Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Update Of Our Investment Process

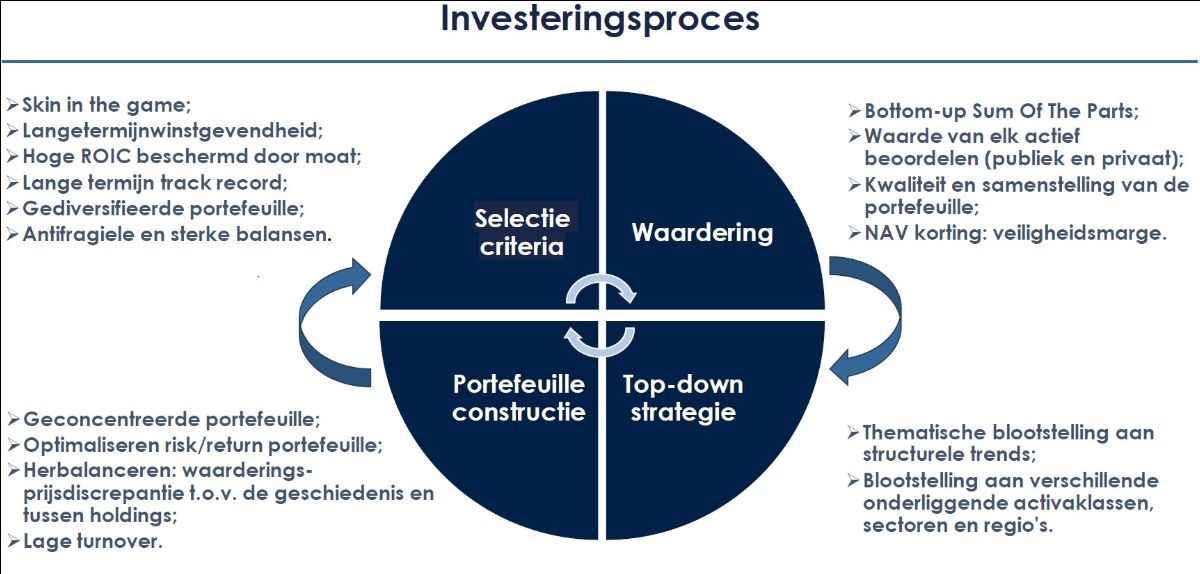

We have revamped the presentation on our investment process. Tresor Capital’s philosophy is that (listed) family holdings generate a structural premium over the general stock market.

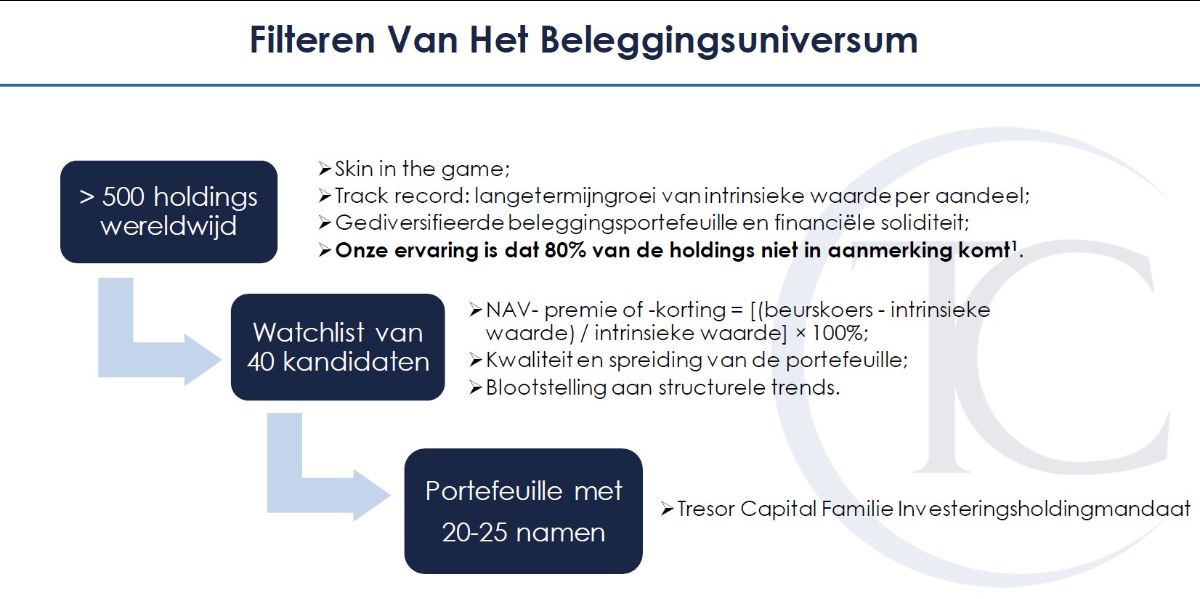

However, not all family holding companies appear capable of delivering a structural premium. In our experience, in 80% of companies, families add limited value. Too often, family holding companies are used as a plaything, or lack a clear focus between the individual companies. So active selection is necessary in our view.

To recognize early which holdings actually create value for us as co-shareholders, we use the filtering and selection process below.

In our view, the management of an Investor AB, Berkshire Hathaway or Constellation Software is the benchmark for how a founding family successfully manages a holding portfolio: decentralized responsibility, low management costs for the group and effective reallocation of incoming cash flows.

When analyzing new holdings, we need to see these core qualities reflected in the corporate culture. Once a shortlist of names is established, we look at the discount to intrinsic value, exposure to emerging secular trends and themes, and build the weight in line with our conviction in portfolio construction. This results in a concentrated basket of companies.

When we identify new trends and themes, we place stronger emphasis on specific holdings. A recent example is our strategy in the second half of the year, responding to the positive outlook of managers in private markets. While our expectation that U.S. interest rates would continue to fall has not yet materialized, strong economic growth of around 3% by 2024 continues to support a positive outlook for private equity managers.Trump’s election win gives the sector an additional boost: individuals are allowed to invest more in private markets in their 401(k) pensions, there are lower taxes on corporate profits, deregulation, and a more favorable environment for IPOs. This makes it easier for private equity managers to cash in on their deals more quickly. Brookfield and KKR are taking full advantage of this trend and are core positions in our portfolio for these reasons.

Tresor works with a concentrated portfolio of a limited number of holdings. The 20-25 names in the portfolio are continuously evaluated, comparing them with short-listed candidates.

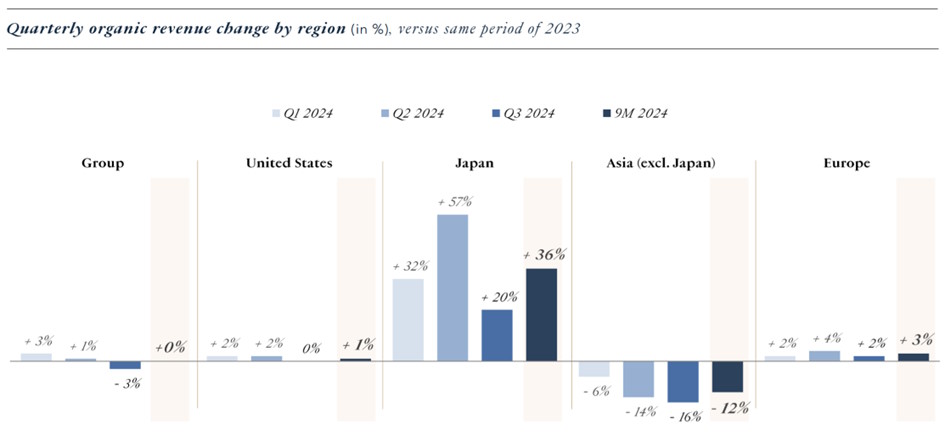

We are currently critically evaluating whether to reduce our (in)direct exposure to China. In India, the stock market has risen sharply, leading to profit-taking by investors. In China, a comprehensive stimulus plan is failing to materialize, the population is aging, and many consumers have their assets tied up in real estate that has depreciated. As a result, they are keeping a tight hand on the purse strings, putting pressure on the luxury industry in particular.

In addition, China imposes significant import tariffs on European luxury products, such as cognac. So for a company like Christian Dior (LVMH’s parent company), profitability in China is under pressure. Given the Arnault family’s strong track record of repositioning itself after setbacks and the now significant discount at the holding company level, Christian Dior remains within the portfolio.

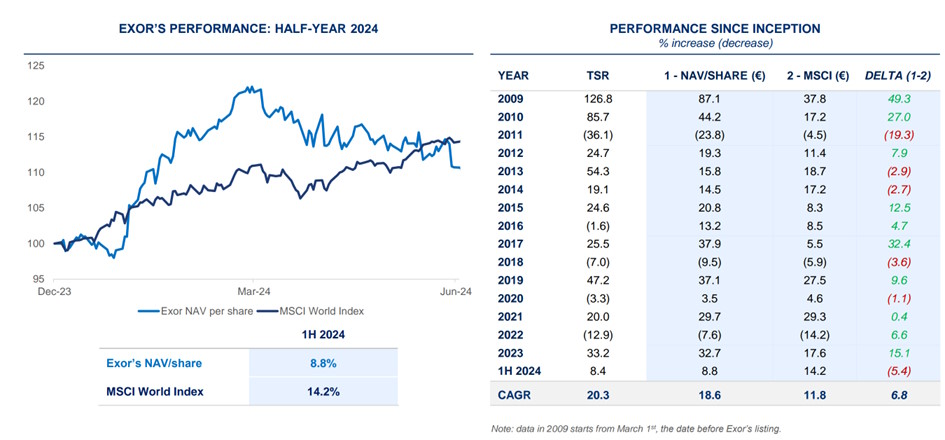

Exor lags behind its own long-term returns and the performance of the MSCI World Index this year. Like Dior, Exor has built an impressive long-term track record (CAGR = 20.3%), with firm action taken during previous crises to restore future growth. This year, however, the disappointing performance in the auto (Stellantis) and agriculture (CNH) sectors stands out.

Stricter European regulations (requiring significant reductions in fleet carbon emissions by 2025) and increasing competition from Chinese manufacturers are putting pressure on margins. Looking at the valuation, we can see that these challenges are already more than factored into the current price.

Scottish Mortgage Trust’s holding portfolio has a strong focus on U.S. technology companies, including NVIDIA. This stock has continued to rise sharply over the past six months and reported significant increases in both revenue and earnings this week. In the third quarter, revenue rose almost 100% year-on-year to USD 35 billion.

ASML is also part of Scottish Mortgage Trust’s portfolio. During its recent investor day, ASML maintained its revenue forecast for 2030 at between EUR 44 billion and EUR 60 billion.

Macro picture

U.S. stocks have outperformed European stocks in 8 of the past 10 years. This year, the yield differential exceeds 20%. Part of the explanation lies in the structurally higher economic growth in the US, estimated at 3% this year, versus 0% for the Eurozone. In addition, Europe is struggling with a weak service sector.

Growing political uncertainty in Europe further contributes to the valuation gap. For example, France is being forced by credit rating agencies to make sharp cuts, while Germany is heading for new elections. Not surprisingly, U.S. stocks are significantly more expensive than European ones. European stocks are currently trading at a price-to-earnings ratio of about 13 for 2025, while in the U.S. it has risen to 23 for 2025.

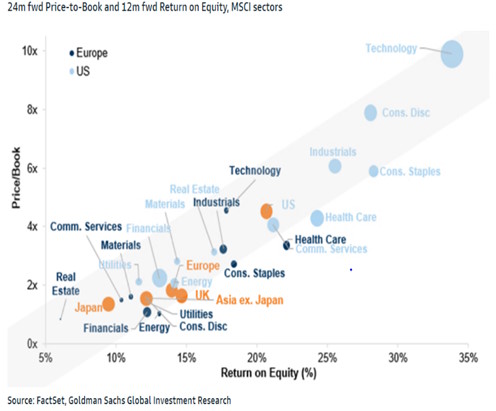

U.S. stocks seem twice as expensive at first glance, but is that really the case? The fact that U.S. stocks have outperformed almost every year since 2010 indicates a structural improvement in their profitability. Sector analyses by Goldman Sachs show that both valuations (price-to-book value) and return on equity are significantly higher in the U.S. in every sector.

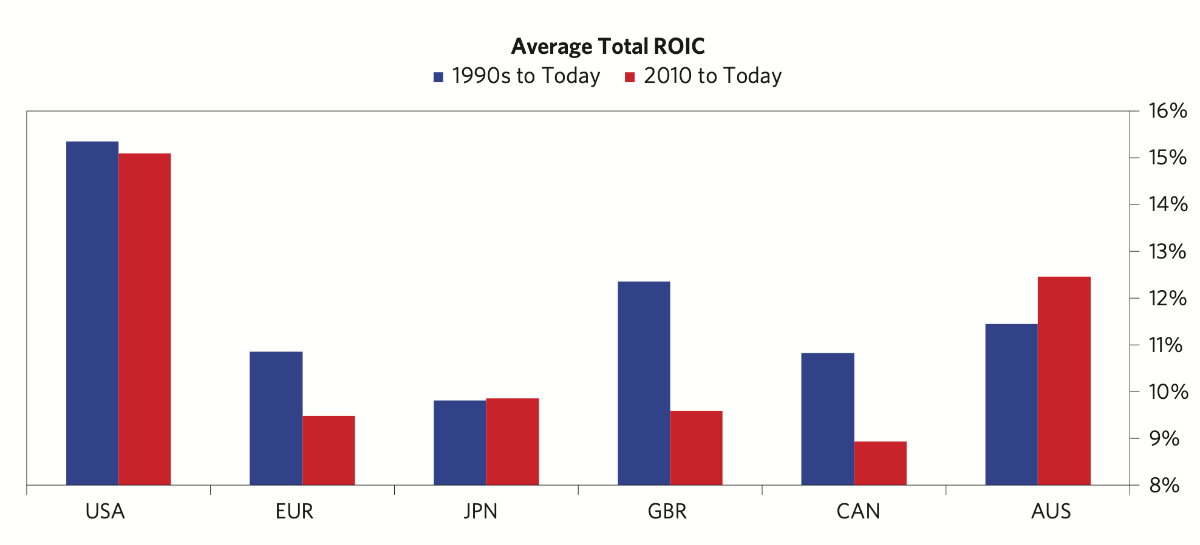

This is further confirmed by the figure below from Bridgewater, Ray Dalio’s renowned hedge fund. It shows that U.S. companies realize a significantly higher return on invested capital (ROIC) than companies in other regions. At the same time, the chart shows that European companies have experienced a sharp decline in their ROIC since the credit crisis. Therefore, the outperformance and higher valuations of U.S. companies are readily explainable and logical.

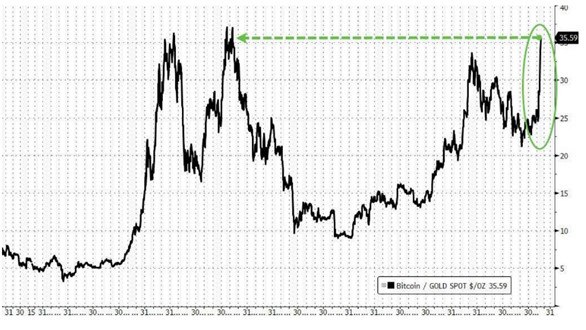

Because of strong economic growth and high profitability, there is a risk that the U.S. economy could overheat. Fed Chairman Jerome Powell expressed similar concerns last week, hinting that any interest rate cuts may be delayed. Especially with US interest rates rising again, gold – after an impressive price rally this year – appeared susceptible to profit-taking. (In fact, the gold price moves inversely to interest rates).

However, the price of the “new gold,” Bitcoin and other cryptocurrencies, continues to rise unabated. Deregulation under the new Trump administration is the main driver in this regard. This has led to a sharp rise in the Bitcoin versus gold ratio, as shown in the figure above.

Chainsaw approach raises eyebrows, but also inspires hedge fund investors

The U.S. budget deficit is now around 8% per year. President Trump has appointed Elon Musk to bring the deficit under control through the newly created Department of Government Efficiency (DOGE). Via Twitter, Musk and Ramaswamy are making numerous proposals to drastically reduce the civil service.

Their approach seems heavily inspired by Argentine President Javier Milei, whose “chainsaw approach” cut social spending by 35%. These reforms have reduced Argentina’s inflation rate from 25% per month to 3% per month. Moreover, Argentina’s budget deficit, which was -5% in 2023, turned into a +0.3% surplus in 2024.

Hedge fund investors have not let these developments go unnoticed and have bet heavily on Argentine companies. This topic was discussed at length in a recent episode of In Good Company with Stanley Druckenmiller and Nicolai Tangen.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl