On May 14, 2025, Tresor Capital hosted a dinner for its associates at the extraordinary five-star La Butte aux Bois venue in Lanaken. Partner Michael Gielkens provided a comprehensive performance update on the family holding portfolio, and also drew attention to the more defensive investment portfolios Tresor Capital has to offer.

Strong performance family holdings

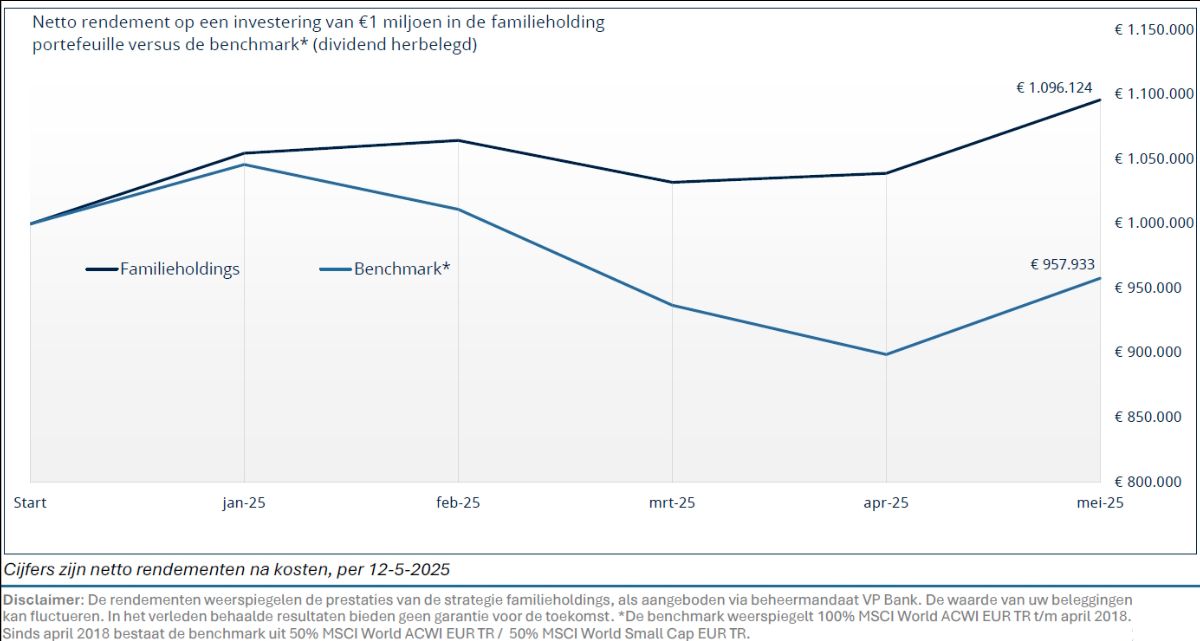

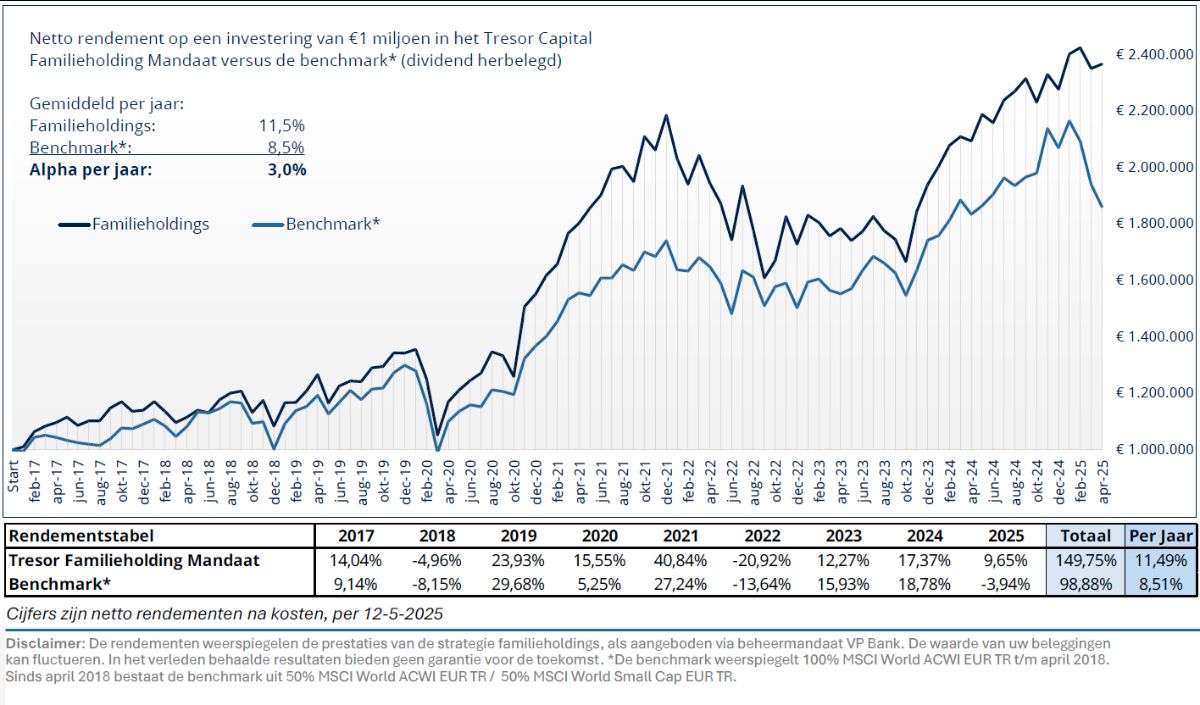

The chosen strategy within the holding portfolio, which is conservative and broadly diversified, once again proved its worth this year with an excellent return of +9.65% (Year-to-date as of May 12, 2025). This achieved an outperformance of no less than +13.7% against a global equity index.

The outperformance can be explained from three main themes. First, the portfolio is more defensively positioned than the benchmark. The portfolio has a wider diversification, with a deliberate overweighting of European names and lower exposure to U.S. technology companies. In addition, cash-rich, countercyclical powerhouses such as Berkshire Hathaway, MBB, Constellation Software and Topicus are experiencing less impact from volatility and are less sensitive to recent perils.

In addition, because there were greater price fluctuations, more trades were made than usual. Positions with above-average exposure to the trade war were unwound. New, relatively countercyclical positions were taken in their place. Examples include D’Ieteren (the parent company of car glass repair company Carglass), 3iGroup (whose main position is discounter Action) and software company Chapters Group (with similar exposure to Constellation and Topicus).

After both the dollar and U.S. stocks fell sharply and more constructive signals around the trade war appeared, we deliberately upped positions that we felt had been punished too harshly. Examples include private equity holdings Brookfield Corporation and KKR and technology holding company Scottish Mortgage Trust, all of which have since made nice recoveries.

Finally, we saw that the allocation choice added value. Indeed, the largest positions were also, to a significant extent, the strong holders of the portfolio. Of particular note here are Constellation Software, MBB and Sofina.

The longer-term performance of Tresor Capital’s family holding strategy, with an average return of 11.5% per year after expenses, beat the benchmark by 3% per year. Although we are content with this margin, we remain vigilant. The portfolio must at all times be optimized for the risk-return ratio. In doing so, we will never compromise on the quality requirements we demand of our positions.

Would you also like to participate in our family holding strategy and do you have free investable assets of EUR 250,000 or more? Then be sure to contact us to discuss the possibilities.

Defensive and Neutral Portfolios

The family holding strategy is the foundation of every model portfolio at Tresor Capital. However, the attention drawn to this equity component, as one of the distinctive strategies our investment boutique has to offer, somewhat undercuts the relatively strong performance of our more defensive propositions.

With an average of 4.8% per year for the defensive portfolio and 6.9% per year for the neutral portfolio, it is fair to say that even the more conservative portfolios have managed to achieve attractive returns. Moreover, they beat the relative benchmarks by a comfortable margin.

A key explanation for this relates to our persistent skepticism about bonds. Although classical investment theory teaches us that bonds belong in more conservative portfolios, we have been very wary of this exposure. When interest rates were near zero or even negative, we saw this as “yield-free risk” rather than “risk-free return. Rather, we seek refuge in attractive alternative asset classes, or gold, for example, as an inflation-proof proposition.

Now that interest rates have fallen sharply again, saving is not keeping up with inflation. We are happy to sit down with you to discuss options around our defensive and neutral portfolios.

Investor AB: Generational thinking in the world of quarterly printing

Tresor Capital’s relationship day also featured Magnus Dalhammar of Investor AB. Investor AB is the investment holding company of the Wallenberg family, an influential Swedish dynasty with a rich history in banking, industry and politics. Its roots trace back to 1856. Since then, the company has successfully adapted to countless challenges, from world wars and pandemics to recessions and even a depression in the 1930s. The family holding company often had to reinvent itself, constantly adapting to changes in the world.

Investor AB is one of Europe’s most influential family-owned companies. Investor AB’s approach is built on patient ownership, with direct stakes in publicly traded companies such as Atlas Copco, ABB and SEB, as well as a solid position in private equity through its affiliate EQT, complemented by unlisted long-term investments in both EQT’s funds and through Patricia Industries’ portfolio.

What sets Investor AB apart is a distinctly generational mindset. A focus on value creation over decades, rather than quarterly results. This philosophy has led to exceptionally stable returns: over the past 15 years, Investor AB averaged +20% per year, and over the period from 1919 to 2015 the annual return was 12%.

Such results do not come out of the blue. The Swedish economy and broader Nordic context form fertile ground, characterized by a strong rule of law, highly educated workforce and an open, innovative market economy. In that context, Investor AB has become a symbol of modern entrepreneurship with social roots.

On our last relationship day, Germany was still being portrayed as the “weak man of Europe” by Tresor Capital investment manager Michel Salden, leading to a somewhat critical reception of the market environment in which the CEO of German family holding company MBB operates. But entrepreneurs remain entrepreneurs, and as it often turns out, stock markets can anticipate, or detach themselves from, national politics and macroeconomics.

MBB stock is proof of that. With a return of +67% this year (as of May 12, 2025), it is currently the best-performing stock within the Tresor Capital family holding strategy. The company proved to be excellently positioned to benefit from the recently inflated infrastructure spending in Germany.

While past results are no guarantees for the future, we might just be able to mention good numbers from Investor AB at the next relationship day. Dalhammar emphasized that he cannot make any promises, but did pass along this, “Those who dare to look a decade from now will see beyond the noise of today.”

Guest speaker Giezenaar: Dutch real estate as a silent force

In addition to equity strategies, the topic of Dutch real estate was also discussed in detail at the relationship day. Claudia Giezenaar, managing partner at Vivet, gave a clear presentation on opportunities in the domestic residential real estate market.

Vivet makes it possible to invest in real estate. Through Vivet you can invest in Dutch rental properties. The goal of Vivet is to grow your assets, through a stable return. Besides initiating and structuring real estate CVs, Vivet also has the management in-house. This ensures short lines of communication with the tenant and Vivet is actively involved in the real estate.

Vivet positions itself as an active fund manager that responds to the structural shifts within the Dutch real estate landscape. It needs little explanation that individuals and entrepreneurs are investing less in Dutch real estate for tax reasons. This does not alter the fact that the fundamentals continue to improve: a growing population, smaller families and an equal/shrinking supply result in structural housing shortages.

An important trend is the unwinding of existing portfolios that are increasingly being disposed of by insurers and pension funds. Giezenaar explained how Vivet thinks countercyclically: with direct involvement in management, an eye for sustainability and attention to social value. The strategy focuses on solid rental streams, value creation through renovation and repurposing, and a realistic entry-level valuation. With this, Giezenaar says Vivet offers “peace in the noise” for investors looking for real assets with inflation protection.

In the context of Tresor’s family holding strategy, which traditionally does not emphasize indirect real estate, this type of investment provides a nice alternative building block. The direct return of over 5% annually, which is paid quarterly, is an attractive base. On top of that, in the eviction strategy, depending on the number of mutations, one can realize significant indirect returns. In 2024, for example, this resulted in a total return of 17%.

Through Tresor Capital’s Swiss custodian bank, you can subscribe directly to Vivet. You will then have a line in your portfolio, just as with the other investment propositions.

Should this be of interest to you, for example as an alternative to your existing real estate portfolio or an addition to existing investments, please let us know.

Conclusion

The number of relationships present continues to grow significantly. We thank you for the trust placed in us. Based on the many enthusiastic reactions, we can confidently state that the relationship dinner was a success. As far as we are concerned, this is certainly reason to organize a sequel, for which the first contacts with interesting guest speakers have already been made.

Not a client yet but interested in our services? Feel free to let us know. We would be happy to make an appointment to explain our services in more detail. Of course we are also open to warm introductions within your network.

Sincerely,

Investment manager