Monthly Bulletin October 2022

Attached please find the monthly report, in which we share our views on conditions in the financial markets.

Monthly Review: Why The Glass In Investing Is Half Full

The past few years have been anything but calm, both socially and economically. Financial markets have also been turbulent, and 2022 is a prime example of this. In our reporting, we always strive to keep a long-term focus, specifically on the strong developments of the securities within our portfolio. This often translates into articles with an optimistic message.

Although many associates say they generally appreciate this, it can create resistance in the shorter term, especially if returns are under pressure. Moreover, the news coverage is anything but positive: newspapers and magazines often do not predict much good, and investment gurus can always be found proclaiming that the stock market could fall even further or that the economic situation will continue to deteriorate.

The so-called “talking heads” fill airtime with a potpourri of opinions, but ultimately none of them has a crystal ball. In the book “Super Predictors,” Professor Philip Tetlock writes, based on extensive research, that we humans are actually incredibly bad at making predictions. Only a very limited number of people can make somewhat accurate predictions on a one- or two-year time frame, but that always turns out to be in hindsight. Moreover, it is far from certain that most of the predictions of “super predictors” are correct, partly because of the constantly changing conditions of the world.

The traditional media has become increasingly sensationalist in recent years – reinforced by social media. Relatively minor problems of a transient nature are widely reported because that guarantees higher newspaper circulation, more clicks and higher ratings. Tetlock indicates that the number of news stories a person reads actually has a negative effect on the ability to make predictions, because the vast majority of news stories involve “noise on the line” rather than meaningful signals.

Moreover, there is an extensive fear industry of doomsayers and predictors of doom that has made it a business model to announce one crisis after another. They usually make eye-catching statements, garnering media attention. They are welcome guests at conferences because of their bold statements. It is sometimes jokingly said that these doomsayers predicted six of the last two recessions.

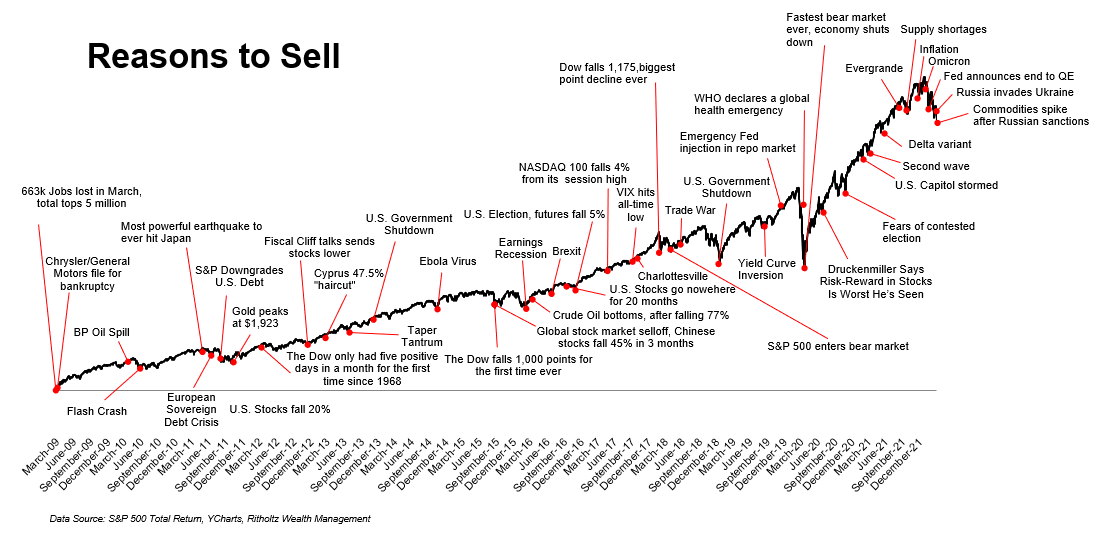

However, investors with a long-term horizon who wish to grow their capital sustainably and/or preserve purchasing power are largely better off viewing this as “noise on the line.” We have previously shared the figure of “reasons to sell” in the chart below updated through 2022 (click on the image for a larger view).

The chart shows all the headlines that have influenced media and investor sentiment since the credit crisis. Each headline could be seized upon as a reason to sell, but each time that would have turned out to be a mistake. The stock market often looks past such concerns and then anticipates a recovery. This was most evident during the corona crisis, when the lockdowns were actually ratified the stock market had already bottomed.

Anyone who reads these headlines, or is an avid follower of the news, would almost forget that we have indeed experienced tremendous positive development socially. Living standards have improved significantly in recent decades, and hundreds of millions of people worldwide have moved out from under the poverty line. Human ingenuity and innovativeness result in long-term economic growth, which translates, among other things, into higher stock prices. Viewed this way, then, it pays to see the glass as half full.

However, being an optimist does not mean being naive about risks and macroeconomic or geopolitical challenges that arise. We regularly review developments to consider how our portfolios are or may be affected, which is a standard part of our risk management.

If an investment case is fundamentally under pressure, this is a reason for us to sell. In the financial literature, however, price fluctuations (volatility) are labelled as a risk, and that is where we think they are wrong. Intermediate price fluctuations are part of investing, a falling price does not mean that there is something wrong with the security concerned. It is only a reflection of the perception of investors.

In the short term sentiment determines the stock price, in the medium term fundamental developments, and in the very long term corporate culture plays an important role (see also the chart above).

It’s about timing in the market, not timing (getting in and out) of the market. The explosive recovery we saw in November following the release of the better-than-expected inflation data in the United States is further proof of this.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner