Herewith you receive our monthly report in which we share current insights. Each month we discuss different topics, ranging from trends and opportunities in the financial markets to in-depth analyses of relevant developments or strategic themes. Our goal is to provide you with valuable information in line with the constantly changing investment environment so that you are better informed about the dynamics of today’s financial world.

Change Is The Only Constant

“Change Is The Only Constant.” So said the Greek philosopher Heraclitus some 2,500 years ago. By this he meant that everything in the universe is constantly changing and nothing ever really stays the same. This statement can also be translated to macroeconomics, geopolitics and financial markets. We write about this regularly in our weekly newsletter. In our monthly bulletins, however, we zoom out a bit more and try to discuss broader themes.

Kodak used to be a rock-solid brand, until the digital camera made its appearance. Everyone called with a Nokia or Blackberry phone, until the iPhone came on the scene. Streaming services made video stores and CD stores obsolete, while digital media drastically reduced newspaper circulation.

These are all examples of business models that at some point were thought to have a sustainable competitive advantage. Management teams, supervisory directors and shareholders must therefore constantly ask themselves whether the competitive advantage is getting stronger, or whether it is under pressure.

Companies that continually reinvent themselves

As a company, it is important to change with the times, to move with the times. The best example of this is the Swedish Wallenberg family. Their family motto reads:

“The only tradition that matters is the transition from the old to what is to come.”

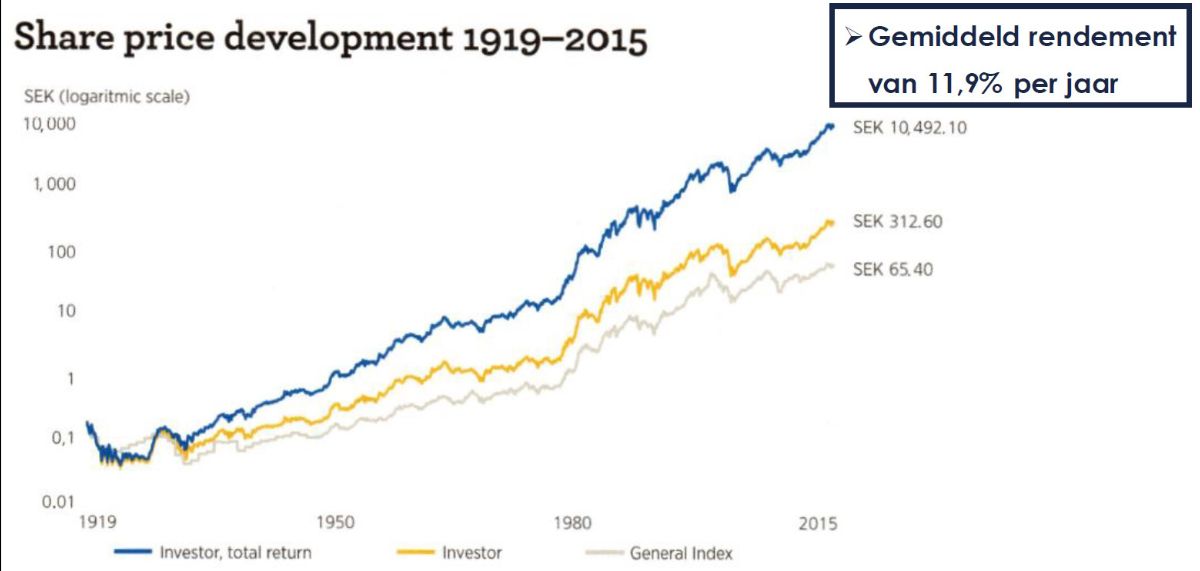

Investor AB is the investment holding company of the Wallenberg family. Its roots trace back to 1856. Since then, the company has had to endure countless trials and tribulations, from world wars and pandemics to recessions and even a depression in the 1930s. The family holding company often had to reinvent itself to continuously adapt to the changes in the world.

Investor AB has been extremely successful at this, as evidenced by the chart below. Investors who had invested capital in Investor AB since its IPO in 1919 and reinvested the dividends would have earned an average return of as much as 11.9% per year. Over the past 20 years, this has even been an impressive 17.3% return per year.

Thanks to the Wallenberg family as a controlling shareholder, Investor AB manages to maintain its long-term focus. Chairman Jacob Wallenberg in the 2023 annual report praised the companies in the family holding company’s portfolio that “see the importance of looking ahead, of future-proofing.” Wallenberg:

- “Take sustainability as an example, where several of our companies are thriving because they have been able to adapt to the green transition and how it is fundamentally changing society, in everything from how we generate energy to how we produce and how we consume. By thinking ahead, these companies have been able to gain new, stronger market shares and positions.”

- “Amidst all the unpredictability, one thing remains perfectly clear: competition is fierce and forces our businesses, and ourselves, to constantly focus on efficiency and agility. We must always evaluate how activities add value to customers and how we can operate in the most efficient way. This is where AI software provides opportunities to work faster and smarter.We support our companies to keep investing, especially in innovation, digitalization and sustainability, to future-proof their business.”

Investor AB’s sustainability reporting is extremely comprehensive

Investor AB’s sustainability reporting is extremely comprehensive

Investor AB takes an active role on the supervisory boards of its subsidiaries in future-proofing their business models. In recent years, digitalization, in particular artificial intelligence, and sustainability have been the most important topics.It is not surprising, as far as we are concerned, that both Investor AB and its subsidiaries have made very significant leaps forward in reducing their carbon emissions in recent years , and have also made the relevant reporting much clearer.

Nor does it surprise us that the two main subsidiaries (ABB and Atlas Copco) are indispensable in building the infrastructure around artificial intelligence. Think of crucial components for data centers, in which both are indispensable players. Atlas Copco is also one of the most important suppliers to chip machine manufacturer ASML.

Wafers for semiconductor manufacturing

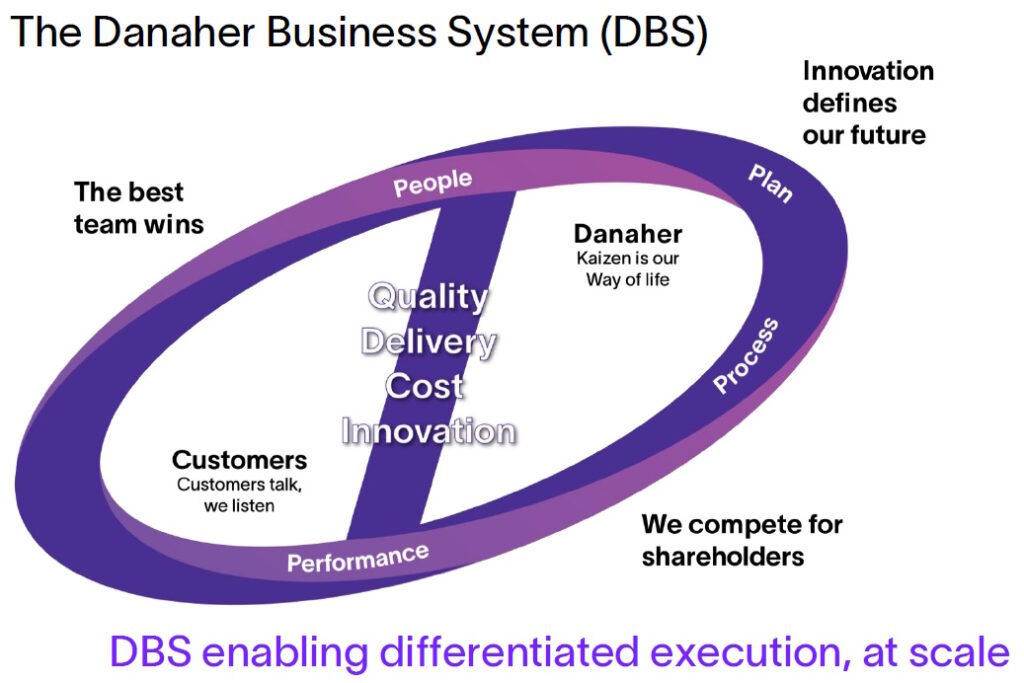

With our family investment holding strategy, we focus on companies that have proven their ability to hold their own in different market conditions. A process of continuous improvement is essential to this. One of the best illustrations of how investment holding companies apply this in practice was given last year by Mitch Rales, the co-founder and major shareholder of Danaher.This was such a fascinating interview that we devoted an entire monthly report to this podcast. There is a cross-generational time horizon at Danaher. For example, Rales states that at Danaher,“theydon’t think in terms of quarters or years, they think in terms of decades, or even an unlimited time horizon. “The entire corporate culture is set up with the idea that every little improvement over the longer term results in big steps forward, decentralized-driven where every employee bears their responsibility. In fact, Rales emphasizes that“the deeply rooted culture of continuous improvement that we have in the company” is the most underrated crucial aspect of the family holding company’s historic business success.

We concluded as follows:

- “So our conclusion is that it is not the strong market position in the healthcare sector that is the moat , the so-called Danaher Business System (DBS) and corporate culture are Danaher’s true competitive advantage.”

Two recent examples: Markel and Topicus.com

In 2025, two investment holding companies came up with striking news. The investment holding company Markel announced that it will conduct a strategic review, which will include a thorough examination of its underperforming insurance division.

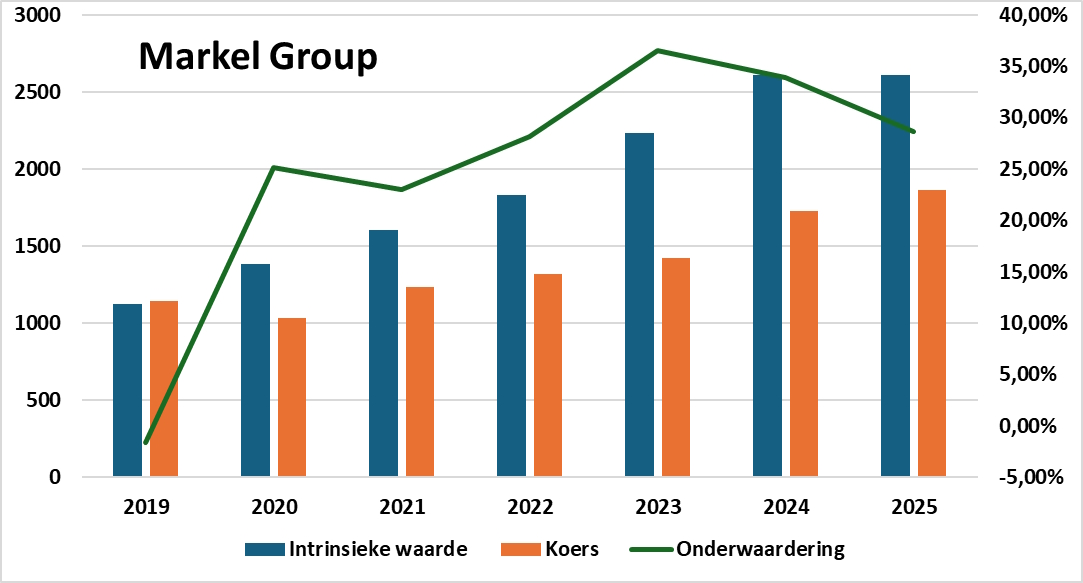

Markel says that according to its own calculations, the net asset value per share has risen 18% per year over the past five years, while the stock price has risen only 9% per year. At the end of 2024, according to Markel’s figures, the undervaluation was 34%. Markel attributes this in part to the performance of its insurance business.

After the strategic review was announced, the stock price shot up by as much as 11%, already significantly reducing the undervaluation according to Markel’s calculations, as you can see in the image below. Investors are clearly applauding management and the supervisory board’s intervention.

- “The best companies are able to reinvent themselves over time. We think this could be a crucial turning point for Markel, which could usher in a new period of strong performance and value creation.”

Net asset value and share price per Markel share (left axis in USD) and undervaluation (right axis). Source: Markel Group Q4 press release

- “Acquisitions on which Topicus makes a 20%+ return are an excellent way to grow, especially in the fragmented European market we see a bright future to sustain this for years to come.

Something that makes Topicus’ investment case much more attractive, however, is that the company is actually positioning itself as a holding company. Asseco is the first minority holding in which Topicus has invested a large amount. This significantly expands the investment universe, and increases the likelihood that Topicus can reinvest the bulk of its annual cash flow at attractive returns.So that also means that the period during which the company manages to make exceptional stock price returns may be much longer than what many investors initially thought. We saw this as an opportunity, but did not expect it to become a reality at this stage.”

The previous paragraphs indicated how different investment holding companies deal with change. At Tresor Capital, several things are changing while much remains the same. For example, within the family investment holding strategy, we continue to focus on companies with:

- An anchor shareholder (skin in the game)

- Strong returns on invested capital

- A sustainable competitive advantage

- A good track record of profitability

- A diversified portfolio

- A strong balance.

At Tresor Capital, we also move with the times. In looking ahead to 2025, we wrote:

- “In 2025, the gradual optimization toward even higher-quality businesses will continue. In particular, the companies that have been falling short of our return target for several years now will be critically examined. It is not that these companies are necessarily bad, but thanks to the growth in capacity within Tresor, we can now screen new candidates faster and more efficiently.Over the past period, our relations have already seen some mutations, which will continue in 2025. The focus remains on a relatively low turnover in the portfolios, but opportunities for improvement will be seized. In doing so, we do not even hesitate to kick against sacred cows.”

Conclusion

Change is the only constant, both in the economy and in the companies we follow. Successful family holding companies are distinguished by their ability to move with new realities without losing their long-term vision.

For investors, agility is essential to seize opportunities in a constantly changing market. At Tresor Capital, we therefore look for family businesses that not only hold their own in times of change, but come out stronger.

For more information about any of our propositions, please contact your contact person or send an email to info@tresorcapital.nl.

Sincerely,

Michael Gielkens, MBA

Partner

+31 (0) 642 602 990

michael@tresorcapital.nl

www.tresorcapital.nl