Receive Tresor Capital’s free weekly newsletter, which includes:

- Analyses of family holding companies and serial acquirers

- Deep dives into fundamental investing

- Michel Salden’s keen macro vision

While a large number of international investors gathered in Stockholm March 17-18 for the Redeye Serial Acquirer conference, one of the most successful players in the field, Lifco (Stockholm: LIFCO-B), chose not to participate. Their focus is elsewhere. For Tresor Capital, however, CEO Per Waldemarson gladly made time.

On March 19, he personally opened the doors of the modest headquarters to Tresor Capital partner Michael Gielkens. The fact that he poured the coffee himself immediately set the tone: at Lifco, the important people do not work at the headquarters, but in the subsidiaries. It was the start of a conversation that went deep into the heart of what makes Lifco unique.

Keep it simple, keep it decentralized

Lifco’s philosophy is one of radical simplicity and decentralization. The headquarters has only about 35 FTEs, a conscious decision. “We’ve been here for 25 years and want to survive the next 25,” Waldemarson said. That long-term vision dictates everything. The focus is on the operation, not the holding company. A central HR department for the 7,000 employees? There isn’t one. Waldemarson sees his job as protecting his team from bureaucracy so they can focus on what really matters: creating value in the businesses.

This decentralized structure is not an end in itself, but a means to be decisive. “The decentralized structure allows our CEOs to take the measures relevant to their company in a crisis.” It also allows Lifco to keep a finger on the pulse. “We know we have question marks with 4-5% of CEOs. If that was 30%, we’d have a big problem.”

Lifco CEO Per Waldemarson (left) and Tresor Capital partner Michael Gielkens

Buy to own forever

Lifco’s acquisition strategy is as disciplined as their operating model. “We only want to buy companies that we can hold forever,” states Waldemarson. This strategy has resulted in an impressive track record. Of the nearly 300 acquisitions, only three failed to meet expectations due to a significant and unforeseen market shift. An exceptionally low percentage that underscores the quality of their selection process.

Moreover, the quality of the portfolio has risen sharply. Over the past five years, the average EBIT margin exceeded 25%. The reason is an even sharper focus on companies with superior niche market position and pricing power. Waldemarson is even concerned that they “risk being too picky,” but long-term results prove otherwise.

The decision process in an acquisition is clear and follows a strict sequence. First the question, “Is the quality good enough?” The most important selection criteria for Lifco are an EBIT margin of at least 20% and, crucially, pricing power. Waldemarson is crystal clear on this: “If you can’t implement a 5% price increase, you don’t have pricing power.”

Only when the answer about the quality of an acquisition candidate is a resounding “yes,” does the question follow as to what one is willing to pay. Usually this is 8x EBITA, but for absolute top companies it can go up to 9x or 10x, with the confidence that, for example, a price increase will bring the multiple back to the desired level within 12 months.

The potential in these niches is enormous. Waldemarson explains that classic economic laws don’t apply here. “A company with a current margin of 25%, can grow to a 40% margin in 10 years because the niche is so small.” These “irrelevant markets” are so unattractive to new entrants that profitability can grow sustainably without competitive pressure.

The competition: Lifco in a class by itself

In an industry with respected players like Indutrade, Addtech and Lagercrantz, one would expect fierce competition. The reality for Lifco, however, is different. Once Lifco sits down with an entrepreneur, they almost always manage to trounce the competition. Waldemarson puts it bluntly: “When we talk to entrepreneurs, it’s very, very rare that they don’t sell to us.”

Victory is achieved not with a higher bid, but with the strength of their model and the promise of a sustainable future. The only battle they sometimes lose is the one with a founder in his 40s who prefers a quicker exit through private equity.

Lifco’s power of persuasion is virtually irresistible to the more common generation of entrepreneurs: “If they are 58-60 and don’t even work in the business (anymore), but still have family or acquaintances in the business or live in the same village, a good home for this business like Lifco is the most important thing that matters.” For these sellers, who want to secure the legacy of their life’s work, Lifco is simply the surest and best choice.

The “Superstars” as Secret Weapon

What really sets Lifco apart, according to Waldemarson, are their “superstars”: the group managers who oversee clusters of companies. It is these individuals, with the Lifco DNA deep in their fibers, who create the magic. When they talk to an entrepreneur, the salesperson feels they are not dealing with financial engineers, but with people who understand the business and can help take the company to the next level, such as entering the U.S. market or optimizing pricing.

This trust-based culture is the backbone of the company. Major shareholder Carl Bennet gives his trust to Per Waldemarson, who passes it on to his group managers, who in turn give it to the company executives. Should this trust be broken, the response is immediate and harsh. “In a trust-based company, you have to take rock-hard action immediately,” Waldemarson said.

But is this model, which relies so heavily on culture and trust, scalable? Until a few years ago, Lifco’s CEO still visited each company to be acquired in person. With the growth in capabilities and skills within the team, that is no longer necessary. “Until 2015 there were two of us, now we have 20 that we can send out,” he says. This expansion, with a core of highly experienced forces and internally developed talent, allows Lifco to scale up without sacrificing quality.

A look to the future: disciplined growth

Although the valuation of serial acquirers is a hotly debated topic, the CEO is not swayed by the delusion of the day. He himself consistently buys stocks for the very long term (20+ years) and would be “very disappointed if Lifco doesn’t beat the index in 10 to 20 years.”

Waldemarson is ambitious: “It would be nice if one day we were worth SEK 1,000 billion,” but based on fundamentals, not in a bubble. The ambition is there, but always within the framework of discipline. Growth targets of 5% on sales and 10% on earnings are already very satisfactory. The dividend forces discipline in acquisitions and prevents the organization from growing too fast. “In building Lifco, we are risk-averse; we don’t optimize everything to the extreme.” He is also pragmatic about the model itself. “We think 10 years ahead. If the model no longer works, we split the company. That could happen in 5 or 20 years.”

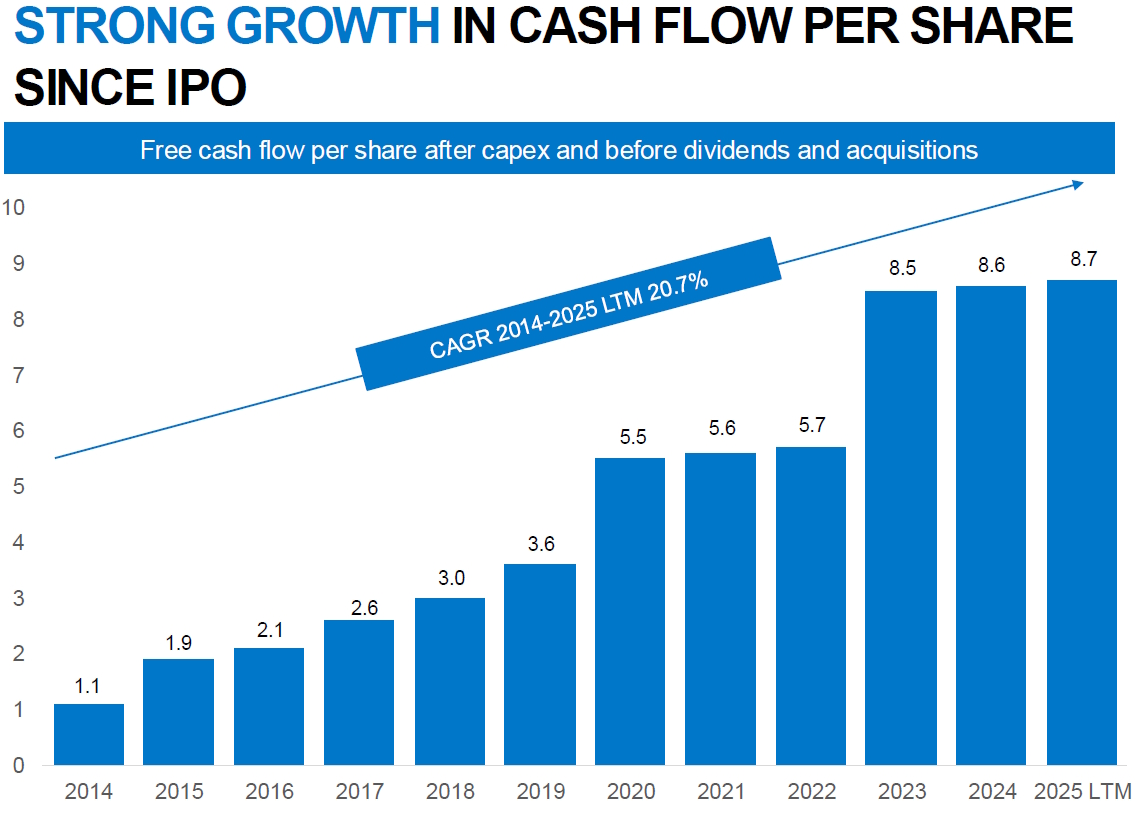

The holy grail for Lifco CEO Waldemarson: free cash flow per share growth, a good approximation of net asset value trends

How he tests the quality of growth? Waldemarson points to cash flow per share. “If a company doesn’t report this as such, that’s a red flag to me,” he says. He emphasizes that this should be after all capital investment (capex); he calls the distinction between growth and maintenance investment “bullshit.” His second red flag is for companies that do creative accounting. “I never invest in companies that capitalize things on the balance sheet,” he says, referring to practices such as capitalizing intangible assets after an equity-financed acquisition.

Conclusion

The meeting in Stockholm confirmed our image of Lifco. This is no average serial acquirer, but a best-in-class acquisition machine built on the pillars of simplicity, patience, a rock-solid culture and an unwavering focus on the long term and quality. With this almost maniacal focus and a scalable organizational structure, Lifco seems well positioned to create value for its shareholders for years to come.

Lifco ended the trading week on the Stockholm Stock Exchange at a price of SEK 379.60 per share.