Attached please find the monthly report, in which we share our views on conditions in the financial markets. We try to go in-depth, raise important topics for investors, or take a closer look at recent events.

Charlie Munger: Iconic Investor, Sharp Mind And Striking Personality

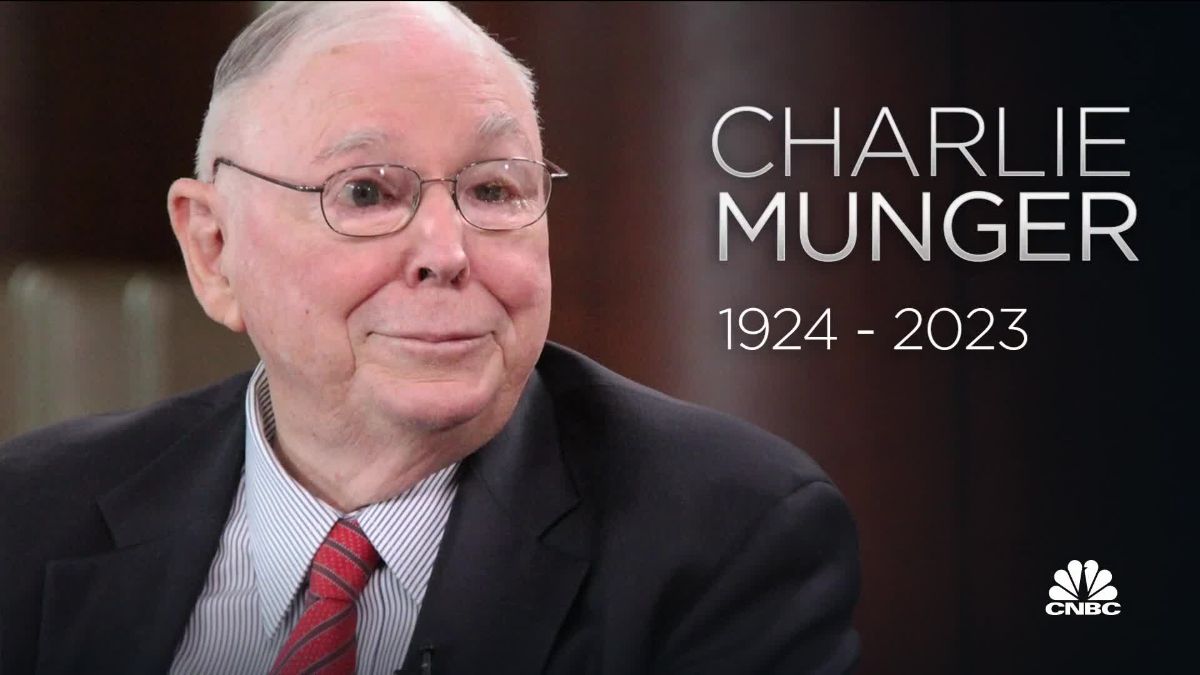

In our weekly newsletter, we regularly cover developments within our portfolio. in the monthly newsletter, we try to zoom out a bit more, to discuss larger themes and delve deeper into issues. This month is dedicated to Charles T. Munger, who passed away on Nov. 28 at the age of 99. A weekly newsletter, or a monthly report, does not do justice to the influence Munger had on the investment world, and not least on Tresor Capital’s investment vision. Still, we don’t want to let this event go unnoticed.

Charles T. Munger

Along with his friend and associate Warren Buffett, Munger has established one of the most impressive track records in the investment world. Our associates have partly capitalized on this, through an equity stake in the holding company Berkshire Hathaway.

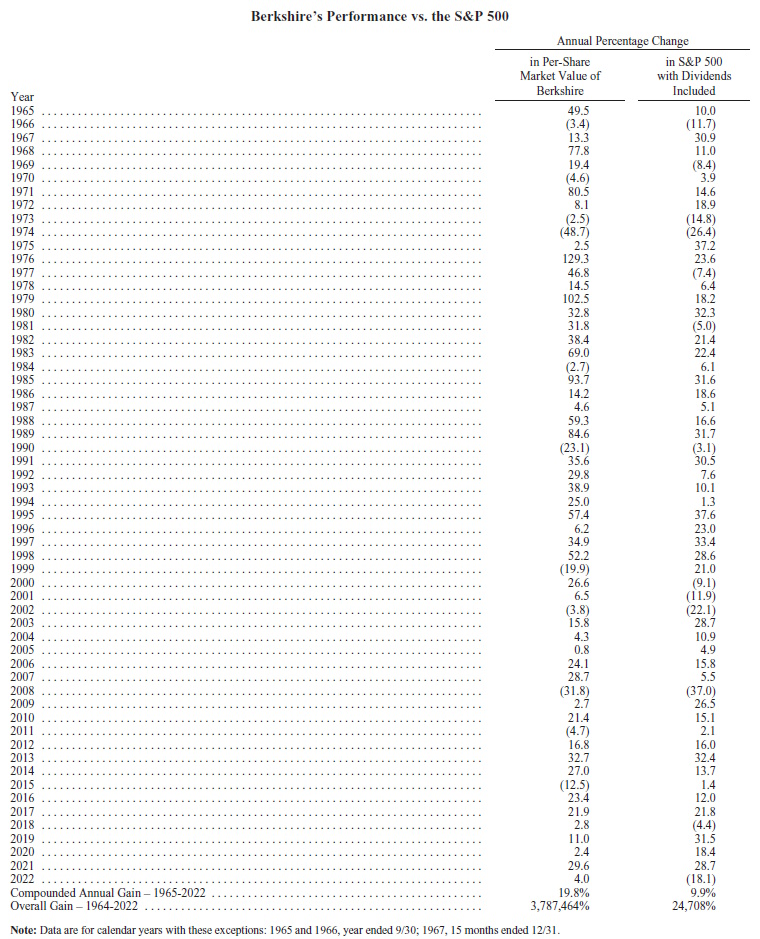

Since 1965, Berkshire Hathaway has achieved an average return of 19.8% per year, according to the table below, which appears as the first page in the holding company’s annual report each year. The S&P 500 stock index achieved a return of 9.9% per year during this period.

Both returns may be there, but the difference in absolute returns due to the miracle of compound interest is significant. Berkshire Hathaway posted a total return of 3,787,464% through 2022 versus 24,708% for the stock market index.

Charlie Munger always emphasized that success in investing does not depend on your IQ, but on your behavior and temperament. Munger modestly states that Berkshire really hasn’t done exceptional things, one has simply tried to do less stupid things than others, he summarizes in the quote below.

“It is remarkable how much advantage people like us have gained in the long run by consistently not being stupid, rather than trying to be very intelligent.”

Charles T. Munger

Munger is known for his perceptive, often humorous comments(click here to watch a short YouTube compilation to illustrate). For example, he once said, “If people weren’t so often wrong, we wouldn’t be so rich.” It is no secret that many investors achieve suboptimal returns from their actions due to a variety of psychological effects. One example is getting in at record prices and chasing all kinds of hypes, and, on the contrary, getting out at lows because one fears incurring further losses. Munger was often on the other side of such trades with Buffett.

Munger was crucial in building today’s Berkshire Hathaway, but also in the transition of Buffett’s investment vision. Buffett attributes the transition from a focus on low-valued, poor-quality value stocks (“cigar butts” with one last puff left in them) to high-quality companies with a sustainable competitive advantage entirely to Munger. “Because of him, we started looking for wonderful companies at reasonable prices, rather than reasonable companies at wonderful prices,” Buffett said later. “Berkshire was shaped according to Charlie’s blueprints.”

Much of Munger’s investment vision can be seen at Berkshire. For example, the portfolio is highly concentrated because, according to Munger, “the whole secret of investing is to find investments where it is safe and prudent not to diversify. Diversification is for the uninformed investor; it’s not for the professional.”

Berkshire also does relatively few trades because Munger states, “In investing, you select a few great companies and then sit on your ass. The big money is not in buying or selling, but in waiting.”

Most tellingly, Munger still announced new investments in recent years as “long-term investments,” despite his advanced age. Reportedly, his last purchase several quarters ago was a position in China’s Tencent.

A lifetime of learning

Munger has spent his life preaching rationality and becoming aware of psychological biases. He has accumulated a very broad body of knowledge through continuous learning. Munger studied mathematics, physics, meteorology and mechanical engineering, among other subjects.

He then graduated magna cum laude in law from the prestigious Harvard University. Like his great role model Benjamin Franklin, one of the founding fathers of the U.S., Munger was a true autodidact. For example, he became an expert in architecture and psychology. Through the quotes below, Munger encourages everyone to keep learning.

“If you want to live long, you have to keep learning. What you used to know is not enough. If you don’t adapt, you are like a one-legged man in a match ass-kicking.”

Charles T. Munger

“I constantly see people moving forward in life who are not the smartest, and sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up.”

Charles T. Munger

Berkshire Hathaway after Munger (and Buffett)

Munger’s passing also makes investors look at 93-year-old CEO Buffett with an oblique eye. Buffett wrote just before Munger’s death in a letter to shareholders: ” I realize that I am in the extra time. We have the right CEO to succeed me and also the right Board of Directors. Both are needed. The advantage of Berkshire is that it is built to last. “

Since 1965, Buffett and Munger have built a corporate form and culture that should be able to propel the organization well for decades to come – even without Buffett or Munger at the helm. The Financial Times devoted a worthwhile article (click here to read it) to the future of Berkshire without either top executive at the helm.

In any case, the succession plan has been public for several years. Buffett’s son Howard (68) will be responsible for overseeing the company’s culture as chairman of the SB. Greg Abel (61) will be given day-to-day management and ultimate responsibility as CEO. As vice president, he is already currently responsible for the ins and outs of all operations except insurance, that responsibility falls to vice president Ajit Jain (72). Todd Combs (52) and Ted Weschler (61) will manage the listed equity portfolio. They already manage more than USD 30 billion independently, without any interference from Buffett.

Jokingly, but with a grain of truth, Buffett has hinted many times in recent years that Berkshire may actually be improving with this new format. Abel is much more “hands-on,” taking an active approach in improving the businesses within the holding company. Buffett repeatedly stated that Jain has a much better understanding than himself in terms of insurance, while Combs and Weschler have made better returns than himself in recent years, according to Buffett.

At least they have had decades to learn from the grandmasters, but whether they can match the unique insight of Buffett and Munger remains to be seen. However, it will be virtually impossible to get such a good capital allocator as Buffett at the helm. “Too bad then,” Munger succinctly stated. Munger himself posited the view that Berkshire investors will continue to earn fine returns after Buffett.

In his latest interview with CNBC (see below), Munger stated on this, when asked about the large cash mountain (USD 160 billion), “Who better to put the money to work than the individuals who have experienced Berkshire up close over the past few decades, who have seen how the company was shaped and how successfully that method has worked?”

Thought remains

Just last month, Munger gave an interview to CNBC’s Becky Quick. It would prove to be his last interview. We are happy to share the full, nearly two-hour interview with you(click here or on the image below). Even just before his death, the nearly 100-year-old Munger was still mentally sharp as a knife.

Charlie Munger will no longer provide us with sharp commentaries, comedic observations or wise anecdotes. His thought leadership, however, will remain. Munger’s legacy is a wealth of investment wisdom and life insights, a legacy that will continue to enrich the minds of investors around the world for decades to come. His lessons, founded on a blend of intelligence and common sense, will navigate many investors through the complex financial world and life in general.

If you have any questions or comments about this e-mail or other matters, please kindly contact us using the details below.

Sincerely,

Michael Gielkens, MBA

Partner