On February 28, issue 3 of 2025 in the Guide to the Best Investor of the Flemish Federation of Investors (VFB) published an analysis from our hand on the investment holding company Topicus.com. We share the analysis below.

The VFB magazine is full of interesting reflections on the stock market, interviews with executives of listed companies and business analyses. For a very reasonable price of only a few tens of dollars a year, it is possible to become a member, thus gaining access to exclusive events, exclusive analyses and the stock market magazine.

Topicus: acquisition pace accelerates

It is striking how quickly sentiment can turn. Just last year, Topicus paid a special dividend of 127 million euros. It was not entirely clear whether part of the shareholders wanted a cash distribution, or whether Topicus could not find enough acquisition candidates. The latter argument in particular was resisted by many investors.

Investors were still willing to pay a hefty premium over parent company Constellation Software shortly after the 2021 IPO. After all, Topicus was smaller, so it had a longer runway to scale up and could grow faster. But Constellation makes more than 100 acquisitions a year, so there is a constant news flow of new acquisitions. Because of its smaller size, you can’t expect the same consistency from Topicus. Sometimes deals move more slowly. We understand through our sources that Topicus maintains contact with an entrepreneur for an average of seven years before it comes to an acquisition.

After a period of relative drought, we already noticed that the pace of takeover accelerated in the fourth quarter. Although the share price initially rose to a record 141 Canadian dollars, the stock then slumped again. We took advantage of this to expand our position. Meanwhile, the share price is a good 10% higher due to the recent news flow.

For example, with the acquisition in Belgium of Cipal- Schaubroeck, Topicus realized the largest acquisition since the IPO. The holding company also expanded into Asia. It acquired PT Realta Chakradarma, an Indonesian software company that has been providing solutions for the hotel industry since 1983, particularly for high-end hotels and hotel chains. This acquisition marks Topicus’ first expansion into Asia and strengthens its presence in the hospitality industry. Topicus sees this acquisition as a springboard for further expansion through acquisitions in the fast-growing Asian region.

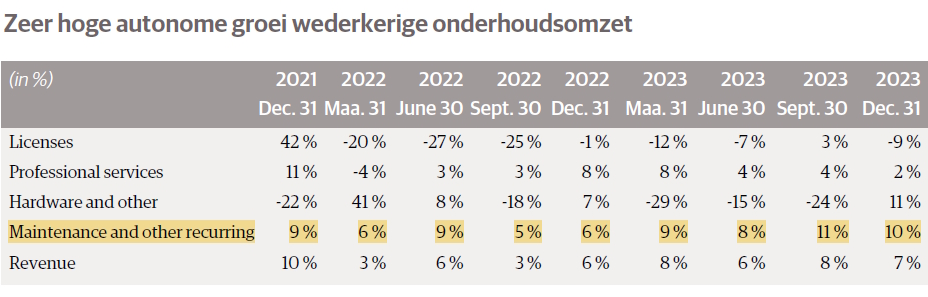

Our investment case on Topicus.com is actually quite similar to that of parent company Constellation Software: niche software that is mission-critical, a competitive advantage and a high degree of reciprocal revenue through software maintenance contracts. Reinvesting cash flows at very high returns (20% and above) and the potential to sustain this for years only make the case for Vertical Market Software (VMS) more attractive. The Constellation group is the best in this business.

Given its expected growth profile and returns on invested capital, we believe Topicus.com is still an attractively valued acquisition machine. Recent acquisitions have once again demonstrated that they have not lost the ‘trick’, and the expansion into Asia is a striking and interesting move that we will follow with great interest.

Recent acquisitions show that Topicus has found a new gear. In total, Topicus is estimated to have already invested nearly 700 million euros by 2025. That is more than the total amount of acquisitions (534 million) since the IPO in 2021. Acquisitions on which Topicus achieves a return of more than 20% are an excellent way to grow.

What makes Topicus’ investment case even more attractive, however, is that the company is actually positioning itself as a holding company. For example, it recently took a minority stake for the first time. This significantly expands the investment universe, and increases the likelihood that Topicus can reinvest the bulk of its annual cash flow at attractive returns. So that also means that the period during which the company manages to record exceptional share price gains may be longer than what many investors initially thought.

Last month, Topicus reached a new record price. The stock has already risen some 17% this year. We stress that the intrinsic value has risen at least as fast. Thus, in our view, the valuation is still as attractive as when we increased our position in Topicus by 60% in December.

Note: Figures and arguments are current at the time of publication on Feb. 28, 2025.