Monthly Bulletin September 2022

Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Monthly Bulletin: The Miracle Of Compound Interest

The financial markets are currently testing investors’ patience and confidence. Despite a falling stock market, it pays to stay put and keep faith for the long haul.

In our August monthly report, we wrote that in the short term, a stock price is affected by sentiment, which can cause it to deviate substantially from the underlying, intrinsic company value. In the longer term, the stock price reflects a company’s intrinsic value. Since the economic cycle cannot be predicted, we pointed out the secular trends to which the securities in our portfolios have exposure. You can read this newsletter back here.

By investing in high-capitalization companies that are crisis-proof and are able to achieve a good return on invested capital through a full cycle, we seek to achieve our relationships’ financial objectives over time. Three key components that give us a significant advantage over the average investor in this regard are: patience, perseverance and a long time horizon.

“Time is the friend of the great company, and the enemy of the mediocre company” is one of the tile sayings of Warren Buffett, one of the best investors of all time. Buffett emphasizes that a great company continues to create value for investors and society over time, while mediocre companies have only mediocre results to offer. These things ultimately translate into the stock prices of respective companies as well.

Buffett became one of the richest people in the world, and he owes that personally to the fact that he was born in the U.S., that he has good genes and to compound interest (also called the interest-on-interest effect). Those first two variables are out of one’s control, but compound interest is a phenomenon that any investor can take advantage of.

Illustrative examples compound interest

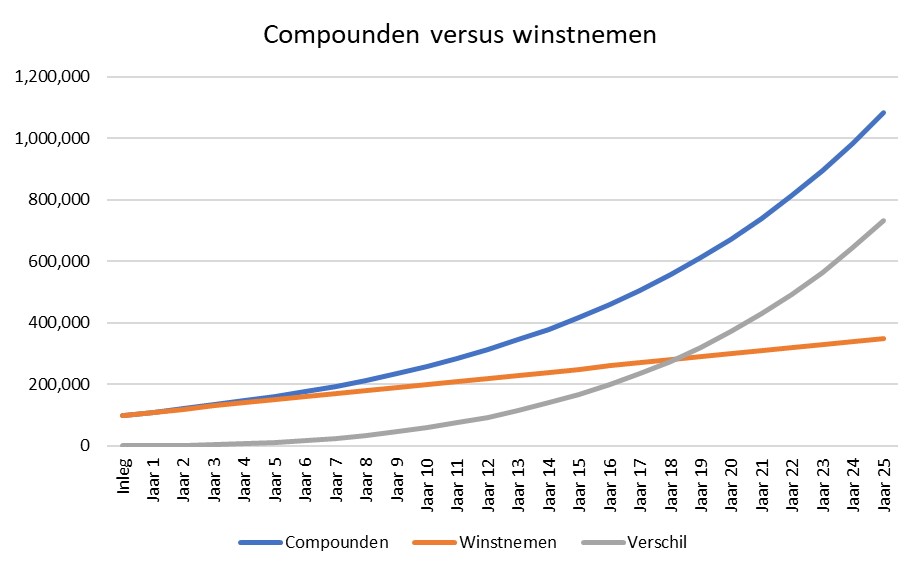

An illustrative example. Two investors have EUR 100,000 to invest. Investor 1 knows that “compounding,” or compounding return on return, will produce the best results. Investor 2 extracts profits on the last trading day of the year, and thus continues investing with the initial deposit. Assuming a fictitious average return (for illustration purposes) of 10% per year and an investment horizon of 25 years, the results are as follows: the capital of investor 1 has grown to EUR 1,083,471 and that of investor 2 has grown to EUR 350,000 (after all, he earned 10% on his deposit each year). The difference between compounding or taking profits is EUR 733,471.

We are sometimes confronted with the statement, “no one has ever become poorer from taking profits.” If we consider missed returns as costs, the chart above shows the opposite of that statement.

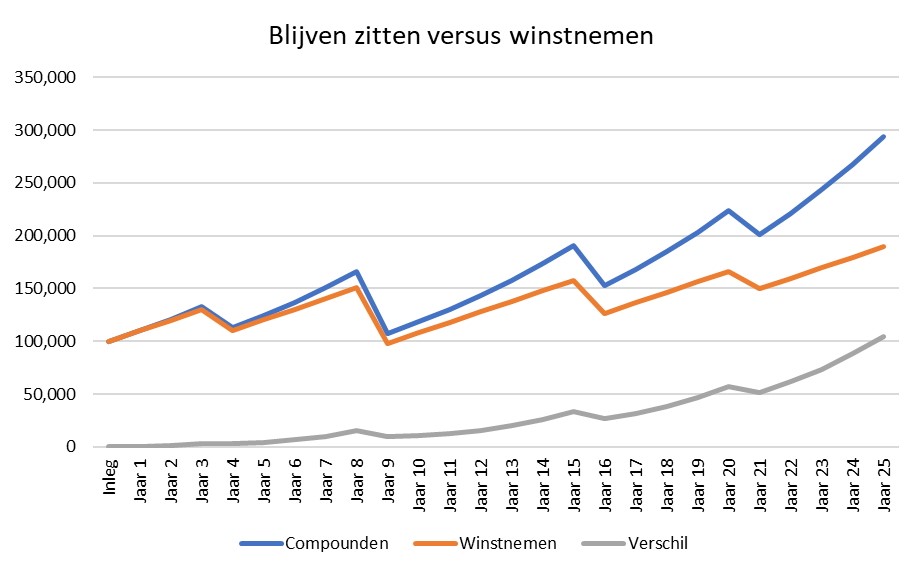

Another argument for taking profits is that this would then allow one to temper the impact of stock market declines. We take the same two investors from the previous example, but introduce four stock market declines. A 15% fall in year 4, a 35% fall in year 9, a 20% fall in year 16 and a 10% fall in year 21. The investor who takes profits each year is still more than EUR 100,000 behind compared to the investor who “just” stays put and lets compound interest do the work.

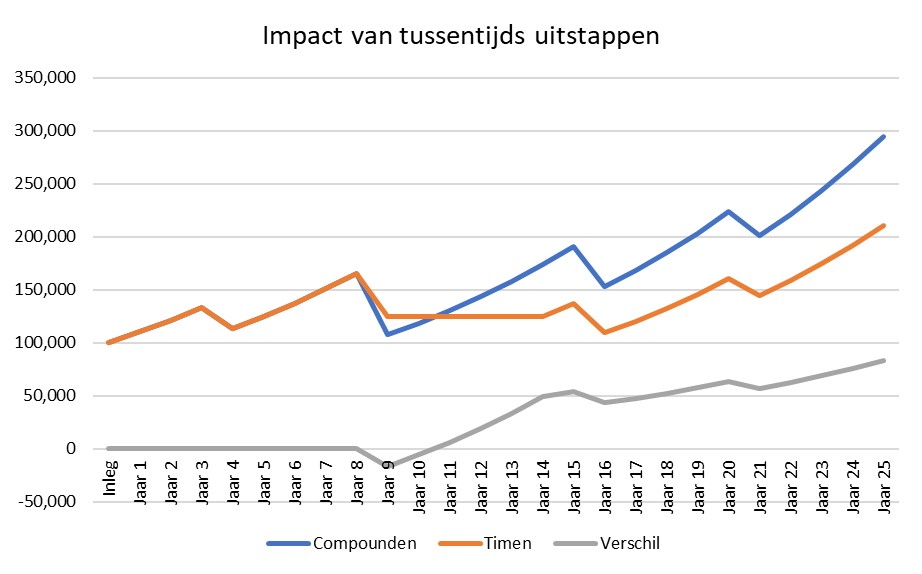

In the introduction to this monthly report we wrote that in addition to a long time horizon, patience and perseverance are also important. The investor in example 2, who is aware of compounding and therefore does not take profits in the meantime, must also be able to withstand a bump. Suppose the stock market fall in year 9 makes this investor so nervous that he decides to exit the market completely with a 25% loss. The stock market then fell another 10% before bottoming out with a total drop of 35%. The investor feels vindicated in his decision to exit.

Moreover, the experience with the stock market was so negative that investing was a dirty word for a long time. Only after a few good years on the stock market, reports of returns in the media and positive signals about the stock market from the personal environment, did the investor decide to enter again at the end of year 14 with the amount he had left in year 9.

The investor paid a high price for the interim exit, as can be seen in the chart above. Although in year 9 a further loss of another EUR 16,564 was saved by exiting, the asset counter in year 25 finally stands at EUR 210,909. However, if the investor had “just stayed put” in year 9, instead of trying to time the market, the assets would have grown to EUR 294,382. The cost of exiting mid-term, therefore, was EUR 83,473. A telling quote attributed to Albert Einstein reads, “Compound interest is the eighth wonder of the world. Whoever understands it, deserves it. Whoever doesn’t understand it, pays for it.”

Suffice it to say that the examples cited are, of course, an abstract simplification of reality, but we are trying to illustrate that intermediate exits or profit-taking can have disastrous consequences for ultimate returns. As managers of our clients’ capital, we see it as one of our most important tasks to let the effect of compound interest do its work. To quote Buffett’s partner Charlie Munger, “The first rule of compounding: never interrupt it unnecessarily.”

Above-average returns

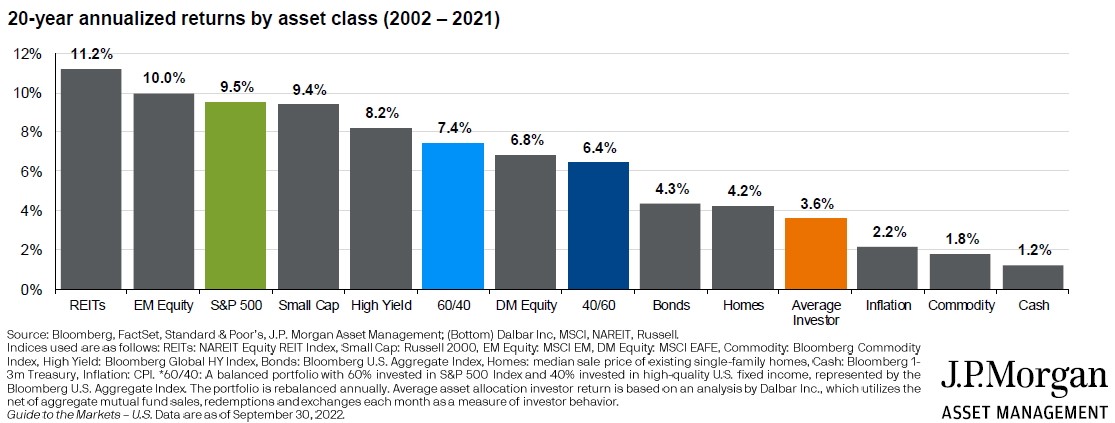

We chose our words carefully in the introduction to this piece: the investor who combines patience, perseverance and a long time horizon has a significant advantage over the average investor. The average investor, how do you chart them?

JP Morgan offers the answer in its “Guide to the Markets.” Based on an annual study by research firm Dalbar, which it has conducted and published since 1984, it reveals that the average investor is his or her own worst enemy. By trying to time the market, take a “ride” or make trades too often, investors miss the boat of compound interest.

The Dalbar study shows that the average investor managed to achieve an average return of 3.6% per year over the past 20 years. This is only narrowly ahead of inflation. A traditional neutral portfolio consisting of 60% bonds and 40% stocks posted an average return of 6.4% per year, while the U.S. S&P 500 stock index managed an average return of 9.5%.

Dalbar draws a clear conclusion: “Investors who remained patient and did not focus on short-term market fluctuations were significantly more successful than those who allowed their emotions to dominate.”

Especially in difficult stock market times, it is important to stick to the strategy we have adopted in order to achieve the intended investment objectives in the longer term. We write our newsletters, in part, to support our clients in keeping their focus on the long term.

In the meantime, we do remain short on time and seek to optimize the risk-return ratio where possible, by (re)buying securities that are trading at an undervaluation of above 30 or 40% due to the excesses in the financial markets, while monetizing positions with a smaller margin of safety.

We cannot predict what the central banks will do, how inflation will develop, what Putin’s next move will be or what black swans may be ahead. What we do know is that high-quality companies with pricing power and a strong competitive position produce good returns over time that can meet financial investment objectives.

Their strong balance sheet allows them to weather a crisis, and possibly even profit from it by increasing their market share and/or acquiring competitors. Meanwhile, we patiently invest with knowledgeable families, entrepreneurs and seasoned investors who have put a substantial part of their capital on the line(skin in the game) to make their company or fund a success. As far as we are concerned, this is a rock-solid driving force that inspires confidence toward the future.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner