Receive Tresor Capital’s free weekly newsletter, which includes:

- Analyses of family holding companies and serial acquirers

- Deep dives into fundamental investing

- Michel Salden’s keen macro vision

On Wednesday, 5 November 2025, we had the pleasure of welcoming more than 110 of our valued business relations to the beautiful setting of La Butte aux Bois in Lanaken. It was a special evening, filled with in-depth conversations, valuable insights and a shared vision on sustainable asset management, particularly in a market that feels increasingly volatile and turbulent.

The evening was dedicated to our half-yearly update, during which we not only shared recent developments within Tresor Capital, but also explained our strategy and vision. We were joined by two exceptional guest speakers from Canada and Scotland, who represent two of the key investment propositions within our portfolios.

Tresor Capital update on the theme of “Staying the course with skin in the game”

The evening was opened by Michael Gielkens, partner at Tresor Capital, and Michel Salden, Investment Manager. They took the attendees through the current state of affairs in the market and the positioning of our portfolios.

More and more people are finding their way to Tresor Capital, and we are proud of that. It confirms our philosophy, which is based on fundamental investing, a very long-term horizon and a concentrated portfolio of our strongest convictions. We think like co-owners, not traders. This is reinforced by the fact that we co-invest our private wealth in the same propositions as our clients. For us, “skin in the game” is not a marketing term, it is the foundation of our partnership with our clients.

A portfolio of quality and resilience in a market where success seems synonymous with the word AI*

Performance and adjustments in 2025

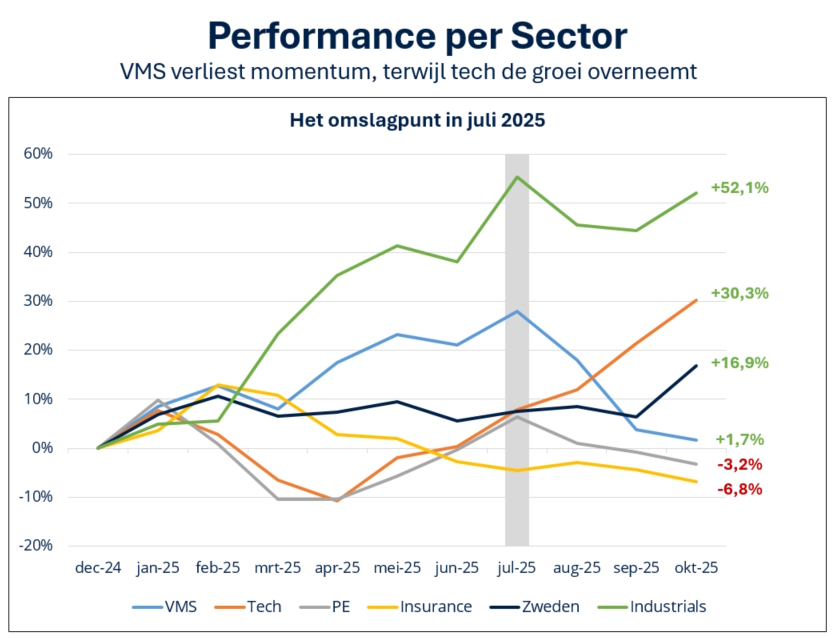

A look at performance through October, as illustrated in the chart above, highlights the resilience of the strategy. In a volatile year, in which the benchmark experienced peaks and troughs, the family holding mandate managed to follow a more stable path and achieve a return* of 7.81%. This means that the portfolio outperformed the benchmark, which ended at 7.46%. During the presentation, the holding portfolio was divided into six segments, as you can see in the image below.

The year 2025 got off to a strong start, largely driven by Vertical Market Software (VMS) and industrials. Industrial MBB, whose CEO Constantin Mang was our guest speaker for two years in a row, led the way this year with a return of more than 95% through October.

Later in the year, we saw VMS companies such as Constellation Software and Topicus lose momentum due to fears that artificial intelligence (AI) could replace their niche software. We do not share these fears. As explained during the client day, the “moat” of VMS companies is deeply rooted in business-critical workflows and decades of trust built up with entrepreneurs. AI is not a replacement here, but an enhancer. We previously shared our vision in a article, which you can read here on our website. The tech sector, led by a strong recovery at Alphabet, took over the growth trend later in the year.

We have made a significant reallocation within our selection of Swedish holding companies. We have consolidated our position in Indutrade to what we consider to be the superior serial acquirers AddTech and Lifco, which show a higher return on invested capital (ROIC) and better profit development. We previously announced this as explained in our newsletter.

In addition, the portfolio has been adjusted to increase exposure to technology and AI. By purchasing undervalued holdings with exposure to this sector, we avoid simply following the hype and maintain our focus on fundamentals. We did this through two transactions. First, we opened a new position in Alphabet. After a period of uncertainty surrounding competition from ChatGPT, Deepseek and Trump’s trade tariffs, which offered attractive opportunities to build our position, the company regained its leading position, resulting in strong growth in Cloud, Search and YouTube. Since its addition to the portfolio, it has been one of the strongest performers with a return of +60.5% on the average purchase price.

Secondly, the existing position in Scottish Mortgage Trust has been significantly expanded, as this holding was still trading at a discount of more than 10% (historically, there was virtually no discount). This holding company provides us with diversified exposure to a basket of both listed and private tech and growth companies, further broadening our AI exposure. You can read more about this holding company later in this report.

To make the portfolio more resilient to market fluctuations, less cyclical names such as 3i Group and Heico have also been added. 3i is the owner of the successful non-food discounter Action, whose value proposition is highly resilient in times of economic headwinds. Heico is a major supplier of (often mandatory) replacement parts for the aviation and defence industries, sectors that are driven by long-term contracts and safety requirements, rather than by economic conditions.

The opportunity in family holdings

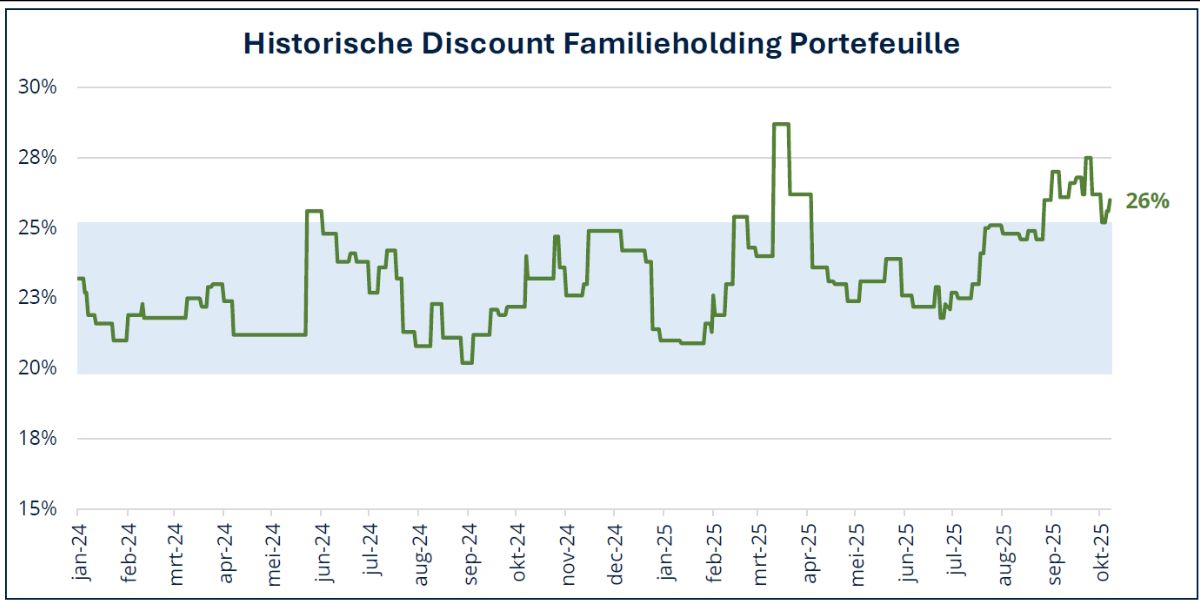

At the end of October, our family holding portfolio was trading at an above-average undervaluation.

With a discount of 26% compared to the net asset value, we see an excellent opportunity to become a co-owner of the high-quality companies that form the backbone of our strategy.

A look at the world and the macroeconomic outlook

Michel Salden then outlined the macroeconomic outlook. He opened with an image of Europe as “the sick man”, visually represented as a patient on an ECB drip, under the watchful eye of Christine Lagarde. This stagnation, combined with rising sovereign debt, inevitably leads to a less favourable fiscal climate and a search for higher taxes, which drives capital flight from the region.

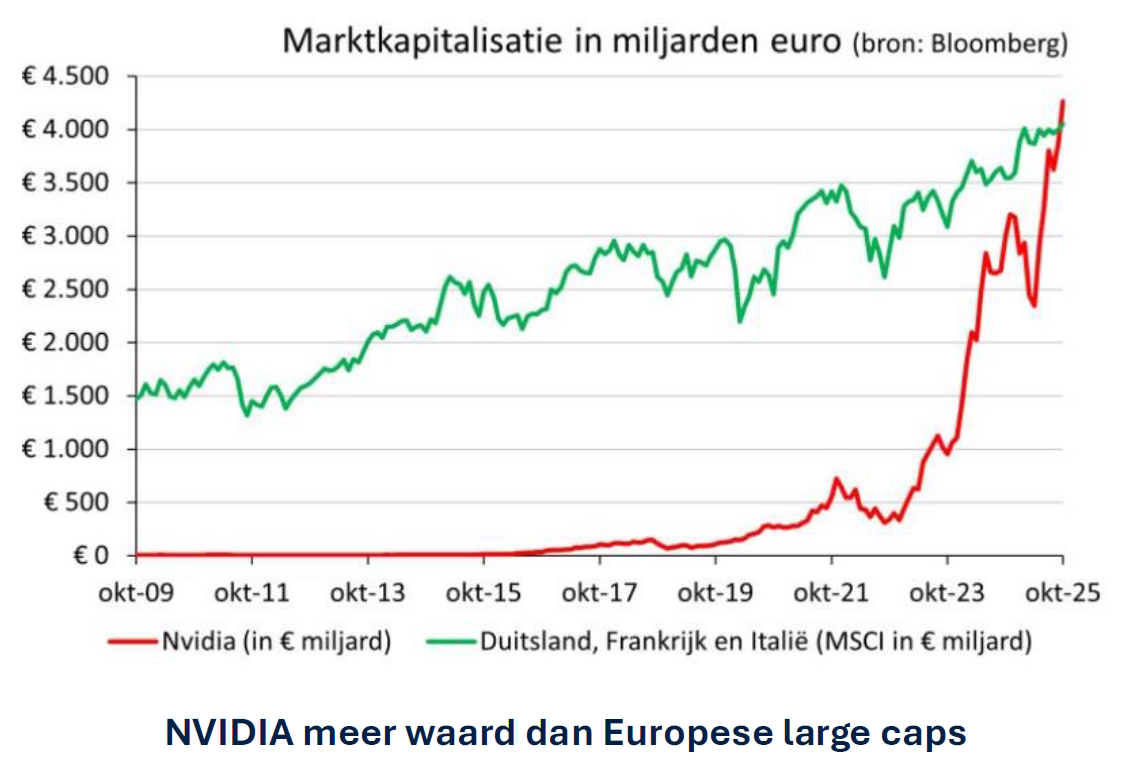

At the same time, there is a global race for dominance in AI. This race is mainly being fought between the United States, which innovates, and China, which copies, while Europe mainly regulates. Companies such as Microsoft, Amazon, Alphabet and Meta will invest more than USD 400 billion in 2025 alone. This explosive investment cycle is in turn leading to a new, physical bottleneck. The demand for energy from data centres is growing exponentially, and the capacity of existing electricity grids simply cannot keep up with this pace.

In the US, the ‘Buffett Indicator’ (the total market capitalisation of the NASDAQ as a percentage of GDP) points to extremely high valuations, which now exceed the peak of the dot-com bubble in 2000. This dangerous overvaluation in the US reinforces our choice to overweight fundamentally sound, reasonably valued Canadian/European family holdings, supplemented by specialised funds.

Building a future-proof investment boutique

Finally, we highlighted the operational developments that further improve our services and make Tresor Capital more future-proof and accessible.

An important milestone is the addition of ABN AMRO in Belgium and the Netherlands as our newest custodian bank. This step was a direct response to the wishes of our growing Belgian clientele in particular. It offers fully integrated processing of the Tax on Stock Exchange Transactions (TOB) and streamlined handling of capital gains tax. Our entire range of products is available at the bank. In addition, it offers the possibility of gaining exposure to our strategy via a BE IBAN number.

In parallel with this, the Actively Managed Certificate (AMC) was successfully launched earlier this year. This certificate is similar in operation to an ETF, closely follows Tresor Capital’s family holding strategy and offers clients an alternative and flexible way to invest. The main advantages are its daily tradability and the potential opportunities it offers for tax optimisation. The AMC is also available through a management mandate with ABN AMRO.

With an eye on 2026, the upcoming launch of the Tresor Capital mobile app was announced. This app, which will go live in the first quarter, brings together all essential information in one user-friendly place. It gives clients direct insight into their portfolio, a complete overview of transactions, and access to all reports and invoices.

Together with the upcoming launch of a new, searchable website for our newsletter, this represents a major step forward in the further digitisation and accessibility of our services. With these initiatives, we continue to build a future-proof and accessible investment boutique.

Andrew Brenton and the discipline of Turtle Creek

As the first guest speaker of the evening, Andrew Brenton, CEO and co-founder of Canadian firm Turtle Creek Asset Management, provided an in-depth update on his strategy and vision. He opened directly with the most pressing question in the current investment climate: what can investors expect from the stock market in the coming years?

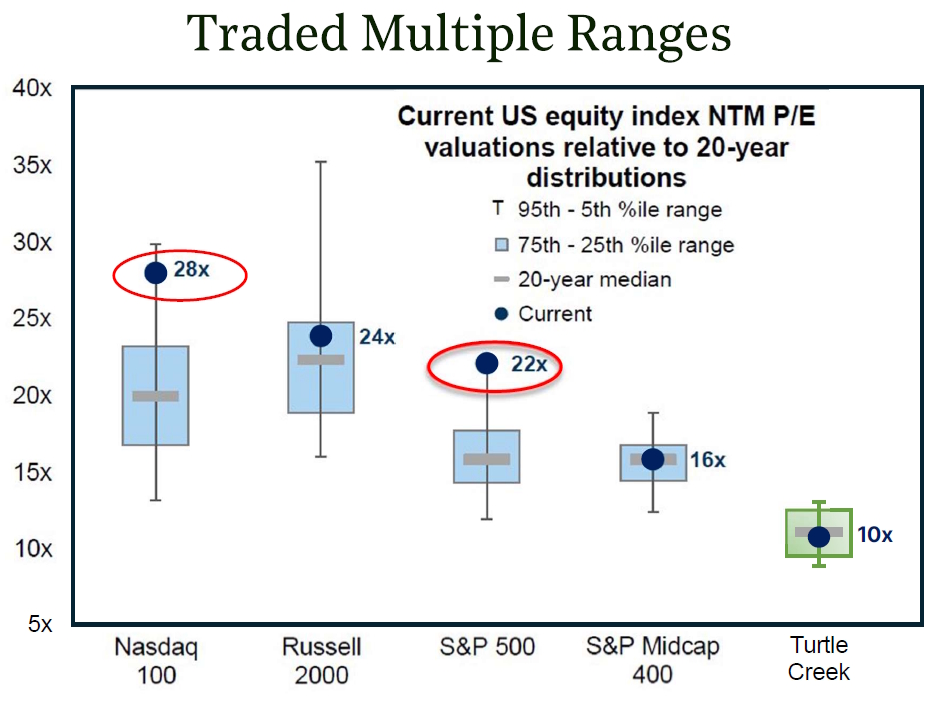

Brenton painted a sober picture for investors who simply follow the index. Based on a decade-spanning analysis, he showed that the return on the S&P 500 for the next ten years is likely to be close to zero, somewhere between -1% and +2%. The reason for this is that the current high valuations, with a price-earnings ratio of 22x-23x, simply leave no room for multiple expansion as a return driver.

Brenton countered this expensive market with his own strategy, which he describes as ‘A different kind of value investing. A better kind of private equity.’ He illustrated this point with a powerful chart (shown below) that puts today’s valuations in historical perspective. While the Nasdaq trades at 28x earnings and the S&P 500 at 22x (both at the absolute top of their 20-year median), Turtle Creek’s concentrated portfolio trades at a historically low 10x earnings.

Their returns, Brenton argued, do not come from speculation on higher multiples, but from pure underlying profit growth. With Turtle Creek expecting profit growth of more than 20% per year (double their historical average), the portfolio is positioned to create value on its own merits, regardless of the market.

Brenton was also transparent about the recent underperformance, which he explained as a direct result of their discipline. In a risk-on tech rally, driven by the flavour of the day, they deliberately choose not to participate. Their focus is on buying quality companies when their Business Value (their internal estimate of value) is significantly higher than the stock market price.

The core of the Turtle Creek philosophy is ‘Time Arbitrage’. The longer the horizon, the greater the chance of outperformance. Over a period of 10 years, Brenton demonstrated that their strategy outperformed the market in 98% of cases. This resulted in an annual compound return of 19.2% since its inception in 1998, compared to 8.2% for the market. This disciplined, research-driven approach focused on consistent compounding fits seamlessly with Tresor Capital’s core philosophy. We are therefore proud that Tresor Capital is the only party in Europe that can offer its clients access to Turtle Creek’s highly sought-after institutional founder share class.

Hamish Maxwell and Scottish Mortgage’s bold vision

After a culinary appetiser, Hamish Maxwell, Investment Specialist at Scottish Mortgage Investment Trust, took the floor. With his background in the Royal Navy, where he served on submarines, Maxwell drew a powerful parallel. In both the navy and the financial markets, patience, discipline and a steady hand are essential when the waters become turbulent.

The core of his argument was Scottish Mortgage’s ‘Distinctive DNA’. In a world that seems obsessed with quarterly results, he offered a refreshingly different and bold perspective. The entire philosophy of the trust, he explained, is based on one fundamental principle: the search for ‘Outliers’.

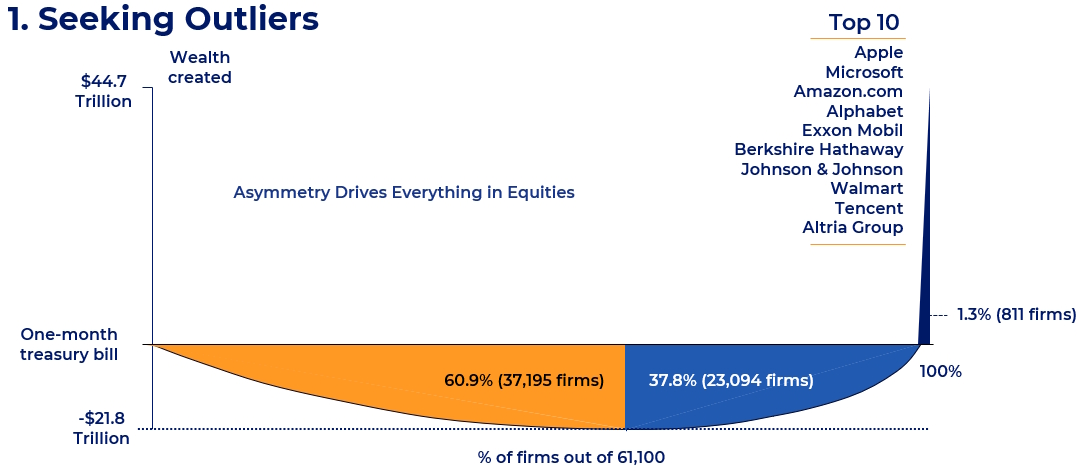

Maxwell referred to a groundbreaking study that analysed the returns of more than 61,000 global equities. The conclusion was shocking. Only 1.3% of all companies (811 in total) were responsible for 100% of all net market value created above government bonds, because 37.8% of the winners’ profits had to compensate for the losses of the 60.9% losers. As a result, the remaining 98.7% of companies performed on balance only as well as risk-free T-bills. Scottish Mortgage’s mission is therefore not to follow the market, but to find and hold on to only those 1.3% ‘outliers’.

This inevitably leads to what Maxwell calls ‘asymmetric returns’. After all, the loss potential of a share is limited (a share can “only” lose 100% of its value), while the profit potential is theoretically unlimited. This was illustrated with examples such as NVIDIA, which generated a total return of more than 13,000% for the investment holding company (shareholder since 2013).

However, to find such winners, one must accept extreme volatility. Even the biggest winners, he demonstrated, experienced huge price declines. At one point, NVIDIA fell 56% and Tesla 65% from their peak. According to Maxwell, one must therefore have the ‘imagination, conviction and long-term thinking’ to hold on to them at precisely that moment.

This search for ‘outliers’ first brings Scottish Mortgage to ‘Transformational Growth Themes’. These are the structural trends that will dominate the coming decades. Examples include the digitisation of commerce (with positions such as Amazon and Mercado Libre), the digitisation of the financial world (Stripe, Revolut), the evolution of transport (SpaceX, Joby), and, of course, the “Enablers of AI” (TSMC, NVIDIA, ASML).

A second, and perhaps the most distinctive, element is its significant exposure to private companies. Maxwell explained that the listed market is experiencing an ‘era of missed growth’ because today’s most successful companies (such as SpaceX and ByteDance) are choosing to remain private for longer. Thanks to its “permanent capital structure” and reputation as a patient, supportive shareholder, Scottish Mortgage has access to the world’s “unicorns”. The portfolio currently consists of approximately 27-30% unlisted companies, including SpaceX (their largest position at 7.6%), ByteDance, Stripe and Databricks.

The resulting portfolio is, as Maxwell demonstrated, ‘global and unlimited,’ a pure output of bottom-up stock picking. The result is a holding with ‘distinctive DNA,’ built on a 116-year history of patient capital management that is ideally positioned for tomorrow’s growth opportunities.

An evening full of connection

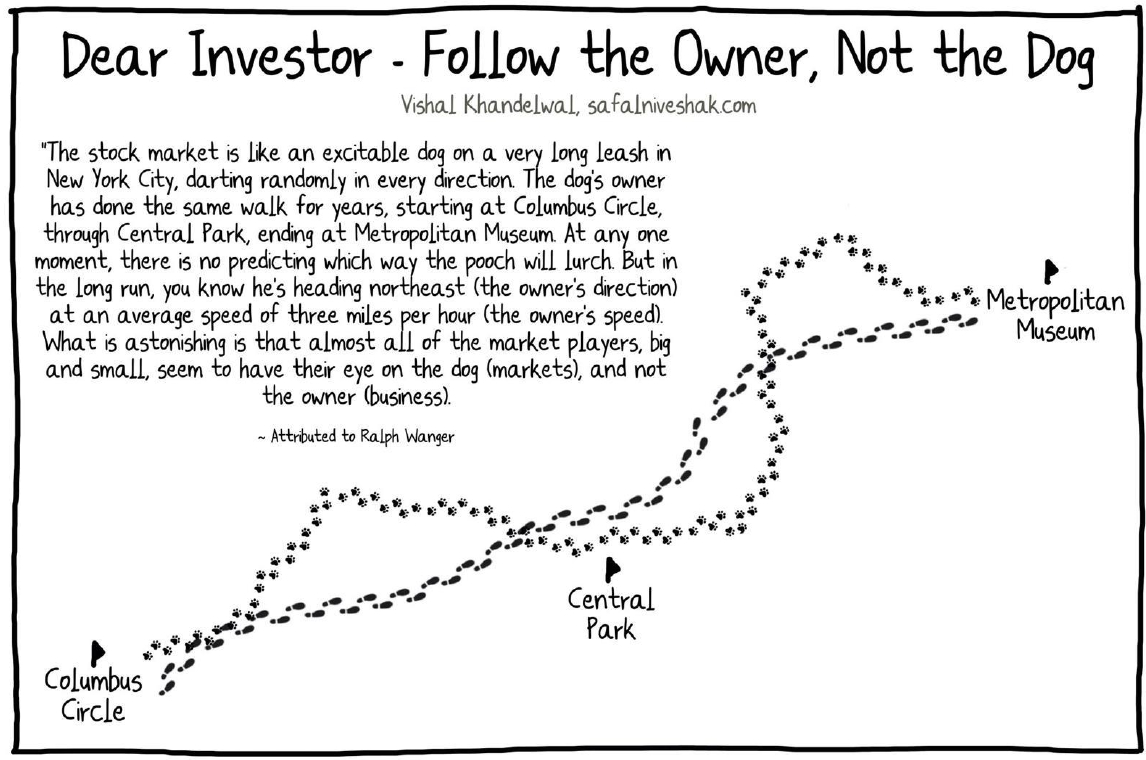

The core message of the evening was clear: don’t be led by the whims of the short-term market. As the metaphor “Follow the Owner, Not the Dog” in the figure above illustrates, the market (the dog) may be all over the place, but the underlying value of companies (the owner) follows a more predictable path. So we follow the owner.

The presentations were followed by a three-course walking dinner, which provided ample opportunity to chat with the speakers and the Tresor Capital team. It was a wonderful evening filled with good conversation.

We would like to thank everyone who attended. Your trust and presence form the foundation of our success. We look forward to seeing you again soon. In April, we expect to welcome Harold Boël from Sofina as a guest at our next event (exclusively accessible to Tresor Capital clients).

If you are not yet working with us, but share our vision of “skin in the game” and investing in long-term quality, we would love to hear from you via info@tresorcapital.nl or in response to this email.

Disclaimer:

*The returns reflect the performance of the family holding strategy, as offered through VP Bank’s management mandate. The value of your investments may fluctuate. Past performance is no guarantee of future results. The benchmark reflects 100% MSCI World ACWI EUR TR until April 2018. Since April 2018, the benchmark has consisted of 50% MSCI World ACWI EUR TR / 50% MSCI World Small Cap EUR TR. Past performance is no guarantee of future results.

Sector returns are calculated based on the current weighted allocation; within each sector, each position contributes in proportion to its share within that sector.

***AMC: Tresor Capital does not provide tax advice. For tax consequences or optimisation within investment products such as the AMC, we advise you to contact a certified tax advisor.