A delegation from Tresor Capital attended Sofina’s shareholders’ meeting on May 8, held in the impressive building on Brussels’ rue de l’Industrie. We thanked CEO Harold Boël afterwards for organizing the meeting after Berkshire Hathaway’s annual meeting, which made it possible for us to attend both events.

In preparation for the meeting, Belgian investor organization VFB organized a digital event as part of a campaign to get more investors to shareholder meetings. Tresor Capital partner Michael Gielkens provided a short introduction about Sofina there, which you can watch on Tresor Capital’s YouTube channel.

Sofina’s shareholders’ meeting focused on a clear message: in turbulent times, it is essential to stick to a robust strategy focused on generations, not quarters. In doing so, Dominique Lancksweert, chairman of Sofina, set the tone firmly with his criticism of the trade war being waged by the U.S. government led by Donald Trump.

Lancksweert, who himself lived and worked in the U.S. for a long time, spoke from personal experience and called Trump’s current policies no reflection of the “real America.” He expressed concerns that the trade tariffs put in place will ultimately be especially harmful to the U.S. economy itself. Still, he remained cautiously optimistic about the U.S.’s ability to recover, referring to the strength of American institutions, universities and pragmatic entrepreneurship culture.

At the same time, he stressed the need for more European cooperation in the field of defense, in which he said Europe has been dependent on the U.S. for too long. He specifically mentioned the need to reduce bureaucratic obstacles and forge more effective partnerships.

Robust model: thinking in generations

Sofina strongly emphasized its long-term approach and resilience. The company is run by the Boël family, which has made its mark on business for 125 years and has guided their organizations through numerous economic crises and conflicts. The family-controlled business model is robust and has stood the test of time. It once again emphasizes the need for a long-term horizon.

About the recent price fluctuations in the financial markets, people react soberly:

“We think in decades, not quarters. We are long-term oriented, across generations, and are also aware that short-term markets often focus on disaster scenarios, with little regard to the future .”

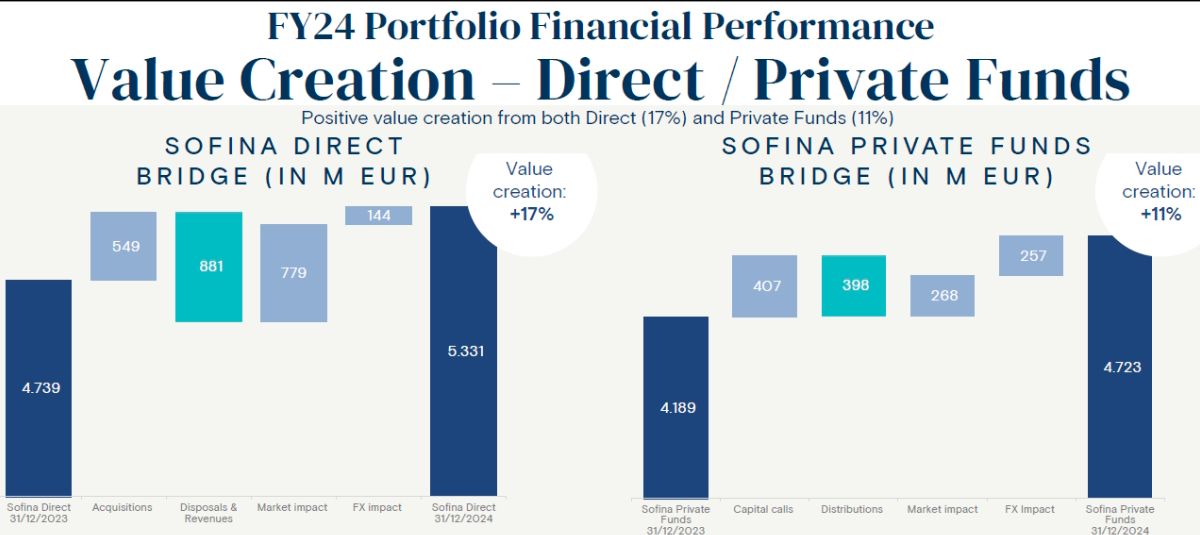

Harold Boël, CEO of the holding company, spoke of a return to a more normalized market in 2024, in which direct positions such as Drylock and Cognita performed strongly. Among private investments, younger companies showed a balanced picture between capital calls and distributions, following earlier years of high double-digit growth.

Boël emphasized how crucial sustainable value creation and diversified allocation of capital are. He referred to specific successful investments, such as “champion” Team.Blue, which helps companies with their digital transition. Because Sofina had built relationships over several years, the holding company was able to invest when the opportunity arose.

Boël also mentioned Sierra, a rapidly growing cybersecurity company that protects data of large enterprises. The Sofina CEO emphasized that this is one of the fastest growing software companies in a long time. Thanks to good relationships with reputable venture capital funds, it was possible to make this investment. Both companies illustrate Sofina’s strategy of carefully building and maintaining relationships, which is a cornerstone of their success.

A prime example was the recent exit of refrigerated truck rental company Petit Forestier. Sofina took the company off the stock market seventeen years ago, thanks to a good relationship with the Forestier family. Thanks in part to Sofina, the company was stabilized and gained a strong market position. After 17 years of cooperation and value creation, this company was successfully sold to private equity last year. This long-term approach is typical of Sofina’s modus operandi, which focuses not only on financial results, but also on sustainable relationships and interests that are in line with each other.

Against our better judgment, we asked Boël about the rate of return Sofina obtained on the investment in Petit Forestier. Boël stressed that Sofina could not provide return figures, because then one could find out the secret sale price. The top executive sufficed by saying that it was a clearly profitable investment for Sofina.

On investments in venture and growth capital funds, Boël commented that Sofina has invested heavily in the funds of existing partners. Sofina’s reputation as a patient investor with long-term capital also provides the family holding company with access to new, reputable fund managers.

For example, the more difficult market environment provided an opportunity for Sofina to get a foot in the door at renowned European venture capitalist Index Ventures. However, Boël also emphasizes that the successful fund managers of the past may not be the winners of tomorrow. As such, it is important to also continuously develop new relationships, citing the 20VC Fund as an example.

Impact trade war limited, but not to be underestimated

Despite its confidence in its business model, Sofina is very aware of the risks of geopolitical tensions and economic challenges. Boël emphasizes that Sofina also exists to move through turbulent times. Patience and a clear vision add value in uncertain times.

With about 34% of its portfolio in U.S. dollars, Sofina is feeling the impact of the dollar’s recent decline. Boël stressed that every percent drop in the dollar costs about EUR 55 million in intrinsic value. However, that is the picture if you take the picture at this time.

At the same time, Boël pointed to a natural long-term hedge from a cash flow perspective. Through its private equity activities, Sofina is both a buyer and seller of dollars on a daily basis. Sofina invests in numerous mutual funds through its capital calls. At the same time, Sofina sells dollars daily because it receives distributions (profit distributions) from these funds. In the longer term, therefore, dollar sensitivity is reasonably hedged.

The sectors in which Sofina operates, consumer goods, education, healthcare and life sciences, are relatively unaffected by trade tariffs because of their strong local anchoring. The business models tend to be Business-to-Consumer. Sofina has always had a focus on investing in companies operating in their local markets. This was also a strategic reason behind the move to Asia 15 years ago, where they benefit from the growing local middle class. The digital transformation of services also significantly reduces the direct impact of trade tariffs.

Despite this short-term turbulence, however, Boël remains optimistic about the longer term. Sofina has the ability to look through an investment cycle and consider the perspective of several years. This is clearly positive and a differentiating factor in the sectors in which Sofina operates.

Sofina is even seeing increased deal flow, many interesting investment opportunities are presenting themselves that are currently being worked hard on. With EUR 1 billion in cash and EUR 1.19 billion in credit facilities, Sofina is excellently positioned to take advantage of this market turbulence.

Net asset value

Sofina’s net asset value as of March 31, 2025 was set at EUR 9.93 billion, equivalent to approximately EUR 300 per share. At the end of 2024, the net asset value was still EUR 10.3 billion. The decrease reflects dividend obligations worth EUR 122 million (Sofina will pay EUR 3.50 per share in dividends later this month) and an impact of some EUR 260 million due to exchange rate effects, i.e. the dollar in particular.

Strategy and vision for the future

A shareholder raised the question of whether Sofina should not concentrate more. After all, Sofina invests in many different positions and funds, do the costs of tracking so many positions outweigh the benefits?

Boël answered passionately:

“I believe the benefits clearly outweigh the costs. The logic behind the large number of positions in the portfolio is twofold. One is quite simple: diversification. By having many positions from a risk management standpoint, the impact of one bad investment on the total intrinsic value is limited. There is a saying in finance, “diversification is the only free lunch. It reduces portfolio volatility.

With our focus on venture and growth capital investments, there is an additional advantage. At any given time, there will be a very limited number of companies that manage to generate exceptional returns, so-called “outliers. That means an investment that returns not 2x or 3x the investment, but 5x, 10x or 15x.

In the venture capital world, the vast majority of the returns you can earn are generated by such investments. That means that, from a purely statistical point of view, if you have a larger portfolio, particularly a large exposure to venture capital funds, the chances of being exposed to one of such companies are significantly higher.

An example is the software company Snowflake, which went public in 2020. This investment gave Sofina a return of about EUR 100 million. This was possible because we had exposure to Snowflake through multiple funds, including through Iconic, Sequoia and a16. By having exposure to such ‘outliers’ in a diversified way, you also increase the chances of achieving exceptional returns.”

On future investments, it was clearly stated that Sofina will not be entering defense or similar B2G (business-to-government) sectors anytime soon, due to a lack of internal expertise. The emphasis remains on consumer-oriented and sustainable investments within their own circle of competence.

One shareholder inadvertently got the laughs by expressing his concerns about Sofina’s exposure to “Battery Ventures,” as batteries are a very volatile sector, according to him. Harold Boël emphasized that Battery Ventures is purely the name of the fund manager. It has as much to do with batteries as Sequoia (named after the largest trees in the world) has to do with trees.

From left to right: Michel Salden, Erik Klinkers, Michael Gielkens, Sofina CEO Harold Boël and Jelle Vermeulen

Finally, we asked Boël how he views the venture capital market in the various regions in which Sofina operates. Boël:

“In the short term, I expect volatility in the venture capital market. For the longer term, we are very optimistic. That’s part of our belief that innovation and growth don’t stop. We currently see in the market that the turbulence has not impacted the younger companies we have where several rounds of financing have taken place.

Anything to do with Artificial Intelligence, or anything that even has AI in the name or company description, automatically gets a higher multiple. So you have to separate the wheat from the chaff in this area. In that sector, fundraising remains very active.

There is little difference between regions. Indeed, venture capital is fundamentally about the business idea and the market in which it operates. Therefore, the macroeconomic environment plays less of a role. Even in a very bad macroeconomic environment, you can have a great venture capital investment.

The flip side of that is that venture capital investments have a longer term, so you have to have a lot of patience to get your money back. They are also inherently riskier, because it is difficult to innovate.”

Conclusion

Sofina remains true to its strategy of long-term investment and sustainable value creation, regardless of economic uncertainties or geopolitical tensions. As Boël aptly put it, “We think in generations, not quarters.” With its resilient approach and attention to diversification, Sofina remains well positioned to navigate future volatile market conditions.

With a controlling family that has been successful in business for 125 years, a strong war chest and a relentless dealflow of handsome investment opportunities, the future looks bright for Sofina.

Watch back

Fans can watch the video recording of the event in its entirety here. Slides from the presentation at the shareholder meeting can be downloaded here.

Sofina ended the trading week on the Brussels Stock Exchange at a price of EUR 258.60 per share.

On behalf of the entire Tresor Capital team, we wish you an enjoyable weekend. Please feel free to contact us at info@tresorcapital.nl with any questions or comments.

Sincerely,

Investment manager