Recently, Tresor Capital partner Michael Gielkens gave a presentation for VFB trefpunt Limburg in Hasselt on holdings. On behalf of the website “De Kwaliteitsbelegger,” the Dutch-language counterpart of Compounding Quality by well-known investor Pieter Slegers, Willem Verstrepen attended the presentation.

Pieter and Willem wrote a short report with ten holding classes on the website of The Quality Investor, which we reproduce here with permission.

Recently, Michael Gielkens gave a lecture on holdings.

He is a friendly man with tons of experience in the stock market.

Today, let’s look at Michael Gielkens’ ten holding lessons.

What are Holdings?

Holdings are companies that invest in other (un)listed companies.

Often they do not produce goods or services themselves. They make money by investing in other companies.

Just as you make money by investing in stocks, so does a holding company.

1. Holdings do better in the long run

Holdings create long-term shareholder value.

There are two main reasons:

- They spread risk by investing in multiple companies and sectors

- Many holdings are run by outstanding managers

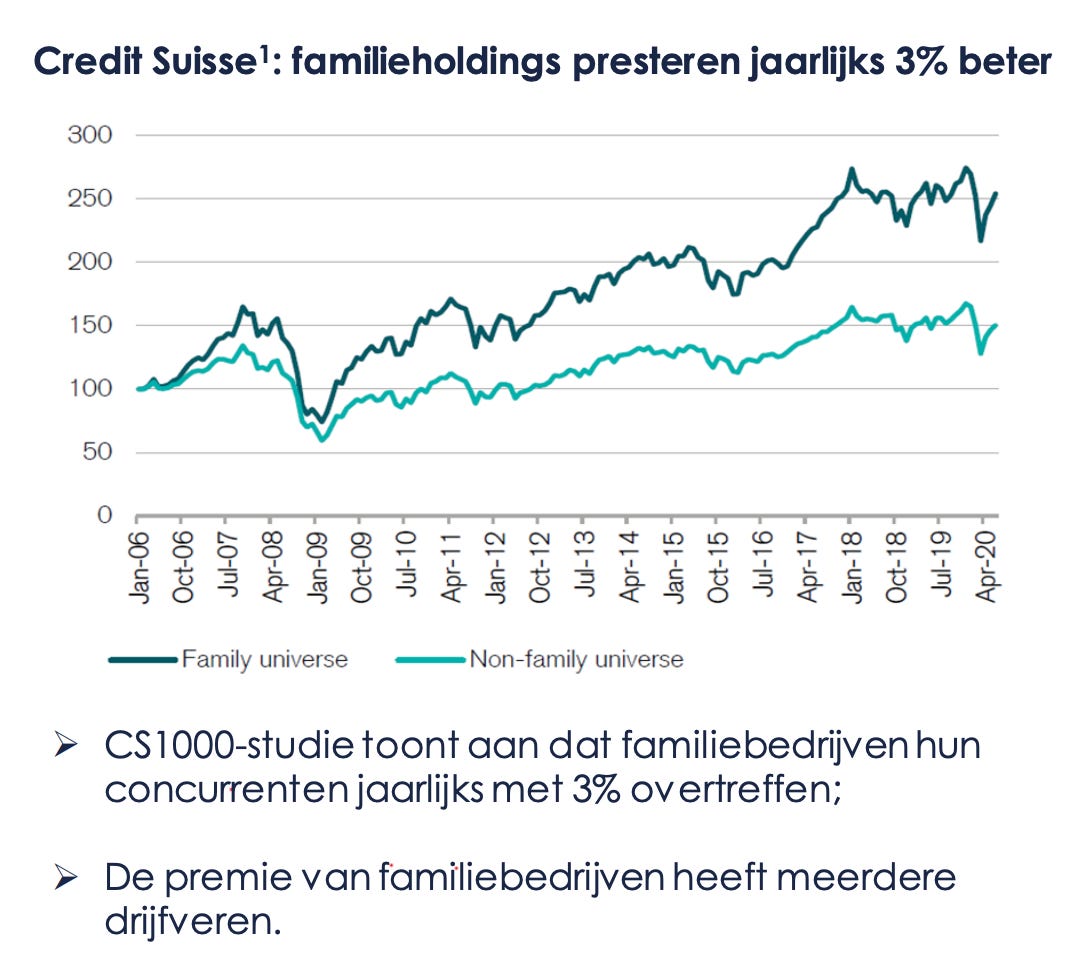

2. Family holding companies are doing better

The philosophy of Tresor Capital?

Invest in holdings with skin in the game.

These holdings think not in quarters but in years.

They want to transfer the business to their (great) grandchildren.

Family holding companies do better by an average of 3% a year:

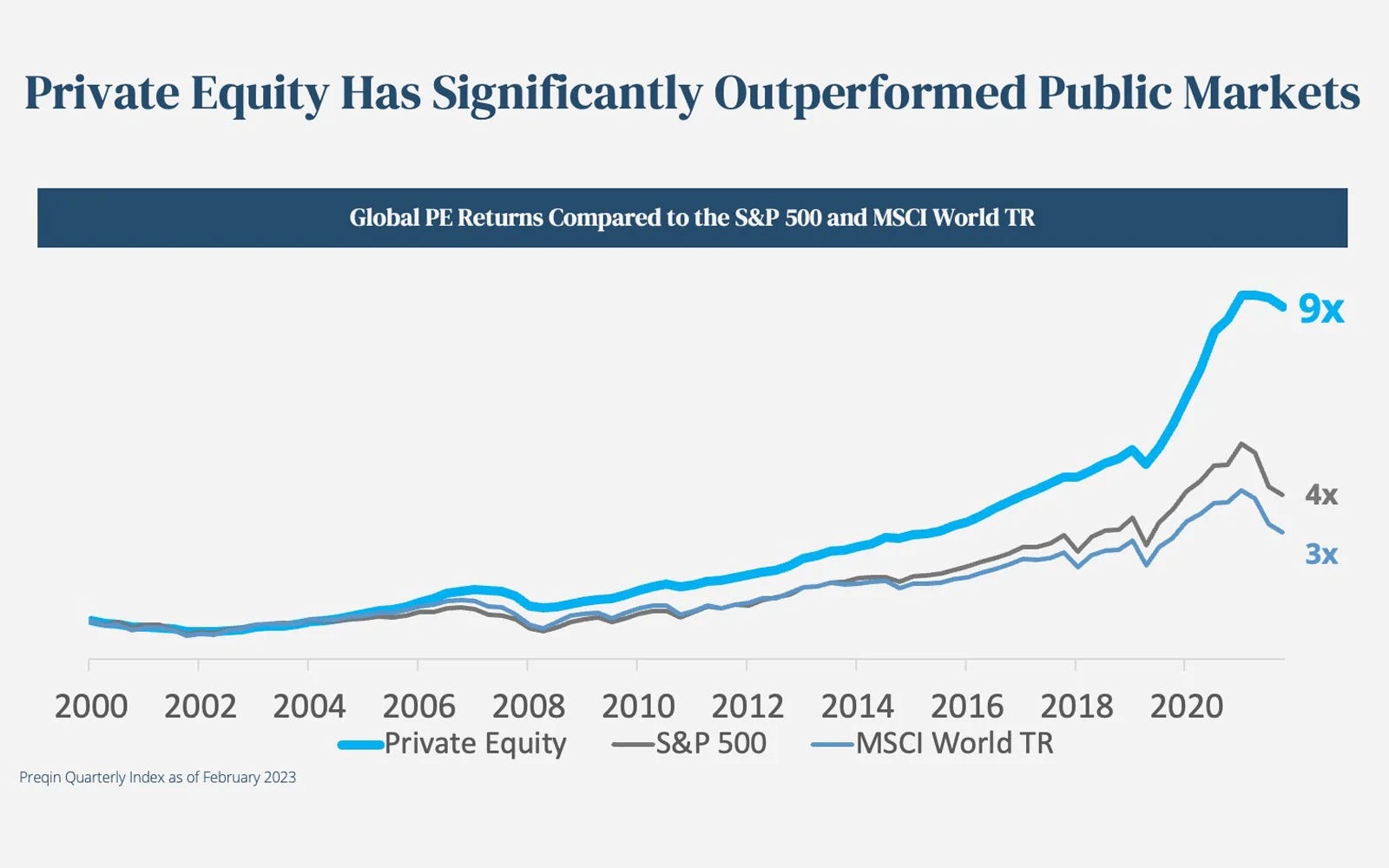

3. Entry ticket to Private Equity

Holdings have access to Private Equity.

Through Private Equity, you invest in unlisted companies.

The beauty? Private Equity generally outperforms publicly traded companies:

4. Invest only in the best holdings

A holding company often invests in multiple companies.

Therefore, your Portfolio can already be very diversified with five holdings.

Only the best will do. Select only the holdings you are most convinced of.

“Too much diversification can protect a portfolio from big losses, but it can also protect you from big gains.”

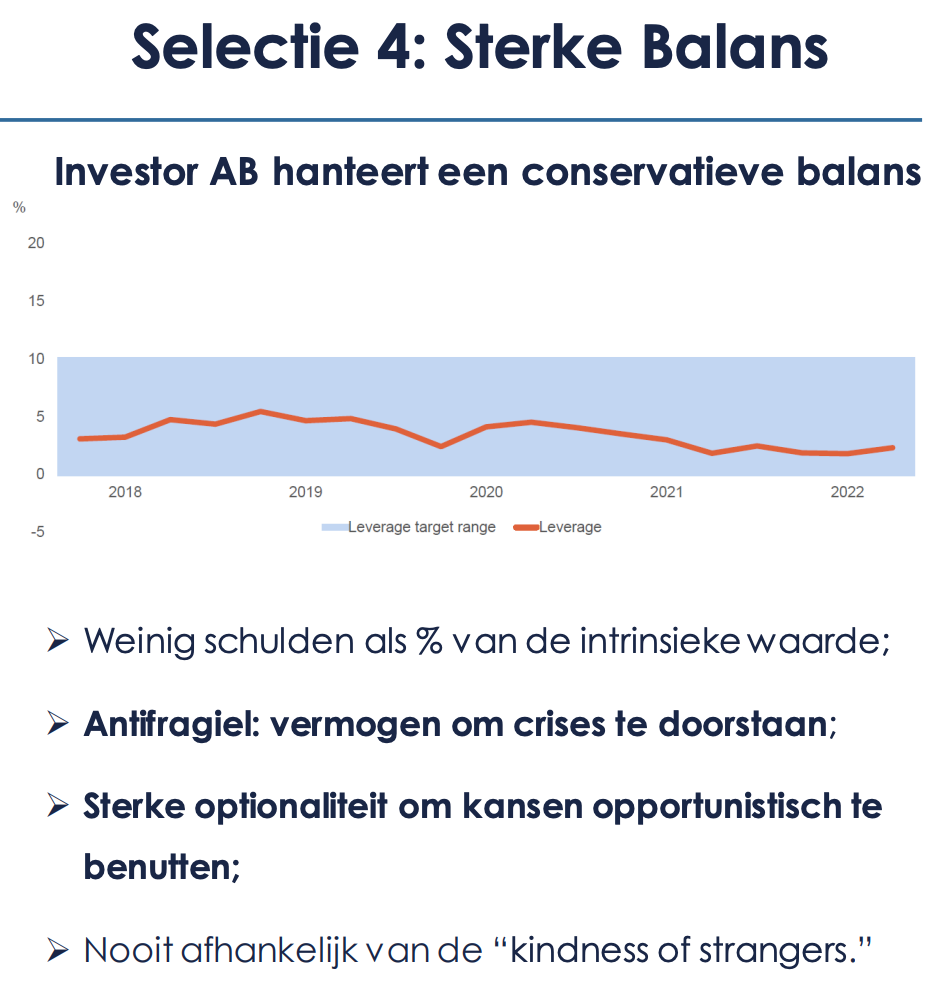

5. Look at the balance

With holdings, a healthy balance is extremely important.

Why? A strong balance sheet not only helps them survive crises, it also provides opportunities to take on debt when needed.

So holdings with a healthy balance sheet can make bargains when the blood runs through the streets in the stock market.

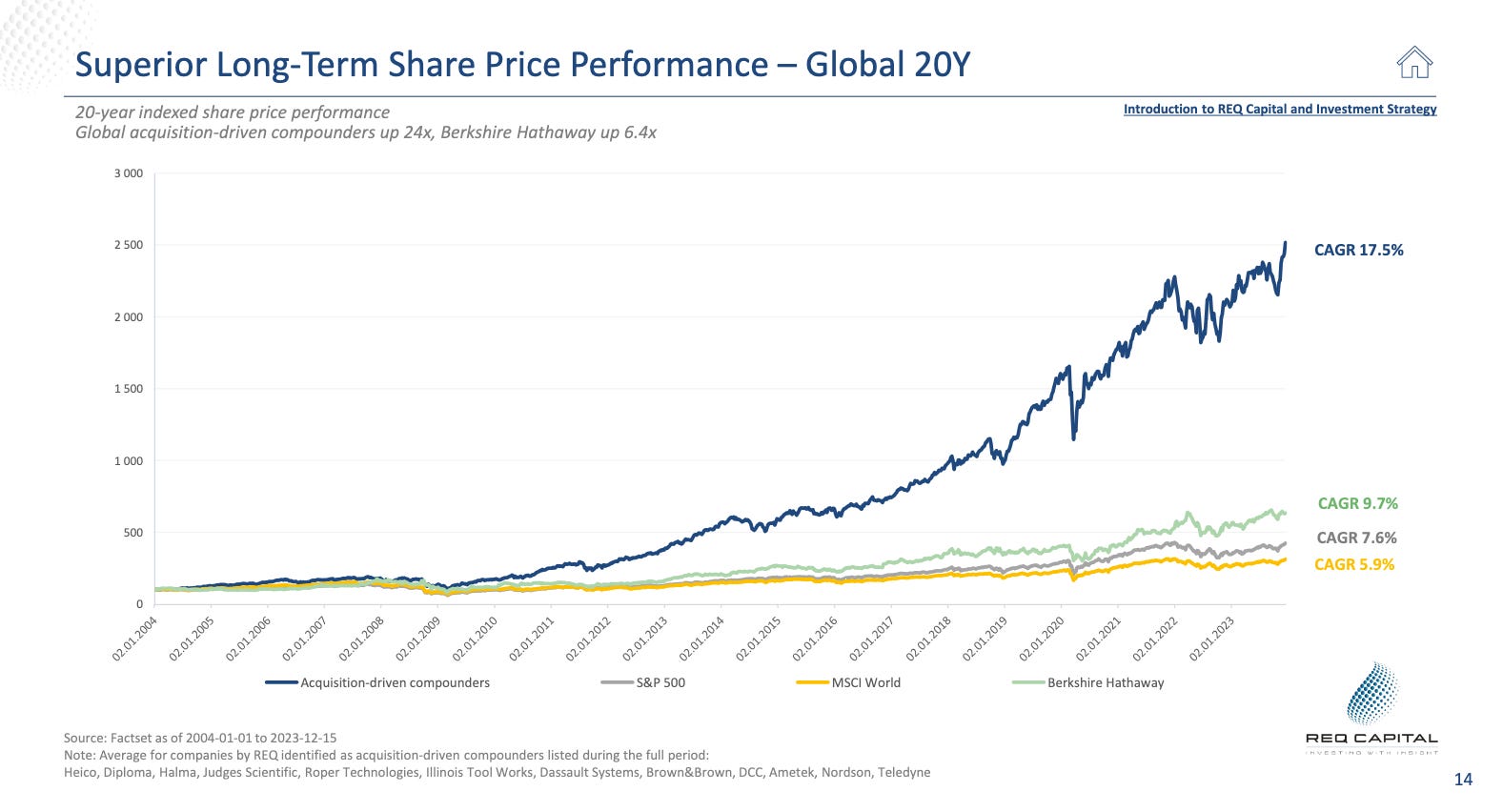

6. Serial acquirers

Michael is a big fan of serial acquirers.

These are companies that systematically acquire other companies. It is a core part of their growth strategy.

A study by REQ Capital proves that serial acquirers are doing extremely well in the stock market:

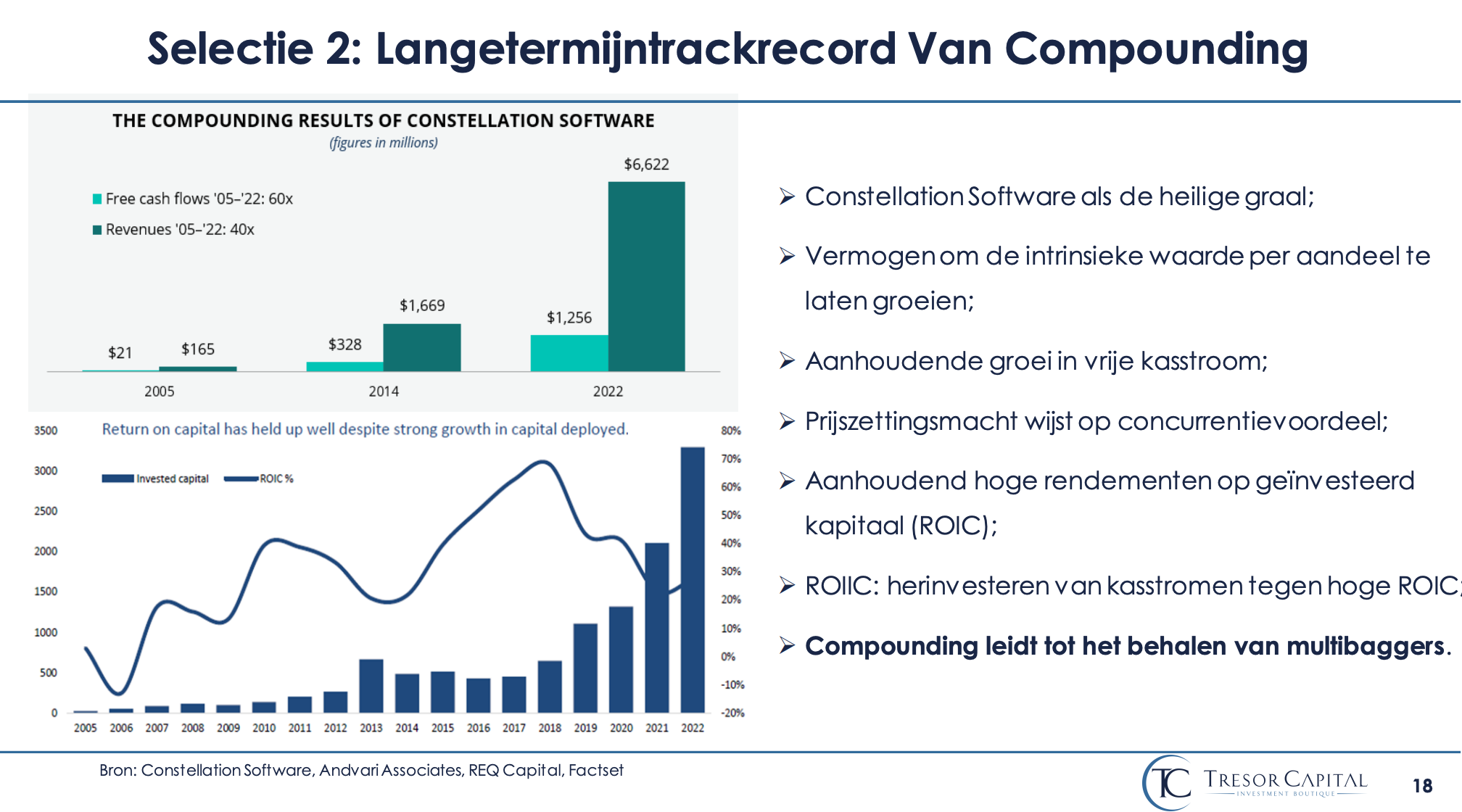

7. Strong track record

Constellation Software is Michael’s favorite serial acquirer.

This Canadian company acquires niche software companies and is very successful at it.

The reason? It has an excellent track record for long-term value creation.

Now let’s look at the three most important lessons.

8. Focus on secular trends

Look for holdings that benefit from an attractively growing end market.

Consider topics such as digitization, robotization, sustainability, aging, …

Companies operating in a growing end market can more easily grow themselves.

9. Don’t just look at Belgian holdings

There are 11 listed holding companies in Belgium. Worldwide, there are more than 500.

Only the best holdings are worth your Portfolio.

Therefore, look at foreign companies as well.

So you don’t exclude such top performers as Investor AB, Constellation Software, LVMH, Topicus, …

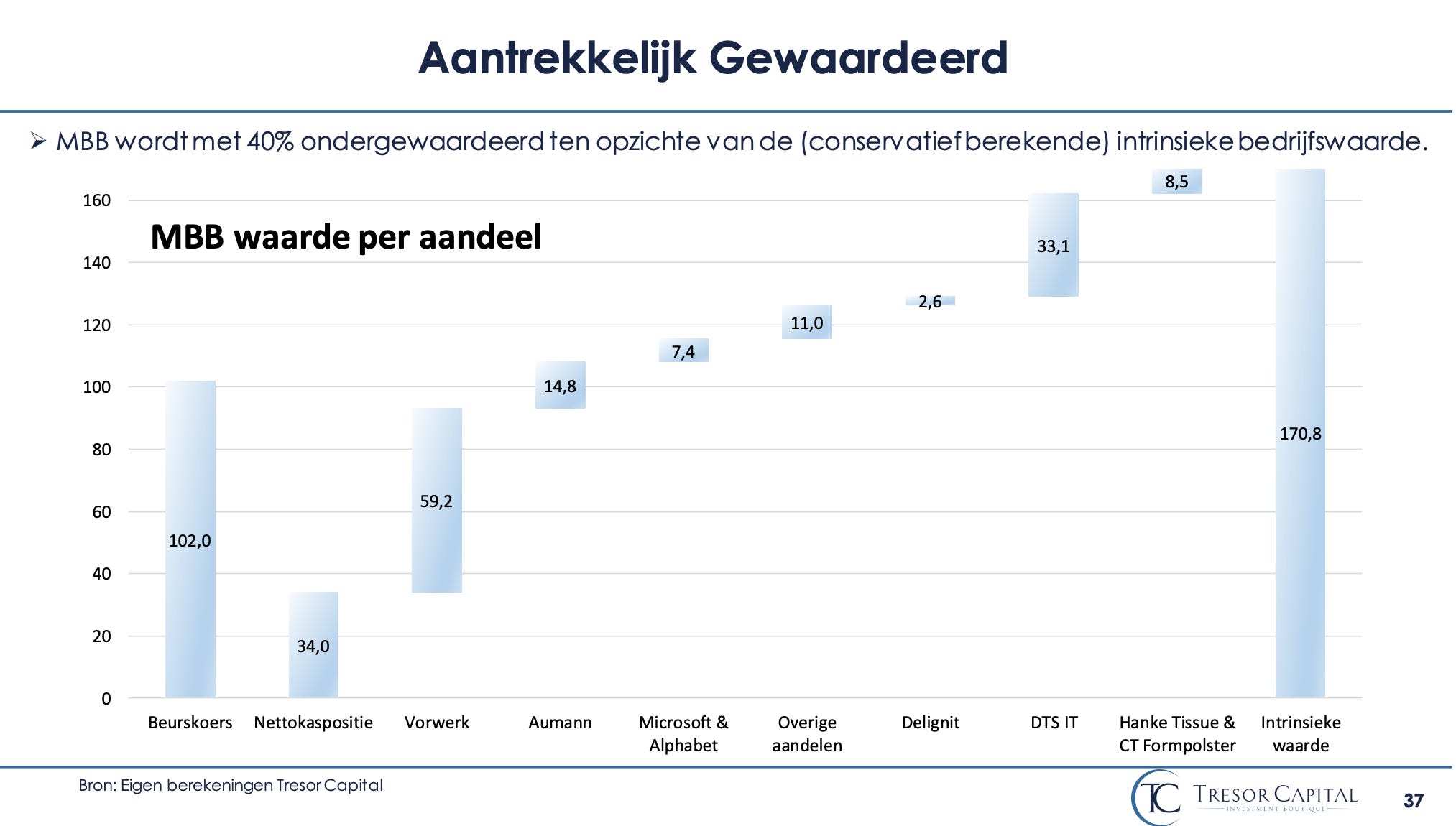

10. Valuing Holdings

Holdings are valued by comparing their intrinsic value to their stock price.

You calculate intrinsic value by adding up the value of all the companies in the holding company and subtracting net debt.

In doing so, you look at how much each company in the portfolio contributes to the total.

Conclusion

That was it for today.

Here are Michael Gielkens’ ten holding lessons:

- Holdings do better in the long run

- Invest in family-managed holding companies

- Holdings = entrance ticket to Private Equity

- Invest only in the best holdings

- Look at the Balance Sheet

- Serial acquirers = often great companies

- Look at the track record

- Focus on secular trends

- Don’t just look at Belgian holdings

- Use Sum-Of-The-Parts as rating

Source:

The Quality Investor -The10 Holding Lessons of Michael Gielkens