Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, touch on important topics for investors, or take a closer look at recent events.

The Importance Of Time In The Market (Instead Of Timing The Market)

At the beginning of this month, there was suddenly a very solid stock market correction. We already wrote this brief analysis about it in our weekly newsletter. Although corrections of more than 5% occur about three times a year, the solid correction in a relatively short time reminded of March 2020 and some periods in 2022.

That raises the question among some investors whether it might not be wiser to just take some money off the table by selling shares. In 2022, amid the prolonged downturn in the stock market, we cited a quote from Howard Marks from an interview with Bloomberg. Marks is a commissioner at investment holding company Brookfield Corporation and may count Warren Buffett, among others, among his followers because of his often accurate and rational reflections on financial markets.

Howard Marks

Howard Marks

When asked how to prepare for any further price declines, Marks responded clearly:

-

-

- “One of the basic tenets of our investment philosophy is that we cannot time the market. That means two things. One: we will never sell positions to go liquid, to be ready for any falling stock prices. And two: we will not wait for a stock to get even cheaper.

- If it is attractively valued today, we buy it today. If it’s even cheaper six months from now, we buy more of it. That works many times better than predicting that the stock market will be lower in six months, because that is something no one is capable of doing.”

-

A telling quote from renowned investor Peter Lynch is, “Far more money has been lost by investors trying to anticipate corrections, than the losses during an actual correction.”

Research Fidelity

By extension of trying to anticipate corrections, there are also investors who take profits. A persistent fallacy is captured in the statement “no one has ever gotten poorer from taking profits.” We previously wrote this article about that, with some mathematical examples showing that profit taking can indeed cost money.

A famous quote from Charlie Munger is, “The first rule of compounding: never interrupt it unnecessarily.” Heading into multibaggers (stocks yielding multiples of the initial deposit), it is very difficult to resist the temptation of taking profits in the meantime. That’s why Fidelity found that the investment accounts of deceased investors performed best.

The investors were no longer alive, so they didn’t look at their investment portfolios daily. They did not check the stock prices several times a day. As a result, they were not tempted to over-trade, to time the market and did not engage in rebalancing their portfolios.

This often produced highly concentrated portfolios, as the winners kept winning. Classical investment theory states that it is important to rebalance regularly. In this regard, Peter Lynch once made the apt statement that “selling your winners and holding your losers is like pruning the flowers and watering the weeds.” Not wise, in other words.

Research Professor Bessembinder

Professor Hendrik Bessembinder of the W.P. Carey School of Business is best known for his research that showed that only 4% of all stocks provide returns over a period of more than 90 years.

The title of the report is “Do Equities Beat Government Bonds?” At first intuitively, you would think so. After all, equities have a risk premium because they are riskier than government bonds and investors should be compensated for that.

Professor Bessembinder spoke in the Meb Faber podcast about his studies

Professor Bessembinder spoke in the Meb Faber podcast about his studies

Bessembinder analyzed all monthly stock returns from 1926 through 2015, and found that only 47.7% produced a return higher than the return on a monthly U.S. government bond. Moreover, only 42.1% of longer-term stocks had a lifetime return “higher than the return on holding a one-month bond over the same horizon, and more than half produced a negative lifetime return.”

The main explanation for this surprising finding is that many publicly traded companies have relatively short lives. The median (the middle number) of all companies in terms of lifespan from 1926 to 2015 was only 7 years.

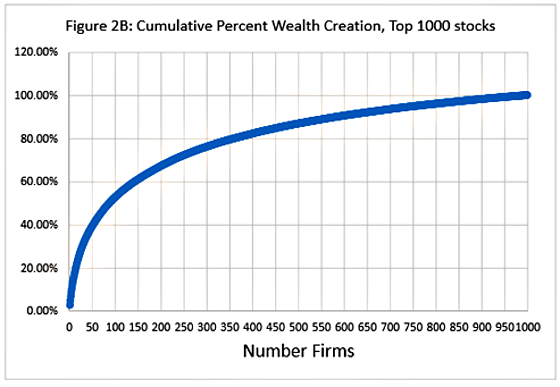

In an experiment, Bessembinder tried to investigate whether selecting any stock over these 90 years could produce above-average returns. Extensive simulations showed that 96% of individual stocks did not outperform the stock market. Of the 1,000 best-performing stocks, less than 4% accounted for all the value created. The other 96% only managed to perform on par with a one-month bond. The figure below shows the number of stocks accounting for the percentage value creation of those 1,000 stocks.

Bessembinder published a new study a few weeks ago, examining 29,078 publicly traded stocks from 1925 through 2023. A whopping 51.6% of all these companies had cumulative negative returns. In contrast, seventeen stocks were able to produce cumulative returns of more than five million percent. A return of USD 50,000 for every dollar invested in them.

By the way, it is interesting to note that Professor Bessembinder in the Meb Faber podcast also talks about the importance of sticking with your winners, as we have already shown above with the quote from Peter Lynch.

Conclusions for investors

Since a small group of stocks provides all the returns in the stock market, passive investing has gained tremendous momentum. Simply by participating in the stock market, you can already earn good returns. Although we do not discount that conclusion, we do see that there are stocks of companies with characteristics that produce outperformance.

The 96% named by Bessembinder includes both winners and losers. The extra return on top of a government bond is zero on balance, but the winners in this group are offset by the countless companies that didn’t make it. Consider, for example, many of the loss-making technology companies that went public to profit from the technology bubble in the 1990s, as well as, for example, a company like Kodak that was simply competed out. Capitalism creates a lot of value, but there are also plenty of companies that get passed over.

Bessembinder also showed that about 30% of companies beat the stock market during their lifetime. If you randomly select stocks, it will be difficult to beat the stock market. In a later study, Bessembinder found that there were several corresponding characteristics that accounted for the outperformance of the aforementioned 30% companies. These included above-average earnings growth, above-average sales growth, a history of excellence and above-average spending in research and development.

Family holding companies are among the winners

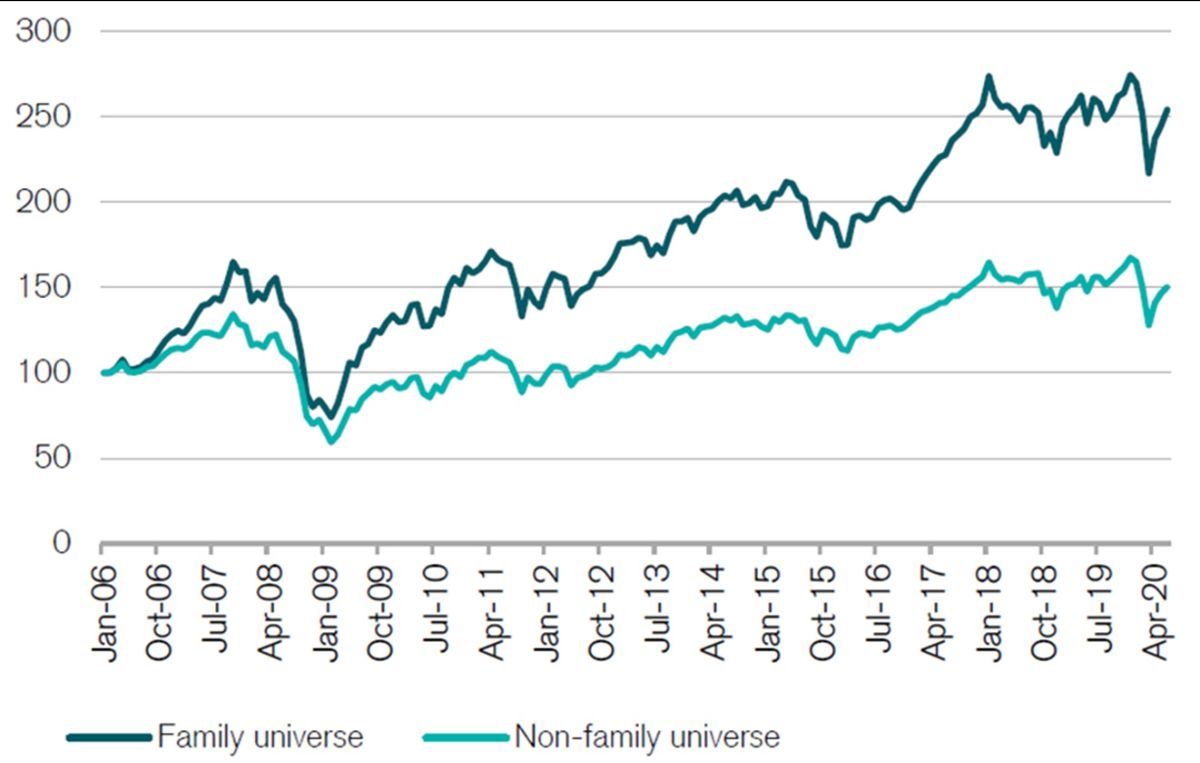

A reader of our newsletters will find many of these traits familiar. In our last monthly report, we wrote about some of the traits of family-owned companies that cause them to beat the stock market over the longer term:

- “The CS Research Institute found that family businesses produce better returns, as shown in the figure above. Key explanations for this better return include that family businesses have a long-term focus, have lower debt levels and typically investing more in research and development. This results in faster sales growth and higher profitability .”

Family holding companies are a subgroup in the stock market whose long-term focus makes them outperform. We wrote about that last month:

- “One thinks in generations, rather than quarterly profits. Family stewardship has as its primary goal the preservation and sustainable growth of family wealth. To achieve this, they manage their portfolio in an active, fundamental way. They value entrepreneurship highly, and usually have a knack for good investments.”

Family holding companies tend to be averse to hypes. For example, they did not jump on the hype of the Internet bubble in the 1990s. They also steer their companies from the supervisory board and as committed shareholders to move with the times.

A famous quote from the Wallenberg family reads,“The only tradition worth keeping is that of continuous change.” This is evident in Investor AB’s development, with a focus on digitalization, innovation and decarbonization (reducing Co2 emissions) at the top of the agenda at all portfolio companies.

For every family holding company in our portfolio, we can provide examples of this, which says a lot about the future-proofing of the Tresor Capital Family Holding Mandate. They have very deliberately realigned their portfolio to megatrends that will define tomorrow’s world. By applying an active selection within the investment companies, from holding companies to serial acquirers, we have been able to achieve nice returns for the time being.

To return to the title of this monthly report, both Bessembinder’s studies, the CS Research Institute’s study and the cited theses of reputable investors point to the fact that it is especially wise to be in the stocks of successful (family-owned) companies, i.e., time in the market, rather than timing the market by constantly getting in and out. Ultimately, you end up missing out on the most returns in the long run as a result.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl