Receive Tresor Capital’s free weekly newsletter, which includes:

- Analyses of family holding companies and serial acquirers

- Deep dives into fundamental investing

- Michel Salden’s keen macro vision

Earlier this month, we traveled to Hamburg for Chapters Group’s annual Capital Markets Day and shareholder meeting. As Tresor Capital, we attach the utmost importance to closely monitoring the companies in our portfolio. We can confidently report that this day not only confirmed our conviction in your and our investment in Chapters Group, but significantly strengthened it.

For an introduction, we recommend reading our earlier analysis on Chapters Group.

At a time when much communication is digital and remote, the personal approachability, openness and transparency of the management of Chapters and its subsidiaries was a breath of fresh air. We have rarely seen a company provide such detailed insight into strategy, operational improvements and future plans. In this newsletter, we share key insights.

From left to right: Pieter Slegers (Compounding Quality), Marlene Carl (CFO), Jan Mohr (CEO), Michael Gielkens (Tresor Capital) and Kristof Heyndrikx (Potential Multibaggers/Best Anchor Stocks)

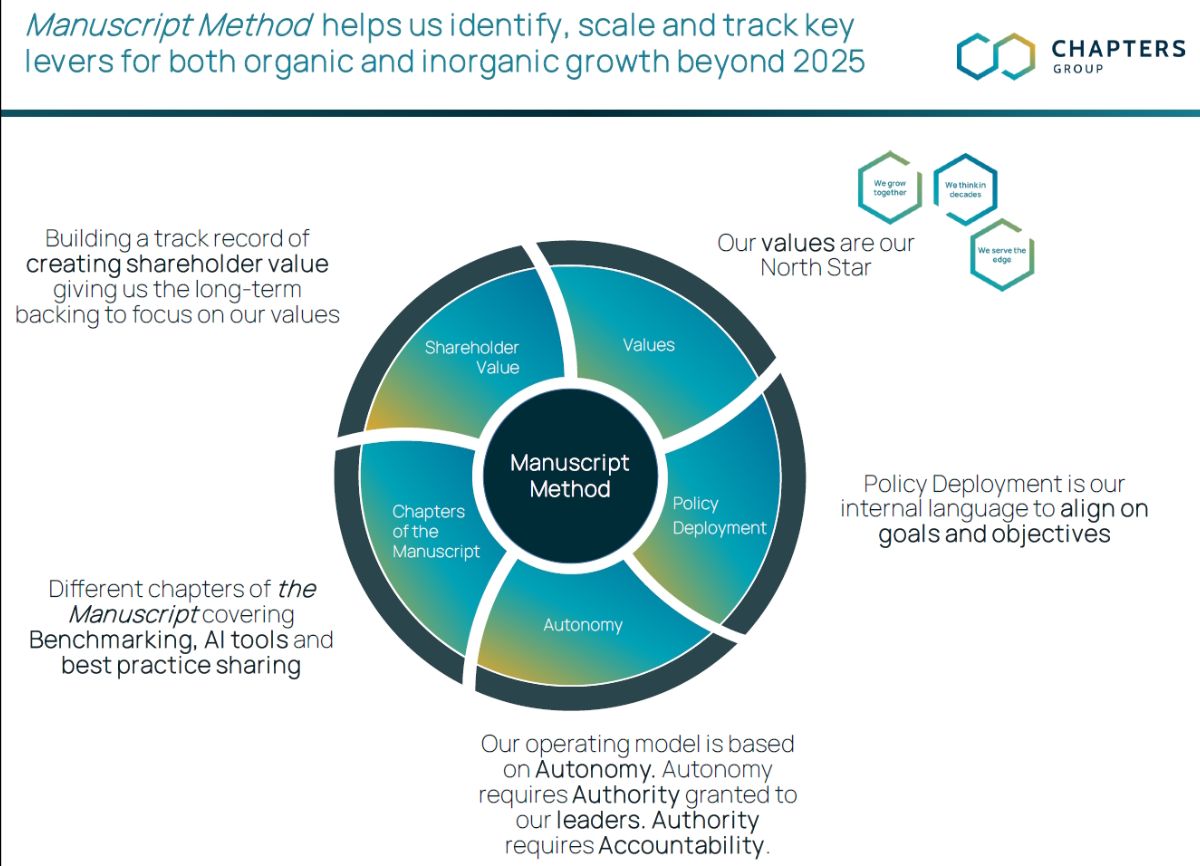

The Manuscript Method as an engine for organic value creation

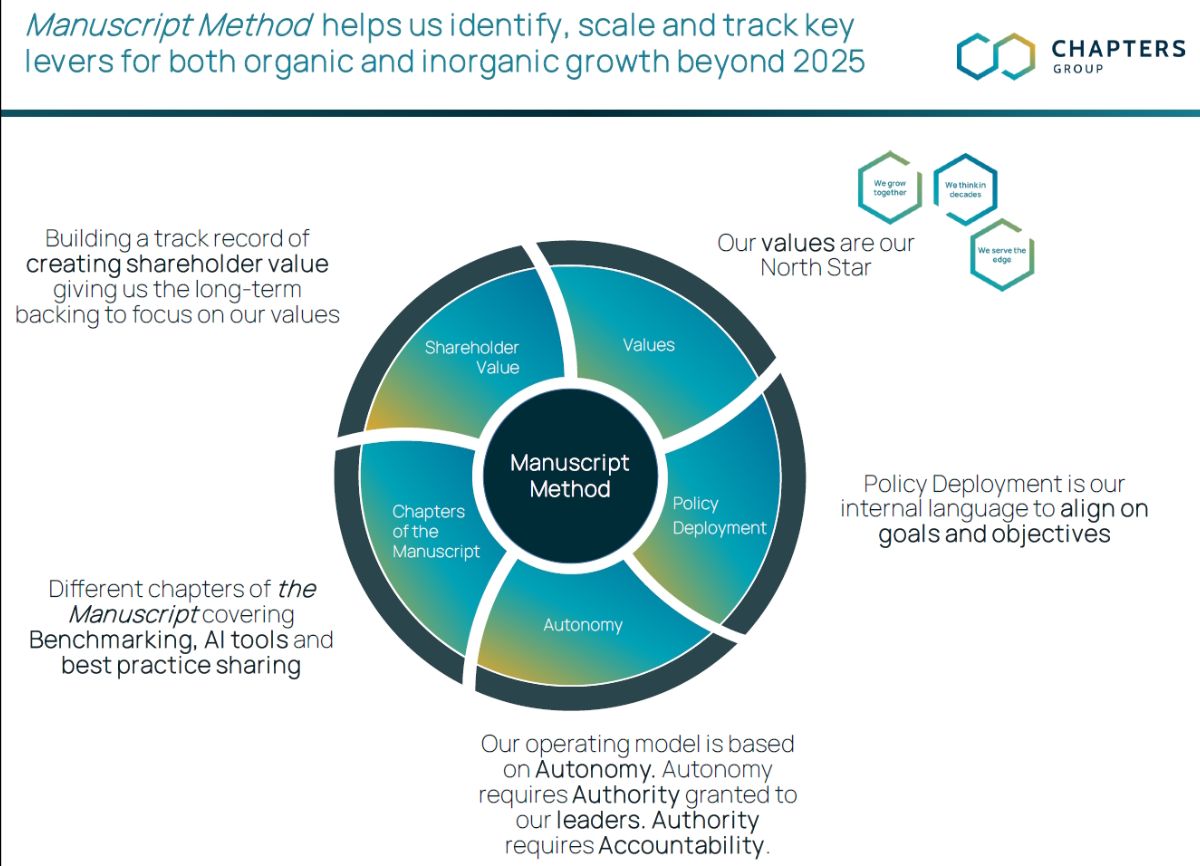

The common thread through all the presentations was the implementation and initial results of the “Manuscript Method.” This is the internal method for continuous operational improvement being rolled out throughout the group, entirely in the spirit of the famous Danaher Business System. It is therefore no coincidence that Mitch Rales, co-founder of Danaher, is one of Chapters Group’s major shareholders.

The rationale for this approach is clear and was explicitly stated: “World-class performance does not come naturally, it is produced.” Chapters recognizes that the companies they buy typically offer potential for continuous improvement, and the Manuscript Method serves as a blueprint for turning this potential directly into higher, sustainable profitability. Designed to equip operating company teams with the right tools and processes to grow their businesses profitably, the method enables Chapters as a holding company to provide the right support and templates in a scalable way.

COO Marc Maurer, with his background at one of Constellation Software’s largest operating units, is the driving force behind this. He has developed a kind of dashboard, an improved version of what we see at industry peers, that holds up a mirror to each subsidiary: this is where you score, this is where you can improve, and this is the potential.

Previously, there was little or no such steering. The portfolio consisted of many successful, often founder-run software companies, but there was what could be called “organized chaos. In practice, this manifested itself in stagnant product development, a lack of structural pricing adjustments based on customer value-add, and an operational focus more on maintaining the status quo than on achieving growth. Companies were scared to raise prices for fear of losing customers; some had never even done so.

The most telling anecdote illustrating this profit potential came from COO Marc Maurer. He described a visit to a subsidiary. Over dinner with the founders, who had entrusted their life’s work to Chapters, his first piece of advice was to double the prices immediately. Then they choked for a moment. The fear of an exodus of customers was palpable.

Yet, after extensive consultation and with the support of Chapters, the price was increased by 84%. The result was nothing short of spectacular and an absolute paradigm shift for local management: 0% customer turnover, or 100% customer retention. The entire 84% sales growth was pure price increase that flowed directly into profits. So the obvious conclusion is that even an 84% increase was still too conservative and the company had left significant profits on the table for years.

- Standardized processes: Clear requirements that must be met, describing what, by whom and when something must be done. This ensures a uniform basis of operational hygiene throughout the group.

- Standard modules and templates: Proven methods for practical implementation of the standards, including immediately usable document templates for financial reports or budgeting cycles, for example. This enables fast and efficient rollout.

- Best-practice modules: Proven methods or case studies for specific areas, such as “Value Based Price Normalization,” which moves away from looking at in-house costs and toward the ROI the software provides the customer. Another example is the use of standardized contracts for loans between group companies, which simplifies internal capital allocation.

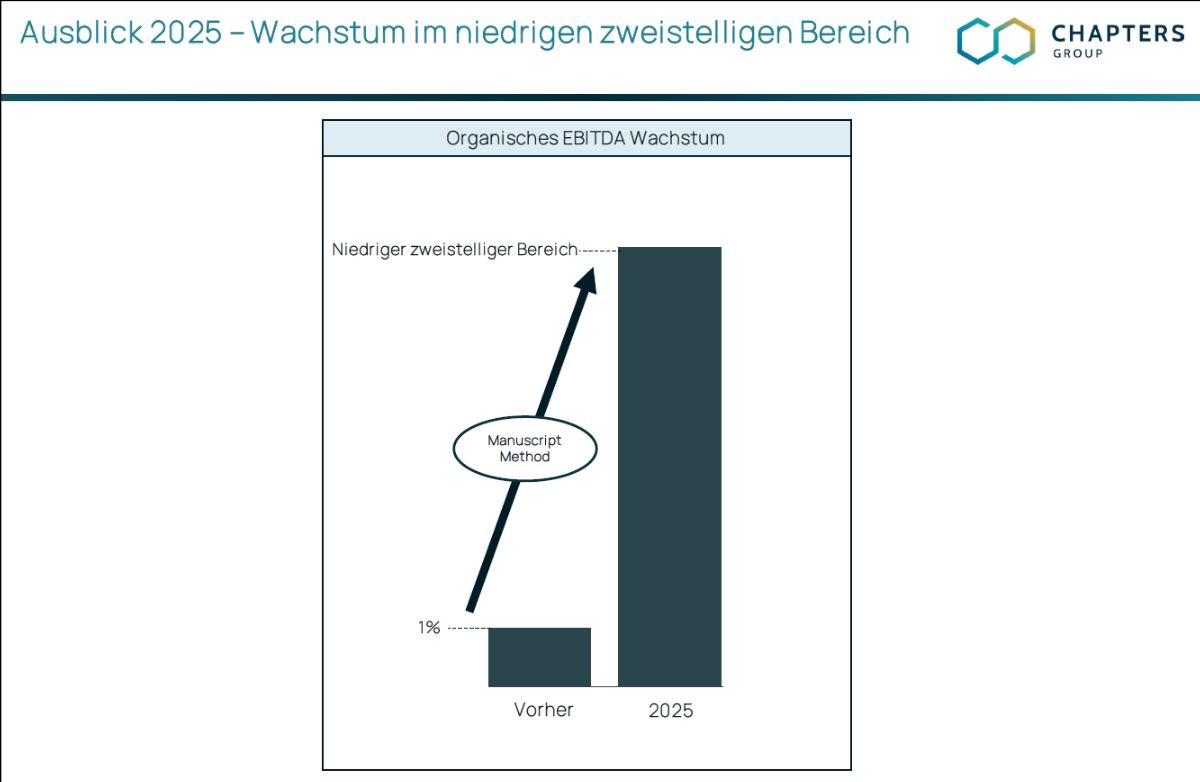

The price increase example falls under one of the “Manuscript modules,” the “Strategic Pricing Review. The concrete, measurable goal of the method is to accelerate organic EBITDA growth from around 1% historically to a level in the low double digits by 2025 and beyond. This organic growth is the most qualitative and profitable form of growth.

The organizational blueprint for scalable growth

Chapters does not hide its admiration for Constellation Software, the industry’s absolute tone-setter. However, they make a conscious effort to improve the model in critical areas to facilitate sustainable growth. One significant difference is the way best practices are shared. Whereas at Constellation this is often done at conferences, which is a form of event-driven knowledge transfer that must then “sink in,” Chapters is building a central database accessible to all.

A central part of the value Chapters adds is breaking ingrained patterns. To do this, Chapters used the apt analogy of “grandma’s wallpaper.” Just as one fails to notice the old wallpaper in a grandmother’s house after years, founders and managers of acquired companies often become “blind” to inefficiencies or outdated practices; “it’s just always been there. Chapters breaks through this by providing a fresh, outside perspective and, more importantly, applying data-driven benchmarking. By comparing the performance of over 50 comparable companies side by side, it immediately reveals where there are opportunities for improvement, for example, in daily consultant rates or pricing strategy.

An example: a subsidiary had, on its own initiative, developed a successful method for staff retention. This was noticed by headquarters and immediately spread as a best practice throughout the group. This illustrates the philosophy: not a 100% decentralized organization, but decentralized responsibilities within a central framework of proven methods. As one of the slides put it, “Decentralization is one of our superpowers.” The Manuscript Method provides the consistency and standards needed for this decentralization to be effective.

The company visualizes this in a 2×2 matrix: a decentralized organization without standards is a “circus,” where everyone does what they want and synergy is impossible. A centralized organization with standards is an “army,” efficient but rigid and unenterprising. Chapters positions itself as a decentralized organization with standards: a model in which everyone adheres to a common set of ground rules, allowing maximum autonomy and effectiveness. It is a hybrid model based on autonomy, which requires authority, which in turn requires accountability.

This is supported by an increasingly strong management team. In addition to CEO Jan Mohr (the architect of the transformation) and CFO Marlene Carl (with extensive experience in leveraged finance in London and Frankfurt), the arrival of COO Marc Maurer (with his deep experience in VMS and M&A at Constellation) and Bastian Krieghoff (founder of Fintiba and now head of FinTech) is crucial to the execution of the strategy. Each brings an essential piece of the puzzle: Mohr the vision, Carl the financial discipline, Maurer the operational M&A expertise, and Krieghoff the entrepreneurial spirit of a successful founder.

A crucial, but often underexposed, element of the organizational blueprint is the compensation structure that encourages a true owner-operator mentality. Platform-level leaders directly own shares in their own platform, linking their compensation directly to the performance of the companies they manage. What makes the structure unique is the addition of a put-call option. This option allows them to eventually convert their platform shares to shares in the Chapters Group itself. This provides a dual alignment: it encourages both local entrepreneurship in the short to medium term and a focus on the group’s overall long-term value creation.

Underlying earnings power: analysis of operating EBITDA

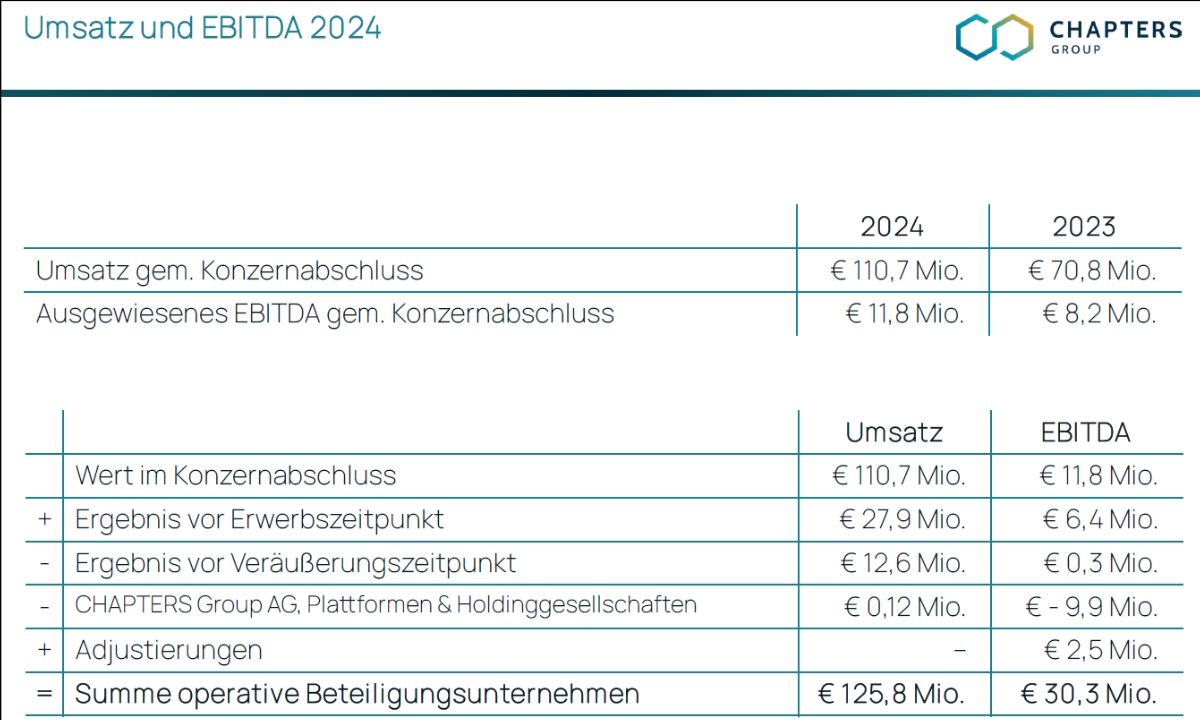

The key to understanding Chapters’ earnings potential lies in seeing through the reported numbers and focusing on the underlying operating performance. The reported revenue for 2024 was EUR 110.7 million, but when the full-year revenue of all portfolio companies is included, one arrives at an operating revenue of EUR 125.8 million.

Even more significant is the difference in EBITDA, the measure of gross profit. The reported figure was EUR 11.8 million. It is important to note here that the difference between these figures arises partly because the accounting rules applicable in Germany can give a distorted picture. This effect is further reinforced by the timing of acquisitions and the allocation of holding costs. The company’s actual engine is the combined operating EBITDA of all subsidiaries, and that amount is EUR 30.3 million.

This amount of EUR 30.3 million is a very important indicator of the company’s current state. It represents the portfolio’s normalized earning capacity and is the basis from which the company’s investment capacity derives. This operating result provides a good picture of the company’s economic reality and is thus a crucial figure for analyzing growth potential.

The acquisition strategy in practice: two case studies

The inorganic growth strategy is being implemented at a rapid pace, serving as a second, powerful engine for future earnings growth. Since December 2024, numerous companies have been added to the group, including inedee, Cogima, Simmeth System, PSI Transcom, Expatrio, ProLogic, FinfoX, Cybersense, VAB and Linear. Two case studies demonstrate how this strategy directly contributes to profit potential:

Public Sector Case Study

The acquisition of PSI Transcom was a strategic move to strengthen its position in mission-critical software for the public sector. The company was renamed PEAK Mobility. The rapid follow-up acquisition of Verkehrsautomatisierung Berlin (VAB), a company in the exact same industry, demonstrates the strategy of building deep, specialized platforms. This not only increases competitive advantage, but also provides the opportunity to sell additional, high-margin modules and services to an existing customer base.

Moreover, the interesting thing is that PSI Transcom was something of an underdog within its previous parent company, as it was not a core business for software group PSI. We wrote about this at length in our analysis on Chapters Group, which you can read back here.

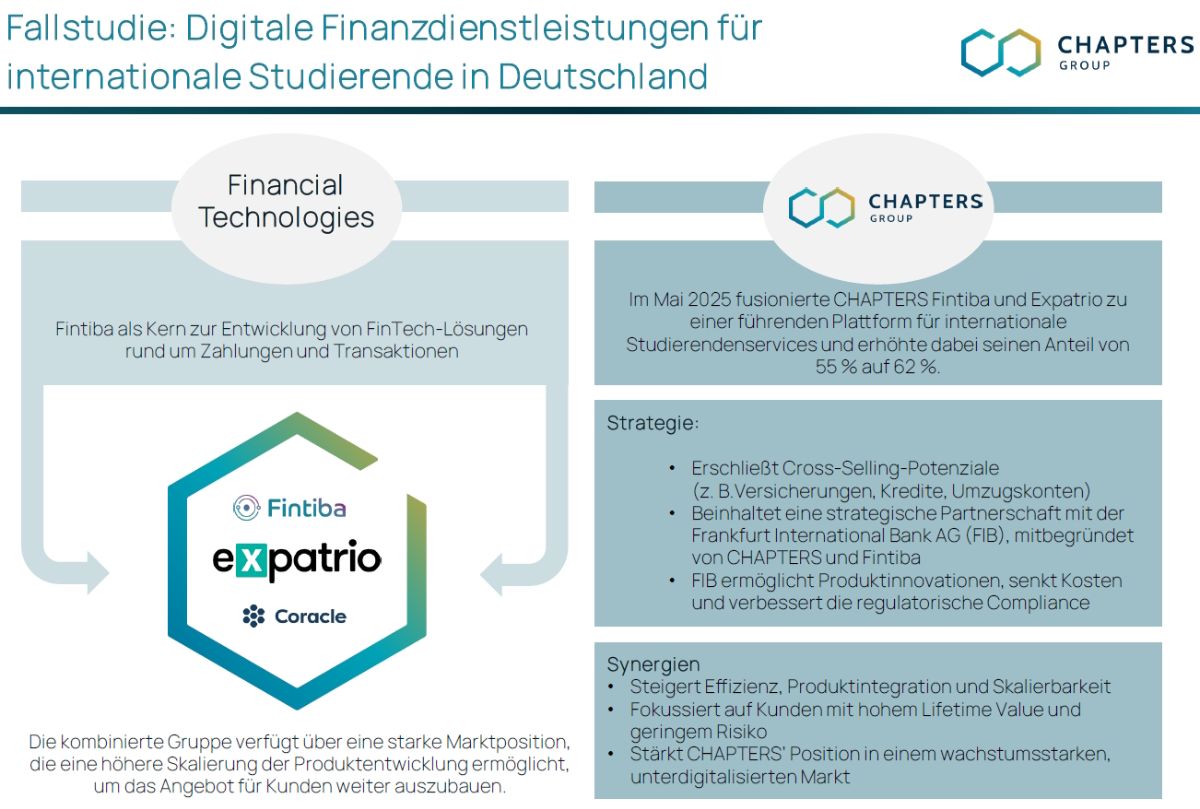

Case Study FinTech

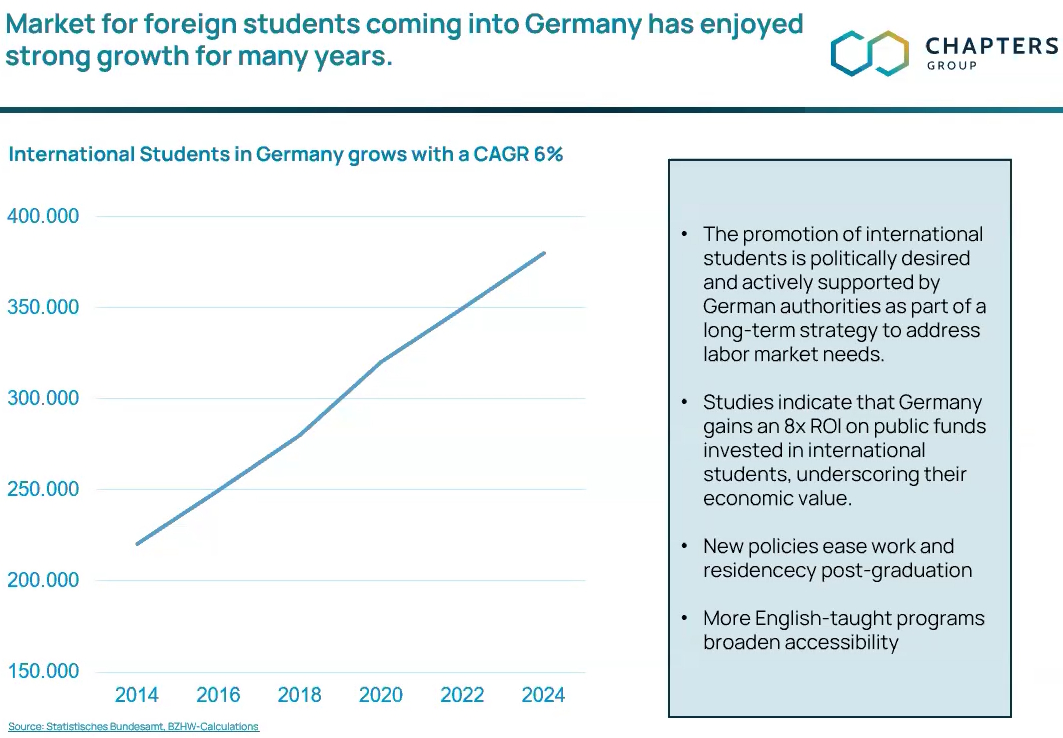

A powerful example of both the operational methodology and the strategic M&A vision can be seen at the FinTech pillar centered around Fintiba. Internally, this is one of the first and most successful examples of the “Policy Deployment” methodology in practice. This was not an abstract plan, but a structured approach focused on breakthrough objectives such as increasing market share and customer lifetime value (LTV). The results were tangible and significant: the method led to growth of as much as 135% in the crucial Indian market, driven in part by strong underlying market growth from international students coming to Germany (a market growing at an average rate of 6% per year, see figure below).

The recent merger with competitor Expatrio has created an entity with an almost 100% market share in “blocked accounts,” a mandatory product for non-EU students. However, the market seems to interpret this merger as a simple consolidation (1+1=2), while the reality as far as we are concerned is a 1+1=4 or 5 scenario. Indeed, the strategic focus has completely shifted: instead of competing against each other, all energy is now focused on exploiting the enormous upsell potential.

The “blocked account” is just the “wedge product” to bring in the customer. The real, high-margin growth comes from the sale of additional services: a regular bank account (through Chapters’ own banking subsidiary FIB), insurance (especially mandatory health insurance) and, eventually, investment products. The goal is to significantly extend the current customer retention of about two years and keep long-term customers in the ecosystem.

This transformation is being led by Fintiba’s founder and CEO, who was one of the first to fully embrace and implement the Manuscript Method. His leadership gives great confidence in the potential for both optimization of the existing business and organic growth of new services. This combination of factors, in our estimation, could lead to organic growth potential that could approach 20%, a possibility that the market does not seem to be pricing in at this time.

To ensure quality and discipline in the high pace of acquisitions, Chapters employs a strict process guided by so-called “guardrails.” These are 10 standardized, quantitative criteria that a potential acquisition must meet, such as minimum margins, maximum customer concentration and growth rates. This standardized filter ensures a scalable and efficient M&A process. However, it is not a rigid straightjacket; deals that fall outside these “guardrails” can still be done, but require explicit and well-reasoned justification. This combines process discipline with the flexibility to take advantage of special opportunities.

Growth model analysis: the flywheel effect

The choice of Adjusted Earnings Per Share (EPS) as the primary measure of value creation is a deliberate and important one. The reason is that EPS captures the full economic reality of the complex group structure. Unlike standard consolidated figures, EPS counts the earnings contribution of all entities, including those in which Chapters does not have 100% ownership but which are not fully consolidated. This provides a purer picture of the total value created for shareholders.

Understanding how operating profits from subsidiaries flow through to the holding company is essential to understanding the transaction structure. In a typical acquisition, a platform establishes a new company that purchases the target company. Financing of the acquisition price is provided by bank loans, any vendor loans (“vendor loans”), and a shareholder loan from Chapters Group itself at an interest rate of 10%. The cash flows generated by the acquired company then follow a strict repayment sequence (a “waterfall”): first the banks are paid off, then the vendors, and only last is the 10% loan from Chapters itself repaid. This structure gives Chapters a preferential return on invested capital and also provides protection in a negative scenario.

The internal benchmarks used by Chapters result in a return on invested capital of about 25%.

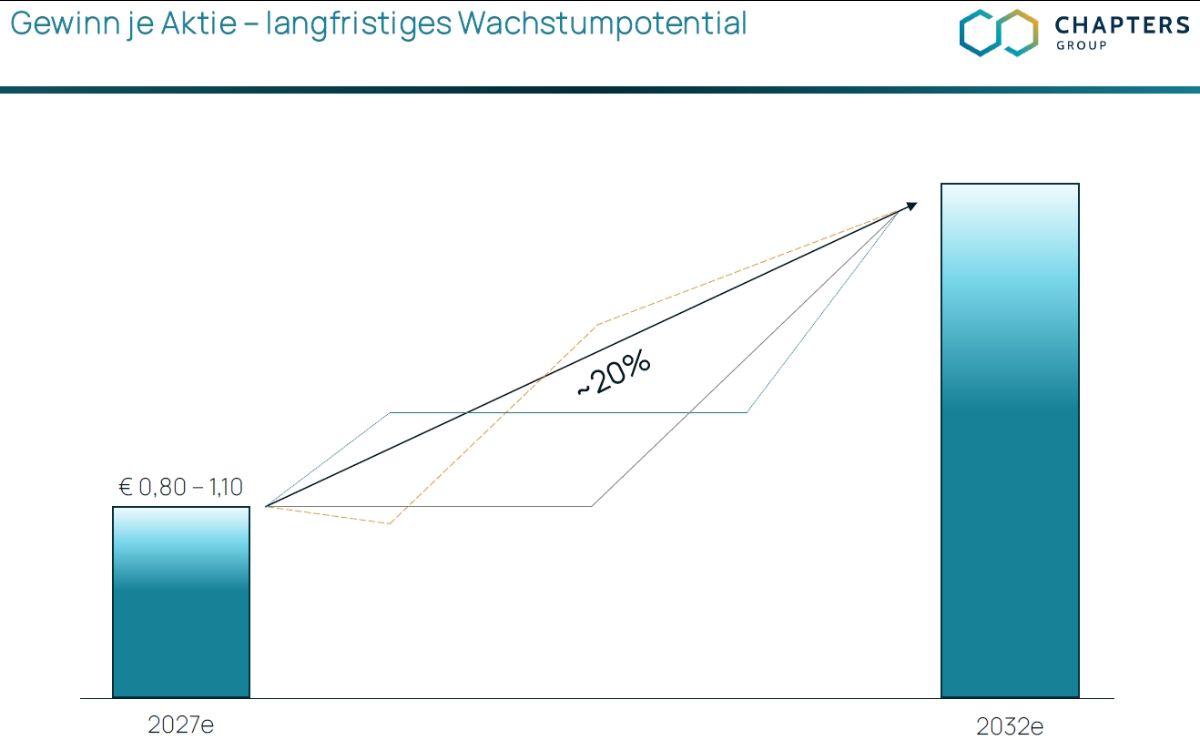

All this culminates in the prospects and the enormous long-term earnings potential. Management has set a clear and ambitious target: earnings per share (excluding earnings on listed companies) in the range of EUR 0.80 – EUR 1.10 by 2027.

The mechanism behind this was visualized as the “Earnings per Share flywheel,” a flywheel that drives earnings per share. The components of this flywheel are: organic growth, debt levels (leverage), repayment profiles, speed of M&A spending, and multiples paid. It is the optimal alignment of these factors together that should accelerate earnings growth.

From left: Michael Gielkens (Tresor Capital) and Matthias Saggau (chairman Chapters Group).

An important part of the strategy to maximize the flywheel effect is the active evolution of the financing structure. Traditionally, acquisitions were financed with loans that are repaid over the term. Chapters, however, are increasingly shifting to so-called “bullet” loans, where only interest is paid during the term and the principal is repaid in one lump sum at the end. Although these loans often have slightly higher interest rates, the strategic advantage is significant: it maximizes available cash flow in the first few years after an acquisition. This cash does not need to be used for repayments and thus can be reinvested directly in new acquisitions, which significantly accelerates the compounding effect of the flywheel.

A crucial insight we gained from this is that the flywheel effect is probably still too conservatively estimated by investors. Higher organic growth (the focus of the first chapter) leads directly to higher cash flow, which enables faster repayments. This increases the capacity for new, profitable acquisitions, making the flywheel spin faster and faster.

To make the growth potential tangible, a basic flywheel model scenario was presented. Even with what can be seen as conservative assumptions, the results are impressive. This base scenario assumes 5% organic growth, an average purchase price of 7 times EBITDA, and an annual acquisition volume of EUR 24 million in EBITDA. Based on these inputs, the model leads to an expected compound annual growth rate (CAGR) of earnings per share of approximately 21.5% from 2027 to 2032. This shows that even without extreme assumptions, the model should be able to achieve growth rates among the top listed companies.

- A scenario with 5% organic growth and a 7x entry multiple leads to an EPS of EUR 2.65 in 2032.

- A scenario with 10% organic growth and a 7x entry multiple leads to an EPS of EUR 3.35 in 2032.

- The most optimistic scenario on the slide, with 10% organic growth and a slightly lower entry multiple of 6.5x, even projects an EPS of EUR 4.94 in 2032.

Given the successes of the Manuscript Method, a structurally higher level of organic growth seems a realistic scenario. A scenario we have adopted, based on observations of the day, assumes 8-10% organic growth and 12-15% acquisition growth per year, which would mean total compound cash flow growth of 20-25%. The sensitivity analysis shows that such a path could lead to earnings per share significantly higher than what the market currently seems to be pricing in. Even if the valuation multiple in the stock market were to decline somewhat, such underlying growth implies an attractive potential return from current levels, in our view.

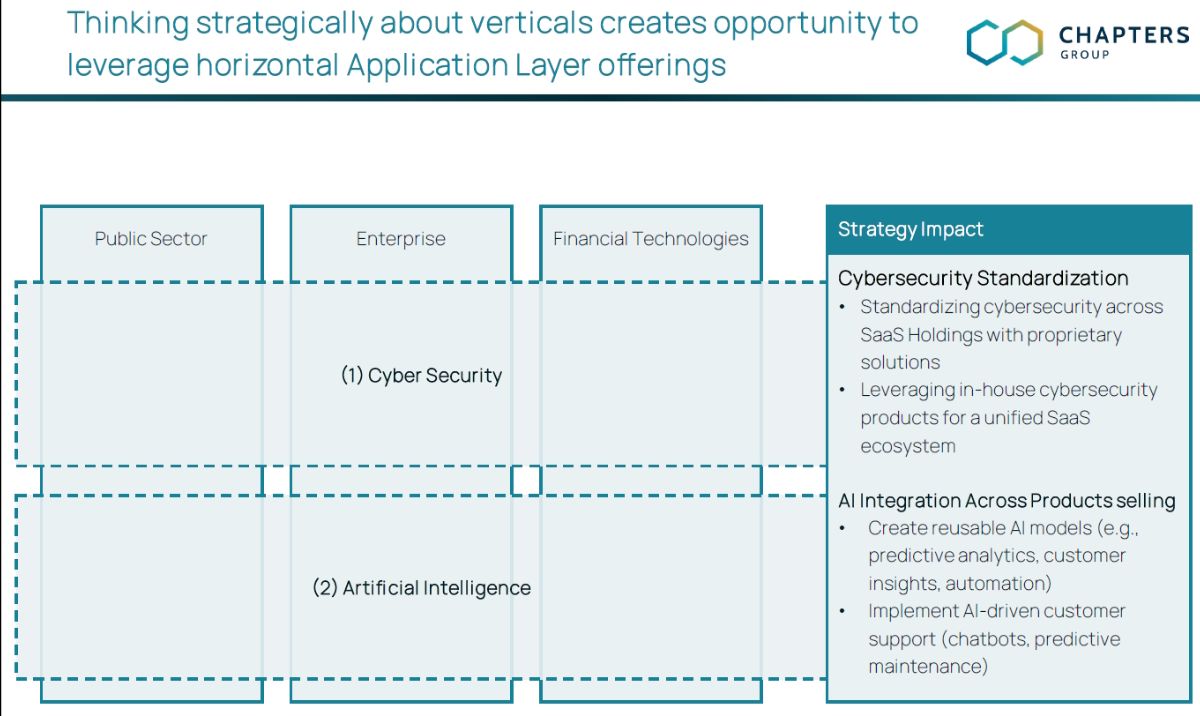

Two strategic pillars: AI and cybersecurity

CEO Jan Mohr emphasized that there are two technological megatrends that will define the future of any software company, including Chapters: Artificial Intelligence (AI) and cybersecurity. He described them as “two trains coming at us.” A company can choose to jump on board and be taken on a long journey of growth and innovation, or it can stand still and be run over. Ignoring these trends is not an option.

AI: The application layer as the new profit engine

Chapters’ vision of AI is clear and strategic. Using an analogy of his daughter’s Crocs shoes (the robust base, the “core database system”) and the “Jibbitz” or pins you can stick on them (the “application layer”), Jan Mohr explained the business model. Chapters has traditionally owned the “shoe”: the deeply embedded, mission-critical software systems in which customers manage their data and processes. These are systems that are not easily replaced.

To further point out the impact of AI, the ‘Jibbitz’ analogy was extended with a comparison to Etsy. Whereas Crocs itself sells the official, relatively expensive ‘Jibbitz,’ a platform like Etsy allows countless creatives to produce much cheaper, faster and more varied alternatives. AI does for software development what Etsy does for ‘Jibbitz’: it democratizes and accelerates application layer production. As a result, Chapters can now build a wide range of applications themselves, faster and cheaper than ever before, on top of their own solid core databases.

Cybersecurity: From Duty to Commercial Opportunity

Cybersecurity is no longer seen as just a cost or a necessary line of defense, but as a crucial commercial differentiator and a fiduciary duty to customers. In a world full of digital threats, rock-solid security is a rock-solid selling point, particularly in public sector tenders.

The strategy is twofold. First, since 2024, strategic investments have been made in acquiring cybersecurity companies. This knowledge and technology is then rolled out across the portfolio as a horizontal layer. An example is software that continuously monitors all systems for suspicious activity. This can become a standard, built-in feature of all Chapters products, significantly increasing their value and security. Second, it becomes a cross-selling opportunity. Existing customers can purchase additional, high-margin cybersecurity services, creating a new, organic growth stream.

It is the combination of these two strategic pillars (AI and Cybersecurity) that will make the difference between 3%, 5% or 10% organic growth in the coming years.

Conclusion

We left Hamburg with a significantly strengthened conviction: Chapters Group is not a copy of Constellation, but an evolution of the model. For many companies, a slide similar to the figure above is just a marketing slide put together by consultants, but the Manuscript Method is not a marketing pitch. With Chapters, you sense that people are really living and breathing this.

It is a concrete machine that unlocks latent, high-marginal profits. The acquisition strategy is executed with discipline and a clear strategic vision of future profitability. And most importantly, the growth model includes a self-reinforcing flywheel effect that can grow earnings per share exponentially over the next few years.

The Manuscript Method reminds us of the American investment holding company Danaher, a serial acquirer known for its commitment to continuous improvement through the Danaher Business System. Mitch Rales, one of the co-founders of Danaher, is not coincidentally one of the major shareholders in Chapters Group. We previously wrote an extensive piece on Danaher and the Danaher Business System. By combining and improving the processes and end markets of Constellation and Danaher’s Business System, Chapters has laid the foundations to become a highly successful serial acquirer with an attractive organic growth profile.

The Capital Markets Day and shareholder meeting gave a clear look under the hood of an acquisition machine that is clearly shifting into high gear. The drive to become one of the best software serial acquirers in the world is clearly palpable. Jan Mohr, Mathias Saggau, Marc Maurer, Marlene Carl and the other people at Chapters are building something special. We look forward to being part of this journey as shareholders.

Chapters Group is currently trading on the Frankfurt Stock Exchange at EUR 43.50 per share.