio construction, timing and conviction are at least as important for achieving additional returns.

Athanassakos cites a study by Scott Reardon. He comes to a similar conclusion and emphasizes that several value managers consistently manage to beat the benchmark over long periods of time. Consider legendary investors such as John Maynard Keynes, Prem Watsa and, of course, Warren Buffett and Charlie Munger.

Warren Buffett and the Power of Stock Picking

Warren Buffett and his associate Charlie Munger are known as the ultimate stock pickers. Since Buffett took over Berkshire Hathaway in 1965, the stock has realized an annual return of 19.8% compared to 10.2% for the S&P 500, making Berkshire Hathaway’s investment principles seem timeless and an important guide to successful investing for Tresor Capital as well:

- “Price is what you pay, value is what you get.”

Like Buffett, Tresor focuses on stocks that trade below their intrinsic value. This requires in-depth analysis of a company’s fundamental value and the discipline to wait patiently for an attractive entry price. - “Never lose money”

Limiting downside risk is essential. Tresor does this by investing in stable family holdings and companies with strong balance sheets. This ensures resilience in difficult market conditions and minimizes permanent capital losses. - Long-term perspective

Both Buffett and Tresor rarely sell stocks unless the underlying investment case changes structurally. This patient, strategic approach lowers transaction costs and allows investors to take full advantage of compound returns. - Focus on companies with a strong “moat”

Buffett invests in companies with a sustainable competitive advantage (a “moat”). Tresor also applies this principle, focusing on holdings and companies with strong governance, robust earnings models and good diversification. These companies have a structural advantage over competitors and can therefore generate superior returns over the long term.

Pieter Slegers: another example of an active investor

In addition to Warren Buffett, we also know successful active investors in the Benelux. One of the better-known names is Pieter Slegers, who, like Buffett, applies a structured approach with a strong focus on high-quality, undervalued stocks. Slegers became known as the face behind the successful investment newsletter Compounding Quality and its Dutch-language variant, De Kwaliteitsbelegger.

Recently, Slegers participated in a debate during the Investment Summit in Antwerp, where he discussed active versus passive investing with Martijn Rozemuller of Vaneck, a provider of passive ETFs. During this debate, Slegers emphasized that markets are never fully efficient and that opportunities always exist for patient investors who are willing to perform in-depth analysis.

Even Rozemuller acknowledged that even a passive investor ultimately makes an active choice when selecting specific ETFs, themes or indices. While passive investing can be a good solution for many investors, he argued that active investing certainly makes sense if one focuses on:

- Small- and mid-cap stocks with demonstrable undervaluation.

- A concentrated portfolio of winners: compelling companies (“high conviction stocks”). In doing so, he emphasized that fund managers with UCITS mutual funds are often bound by diversification requirements, which do not allow them to sufficiently grow their best stocks.

- Companies with a strong “moat” (sustainable competitive advantage), emphasizing strong cash flows and high Return on Invested Capital (ROIC).

A well-known example of a successful active strategy is the Morningstar Wide Moat Index, which selects companies based on their structural competitive advantages. On average, this index achieves 4% better returns per year than the S&P 500, plus with less volatility. It shows that active investing, especially in certain niches and market segments, is proven to add value.

Incidentally, Pieter Slegers organized a webinar on active investing with Tresor Capital partner Michael Gielkens on March 24. The recording of this will soon be available for review via the Tresor Capital website and offers valuable insights for investors looking to actively invest.

While we do not claim to emulate the achievements of such luminaries as Buffett and Munger, we do take a similar long-term view. Proven principles from their thinking, as well as the insights of Athanassakos, form an important foundation for our investment strategy. Tresor Capital applies a structured, active approach, with a strong focus on undervalued companies and carefully selected family holdings.

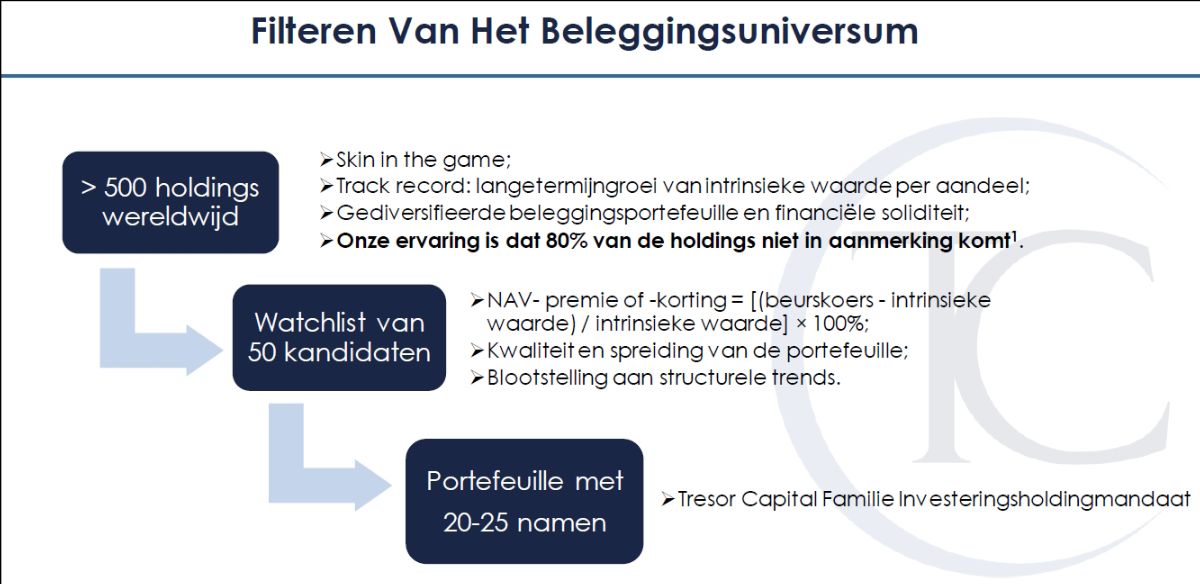

We choose only the best-performing family holding companies that have a proven track record of creating long-term shareholder value and that offer access to companies with sustainable competitiveness (moat) through their portfolio.

However, our active involvement goes beyond investment selection. We actively manage the weighting of these holdings within our portfolio, hold discussions with management, closely monitor company developments and strive to understand companies not only from the outside, but also from the inside.

This thorough approach allows us to make informed decisions and actively add value to our portfolio. This strategy has so far resulted in a structural net outperformance of approximately 1.5% per year over our benchmark, which consists of an equal-weighted combination of the MSCI World Index and the MSCI World Small Cap Index.

Conclusion: stock picking works, provided you do it carefully

The idea that stock picking would be outdated is convincingly refuted by Athanassakos and successful investors such as Buffett. Of course, far from everyone succeeds in beating the market, but with a disciplined approach, careful selection, patience and in-depth analysis, stock picking can demonstrably add value. So stock picking is not dead, but it remains a profession in its own right – with investors especially needing to avoid judging funds or managers solely on short-term results.

For more information about any of our propositions, please contact your contact person or send an email to info@tresorcapital.nl.

Sincerely,

Michel Salden

Investment Manager