Receive Tresor Capital’s free weekly newsletter, which includes:

- Analyses of family holding companies and serial acquirers

- Deep dives into fundamental investing

- Michel Salden’s keen macro vision

At Tresor Capital, we have been following the Swedish market of family holding companies and serial acquirers with particular interest for many years. Names such as Lifco, Indutrade and Investor AB capture our imagination and are an important part of our investment strategy.

Yet the broader story of Sweden as a capital markets leader, Europe’s Wall Street, so to speak, often remains underexposed. The recent Bloomberg documentary “Sweden as Europe’s Bright Spot for Capital Markets,” along with insights from key figures such as Investor AB’s CEO Christian Cederholm, shows why Sweden has developed a unique and superior ecosystem for value creation.

An Investment Culture with Depth and Confidence

The basis of Sweden’s success lies in a deep-rooted and broad-based equity culture. Unlike many other European countries, investing in Sweden is not a niche activity, but an integral part of society. As much as 36% of household wealth is invested in equities, a percentage comparable to that of the United States.

This is driven by an extremely favorable tax environment, with the Investment Savings Account (ISK) as the cornerstone. This structure, with a low flat tax and the absence of capital gains or transaction taxes, has led to a vibrant market with more than two million private shareholders. As Investor AB CEO Christian Cederholm puts it in the documentary, this creates a “positive flywheel”: broad share ownership creates involvement in business and anchors it in society.

The Wallenberg Ecosystem: Capital with an Eternity Perspective

One of the most distinctive features of the Swedish market is the dominant role of patient, family capital. Investor AB, the investment vehicle of the influential Wallenberg family, is the ultimate example of this. It is much more than a passive shareholder; it is an active owner with a vision that spans generations.

CEO Cederholm emphasizes that Investor AB takes a “perpetuity perspective” and fundamentally does not see exits as part of the strategy. One invests in high-quality companies with “structural tailwinds” and a “sustainable existence,” often market leaders with superior products. The goal is not to trade companies, but to build and strengthen them.

This active, engaged shareholding, combined with a strong focus on governance, provides the portfolio companies (including such heavyweights as Atlas Copco, ABB and AstraZeneca) with the stability to innovate and invest for the long term, free from the pressures of short-term results.

This model, in which social anchoring and economic efficiency go hand in hand, is a key factor in the lasting success of the Swedish model. The Wallenbergs’ motto sums it up perfectly:“The only tradition worth preserving is the transition from the old to what is to come.”

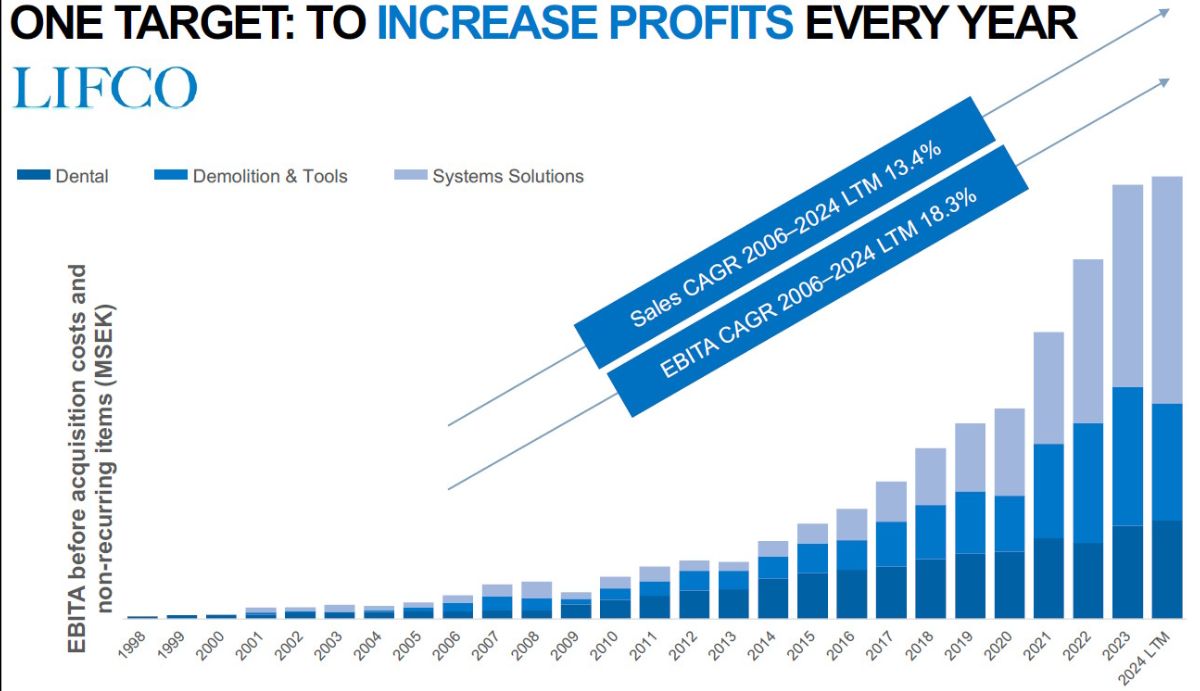

At Lifco, founder and major shareholder Carl Bennet guards that distinctive long-term focus, while Indutrade has the Lundberg family as its anchor shareholder.

A Fertile Ground for Growth and Innovation

The combination of a vibrant capital market and patient capital creates exceptionally fertile ground for both established companies and startups. With more than 1,200 companies listed, Stockholm’s Nasdaq Nordic is one of the world’s most active stock exchanges per capita.

The relatively low average market capitalization lowers the threshold for young, growing companies to raise capital. This is supported by a robust financial infrastructure with players like Swedbank and innovative fintech companies like Froda making financing accessible.

This infrastructure is complemented by an extremely favorable business environment. Sweden combines a strong industrial base (Sandvik, SKF, Ericsson) with global tech pioneers (Spotify and Klarna). Unlike the disruptive culture of Silicon Valley, Sweden opts for a model of gradual evolution, supported by stable regulations, legal certainty and an efficient government. Moreover, the country leads the way in technology adoption; for example, 73% of companies use cloud computing, well above the EU average of 45%.

Where Silicon Valley embraces disruption, Sweden opts for gradual evolution, supported by social policies and stable regulations. Here, sustainability is not a trend but systemic logic: ESG criteria are deeply embedded in corporate strategies, leading to high ESG ratings and broad inflows into sustainable funds. Sweden combines business-friendly taxes (low dividend tax, no inheritance or wealth tax) with legal certainty and an efficient government. The result is a balanced model where economic freedom goes hand in hand with social cohesion.

The Power of Internationalization and the Serial Acquirer Model

Forced by a relatively small home market, an international orientation is in the DNA of Swedish companies. Only a fraction of the sales of Sweden’s largest companies come from their home region. This, as Cederholm points out, forces them to compete on the global stage from day one. This explains why the Nordics, with only 0.3% of the world’s population, are overrepresented in the list of Europe’s most valuable companies.

This climate is the perfect breeding ground for the success of serial acquirers like Lifco and Indutrade. These companies apply the Swedish principles of decentralization, long-term thinking and capital discipline on a global scale. They acquire niche companies and give them the autonomy and resources to grow sustainably. The impressive and consistent growth of their profits, growing even faster than sales, demonstrates the strength and sustainability of this model.

The Tresor Vision: An Oasis of Quality in Europe

Within Tresor Capital’s global portfolio, we see that Swedish holdings are structurally among the best performing investments. The Nordics, and Sweden in particular, are in a class of their own.

The unique interplay of a deep equity culture, patient and active capital, an innovation-friendly business environment and an innate international focus, creates an ecosystem that enables superior, sustainable value creation. For us, Sweden is and remains one of the most attractive and reliable markets to invest in for the long term.

Indutrade, Investor AB and Lifco ended the trading week on the Stockholm Stock Exchange at prices of SEK 262.40, SEK 282.20 and SEK 396.60 per share, respectively.